AT&T – Still Ringing?AT&T. The name alone evokes landlines, long-distance charges, and a time when phones had cords (and possibly rotary dials). But don’t let the vintage vibes fool you — this telecom titan might still have some signal left on the price chart.

Now, I’m not saying AT&T is about to moonwalk up the NASDAQ

625 ARS

10.02 T ARS

112.02 T ARS

About AT&T Inc.

Sector

Industry

CEO

John T. Stankey

Website

Headquarters

Dallas

Founded

1983

ISIN

ARDEUT111713

FIGI

BBG000HDXSF8

AT&T Inc. is a holding company that provides communications and digital entertainment services in the United States and the world. The Company operates through four segments: Business Solutions, Entertainment Group, Consumer Mobility and International. The Company offers its services and products to consumers in the United States, Mexico and Latin America and to businesses and other providers of telecommunications services worldwide. It also owns and operates three regional TV sports networks, and retains non-controlling interests in another regional sports network and a network dedicated to game-related programming, as well as Internet interactive game playing. Its services and products include wireless communications, data/broadband and Internet services, digital video services, local and long-distance telephone services, telecommunications equipment, managed networking, and wholesale services. Its subsidiaries include AT&T Mobility and SKY Brasil Servicos Ltda.

Related stocks

AT&T Wave Analysis – 16 May 2025- AT&T reversed from support zone

- Likely to rise to resistance level 28.35

AT&T recently reversed up with the daily Morning Star from the support zone between the key support level 26.00, 38.2% Fibonacci correction of the upward impulse from January and the lower daily Bollinger Band.

The active

AT&T I Tipping Point : Short Opportunity with Head & ShouldersHey traders after a previous trade trade on the hood hitting targets of 16.4%. Today I bring you NYSE:T

Technical + Fundamental View

Pro Tip

- Breakdown below the Entry Line will be considered at Trade Initiation. (Risky Traders)

R:R= 5.4

- Rest can follow entry at day close post breakdow

T Trading Guide 4/21/25AT&T (T) Trading Analysis for Monday, April 21, 2025

Sentiment Analysis

-Overview: Sentiment on X and StockTwits is neutral, with investors appreciating T’s 4.11% dividend yield but expressing concerns over tariff-driven cost increases. Analyst consensus remains stable, with a “Hold” rating and a

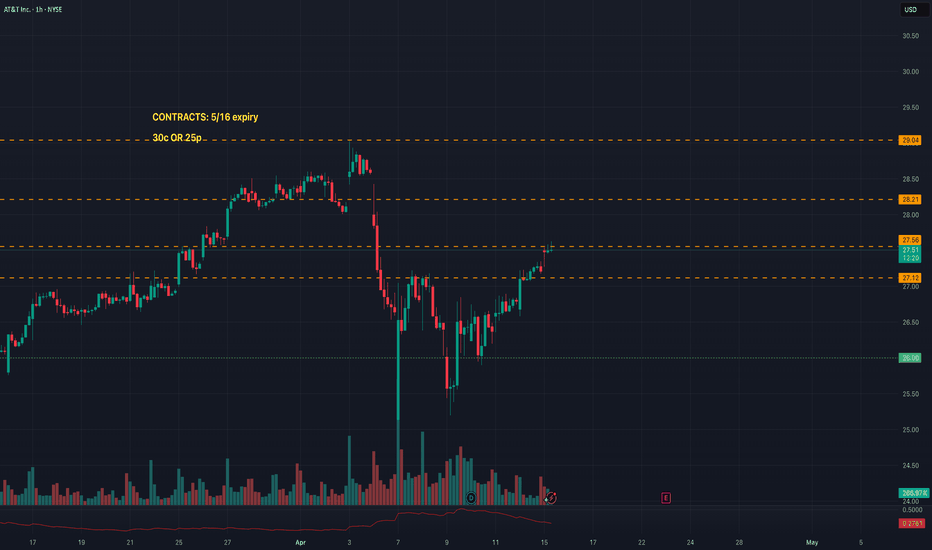

T Trade LevelsYou might notice that this is the Hourly timeframe.

For a ticker that moves 0.83 cents/day, I just needed to know the directional bias up top (ranging but leaning bullish).

I would expect day trades to move level to level.

The contracts listed will be your best options whether day or swing tradi

New Setup: TT : I have a swing trade setup signal. Looking to enter long if the stock can manage to CLOSE above the last candle high(BUY). If triggered, I will then place a stop-loss below (SL) and a price target above it(TP Zone) **Note: This setups will remain valid until the stock CLOSES BELOW my stop-loss l

Quantum's T (AT&T) Trading Guide 4/13/25Sentiment: Neutral. Dividend yield (4-5%) and debt reduction ($123B) attract income seekers, but telecom competition and tariff fears limit enthusiasm. X posts praise stability, though growth concerns persist.

Outlook: Neutral, slightly bullish. Options pin $27, with call buying eyeing $28. ICT/SMT

Quantum's T (AT&T) Trading Guide 4/11/25T (AT&T Inc.)

Sentiment

• Sentiment is neutral with a bearish tilt. April 10 options activity shows put-heavy volume at $26 strikes, reflecting caution. RSI (14) at ~50 (estimated, flat trend at $26.40 close) suggests indecision. X posts highlight concerns over telecom debt loads and tariff risks

THERE IS A POTENTIAL BREAKOUT TO THE UPSIDE IN T[AT&T]As we can see market overall is bull due to creation of higher low and higher high, at the moment market is making a pullback before continuing with its direction to the upside. we are looking for long opportunity in this pullback. keep monitoring from one hour.

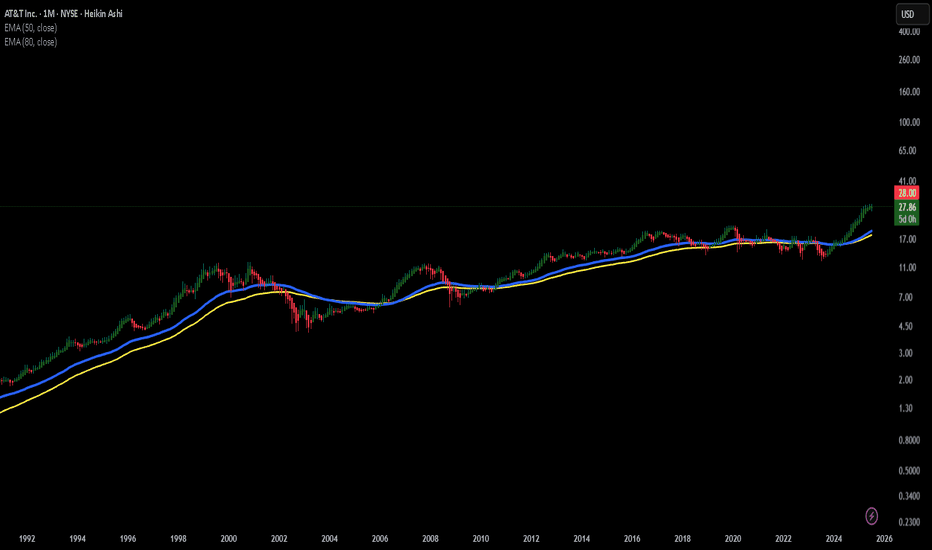

T: In the meantime, making some heavy stridesAT&T is not something we see in the finance news that often nor has the sexiness of the Silicon Valley names, but, since July of 2023, this company has been on a tier. Seem like the new CEO knows what he's doing and combined with missteps from the competitors, T has seen a 100% move up from the bott

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.