Trade Setup: LONG on WFC!📈

🕰️ Timeframe: 30-minute chart

🔍 Pattern: Bull flag / descending channel breakout

📉 Previous Trend: Uptrend with healthy retracement

🧭 Setup: Breakout from short-term correction, aligning with trendline support

🧩 Technical Breakdown:

Support Zones:

$83.00 (holding on ascending trendline)

$82.50

Key facts today

Wells Fargo's shares experienced a decline of 2% to 3.5% in response to a disappointing employment report, which raised concerns regarding the bank's performance amid a potentially slowing economy.

1.00 USD

17.52 B USD

112.16 B USD

About Wells Fargo & Company

Sector

Industry

CEO

Charles William Scharf

Website

Headquarters

San Francisco

Founded

1852

ISIN

ARDEUT110434

FIGI

BBG000FSQWX6

Wells Fargo & Co. is a diversified and community-based financial services company, which engages in the provision of banking, insurance, investments, mortgage, and consumer and commercial finance products and services. It operates through the following segments: Consumer Banking and Lending, Commercial Banking, Corporate and Investment Banking, and Wealth and Investment Management. The Consumer Banking and Lending segment offers consumer and small business banking, home lending, credit cards, auto, and personal lending. The Commercial Banking segment provides banking and credit products across industry sectors and municipalities, secured lending and lease products, and treasury management. The Corporate and Investment Banking segment is composed of corporate banking, investment banking, treasury management, commercial real estate lending and servicing, and equity and fixed income solutions, as well as sales, trading, and research capabilities. The Wealth and Investment Management segment refers to personalized wealth management, brokerage, financial planning, lending, private banking, trust, and fiduciary products and services. The company was founded by Henry Wells and William G. Fargo on March 18, 1852 and is headquartered in San Francisco, CA.

Related stocks

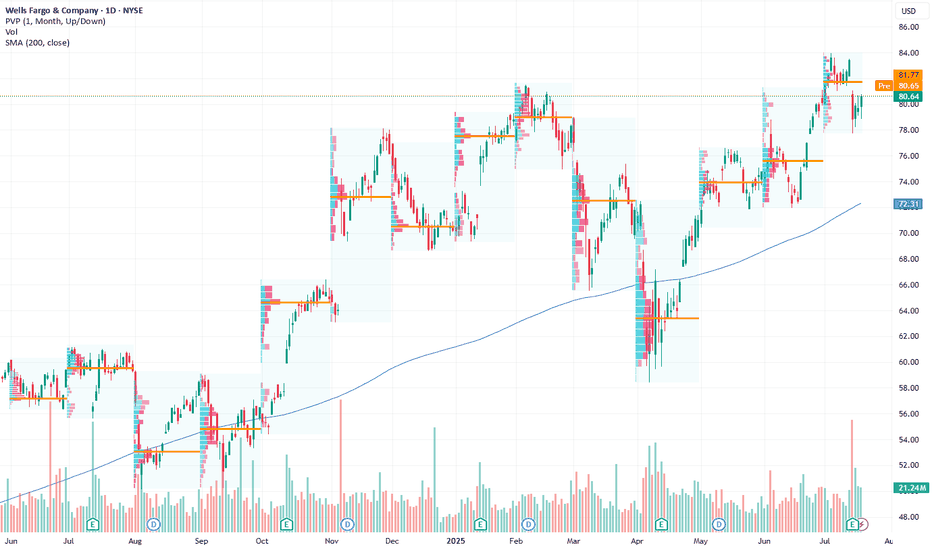

Wells Fargo Stock Chart Fibonacci Analysis 073025Hit the 84.5/423.60% resistance level.

Trading Idea

Chart time frame:D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:E

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise fr

Wells Fargo: Bearish Sentiment Signals Potential DownsideCurrent Price: $80.64

Direction: SHORT

Targets:

- T1 = $77.62

- T2 = $74.81

Stop Levels:

- S1 = $82.25

- S2 = $84.12

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identi

WFC Earnings Setup – 07/14/2025 $86C | Exp. July 18 | Betting on

📈 WFC Earnings Setup – 07/14/2025

$86C | Exp. July 18 | Betting on a Bank Bounce

⸻

🔥 EARNINGS HEAT CHECK

💼 WFC reports BMO (07/15)

📊 Historical move avg: ~3–5%

📍 Current price: $82.53

📈 Above 20D/50D MAs → trend intact

⚠️ RSI = 78.07 = overbought 🚨

💥 Expected move: $2.89

⸻

🧠 SENTIMENT SNAPS

WFC · Daily — Rising-Channel Breakout Idea Toward $89-90Why This Setup Caught My Eye

Multi-year rising channel: Since late 2022 price has respected a neat parallel channel; we’re now testing the upper rail.

Fresh bull-flag breakout: The June pullback carved a tight triangular flag. Last week’s high-volume close above $83 confirmed the breakout.

Measure

Shorting WFC for short-term correction NYSE:WFC is looking at near-term weakness after a strong bearish counter attack candle was seen rejecting the 123.6% Fibonacci extension of the range (71.82-76.50) and the 88.6% deep retracement level of the larger swing low to high (50.20-80.70).

23-period ROC is looking at a bearish divergence

WFC eyes on $74: Major Resistance going into FED rate decision WFC testing a Major Resistance zone going into FED day.

Looking for a Rejection or a Break-and-Retest for next move.

Financials in general are doing well but due for a little dip.

$73.56-74.11 is the key zone of interest.

$68.91-69.60 is first good support below.

==================================

WFC Trade LevelsEither or set-up while in this range.

For day trades, expect price to move between 64.86-66.30 where there is a daily gap down.

For now, the gap is acting as resistance.

When trading gaps, it depends on your objective. Scalpers might be interested in playing off the H/L of the gap.

While intraday

WFC - Faster Up PhaseAs price transitions through fib circle acceleration of price upwards is allowed

Price has been going through an upward movement however slowly, I expect price to move up faster

This is similar to Tesla's moves upward. Kind of moving up in chunks or in big waves

Weekly timeframe

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

WFC.MS

Wachovia Corporation 6.605% 01-OCT-2025Yield to maturity

10.26%

Maturity date

Oct 1, 2025

WFC5760754

Wells Fargo & Company 0.0% 28-FEB-2039Yield to maturity

8.85%

Maturity date

Feb 28, 2039

94CY

WELLS FARGO & COMPANY 2.5% SNR EMTN 02/05/29Yield to maturity

7.50%

Maturity date

May 2, 2029

WFC5467233

Wells Fargo & Company 4.2% 29-AUG-2025Yield to maturity

6.73%

Maturity date

Aug 29, 2025

WFC4776290

Wells Fargo & Company 4.661373% 06-DEC-2028Yield to maturity

6.62%

Maturity date

Dec 6, 2028

WFC5673508

Wells Fargo & Company 6.65% 26-OCT-2033Yield to maturity

6.60%

Maturity date

Oct 26, 2033

WFC5530567

Wells Fargo & Company 5.05% 25-JAN-2026Yield to maturity

6.55%

Maturity date

Jan 25, 2026

WFC5679614

Wells Fargo & Company 6.75% 06-NOV-2033Yield to maturity

6.53%

Maturity date

Nov 6, 2033

US94974BGT1

WELLS FARGO 2046 MTNYield to maturity

6.45%

Maturity date

Jun 14, 2046

WFC5679616

Wells Fargo & Company 6.8% 06-NOV-2038Yield to maturity

6.33%

Maturity date

Nov 6, 2038

WFC5707017

Wells Fargo & Company 6.4% 24-NOV-2033Yield to maturity

6.32%

Maturity date

Nov 24, 2033

See all WFCD bonds

Curated watchlists where WFCD is featured.