Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

547.34 MXN

1.86 T MXN

7.74 T MXN

1.34 B

About Berkshire Hathaway Inc.

Sector

Industry

CEO

Warren Edward Buffett

Website

Headquarters

Omaha

Founded

1839

FIGI

BBG00JX0PGG1

Berkshire Hathaway, Inc. is a holding company, which engages in the provision of property and casualty insurance and reinsurance, utilities and energy, freight rail transportation, finance, manufacturing, and retailing services. It operates through the following segments: Insurance, Burlington Northern Santa Fe, LLC (BNSF), Berkshire Hathaway Energy (BHE), Pilot Travel Centers (PTC), Manufacturing, McLane, and Service and Retailing. The Insurance segment includes the underwriting of GEICO, Berkshire Hathaway Primary Group, and Berkshire Hathaway Reinsurance Group. The BNSF segment involves the operation of railroad systems. The BHE segment focuses on regulated electric and gas utility, power generation and distribution, and real estate brokerage activities. The PTC segment consists of managing travel centers and marketing of wholesale fuel. The Manufacturing segment refers to industrial, consumer and building products, home building, and related financial services. The McLane segment covers the wholesale distribution of groceries and non-food items. The Service and Retailing segment relates to the provision of shared aircraft ownership programs, aviation pilot training, electronic components distribution, retailing businesses, automobile dealerships and trailer, and furniture leasing services. The company was founded by Oliver Chace in 1839 and is headquartered in Omaha, NE.

Related stocks

Berkshire Hathaway looks appealing in todays market conditionsWith most markets at all time highs it is becoming increasingly difficult to find good opportunities for buying. I have decided to allocate about 9% of my portfolio to Berkshire Hathaway as a sort of hedge against some of my other positions. I like to have a diverse exposure to the markets and with

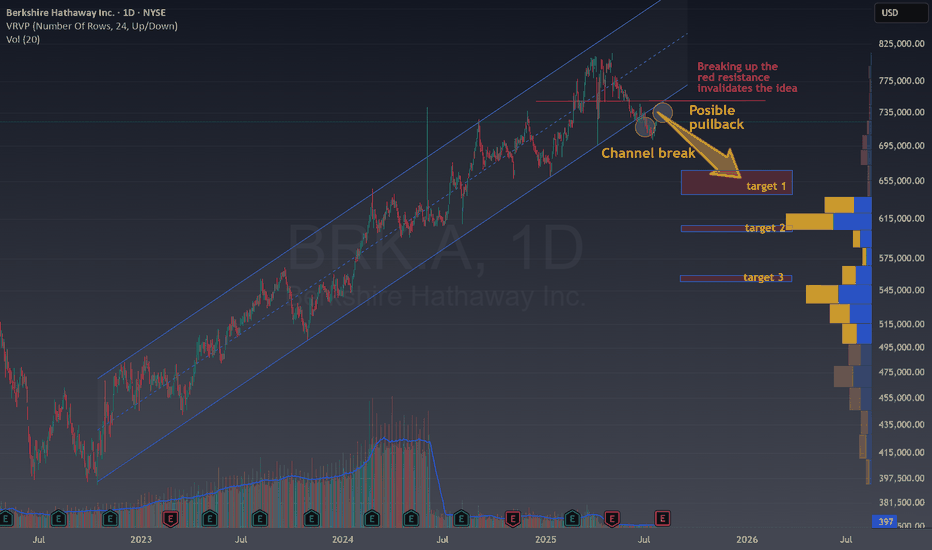

Berkshire is losing the Buffet's premiumTechnical Overview

Looking at the current NYSE:BRK.A chart, several signals suggest a potential shift from the prior bullish trend:

Channel Break : Price has broken down from a long-standing ascending channel, which often marks the end of an uptrend and the start of a consolidation or a bea

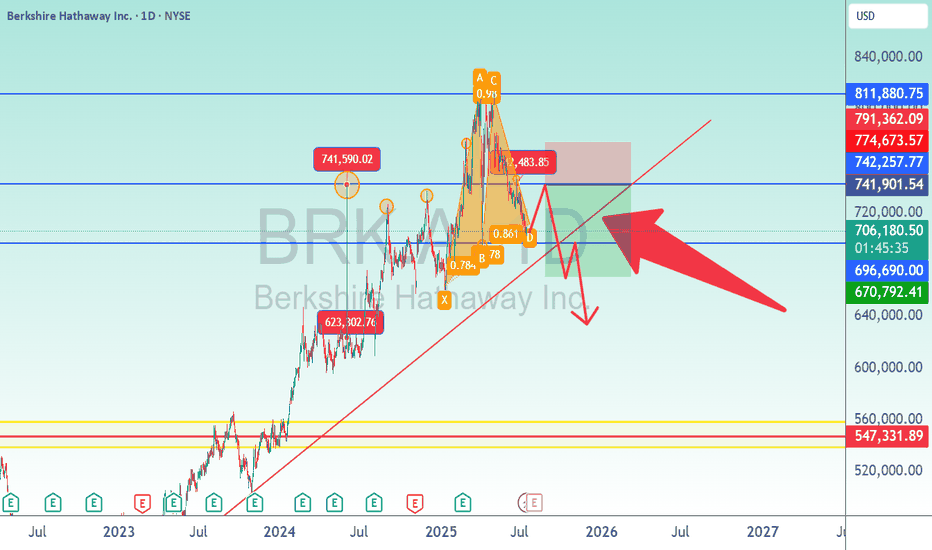

Bershire Hathaway Stock Analysis/BRK.AI looked at this particular stock because of insane activity from $623,302 to $741,590 in one day. That rejection told me to pay attention Money was coming to the door. So if the market is approaching this area again, rejection is the likely response. Looking at a short is temporary. This mar

What's the deal with BRK.B?! Where is the short term bottom?I'm pretty new to this, so I'm looking to see if anyone has any thoughts about BRK.B. The best looking support is the April low, but it seems like it could fall below to the Jan 2025 low with the way it is steadily dropping. That would suck! I'm averaged at $491 and prefer not to see it go that low,

Berkshire Hathaway: Time to consider exitsHello,

Despite recent market volatility, Berkshire Hathaway (BRK.A, BRK.B) has demonstrated resilience, with its stock rising approximately 16% year-to-date in 2025, significantly outperforming the S&P 500’s 2% decline. This performance has fueled speculation about Warren Buffett’s strategy, partic

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

N

ENRN5056545

Northern Natural Gas Co. 4.1% 15-SEP-2042Yield to maturity

7.56%

Maturity date

Sep 15, 2042

N

ENRN5163032

Northern Natural Gas Co. 3.4% 16-OCT-2051Yield to maturity

7.34%

Maturity date

Oct 16, 2051

E

D4914006

Eastern Energy Gas Holdings, LLC 3.9% 15-NOV-2049Yield to maturity

7.26%

Maturity date

Nov 15, 2049

B

BRK5147453

Berkshire Hathaway Energy Company 2.85% 15-MAY-2051Yield to maturity

6.98%

Maturity date

May 15, 2051

See all BRKB bonds

Curated watchlists where BRKB is featured.

Frequently Asked Questions

The current price of BRKB is 8,650.00 MXN — it has increased by 0.18% in the past 24 hours. Watch BERKSHIRE HATHAWAY INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BIVA exchange BERKSHIRE HATHAWAY INC stocks are traded under the ticker BRKB.

BRKB stock has fallen by −2.48% compared to the previous week, the month change is a −3.19% fall, over the last year BERKSHIRE HATHAWAY INC has showed a 5.56% increase.

We've gathered analysts' opinions on BERKSHIRE HATHAWAY INC future price: according to them, BRKB price has a max estimate of 11,314.32 MXN and a min estimate of 9,191.70 MXN. Watch BRKB chart and read a more detailed BERKSHIRE HATHAWAY INC stock forecast: see what analysts think of BERKSHIRE HATHAWAY INC and suggest that you do with its stocks.

BRKB stock is 1.05% volatile and has beta coefficient of 0.50. Track BERKSHIRE HATHAWAY INC stock price on the chart and check out the list of the most volatile stocks — is BERKSHIRE HATHAWAY INC there?

Today BERKSHIRE HATHAWAY INC has the market capitalization of 18.67 T, it has decreased by −3.35% over the last week.

Yes, you can track BERKSHIRE HATHAWAY INC financials in yearly and quarterly reports right on TradingView.

BERKSHIRE HATHAWAY INC is going to release the next earnings report on Nov 3, 2025. Keep track of upcoming events with our Earnings Calendar.

BRKB earnings for the last quarter are 96.96 MXN per share, whereas the estimation was 93.94 MXN resulting in a 3.22% surprise. The estimated earnings for the next quarter are 102.34 MXN per share. See more details about BERKSHIRE HATHAWAY INC earnings.

BERKSHIRE HATHAWAY INC revenue for the last quarter amounts to 1.74 T MXN, despite the estimated figure of 1.73 T MXN. In the next quarter, revenue is expected to reach 1.78 T MXN.

BRKB net income for the last quarter is 232.04 B MXN, while the quarter before that showed 94.30 B MXN of net income which accounts for 146.06% change. Track more BERKSHIRE HATHAWAY INC financial stats to get the full picture.

No, BRKB doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 11, 2025, the company has 392.4 K employees. See our rating of the largest employees — is BERKSHIRE HATHAWAY INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. BERKSHIRE HATHAWAY INC EBITDA is 1.33 T MXN, and current EBITDA margin is 19.46%. See more stats in BERKSHIRE HATHAWAY INC financial statements.

Like other stocks, BRKB shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BERKSHIRE HATHAWAY INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So BERKSHIRE HATHAWAY INC technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating BERKSHIRE HATHAWAY INC stock shows the sell signal. See more of BERKSHIRE HATHAWAY INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.