Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.03 MXN

16.42 B MXN

296.95 B MXN

15.11 B

About CEMEX S.A.B. DE C.V.

Sector

Industry

CEO

Jaime Muguiro Dominguez

Website

Headquarters

San Pedro Garza García

Founded

1906

ISIN

MXP225611567

FIGI

BBG00JX0NGK8

CEMEX SAB de CV operates as a global construction materials company. It offers cement, ready-mixconcrete, aggregates, and urbanization solutions. The firm operates through the following geographical segments: Mexico, United States, Europe, Middle East, Africa and Asia (EMEAA) and South, Central America and the Caribbean (SCA&C). The company was founded by Lorenzo Zambrano Gutierrez in 1906 and is headquartered in San Pedro Garza Garcia, Mexico.

Related stocks

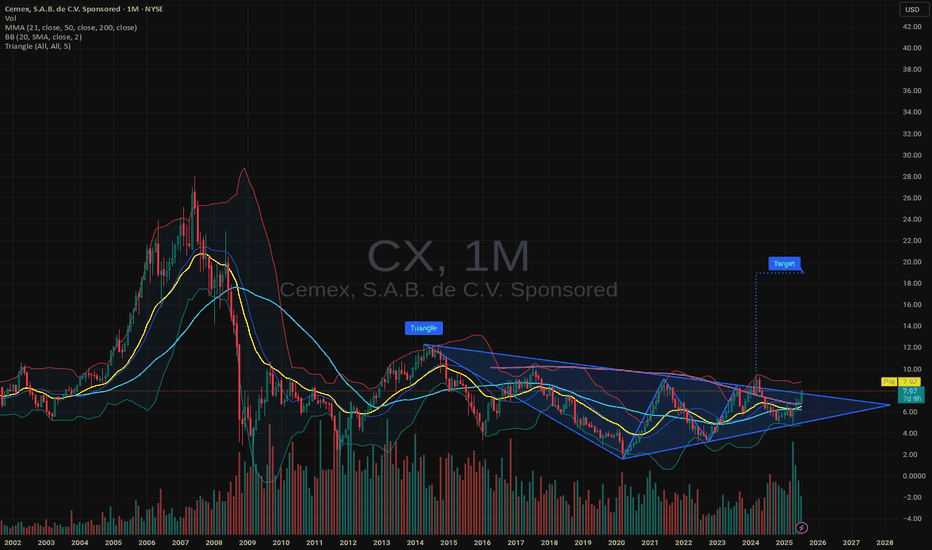

CX | Long | Triangle Breakout & Value Entry | (May 2025)CX | Long | Watching for Triangle Breakout & Value Entry | (May 2025)

1️⃣ Short Insight Summary:

CX has been stuck in a long-term consolidation pattern since 2008, but now it’s approaching a key decision point. We’re seeing signs of potential breakout movement, especially as price compresses within

CEMEX/CPO - Buying OpportunityCEMEX/CPO - Buying Opportunity.

TF analysis: 4H.

According to technical analysis, we can observe that we are in an uptrend channel, in which the price is gaining greater inclination by making higher lows. The projection of the possible upward movement is located up to the upper end of the channel.

The importance of using different TimeframesWhen visualizing the market and conducting technical analysis, it is crucial to interpret different timeframes.

Multi-timeframe analysis can enhance the probability of success in our trading by utilizing support and resistance levels from higher timeframes than our base timeframe.

It is also usefu

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

CX5108068

CEMEX, S.A.B. de C.V. 3.875% 11-JUL-2031Yield to maturity

5.44%

Maturity date

Jul 11, 2031

CX4911672

CEMEX, S.A.B. de C.V. 5.45% 19-NOV-2029Yield to maturity

5.26%

Maturity date

Nov 19, 2029

CX5045771

CEMEX, S.A.B. de C.V. 5.2% 17-SEP-2030Yield to maturity

5.22%

Maturity date

Sep 17, 2030

CEXM

CEMEX S.A.B. 19/26 REGSYield to maturity

4.47%

Maturity date

Mar 19, 2026

CX5197272

CEMEX, S.A.B. de C.V. 5.125% PERPYield to maturity

—

Maturity date

—

USP2253TJW0

CEMEX S.A.B. 25/UND. FLRYield to maturity

—

Maturity date

—

See all CEMEX/CPO bonds

Frequently Asked Questions

The current price of CEMEX/CPO is 15.99 MXN — it has increased by 2.37% in the past 24 hours. Watch CEMEX, S.A.B. DE C.V stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BIVA exchange CEMEX, S.A.B. DE C.V stocks are traded under the ticker CEMEX/CPO.

CEMEX/CPO stock has fallen by −0.62% compared to the previous week, the month change is a 20.00% rise, over the last year CEMEX, S.A.B. DE C.V has showed a 33.58% increase.

We've gathered analysts' opinions on CEMEX, S.A.B. DE C.V future price: according to them, CEMEX/CPO price has a max estimate of 31.56 MXN and a min estimate of 11.14 MXN. Watch CEMEX/CPO chart and read a more detailed CEMEX, S.A.B. DE C.V stock forecast: see what analysts think of CEMEX, S.A.B. DE C.V and suggest that you do with its stocks.

CEMEX/CPO stock is 3.27% volatile and has beta coefficient of 1.54. Track CEMEX, S.A.B. DE C.V stock price on the chart and check out the list of the most volatile stocks — is CEMEX, S.A.B. DE C.V there?

Today CEMEX, S.A.B. DE C.V has the market capitalization of 235.98 B, it has increased by 0.07% over the last week.

Yes, you can track CEMEX, S.A.B. DE C.V financials in yearly and quarterly reports right on TradingView.

CEMEX, S.A.B. DE C.V is going to release the next earnings report on Oct 28, 2025. Keep track of upcoming events with our Earnings Calendar.

CEMEX/CPO earnings for the last quarter are 0.37 MXN per share, whereas the estimation was 0.32 MXN resulting in a 14.54% surprise. The estimated earnings for the next quarter are 0.34 MXN per share. See more details about CEMEX, S.A.B. DE C.V earnings.

CEMEX, S.A.B. DE C.V revenue for the last quarter amounts to 76.58 B MXN, despite the estimated figure of 79.37 B MXN. In the next quarter, revenue is expected to reach 79.97 B MXN.

CEMEX/CPO net income for the last quarter is 6.21 B MXN, while the quarter before that showed 14.98 B MXN of net income which accounts for −58.58% change. Track more CEMEX, S.A.B. DE C.V financial stats to get the full picture.

CEMEX, S.A.B. DE C.V dividend yield was 1.38% in 2024, and payout ratio reached 14.24%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 8, 2025, the company has 44.49 K employees. See our rating of the largest employees — is CEMEX, S.A.B. DE C.V on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. CEMEX, S.A.B. DE C.V EBITDA is 56.15 B MXN, and current EBITDA margin is 19.00%. See more stats in CEMEX, S.A.B. DE C.V financial statements.

Like other stocks, CEMEX/CPO shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade CEMEX, S.A.B. DE C.V stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So CEMEX, S.A.B. DE C.V technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating CEMEX, S.A.B. DE C.V stock shows the buy signal. See more of CEMEX, S.A.B. DE C.V technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.