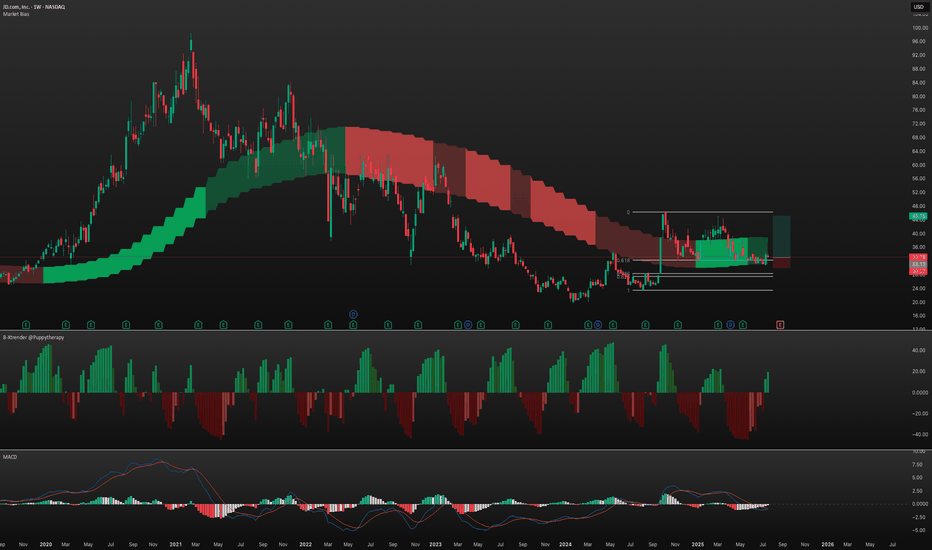

JD last correction is overSince fiscal stimulus announced by China, JD started to print an expanding diagonal which I labeled in black as 1-2-3-4-5. Currently, wave 4 is over (or will be over within a few days) and wave 5, the longest in such a type of diagonal, is set to unfold.

Which supportive evidence I found:

wave 4

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

87.24 MXN

119.82 B MXN

3.36 T MXN

1.35 B

About JD.com, Inc.

Sector

Industry

CEO

Ran Xu

Website

Headquarters

Beijing

Founded

1998

FIGI

BBG00JX0QCR7

JD.com, Inc. is a technology-driven E-commerce company, which engages in the sale of electronics products and general merchandise products, including audio, video products, and books. It operates in the following segments: JD Retail, JD Logistics, and New Businesses. The JD Retail segment offers online retail, online marketplace, and marketing services. The JD Logistics segment includes internal and external logistics businesses. The New Businesses segment is composed of JD Property, Jingxi, overseas businesses and technology initiatives. The company was founded on June 18, 1998, by Qiang Dong Liu and is headquartered in Beijing, China.

Related stocks

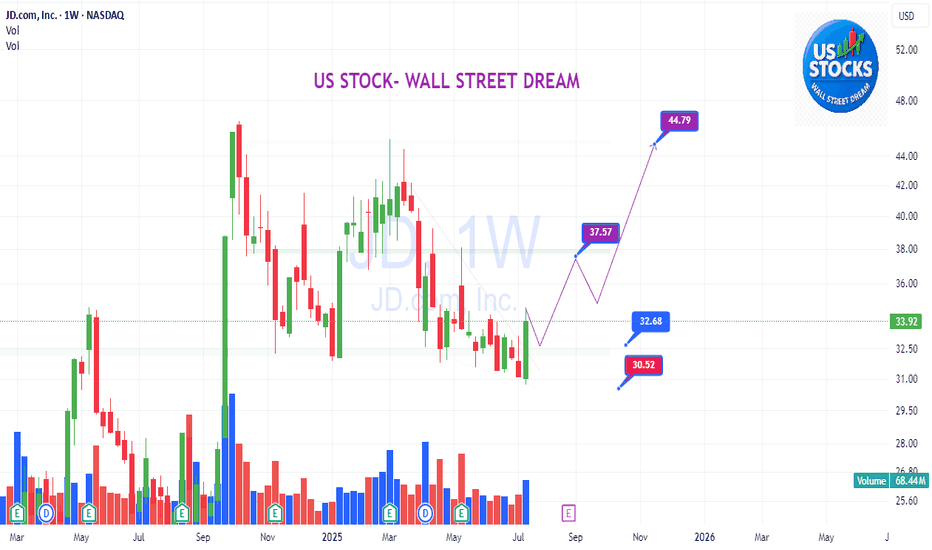

Bullish Gartley Pattern – Trade Setup on JD.comPotential Bullish Gartley pattern has formed with the following structure: XABCD.

initial low X = 23.45 , Price rallies to point A, then forms a corrective structure down to

D = 30.71 trough BCD. CD leg is downward, completing the pattern.

Despite the decline, point D is higher than X, suggestin

$JD | Potential long setupPotential reversal at the .618

If we just K.I.S.S. we might just get lucky.. at least that’s the idea! Right..??

Trade idea:

Potential long scenario playing out that is worth the shot for me, with proper risk management of course. For discussion purposes this is a very small trade in my portfolio

JD.cm | JD | Long at $33.16Like Amazon NASDAQ:AMZN and Alibaba NYSE:BABA , I suspect AI and robotics will enhance JD.com's NASDAQ:JD automation in warehousing, delivery, and retail. There is some risk here, like other Chinese stocks, that they could be delisted from the US market if trade/war tensions rise. But I just d

Has JD.com Bottomed?JD.com has languished for a couple of months, but some traders may think the Chinese e-commerce stock has bottomed.

The first pattern on today’s chart is the April low of $31.80. JD closed below the level once in May but quickly rebounded. That could be interpreted as a false breakdown.

Second, MA

JD.com - To long or not to long ?If you want to gain market share in a newly encroached area that you are entering, sometimes, having hoards of cash in your balance sheet helps. That is the case for JD.com who has recently entered into the food delivery business in China, competing with the likes of market leader, Meituan and Aliba

Bullish BO of a descending channel and triangleJD has been pulling back for quite a while, and has just recently broken from the descending channel, after touching a higher TF dynamic support level, reacting from it and today with volume, obviously, every trade has their risks, plus tomorrow is it's earnings release so keeping that in mind... Ne

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where JD/N is featured.

Frequently Asked Questions

The current price of JD/N is 591.73 MXN — it has increased by 0.88% in the past 24 hours. Watch JD.COM, INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BIVA exchange JD.COM, INC stocks are traded under the ticker JD/N.

JD/N stock has risen by 1.20% compared to the previous week, the month change is a 1.75% rise, over the last year JD.COM, INC has showed a 21.74% increase.

We've gathered analysts' opinions on JD.COM, INC future price: according to them, JD/N price has a max estimate of 1,307.46 MXN and a min estimate of 522.62 MXN. Watch JD/N chart and read a more detailed JD.COM, INC stock forecast: see what analysts think of JD.COM, INC and suggest that you do with its stocks.

JD/N stock is 2.74% volatile and has beta coefficient of 0.78. Track JD.COM, INC stock price on the chart and check out the list of the most volatile stocks — is JD.COM, INC there?

Today JD.COM, INC has the market capitalization of 795.81 B, it has increased by 0.35% over the last week.

Yes, you can track JD.COM, INC financials in yearly and quarterly reports right on TradingView.

JD.COM, INC is going to release the next earnings report on Aug 14, 2025. Keep track of upcoming events with our Earnings Calendar.

JD/N earnings for the last quarter are 23.74 MXN per share, whereas the estimation was 20.16 MXN resulting in a 17.75% surprise. The estimated earnings for the next quarter are 9.64 MXN per share. See more details about JD.COM, INC earnings.

JD.COM, INC revenue for the last quarter amounts to 849.75 B MXN, despite the estimated figure of 820.06 B MXN. In the next quarter, revenue is expected to reach 876.91 B MXN.

JD/N net income for the last quarter is 30.66 B MXN, while the quarter before that showed 28.58 B MXN of net income which accounts for 7.29% change. Track more JD.COM, INC financial stats to get the full picture.

Yes, JD/N dividends are paid annually. The last dividend per share was 20.45 MXN. As of today, Dividend Yield (TTM)% is 3.11%. Tracking JD.COM, INC dividends might help you take more informed decisions.

JD.COM, INC dividend yield was 2.83% in 2024, and payout ratio reached 26.23%. The year before the numbers were 2.56% and 34.39% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 12, 2025, the company has 570.89 K employees. See our rating of the largest employees — is JD.COM, INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. JD.COM, INC EBITDA is 145.48 B MXN, and current EBITDA margin is 4.14%. See more stats in JD.COM, INC financial statements.

Like other stocks, JD/N shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade JD.COM, INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So JD.COM, INC technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating JD.COM, INC stock shows the sell signal. See more of JD.COM, INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.