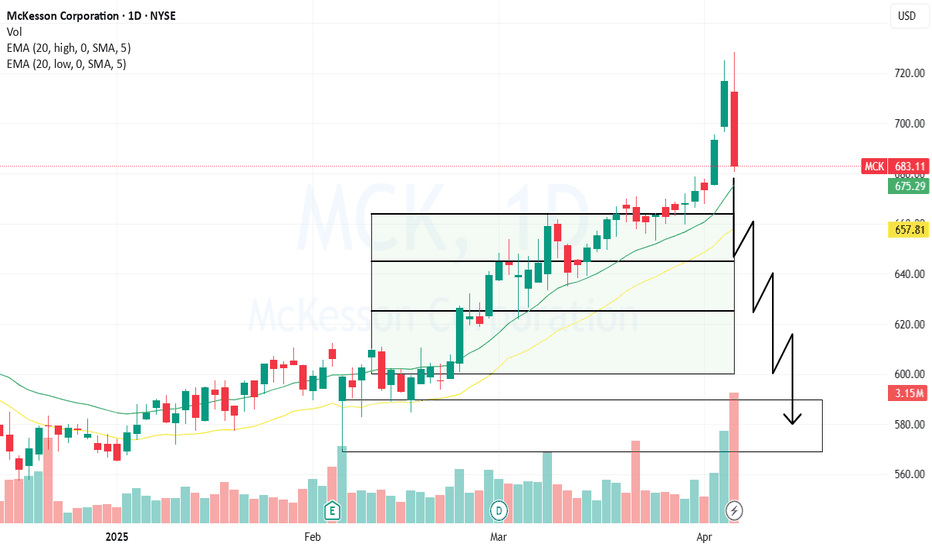

Factors that include a retrace below resistanceMany oscillators are pointing in this direction, as well as technical analysis. It has been a turbulent few weeks, but in a way, it has consistently put us at a reversal point, making it very difficult for this trend to continue beyond 700 until we see a pullback.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

531.89 MXN

67.51 B MXN

7.36 T MXN

124.91 M

About McKesson Corporation

Sector

Industry

CEO

Brian Scott Tyler

Website

Headquarters

Irving

Founded

1833

FIGI

BBG00JX0PW12

McKesson Corp. engages in providing healthcare services. It operates through the following segments: U.S. Pharmaceutical, Prescription Technology Solutions (RxTS), Medical-Surgical Solutions, and International. The U.S. Pharmaceutical segment distributes branded, generic, specialty, biosimilar and over-the-counter pharmaceutical drugs. The RxTS segment offers prescription price transparency, benefit insight, dispensing support services, third-party logistics, and wholesale distribution. The Medical-Surgical Solutions segment provides medical-surgical supply distribution, logistics, and other services to healthcare providers. The International segment refers to the distribution and services to wholesale, institutional, and retail customers in Europe and Canada. The company was founded by John McKesson and Charles Olcott in 1833 and is headquartered in Irving, TX.

Related stocks

A major correction underway could see 500s againThe catalyst doesn't lie, but neither does the TA. We have clearly pointed out key elements to the significance of how low this can go. Major turning points sit at sub 600, volume, and volatility. This will continue to sell off, but expect a retrieval at some point closest to the low 600s.

MCK - LONG SWINGTRADEStock traders may advise shareholders and help manage portfolios. Traders engage in buying and selling bonds, stocks, futures and shares in hedge funds. A stock trader also conducts extensive research and observation of how financial markets perform. This is accomplished through economic and microec

MCK in Sell ZoneMy trading plan is very simple.

I buy or sell when at three of these events happen:

* Price tags the top or bottom of parallel channel zones

* Money flow spikes beyond it's Bollinger Bands

* Stochastic Momentum Index (SMI) at near oversold overbought level

* Price at Fibonacci levels

So...

Here's

Expert Analysis Reveals Key Entry Points!McKesson Corporation (MCK) continues to demonstrate resilience and growth potential, evident from its recent price action and robust financial performance. Here’s a detailed analysis for potential investors.

MCK has been in a steady uptrend, currently trading at $586.34. The stock has shown consist

MCK a large cap medical supply company LONGMCK is a large cap medical supply company- it has experienced respectable earnings reports

and steady growth as medical entities including surgery centers and hospitals are busy catching

up on electric surgeries from the COVID era. It is rising ar or under the second upper VWAP

line. The dual tim

MCK = PERMA-BULL! Long-term buy & hold.Over the past 2 years, MCK has been in a rock-solid, aggressive uptrend, gaining 50% in '22 and 30% in '23. The weekly TTM squeeze just fired LONG (again) for the 4th time in three years. This beast is a case-study in layered AVWAP! You could wait for a pullback (since it is slightly extended fro

either the best recovery or solid continuationidk why NYSE:MCK is down $20 in the post market but the top to bottom was over $25. earning and guidance both beat and future guidance is strong. some link to a rite aid bankruptcy has seemed to be the only dark cloud news. The technicals did max out on its push up to ath......so was this just a t

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

O

OHIO5283946

OhioHealth Corporation 2.834% 15-NOV-2041Yield to maturity

6.73%

Maturity date

Nov 15, 2041

O

OHIO4991199

OhioHealth Corporation 3.042% 15-NOV-2050Yield to maturity

6.53%

Maturity date

Nov 15, 2050

O

OHIO4991198

OhioHealth Corporation 2.807% 15-NOV-2035Yield to maturity

5.51%

Maturity date

Nov 15, 2035

O

OHIO4991195

OhioHealth Corporation 1.775% 15-NOV-2025Yield to maturity

5.47%

Maturity date

Nov 15, 2025

O

OHIO5283943

OhioHealth Corporation 2.297% 15-NOV-2031Yield to maturity

5.01%

Maturity date

Nov 15, 2031

See all MCK bonds

Frequently Asked Questions

The current price of MCK is 13,900.00 MXN — it has increased by 2.72% in the past 24 hours. Watch MCKESSON CORPORATION stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BIVA exchange MCKESSON CORPORATION stocks are traded under the ticker MCK.

MCK stock has risen by 3.07% compared to the previous week, the month change is a 3.07% rise, over the last year MCKESSON CORPORATION has showed a 55.26% increase.

We've gathered analysts' opinions on MCKESSON CORPORATION future price: according to them, MCK price has a max estimate of 15,523.25 MXN and a min estimate of 13,914.13 MXN. Watch MCK chart and read a more detailed MCKESSON CORPORATION stock forecast: see what analysts think of MCKESSON CORPORATION and suggest that you do with its stocks.

MCK stock is 2.67% volatile and has beta coefficient of 0.37. Track MCKESSON CORPORATION stock price on the chart and check out the list of the most volatile stocks — is MCKESSON CORPORATION there?

Today MCKESSON CORPORATION has the market capitalization of 1.72 T, it has increased by 1.53% over the last week.

Yes, you can track MCKESSON CORPORATION financials in yearly and quarterly reports right on TradingView.

MCKESSON CORPORATION is going to release the next earnings report on Jul 30, 2025. Keep track of upcoming events with our Earnings Calendar.

MCK earnings for the last quarter are 207.33 MXN per share, whereas the estimation was 201.33 MXN resulting in a 2.98% surprise. The estimated earnings for the next quarter are 157.24 MXN per share. See more details about MCKESSON CORPORATION earnings.

MCKESSON CORPORATION revenue for the last quarter amounts to 1.86 T MXN, despite the estimated figure of 1.93 T MXN. In the next quarter, revenue is expected to reach 1.83 T MXN.

MCK net income for the last quarter is 25.81 B MXN, while the quarter before that showed 18.33 B MXN of net income which accounts for 40.85% change. Track more MCKESSON CORPORATION financial stats to get the full picture.

Yes, MCK dividends are paid quarterly. The last dividend per share was 13.65 MXN. As of today, Dividend Yield (TTM)% is 0.38%. Tracking MCKESSON CORPORATION dividends might help you take more informed decisions.

MCKESSON CORPORATION dividend yield was 0.41% in 2024, and payout ratio reached 10.69%. The year before the numbers were 0.45% and 10.72% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jun 22, 2025, the company has 45 K employees. See our rating of the largest employees — is MCKESSON CORPORATION on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. MCKESSON CORPORATION EBITDA is 97.62 B MXN, and current EBITDA margin is 1.39%. See more stats in MCKESSON CORPORATION financial statements.

Like other stocks, MCK shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MCKESSON CORPORATION stock right from TradingView charts — choose your broker and connect to your account.