Key facts today

Morgan Stanley will assist SoftBank with a potential U.S. IPO for its PayPay app, aiming to raise over $2 billion, expected in Q4 2025.

Morgan Stanley's Andrew Szczurowski highlighted the Fed's labor target miss, fueling speculation of a possible interest rate cut in September following July's inflation data.

Morgan Stanley's chief economist, Ellen Zentner, reported that inflation has risen, but not as much as expected, amid talks of possible interest rate cuts by the Federal Reserve.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

167.58 MXN

279.17 B MXN

2.24 T MXN

1.22 B

About Morgan Stanley

Sector

Industry

CEO

Edward N. Pick

Website

Headquarters

New York

Founded

1924

FIGI

BBG00JX0P771

Morgan Stanley operates as a global financial services company. The firm provides investment banking products and services to its clients and customers including corporations, governments, financial institutions, and individuals. It operates through the following segments: Institutional Securities, Wealth Management, and Investment Management. The Institutional Services segment provides financial advisory, capital-raising services, and related financing services on behalf of institutional investors. The Wealth Management segment offers brokerage and investment advisory services covering various types of investments, including equities, options, futures, foreign currencies, precious metals, fixed-income securities, mutual funds, structured products, alternative investments, unit investment trusts, managed futures, separately managed accounts, and mutual fund asset allocation programs. The Investment Management segment provides equity, fixed income, alternative investments, real estate, and merchant banking strategies. The company was founded by Harold Stanley and Henry S. Morgan in 1924 and is headquartered in New York, NY.

Related stocks

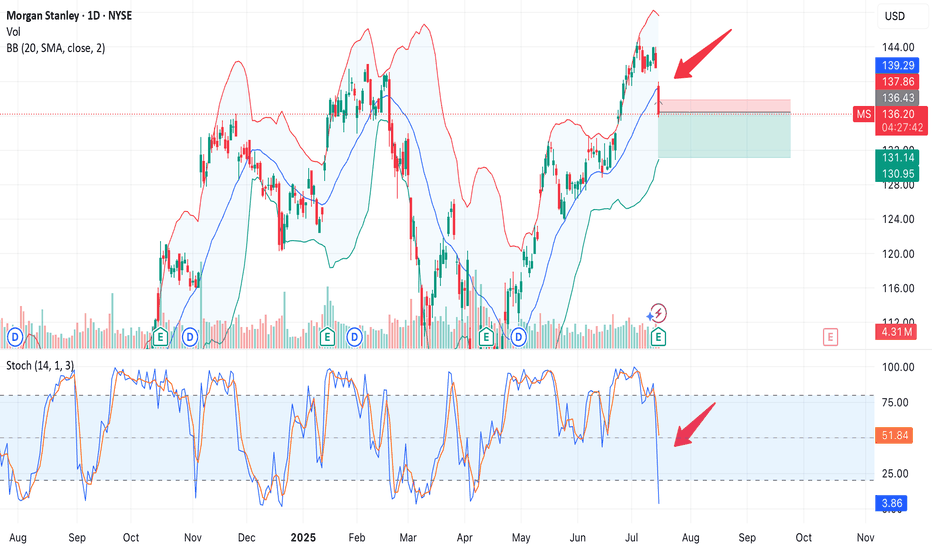

A potential break and retest on MS.OptionsMastery:

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can c

Morgan Stanley: Post-Earnings Reaction & Technical SetupToday, NYSE:MS released strong earnings:

🔹 $2.13 EPS vs. expected $1.98

🔹 Revenue: $16.8B, including:

— +23% in equity trading

— +9% in fixed income

— $59B inflows into Wealth Management

Despite the beat, the stock dropped nearly 4%, signaling possible profit-taking after a 30%+ rally year-to-d

AI Innovations and Global Strategy Current Price: $140.69

Direction: LONG

Targets:

- T1 = $145

- T2 = $150

Stop Levels:

- S1 = $136

- S2 = $135

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify

MS Triple top "SELL" Short opportunityMS has been in a strong uptrend since April 7th 2025. Daily RSI is at 75 and is a great short opportunity near $139. MS has seen a 49% increase in 2.5 months from $94 to $140.

Target 1 on short would be a retest of previous high of $134 / stop would be anything over $141.50

Morgan Stanley (NYSE: MS) Reports Strong Q125 ResultsMorgan Stanley (NYSE: NYSE:MS ) Beats Q1 estimates with record Equity Trading Revenue. The bank posted earnings per share (EPS) of $2.60, beating analyst expectations of $2.18. Revenue reached a record $17.74 billion, topping forecasts of $16.44 billion.

The bank's equity trading revenue soared 45

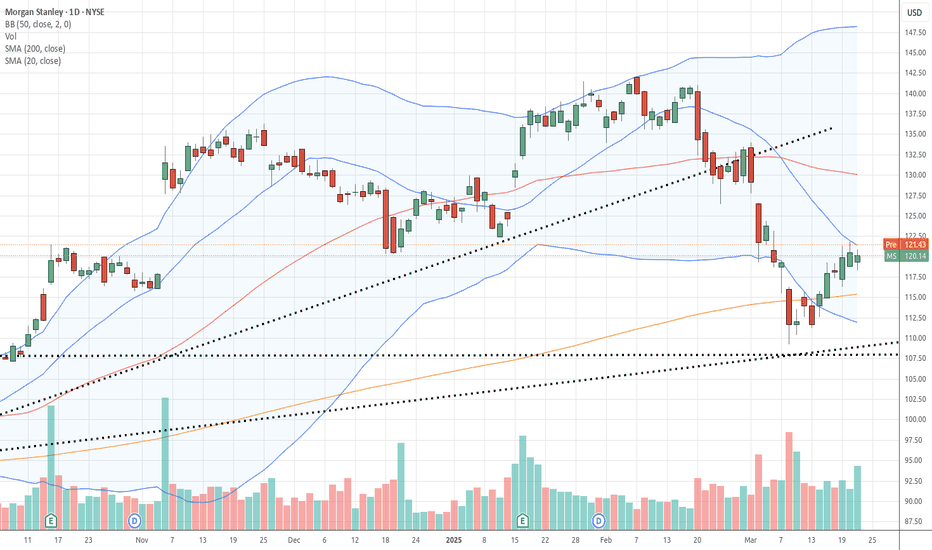

Playing off the potential false breakout?Morgan Stanley's chart is at a critical juncture. After a slide in a descending channel, it briefly poked its head above, but that breakout looks shaky! Now it's dancing around the $115 support zone. A solid hold here, and we might see a bounce. But if that support caves? Watch out for further downs

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

M

MS5169549

Morgan Stanley Finance LLC 0.0% 30-APR-2031Yield to maturity

102.10%

Maturity date

Apr 30, 2031

M

MS4685759

Morgan Stanley Finance LLC 0.0% 29-SEP-2028Yield to maturity

92.20%

Maturity date

Sep 29, 2028

M

MS4855431

Morgan Stanley Finance LLC 0.0% 31-JUL-2029Yield to maturity

64.80%

Maturity date

Jul 31, 2029

M

FR0013328002

MorganStanleyCo 11/06/2026 Bkt of SharesYield to maturity

51.55%

Maturity date

Jun 11, 2026

M

MS5276420

Morgan Stanley Finance LLC 0.0% 03-NOV-2025Yield to maturity

32.95%

Maturity date

Nov 3, 2025

See all MS bonds

Curated watchlists where MS is featured.

Frequently Asked Questions

The current price of MS is 2,686.02 MXN — it has increased by 2.41% in the past 24 hours. Watch MORGAN STANLEY stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BIVA exchange MORGAN STANLEY stocks are traded under the ticker MS.

MS stock has risen by 0.31% compared to the previous week, the month change is a 0.78% rise, over the last year MORGAN STANLEY has showed a 49.46% increase.

We've gathered analysts' opinions on MORGAN STANLEY future price: according to them, MS price has a max estimate of 2,981.18 MXN and a min estimate of 2,273.15 MXN. Watch MS chart and read a more detailed MORGAN STANLEY stock forecast: see what analysts think of MORGAN STANLEY and suggest that you do with its stocks.

MS stock is 2.38% volatile and has beta coefficient of 1.52. Track MORGAN STANLEY stock price on the chart and check out the list of the most volatile stocks — is MORGAN STANLEY there?

Today MORGAN STANLEY has the market capitalization of 4.29 T, it has decreased by −0.07% over the last week.

Yes, you can track MORGAN STANLEY financials in yearly and quarterly reports right on TradingView.

MORGAN STANLEY is going to release the next earnings report on Oct 15, 2025. Keep track of upcoming events with our Earnings Calendar.

MS earnings for the last quarter are 39.95 MXN per share, whereas the estimation was 37.18 MXN resulting in a 7.47% surprise. The estimated earnings for the next quarter are 38.55 MXN per share. See more details about MORGAN STANLEY earnings.

MORGAN STANLEY revenue for the last quarter amounts to 314.99 B MXN, despite the estimated figure of 301.37 B MXN. In the next quarter, revenue is expected to reach 305.13 B MXN.

MS net income for the last quarter is 66.39 B MXN, while the quarter before that showed 88.40 B MXN of net income which accounts for −24.91% change. Track more MORGAN STANLEY financial stats to get the full picture.

Yes, MS dividends are paid quarterly. The last dividend per share was 18.89 MXN. As of today, Dividend Yield (TTM)% is 2.62%. Tracking MORGAN STANLEY dividends might help you take more informed decisions.

MORGAN STANLEY dividend yield was 2.82% in 2024, and payout ratio reached 44.68%. The year before the numbers were 3.49% and 62.71% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 12, 2025, the company has 80 K employees. See our rating of the largest employees — is MORGAN STANLEY on this list?

Like other stocks, MS shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MORGAN STANLEY stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So MORGAN STANLEY technincal analysis shows the strong buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating MORGAN STANLEY stock shows the buy signal. See more of MORGAN STANLEY technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.