15,015.38

0.00 BRL

71.97 B BRL

226.15 B BRL

About Abbott Laboratories

Sector

Industry

CEO

Robert B. Ford

Website

Headquarters

Abbott Park

Founded

1888

ISIN

BRABTTBDR007

FIGI

BBG002Q24FQ6

Abbott Laboratories engages in the discovery, development, manufacture, and sale of healthcare products. It operates through the following segments: Established Pharmaceutical Products, Diagnostic Products, Nutritional Products, and Medical Devices. The Established Pharmaceutical Products segment refers to the line of branded generic pharmaceuticals manufactured worldwide and marketed and sold outside the United States in emerging markets. The Diagnostic Products segment markets diagnostic systems and tests for blood banks, hospitals, commercial laboratories, clinics, physicians' offices, retailers, government agencies, and alternate care testing sites. The Nutritional Products segment caters to the worldwide sales of pediatric and adult nutritional products. The Medical Devices segment includes a broad line of rhythm management, electrophysiology, heart failure, vascular and structural heart devices for the treatment of cardiovascular diseases, and diabetes care and continuous glucose monitoring products, as well as neuromodulation devices for the management of chronic pain and movement disorders. The company was founded by Wallace Calvin Abbott in 1888 and is headquartered in Abbott Park, IL.

Related stocks

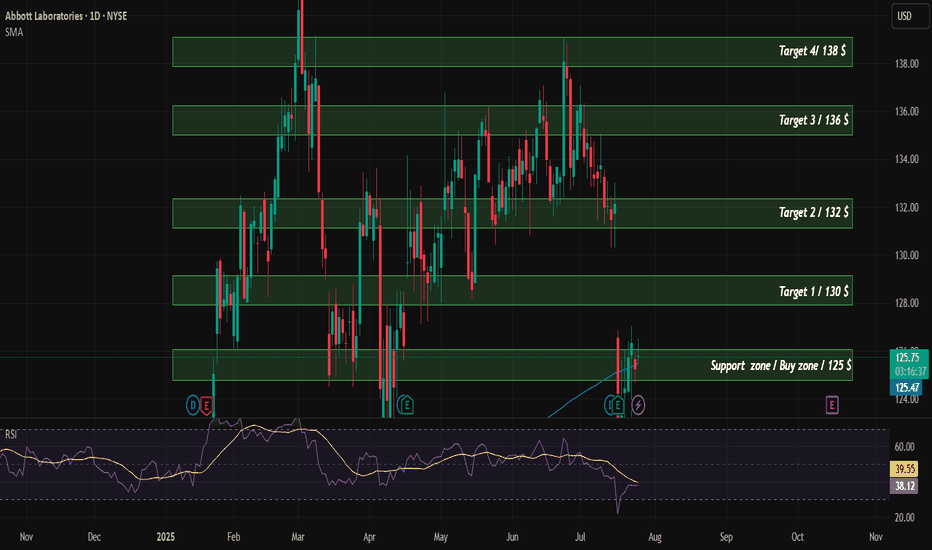

ABT Trade Setup: Breakout Play with 10.6% Upside🏥 Abbott Labs (ABT) Trade Alert

Positioning in this healthcare giant as it breaks out from consolidation - here's the strategic play:

📌 Trade Levels

▶ Entry: $133.12 (confirmed above SMA 50)

🎯 Target: $147.21 (+10.6%)

🛑 Stop Loss: $126.00 (-5.3% risk)

⚖️ Risk/Reward: 1:2

Why ABT Now?

✅ Fundamental

ABT – Clean Technical Setup with Strong Risk/Reward📈 Ticker: NYSE:ABT (Abbott Laboratories)

🕒 Timeframe: Daily

💡 Strategy: Ichimoku + MACD + Risk/Reward Setup

Abbott ( NYSE:ABT ) is showing a compelling long opportunity after a pullback to the Tenkan-sen (conversion line) within the Ichimoku Cloud structure. Price action remains bullish as it res

ABT long at 126.75 -- bad new is good news (for me)ABT got some bad news today when a Missouri judge ruled there would be a retrlal regarding a court case involving ABT's baby formula, and the stock, which was already down 3 days in a row, got thumped. While I don't dismiss long term risk from that news, I'm not in this for the long haul. I will l

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

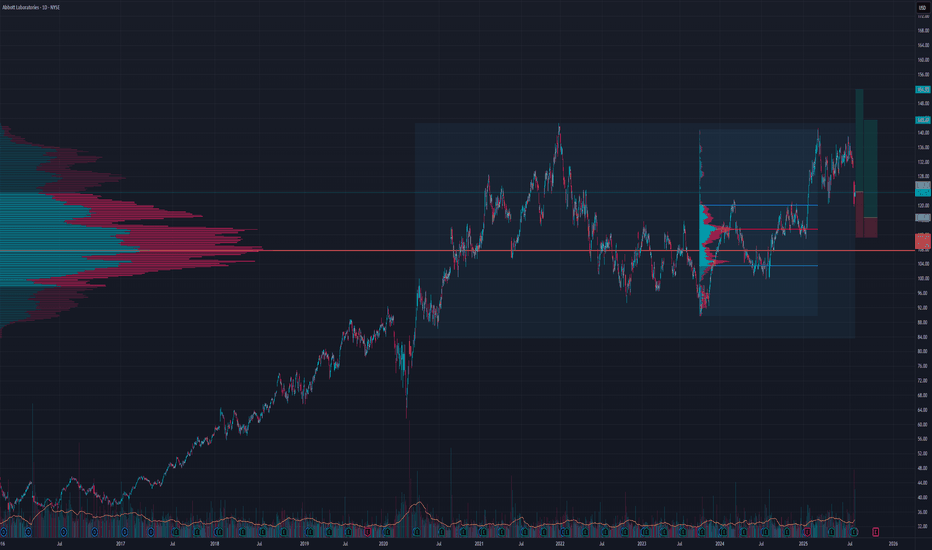

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where ABTT34 is featured.