How to Identify a Head and Shoulders Pattern on TradingViewTo effectively trade the head and shoulders pattern, there are a few factors to consider. If you don’t have an Alpaca account but have a TradingView account, you can sign up for an Alpaca account.

Multiple Time Frame Analysis

Analyze the chart on different time frames—such as 4-hour, daily, and wee

58,500.00

0.00 BRL

30.77 B BRL

269.22 B BRL

About Broadcom Inc.

Sector

Industry

CEO

Hock E. Tan

Website

Headquarters

Palo Alto

Founded

1961

ISIN

BRAVGOBDR003

FIGI

BBG00P14JPL5

Broadcom Inc. is a global technology company, which designs, develops, and supplies semiconductors and infrastructure software solutions. It operates through the Semiconductor Solutions and Infrastructure Software segments. The Semiconductor Solutions segment refers to product lines and intellectual property licensing. The Infrastructure Software segment relates to mainframe, distributed and cyber security solutions, and the FC SAN business. The company was founded in 1961 and is headquartered in Palo Alto, CA.

Related stocks

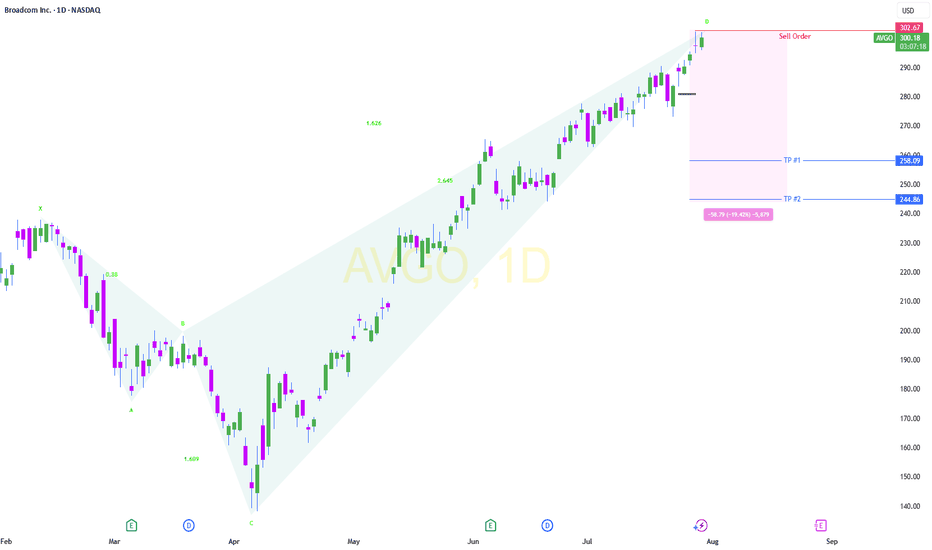

AVGO Bullish Impulse Wave Structure in ProgressAVGO continues its macro advance with a clear 5-wave impulse structure unfolding. The current price action marks the completion of subwave (i) of wave ⑤, setting the stage for a corrective pullback into subwave (ii).

We expect this corrective leg to reach into the 38.2%–50% Fibonacci retracement zo

Broadcom (AVGO): Is This the Dip You've Been Waiting For?Broadcom (AVGO) has been demonstrating a remarkably strong bullish trend since early April, carving out a clear path of higher highs and higher lows. This robust upward momentum is well-defined by a series of ascending channels.

Trend and Channel Dynamics:

Initially, we observed price action mov

AVGO - LONG Swing Entry Plan NASDAQ:AVGO - LONG Swing Entry Plan

Entry Zone 1: $280.80 – $277.00

→ Open initial position targeting +8% from entry level.

Entry Zone 2: $265.50 – $261.00

→ If price dips further, average down with a second equal-sized entry.

→ New target becomes +8% from the average of Entry 1 and Entry 2.

A

AVGO ( Broadcom.Inc ) NASDAQ:AVGO - Continuation of movement within the ascending channel + potential for a breakout to new historical highs. 🔍 Rationale:

• After a strong correction in the first quarter of 2025, the price formed a reversal and has been moving in a clear ascending channel since the beginning of May.

• T

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where AVGO34 is featured.