Berkshire is losing the Buffet's premiumTechnical Overview

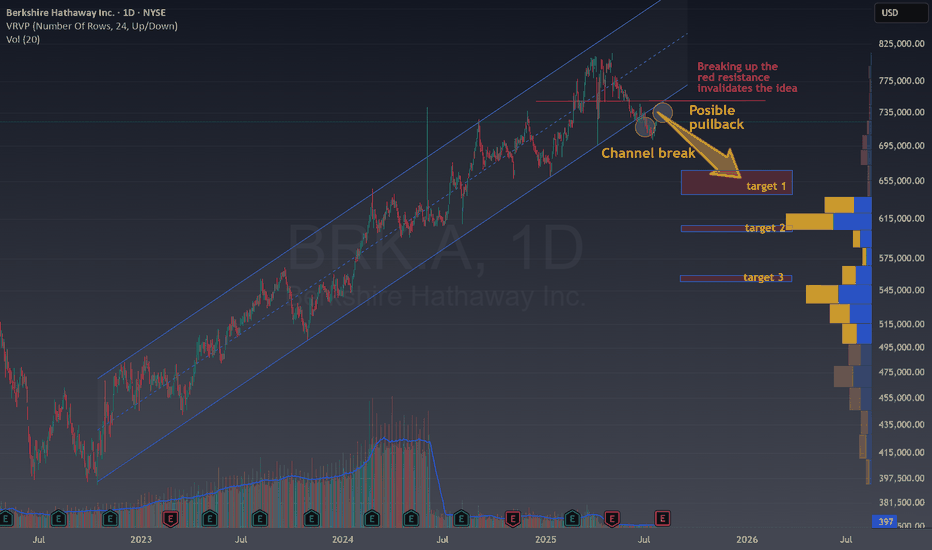

Looking at the current NYSE:BRK.A chart, several signals suggest a potential shift from the prior bullish trend:

Channel Break : Price has broken down from a long-standing ascending channel, which often marks the end of an uptrend and the start of a consolidation or a bea

Key facts today

Berkshire Hathaway's stock has dropped over 10% from its peak, with Class A shares at $712,500 and Class B at $475. Analysts expect few or no buybacks in 2025-2026.

12,903.88

0.01 BRL

479.77 B BRL

2.00 T BRL

About Berkshire Hathaway Inc.

Sector

Industry

CEO

Warren Edward Buffett

Website

Headquarters

Omaha

Founded

1839

ISIN

BRBERKBDR002

FIGI

BBG005HCK769

Berkshire Hathaway, Inc. is a holding company, which engages in the provision of property and casualty insurance and reinsurance, utilities and energy, freight rail transportation, finance, manufacturing, and retailing services. It operates through the following segments: Insurance, Burlington Northern Santa Fe, LLC (BNSF), Berkshire Hathaway Energy (BHE), Pilot Travel Centers (PTC), Manufacturing, McLane, and Service and Retailing. The Insurance segment includes the underwriting of GEICO, Berkshire Hathaway Primary Group, and Berkshire Hathaway Reinsurance Group. The BNSF segment involves the operation of railroad systems. The BHE segment focuses on regulated electric and gas utility, power generation and distribution, and real estate brokerage activities. The PTC segment consists of managing travel centers and marketing of wholesale fuel. The Manufacturing segment refers to industrial, consumer and building products, home building, and related financial services. The McLane segment covers the wholesale distribution of groceries and non-food items. The Service and Retailing segment relates to the provision of shared aircraft ownership programs, aviation pilot training, electronic components distribution, retailing businesses, automobile dealerships and trailer, and furniture leasing services. The company was founded by Oliver Chace in 1839 and is headquartered in Omaha, NE.

Related stocks

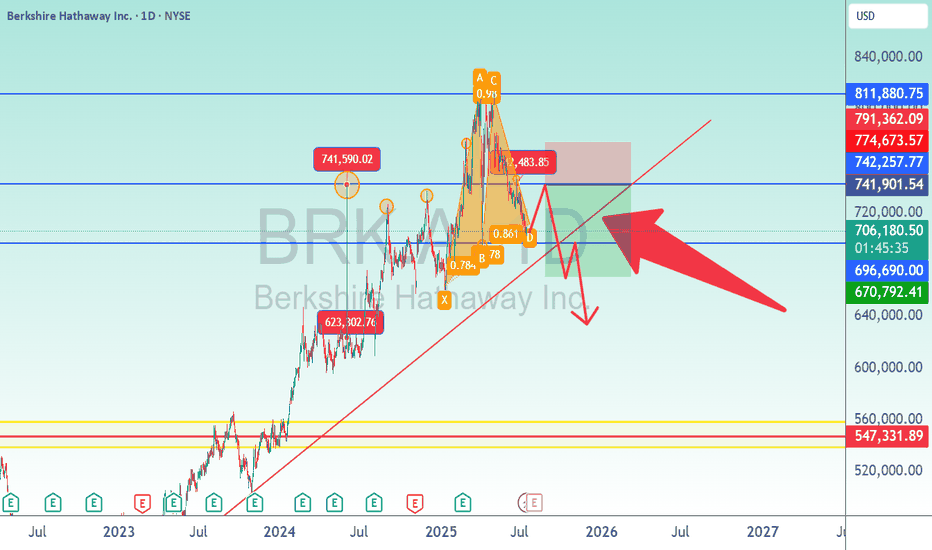

Bershire Hathaway Stock Analysis/BRK.AI looked at this particular stock because of insane activity from $623,302 to $741,590 in one day. That rejection told me to pay attention Money was coming to the door. So if the market is approaching this area again, rejection is the likely response. Looking at a short is temporary. This mar

Berkshire Hathaway looks appealing in todays market conditionsWith most markets at all time highs it is becoming increasingly difficult to find good opportunities for buying. I have decided to allocate about 9% of my portfolio to Berkshire Hathaway as a sort of hedge against some of my other positions. I like to have a diverse exposure to the markets and with

What's the deal with BRK.B?! Where is the short term bottom?I'm pretty new to this, so I'm looking to see if anyone has any thoughts about BRK.B. The best looking support is the April low, but it seems like it could fall below to the Jan 2025 low with the way it is steadily dropping. That would suck! I'm averaged at $491 and prefer not to see it go that low,

Berkshire Hathaway: Time to consider exitsHello,

Despite recent market volatility, Berkshire Hathaway (BRK.A, BRK.B) has demonstrated resilience, with its stock rising approximately 16% year-to-date in 2025, significantly outperforming the S&P 500’s 2% decline. This performance has fueled speculation about Warren Buffett’s strategy, partic

Berkshire Bounce ImminentNYSE:BRK.B Ready To Bounce!

- Breakout and now retesting descending wedge

- Overnight gap up from June 23rd to 24th was filled today

- Retesting top band of 200ema cloud

Targets:

- 3% to 50ma

- 10% to gap fill at $535

If you take anything away from this post, remember this:

Do NOT fade Uncl

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

E

D4914006

Eastern Energy Gas Holdings, LLC 3.9% 15-NOV-2049Yield to maturity

7.66%

Maturity date

Nov 15, 2049

N

ENRN5056545

Northern Natural Gas Co. 4.1% 15-SEP-2042Yield to maturity

7.56%

Maturity date

Sep 15, 2042

N

ENRN5163032

Northern Natural Gas Co. 3.4% 16-OCT-2051Yield to maturity

7.34%

Maturity date

Oct 16, 2051

N

BRK3702175

Northern Pacific Railroad Co. 3.0% 01-JAN-2047Yield to maturity

7.26%

Maturity date

Jan 1, 2047

B

BRK5147453

Berkshire Hathaway Energy Company 2.85% 15-MAY-2051Yield to maturity

7.03%

Maturity date

May 15, 2051

See all BERK34 bonds

Curated watchlists where BERK34 is featured.