Key facts today

HDFC Bank's Q4 FY2025 net profit reached Rs 17,616 crore, up 6.7% year-over-year, exceeding forecasts. The gross NPA ratio improved to 1.33% as of March 31, 2025.

HDFC Bank Limited will hold a board meeting on July 19 to consider the issuance of bonus shares and the declaration of a special interim dividend.

HDFC Bank Limited (HDFCBANK) saw a decline of 0.1% in recent trading, reflecting a broader trend impacting financial services companies in South Asia.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

6.205 BRL

47.34 B BRL

317.40 B BRL

7.66 B

About HDFC BANK LTD

Sector

Industry

CEO

Sashidhar Jagdishan

Website

Headquarters

Mumbai

Founded

1994

ISIN

BRH1DBBDR008

FIGI

BBG00XX9K2R5

HDFC Bank Ltd. engages in the provision of banking and financial services including commercial banking and treasury operations. It operates through the following segments: Treasury, Retail Banking, Wholesale Banking, and Other Banking Business. The Treasury segment is involved in net interest earnings from the investment portfolio, money market borrowing, and lending, gains, or losses on investment operations and on account of trading in foreign exchange and derivative contracts. The Retail Banking segment focuses on serving retail customers through the branch network and other channels. The Wholesale Banking segment provides loans, non-fund facilities, and transaction services to large corporates, emerging corporates, public sector units, government bodies, financial institutions, and medium scale enterprises. The Other Banking Business segment includes income from parabanking activities such as credit cards, debit cards, third party product distribution, primary dealership business, and the associated costs. The company was founded by Aditya Tapishwar Puri in August 1994 and is headquartered in Mumbai, India.

Related stocks

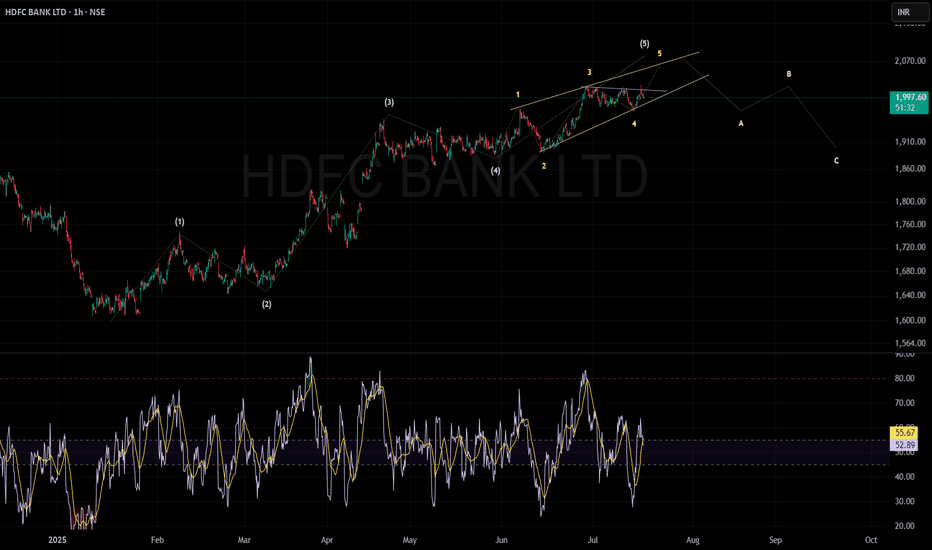

HDFC BANK can move 5th wave upHDFC Bank is currently in the last (5th) wave of an uptrend. This wave is moving inside a narrow, rising wedge pattern called an ending diagonal.

The price can move higher towards ₹2,050–₹2,100 before the trend finishes.

If the price breaks below the bottom of the wedge pattern (ending diagonal),

HDFC Accumulation Breakdown Setup?HDFC seems to be building an accumulation range with:

Range High: ₹1955

Range Low: ₹1908

Currently, price is consolidating within this zone. I'm biased to the sell side for now, expecting a potential breakdown below the ₹1908 level.

⚠️ No confirmation yet — it's a “wait and watch” scenario. A st

HDFC BANK ANALYSIS – 1H TIMEFRAMENSE:HDFCBANK

Symmetrical Triangle Pattern Forming

A breakout or breakdown is likely soon. Price is consolidating within the triangle range.

HDFC BANK ANALYSIS ON 1 HOUR TIME FRAME

IMPORTANT LEVELS TO WATCH:

Resistance: 1941 – 1958 – 1970

Support: 1913 – 1898 – 1885

📌 Chart Pattern: Pr

Bullish on HDFC BANKHDFC BANK has been showing a Bullish price action off late.

The stock was consolidating since 23Apr-25 and if you notice the price action, there has been clear HL formation.

This has also led to a triangular pattern formation and now we have a breakout.

While I was short on HDFC, I have cut that po

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where H1DB34 is featured.

Indian stocks: Racing ahead

46 No. of Symbols

See all sparks