Infosys strong bearish weekly candle !INFOSYS (INFY) – Weekly Ascending Triangle Breakdown | Trendline Retest & Deeper Support

CMP: ₹1,469.60 (as of Aug 1, 2025)

Infosys has broken below an ascending triangle pattern on the weekly timeframe. The upper resistance at ₹1,560 repeatedly rejected price, while higher lows built pressure fro

Key facts today

In Q2 2025, Infosys reported revenue of Rs 42,279 Crore, up from Rs 40,925 Crore, with a net profit of Rs 6,924 Crore, down from Rs 7,038 Crore.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4.175 BRL

17.86 B BRL

108.99 B BRL

3.53 B

About INFOSYS LTD

Sector

Industry

CEO

Salil S. Parekh

Website

Headquarters

Bangalore

Founded

1981

ISIN

BRI1FOBDR005

FIGI

BBG00XXWRH49

Infosys Ltd. is a digital services and consulting company, which engages in the provision of end-to-end business solutions. It operates through the following segments: Financial Services, Retail, Communication; Energy, Utilities, Resources, and Services; Manufacturing, Hi-Tech, Life Sciences, and All Other. The company was founded by Dinesh Krishnan Swamy, Senapathy Gopalakrishnan, Narayana Ramarao Nagavara Murthy, Raghavan N. S., Ashok Arora, Nandan M. Nilekani, and S. D. Shibulal on July 2, 1981 and is headquartered in Bangalore, India.

Related stocks

Swing & Positional Trading and Stock Options Setup _ High Beta✅ Final Setup for Positional and Swing Trades (High Beta Liquid Stocks for Cash and Options)

This trading guide outlines a simple and effective setup for both positional and swing trades, focused on high beta, highly liquid stocks. Follow the rules strictly for better consistency and profitability.

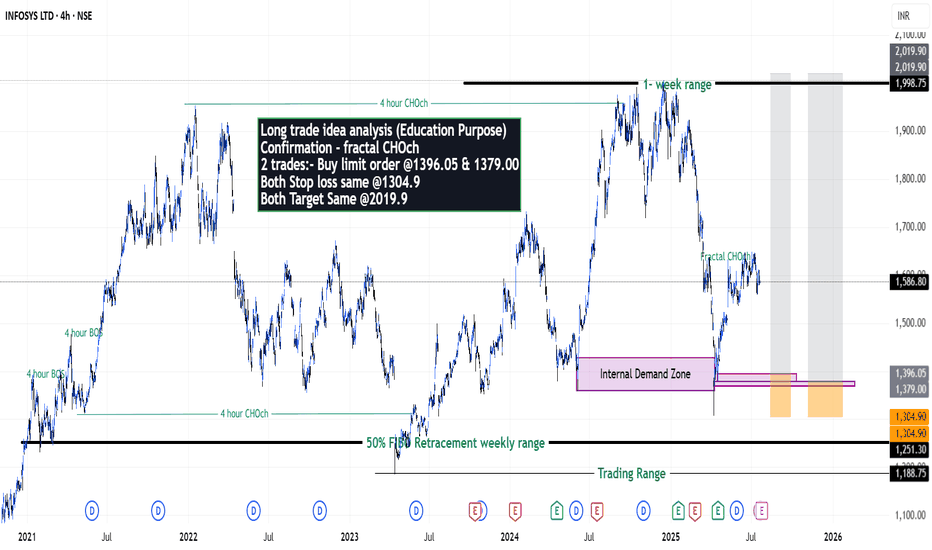

Infosys on getting ready for new high? - {20/07/2025}Educational Analysis says that Infosys (Indian Stock) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - NA

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures:

InfyWhenever marked structure is broken on upper side infy can give good risk to reward trade. However no one knows how much further consolidation can happen.It has slowly started making positive price action above lower time frame 200 ema.

This is just for education and no buying or selling recommendat

INFOSYS 📊 Chart Analysis – Infosys Ltd (INFY)

Currently, the stock is testing a key resistance zone between ₹1620–₹1630.

If the price breaks and closes above this resistance, it can signal a strong bullish breakout.

---

💼 Trade Setup (Based on Cup and Handle Pattern):

Entry (Buy): On a closing above ₹

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where I1FO34 is featured.

Indian stocks: Racing ahead

46 No. of Symbols

See all sparks