Key facts today

Live Nation Entertainment's Q2 revenue hit $7 billion, up 16% year-over-year, with concert revenue at $5.95 billion. Ticket sales reached 155.8 million, but EPS fell to 41 cents.

Live Nation Entertainment settled an antitrust lawsuit over Ticketmaster's competitive practices, resolving claims of regulatory risk concealment and misleading shareholders about compliance.

51,562.500

0.003 BRL

3.44 B BRL

124.83 B BRL

About Live Nation Entertainment, Inc.

Sector

Industry

CEO

Michael Rapino

Website

Headquarters

Beverly Hills

Founded

1996

ISIN

BRL1YVBDR006

FIGI

BBG00XV4VQQ4

Live Nation Entertainment, Inc. operates as an entertainment company. The firm engages in producing, marketing, and selling live concerts for artists via its global concert pipe. It operates through the following segments: Concerts, Sponsorship and Advertising, and Ticketing. The Concerts segment is involved in the promotion of live music events in owned or operated venues and in rented third-party venues. The Sponsorship and Advertising segment manages the development of strategic sponsorship programs in addition to the sale of international, national, and local sponsorships and placement of advertising such as signage, promotional programs, rich media offerings, including advertising associated with live streaming and music-related content, and ads across its distribution network of venues, events, and websites. The Ticketing segment is involved in the management of the global ticketing operations, including providing ticketing software and services to clients, and consumers with a marketplace, both online and mobile, for tickets and event information. The Ticketing segment is an agency business that sells tickets for events on behalf of its clients and retains a portion of the service charge as its fee. The company was founded in 1996 and is headquartered in Beverly Hills, CA.

Related stocks

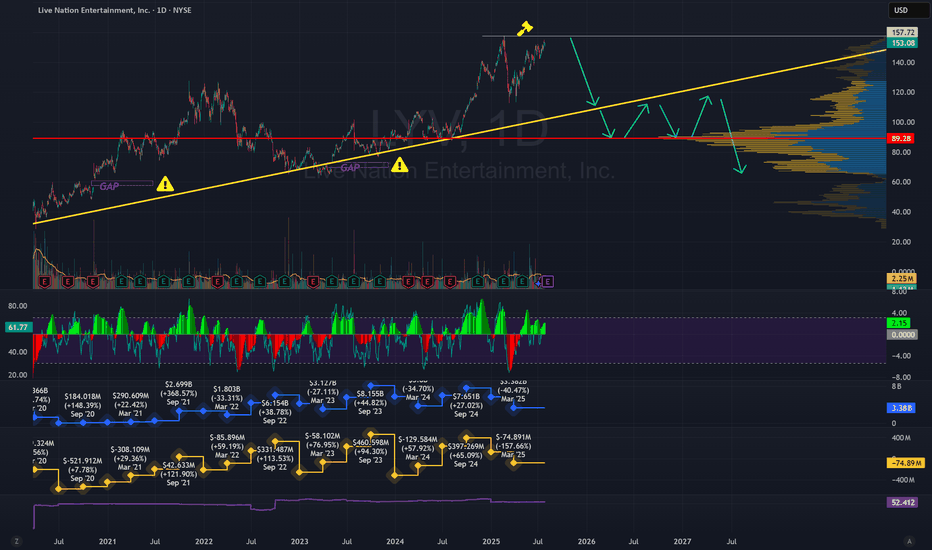

LYV Technical Analysis: Bullish Continuation Pattern SignalsTechnical Analysis:

LYV is exhibiting a strong bullish structure on the daily timeframe. Following a period of consolidation within a larger uptrend, the price has initiated a breakout from a symmetrical triangle pattern. This technical development suggests a high probability of trend continuation,

LIVE NATIONS Stock Chart Fibonacci Analysis 042725Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 127/61.80%

Chart time frame:B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E

WATCH $LYV The upward trend is positiveFundamental Analysis

Fundamental analysis focuses on the financial health, business model, and external market factors that influence a stock's value.

Company Profile

Live Nation Entertainment (LYV) is a global leader in live entertainment and ticket sales, with Ticketmaster as a subsidiary.

It ge

LYV spikes to $140, then pulls back to $120MODs have suggested that I provide more detail about the picks I make.

Sorry. I'm not as verbose as y'all, and I don't like things to be complicated.

My trading plan is very simple.

I buy or sell at top & bottom of parallel channels.

I confirm when price hits Fibonacci levels.

So...

Here's wh

LYV extremely stretched to the upsideUsing the MFI indicator on the 4D chart, you can see that past OB readings (orange boxes) were highly correlated with price corrections. I expect a correction soon, but it might not happen until after Trump is inaugurated. I would express this thesis with an out-of-the-money put with expiration betw

LYV – Bullish Breakout Above The White Resistance ZoneNYSE:LYV has been in a bullish uptrend since Feb 5, 2024 and is continuing to show some strength. I’m not interested in making a late entry here, but the key target is the previous $125.90 all time highs at the green trendline. I think LYV will eventually form a new all time high, but I’m not inter

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

LYV4987774

Live Nation Entertainment, Inc. 6.5% 15-MAY-2027Yield to maturity

5.96%

Maturity date

May 15, 2027

LYV5280317

Live Nation Entertainment, Inc. 6.5% 15-MAY-2027Yield to maturity

5.74%

Maturity date

May 15, 2027

LYV4893725

Live Nation Entertainment, Inc. 4.75% 15-OCT-2027Yield to maturity

5.68%

Maturity date

Oct 15, 2027

LYV5785950

Live Nation Entertainment, Inc. 3.75% 15-JAN-2028Yield to maturity

5.50%

Maturity date

Jan 15, 2028

LYV4611410

Live Nation Entertainment, Inc. 5.625% 15-MAR-2026Yield to maturity

5.11%

Maturity date

Mar 15, 2026

LYV5099205

Live Nation Entertainment, Inc. 3.75% 15-JAN-2028Yield to maturity

4.88%

Maturity date

Jan 15, 2028

US538034BB4

LIV.NAT.ENT. 24/30 CVYield to maturity

1.07%

Maturity date

Jan 15, 2030

LYV5738254

Live Nation Entertainment, Inc. 3.125% 15-JAN-2029Yield to maturity

−7.61%

Maturity date

Jan 15, 2029

LYV4611411

Live Nation Entertainment, Inc. 5.625% 15-MAR-2026Yield to maturity

—

Maturity date

Mar 15, 2026

LYV4893726

Live Nation Entertainment, Inc. 4.75% 15-OCT-2027Yield to maturity

—

Maturity date

Oct 15, 2027

See all L1YV34 bonds