Key facts today

Morgan Stanley is financing Brookfield Asset Management's plan to raise about $3 billion in debt for acquiring Colonial Enterprises, with a deal likely in the loan or bond market by early June.

Morgan Stanley B.V. announced an early redemption of its Global Emerging Markets (GEM) bonds, scheduled for May 30, 2025, as communicated through the Companies Announcement Service of Euronext Dublin.

On May 30, 2025, Morgan Stanley filed a Form 8.5, disclosing its transactions in GlobalData PLC securities as an exempt principal trader serving clients.

15,260.42

0.01 BRL

72.18 B BRL

578.97 B BRL

About Morgan Stanley

Sector

Industry

CEO

Edward N. Pick

Website

Headquarters

New York

Founded

1924

ISIN

BRMSBRBDR008

FIGI

BBG002V13HN2

Morgan Stanley operates as a global financial services company. The firm provides investment banking products and services to its clients and customers including corporations, governments, financial institutions, and individuals. It operates through the following segments: Institutional Securities, Wealth Management, and Investment Management. The Institutional Services segment provides financial advisory, capital-raising services, and related financing services on behalf of institutional investors. The Wealth Management segment offers brokerage and investment advisory services covering various types of investments, including equities, options, futures, foreign currencies, precious metals, fixed-income securities, mutual funds, structured products, alternative investments, unit investment trusts, managed futures, separately managed accounts, and mutual fund asset allocation programs. The Investment Management segment provides equity, fixed income, alternative investments, real estate, and merchant banking strategies. The company was founded by Harold Stanley and Henry S. Morgan in 1924 and is headquartered in New York, NY.

Morgan Stanley (NYSE: MS) Reports Strong Q125 ResultsMorgan Stanley (NYSE: NYSE:MS ) Beats Q1 estimates with record Equity Trading Revenue. The bank posted earnings per share (EPS) of $2.60, beating analyst expectations of $2.18. Revenue reached a record $17.74 billion, topping forecasts of $16.44 billion.

The bank's equity trading revenue soared 45

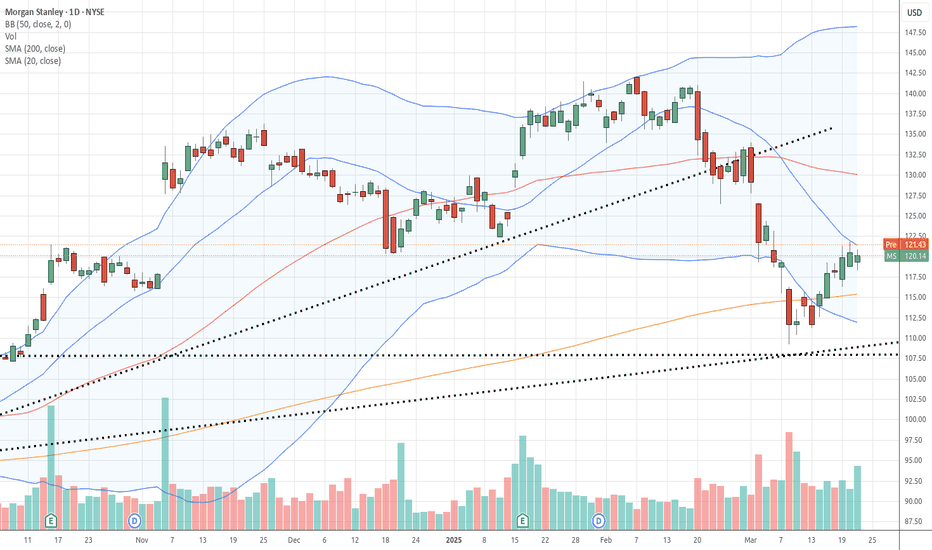

Playing off the potential false breakout?Morgan Stanley's chart is at a critical juncture. After a slide in a descending channel, it briefly poked its head above, but that breakout looks shaky! Now it's dancing around the $115 support zone. A solid hold here, and we might see a bounce. But if that support caves? Watch out for further downs

Morgan Stanley Correction. MSOur last take on MS was dead on and quite profitable. The idea will be linked to this one. ABC zigzag, now impulsing down in C wave. Indicator below are bearish but quite choppy, making meaningful interpretation difficult. Price action, MIDAS cross and behavior of vWAP/US duo are key factors in this

The Last Step Of The 3 Step System ExplainedLook at this chart what do you see?

Yesterday I felt happy because for the first

time even if am broke I get to see the

light of a negative situation

to be esteemed is more important

than gold and silver.

Sometimes all you need is to be

Motivated so that no matter what you

are going through in

Morgan Stanley, can we follow up on great earnings call?Hi guys, we are next looking into Morgan Stanley. Currently they had a fantastic 2024 , with great growth and great beat over their earnings calls.

Fundamental overview :

Morgan Stanley has adopted a bullish stance on U.S. equities, forecasting the S&P 500 to potentially reach 7,400 by 2025. This

Morgan Stanley Wave Analysis – 30 January 2025

- Morgan Stanley is rising inside impulse wave iv

- Likely to rise to the resistance level of 145.00

Morgan Stanley continues to rise inside the minor impulse wave iv, which started earlier from the key support level of 135.00 (the former monthly high from November), acting as support after it was

Morgan Stanley Breaks Free A Bullish Wedge Reversal in ActionMorgan Stanley (MS) on the 4-hour chart has confirmed a breakout from a descending wedge pattern, signaling a strong bullish reversal. The breakout is accompanied by increased momentum, as indicated by the clean surge above the wedge’s upper boundary. This setup is a classic reversal signal, with bu

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

M

MS5169549

Morgan Stanley Finance LLC 0.0% 30-APR-2031Yield to maturity

102.10%

Maturity date

Apr 30, 2031

M

MS4685759

Morgan Stanley Finance LLC 0.0% 29-SEP-2028Yield to maturity

92.20%

Maturity date

Sep 29, 2028

M

MS4855431

Morgan Stanley Finance LLC 0.0% 31-JUL-2029Yield to maturity

71.51%

Maturity date

Jul 31, 2029

M

MS5276420

Morgan Stanley Finance LLC 0.0% 03-NOV-2025Yield to maturity

36.88%

Maturity date

Nov 3, 2025

See all MSBR34 bonds

Curated watchlists where MSBR34 is featured.