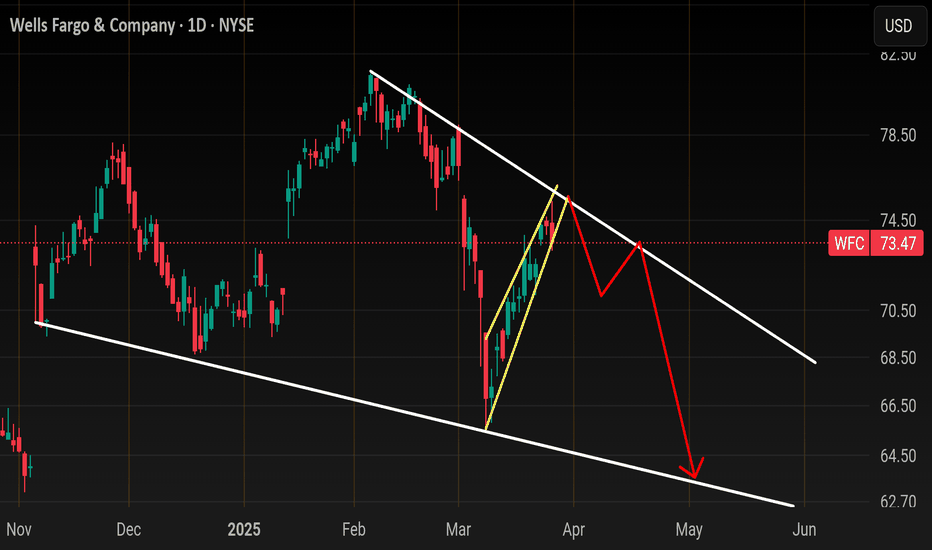

WFC eyes on $74: Major Resistance going into FED rate decision WFC testing a Major Resistance zone going into FED day.

Looking for a Rejection or a Break-and-Retest for next move.

Financials in general are doing well but due for a little dip.

$73.56-74.11 is the key zone of interest.

$68.91-69.60 is first good support below.

==================================

Key facts today

Wells Fargo ended the 2015 agreements with the Office of the Comptroller of the Currency, closing 13 consent orders since 2019. The only remaining order is from 2018 with the Federal Reserve.

Wells Fargo will sell its rail equipment leasing unit to GATX and Brookfield Infrastructure for $4.4 billion, including 105,000 railcars. The deal is set to close by Q1 2026.

Wells Fargo will redeem $450 million in capital securities on June 30, including $150 million in floating-rate subordinated securities and $300 million in floating-rate trust securities.

13,441.03

0.01 BRL

106.32 B BRL

680.74 B BRL

About Wells Fargo & Company

Sector

Industry

CEO

Charles William Scharf

Website

Headquarters

San Francisco

Founded

1852

ISIN

BRWFCOBDR009

FIGI

BBG0019P1PJ5

Wells Fargo & Co. is a diversified and community-based financial services company, which engages in the provision of banking, insurance, investments, mortgage, and consumer and commercial finance products and services. It operates through the following segments: Consumer Banking and Lending, Commercial Banking, Corporate and Investment Banking, and Wealth and Investment Management. The Consumer Banking and Lending segment offers consumer and small business banking, home lending, credit cards, auto, and personal lending. The Commercial Banking segment provides banking and credit products across industry sectors and municipalities, secured lending and lease products, and treasury management. The Corporate and Investment Banking segment is composed of corporate banking, investment banking, treasury management, commercial real estate lending and servicing, and equity and fixed income solutions, as well as sales, trading, and research capabilities. The Wealth and Investment Management segment refers to personalized wealth management, brokerage, financial planning, lending, private banking, trust, and fiduciary products and services. The company was founded by Henry Wells and William G. Fargo on March 18, 1852 and is headquartered in San Francisco, CA.

WFC Trade LevelsEither or set-up while in this range.

For day trades, expect price to move between 64.86-66.30 where there is a daily gap down.

For now, the gap is acting as resistance.

When trading gaps, it depends on your objective. Scalpers might be interested in playing off the H/L of the gap.

While intraday

WFC - Faster Up PhaseAs price transitions through fib circle acceleration of price upwards is allowed

Price has been going through an upward movement however slowly, I expect price to move up faster

This is similar to Tesla's moves upward. Kind of moving up in chunks or in big waves

Weekly timeframe

WFC is moving ahead of the market for better or worse?My overall thesis is we are in the very early stages of a multi-year decline ultimately with the S&P 500 below 3500. I have been wrong many times before so I will just take this thing in stages and see if it plays out. After this massive decline, we should be in for a great market rally of many deca

Wells Fargo $WFC at a turning point📌 09.03.2025 Analysis:

✅ 1. Bearish Divergence:

Price Action: Higher high from Nov 26, 2024 → Feb 6, 2025.

SMI: Lower high from Nov 26, 2024 → Feb 19, 2025.

Interpretation: This confirms a bearish divergence—institutions were not supporting the price move despite a new high.

📌 Notes:

Look at how

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

WFC5001969

Wells Fargo & Company 1.5% 17-JUN-2025Yield to maturity

10.77%

Maturity date

Jun 17, 2025

WFC5760754

Wells Fargo & Company 0.0% 28-FEB-2039Yield to maturity

8.85%

Maturity date

Feb 28, 2039

94CY

WELLS FARGO & COMPANY 2.5% SNR EMTN 02/05/29Yield to maturity

7.50%

Maturity date

May 2, 2029

US94974BGT1

WELLS FARGO 2046 MTNYield to maturity

6.86%

Maturity date

Jun 14, 2046

WFC5679616

Wells Fargo & Company 6.8% 06-NOV-2038Yield to maturity

6.69%

Maturity date

Nov 6, 2038

US94974BGU8

WELLS FARGO 2046 MTNYield to maturity

6.68%

Maturity date

Dec 7, 2046

US94974BGK0

WELLS FARGO 2045 MTNYield to maturity

6.64%

Maturity date

May 1, 2045

WFC5679614

Wells Fargo & Company 6.75% 06-NOV-2033Yield to maturity

6.63%

Maturity date

Nov 6, 2033

NWTP

WELLS FARGO 15/45 MTNYield to maturity

6.63%

Maturity date

Nov 17, 2045

US94974BGE4

WELLS FARGO 2044 MTNYield to maturity

6.62%

Maturity date

Nov 4, 2044

WFC4776290

Wells Fargo & Company 4.553283% 06-DEC-2028Yield to maturity

6.51%

Maturity date

Dec 6, 2028

See all WFCO34 bonds

Curated watchlists where WFCO34 is featured.