ABT – Clean Technical Setup with Strong Risk/Reward📈 Ticker: NYSE:ABT (Abbott Laboratories)

🕒 Timeframe: Daily

💡 Strategy: Ichimoku + MACD + Risk/Reward Setup

Abbott ( NYSE:ABT ) is showing a compelling long opportunity after a pullback to the Tenkan-sen (conversion line) within the Ichimoku Cloud structure. Price action remains bullish as it res

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

158.66 MXN

278.36 B MXN

874.63 B MXN

1.73 B

About Abbott Laboratories

Sector

Industry

CEO

Robert B. Ford

Website

Headquarters

Abbott Park

Founded

1888

FIGI

BBG000L478Y5

Abbott Laboratories engages in the discovery, development, manufacture, and sale of healthcare products. It operates through the following segments: Established Pharmaceutical Products, Diagnostic Products, Nutritional Products, and Medical Devices. The Established Pharmaceutical Products segment refers to the line of branded generic pharmaceuticals manufactured worldwide and marketed and sold outside the United States in emerging markets. The Diagnostic Products segment markets diagnostic systems and tests for blood banks, hospitals, commercial laboratories, clinics, physicians' offices, retailers, government agencies, and alternate care testing sites. The Nutritional Products segment caters to the worldwide sales of pediatric and adult nutritional products. The Medical Devices segment includes a broad line of rhythm management, electrophysiology, heart failure, vascular and structural heart devices for the treatment of cardiovascular diseases, and diabetes care and continuous glucose monitoring products, as well as neuromodulation devices for the management of chronic pain and movement disorders. The company was founded by Wallace Calvin Abbott in 1888 and is headquartered in Abbott Park, IL.

ABT Trade Setup: Breakout Play with 10.6% Upside🏥 Abbott Labs (ABT) Trade Alert

Positioning in this healthcare giant as it breaks out from consolidation - here's the strategic play:

📌 Trade Levels

▶ Entry: $133.12 (confirmed above SMA 50)

🎯 Target: $147.21 (+10.6%)

🛑 Stop Loss: $126.00 (-5.3% risk)

⚖️ Risk/Reward: 1:2

Why ABT Now?

✅ Fundamental

ABT long at 126.75 -- bad new is good news (for me)ABT got some bad news today when a Missouri judge ruled there would be a retrlal regarding a court case involving ABT's baby formula, and the stock, which was already down 3 days in a row, got thumped. While I don't dismiss long term risk from that news, I'm not in this for the long haul. I will l

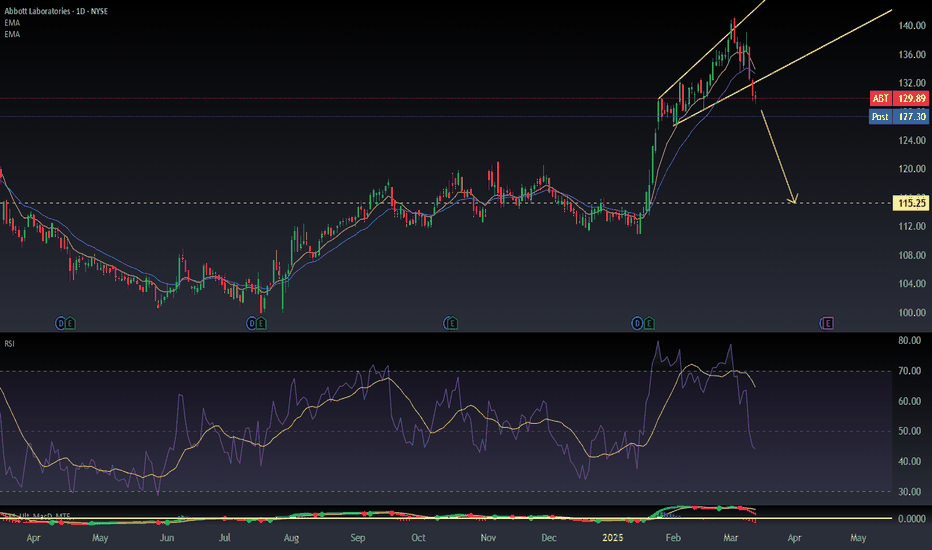

$ABT : Reversal Pattern Just Dropped – Is $115 the NextAlright, let’s check out ABT on the daily chart. The stock enjoyed a steady climb since Jan 2025, riding a clear uptrend line, and now just nailed a technical reversal pattern, and it seems like it’s aiming for a target around $115 per share in the short term (1-3 months).

Abbott Laboratories | ABT | Long at $110.00Abbott Laboratories NYSE:ABT has been making higher highs and lower lows over the last year, potentially signaling a reversal in its downward trend. Monkeypox and the return of cold/flu/COVID season may spark another run to close the price gap on the daily chart around $140. It is currently in a p

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where ABT is featured.

Related stocks

Frequently Asked Questions

The current price of ABT is 2,548.00 MXN — it has increased by 1.92% in the past 24 hours. Watch ABBOTT LABORATORIES stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange ABBOTT LABORATORIES stocks are traded under the ticker ABT.

ABT stock has fallen by −1.08% compared to the previous week, the month change is a −2.11% fall, over the last year ABBOTT LABORATORIES has showed a 39.39% increase.

We've gathered analysts' opinions on ABBOTT LABORATORIES future price: according to them, ABT price has a max estimate of 3,093.39 MXN and a min estimate of 2,470.82 MXN. Watch ABT chart and read a more detailed ABBOTT LABORATORIES stock forecast: see what analysts think of ABBOTT LABORATORIES and suggest that you do with its stocks.

ABT stock is 1.88% volatile and has beta coefficient of 0.27. Track ABBOTT LABORATORIES stock price on the chart and check out the list of the most volatile stocks — is ABBOTT LABORATORIES there?

Today ABBOTT LABORATORIES has the market capitalization of 4.46 T, it has increased by 1.56% over the last week.

Yes, you can track ABBOTT LABORATORIES financials in yearly and quarterly reports right on TradingView.

ABBOTT LABORATORIES is going to release the next earnings report on Jul 17, 2025. Keep track of upcoming events with our Earnings Calendar.

ABT earnings for the last quarter are 22.33 MXN per share, whereas the estimation was 21.97 MXN resulting in a 1.66% surprise. The estimated earnings for the next quarter are 23.68 MXN per share. See more details about ABBOTT LABORATORIES earnings.

ABBOTT LABORATORIES revenue for the last quarter amounts to 212.21 B MXN, despite the estimated figure of 213.19 B MXN. In the next quarter, revenue is expected to reach 209.00 B MXN.

ABT net income for the last quarter is 26.63 B MXN, while the quarter before that showed 191.71 B MXN of net income which accounts for −86.11% change. Track more ABBOTT LABORATORIES financial stats to get the full picture.

Yes, ABT dividends are paid quarterly. The last dividend per share was 11.88 MXN. As of today, Dividend Yield (TTM)% is 1.68%. Tracking ABBOTT LABORATORIES dividends might help you take more informed decisions.

ABBOTT LABORATORIES dividend yield was 1.98% in 2024, and payout ratio reached 29.33%. The year before the numbers were 1.89% and 63.81% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jun 15, 2025, the company has 114 K employees. See our rating of the largest employees — is ABBOTT LABORATORIES on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ABBOTT LABORATORIES EBITDA is 212.06 B MXN, and current EBITDA margin is 24.00%. See more stats in ABBOTT LABORATORIES financial statements.

Like other stocks, ABT shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ABBOTT LABORATORIES stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ABBOTT LABORATORIES technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ABBOTT LABORATORIES stock shows the buy signal. See more of ABBOTT LABORATORIES technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.