US banks are in some kind of trouble.U.S. Banks are currently facing $482 Billion in unrealized losses, an increase of 33% from the prior quarter.

With rates now skyrocketing, these losses are going to increase. Banks, particularly small banks, are in trouble.

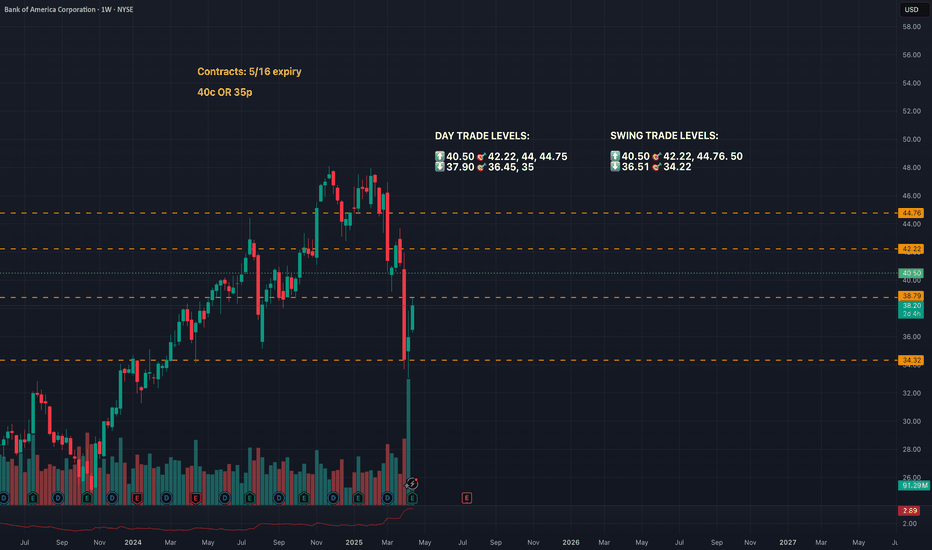

BAC has huge amount of gaps which are ridiculous.

In 1hr TF, there is a

Key facts today

Bank of America expects a 25% drop in Q2 investment banking fees, estimating $1.2 billion in revenue, down from $1.5 billion. Trading business growth is anticipated.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

69.39 MXN

565.69 B MXN

4.08 T MXN

7.52 B

About Bank of America

Sector

Industry

CEO

Brian T. Moynihan

Website

Headquarters

Charlotte

Founded

1904

FIGI

BBG000L47DC8

Bank of America Corporation is a bank and financial holding company, which engages in the provision of banking and nonbank financial services. It operates through the following segments: Consumer Banking, Global Wealth and Investment Management, Global Banking, Global Markets, and All Other. The Consumer Banking segment offers credit, banking, and investment products and services to consumers and small businesses. The Global Wealth and Investment Management provides client experience through a network of financial advisors focused on to meet their needs through a full set of investment management, brokerage, banking, and retirement products. The Global Banking segment deals with lending-related products and services, integrated working capital management and treasury solutions to clients, and underwriting and advisory services. The Global Markets segment includes sales and trading services, as well as research, to institutional clients across fixed-income, credit, currency, commodity, and equity businesses. The All Other segment consists of asset and liability management activities, equity investments, non-core mortgage loans and servicing activities, the net impact of periodic revisions to the mortgage servicing rights (MSR) valuation model for both core and non-core MSRs, other liquidating businesses, residual expense allocations and other. The company was founded by Amadeo Peter Giannini in 1904 is headquartered in Charlotte, NC.

BANK OF AMERICA: Strongest rebound since 2023 eyes $65.Bank of America is heavily bullish on its 1D technical outlook (RSI = 68.687, MACD = 1.120, ADX = 62.779) as it's on an impressive rebound since the April low, which was priced on the 0.236 Fibonacci level of the long term Channel Up that begun in December 2011. Every rally on the 0.236 Fib always h

OptionsMastery: Sitting at resistance on BAC!🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

BAC – Building the Base for a Breakout?Bank of America (BAC) has been consolidating quietly, attracting attention as it sits near a key mid-range level. With a 52-week low of $33.06 and a 52-week high of $48.08, the stock currently trades around $36.92 – roughly 11% above its low and 23% below its high.

This setup could be the calm befo

Bank of America Wave Analysis – 8 May 2025

- Bank of America broke the resistance zone

- Likely to rise to resistance level 44,00

Bank of America recently broke the resistance area between the resistance level 41.35 and the 61,8% Fibonacci correction of the downward impulse from February.

The breakout of this resistance zone accelerated t

BAC Holding Above EMA 200 with Strong Buyer SupportBank of America (BAC) is showing resilience:

Price is above the 209-WEEK EMA, indicating a bullish trend.

Recent down candles have occurred with high volume, suggesting that buyers are absorbing selling pressure.

This behavior often precedes upward movements, as strong hands accumulate shares dur

Bank of America May Face a DowntrendBank of America has rebounded sharply in recent weeks, but some traders may expect a move to the downside.

The first pattern on today’s chart is the series of lower highs since March 3. Combined with the low in early April, a falling channel may have formed.

Second is the price zone between roughl

Good times are brewing for the central banks

Bank of America (BAC) | 4D Chart 📈

After a hard dip into $33.07, BAC is finding its legs — now reclaiming the 0.382 Fib level (38.78) and pushing toward the 0.5 zone at $40.54. A full retrace into the 0.618 (42.30) and possibly the 0.786 (44.81) would not be far-fetched if this bullish pressure co

BAC on the UPTRENDBAC has completed the correction. Now running on the Uptrend.

On chart frame WEEK, the price was crossed MA200 then back up.

On chart frame Day, the volume so high and RSI look good.

It's mean, the Uptrend started from 04.09.25.

In the short term, the price still has to come back to fill at least

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

BAC4161408

Bank of America Corporation 4.05% 15-SEP-2036Yield to maturity

48.96%

Maturity date

Sep 15, 2036

BAC5354838

Bank of America Corporation 3.5023% 16-FEB-2027Yield to maturity

8.00%

Maturity date

Feb 16, 2027

See all BAC bonds

Curated watchlists where BAC is featured.

Related stocks

Frequently Asked Questions

The current price of BAC is 841.01 MXN — it has decreased by −1.51% in the past 24 hours. Watch BANK OF AMERICA CORPORATION stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange BANK OF AMERICA CORPORATION stocks are traded under the ticker BAC.

BAC stock has fallen by −1.06% compared to the previous week, the month change is a −2.05% fall, over the last year BANK OF AMERICA CORPORATION has showed a 12.89% increase.

We've gathered analysts' opinions on BANK OF AMERICA CORPORATION future price: according to them, BAC price has a max estimate of 1,087.99 MXN and a min estimate of 830.31 MXN. Watch BAC chart and read a more detailed BANK OF AMERICA CORPORATION stock forecast: see what analysts think of BANK OF AMERICA CORPORATION and suggest that you do with its stocks.

BAC stock is 1.84% volatile and has beta coefficient of 1.23. Track BANK OF AMERICA CORPORATION stock price on the chart and check out the list of the most volatile stocks — is BANK OF AMERICA CORPORATION there?

Today BANK OF AMERICA CORPORATION has the market capitalization of 6.37 T, it has increased by 2.79% over the last week.

Yes, you can track BANK OF AMERICA CORPORATION financials in yearly and quarterly reports right on TradingView.

BANK OF AMERICA CORPORATION is going to release the next earnings report on Jul 16, 2025. Keep track of upcoming events with our Earnings Calendar.

BAC earnings for the last quarter are 18.44 MXN per share, whereas the estimation was 16.73 MXN resulting in a 10.21% surprise. The estimated earnings for the next quarter are 16.93 MXN per share. See more details about BANK OF AMERICA CORPORATION earnings.

BANK OF AMERICA CORPORATION revenue for the last quarter amounts to 560.65 B MXN, despite the estimated figure of 552.66 B MXN. In the next quarter, revenue is expected to reach 508.26 B MXN.

BAC net income for the last quarter is 151.52 B MXN, while the quarter before that showed 138.96 B MXN of net income which accounts for 9.04% change. Track more BANK OF AMERICA CORPORATION financial stats to get the full picture.

Yes, BAC dividends are paid quarterly. The last dividend per share was 4.97 MXN. As of today, Dividend Yield (TTM)% is 2.28%. Tracking BANK OF AMERICA CORPORATION dividends might help you take more informed decisions.

BANK OF AMERICA CORPORATION dividend yield was 2.28% in 2024, and payout ratio reached 31.12%. The year before the numbers were 2.73% and 29.90% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jun 13, 2025, the company has 213 K employees. See our rating of the largest employees — is BANK OF AMERICA CORPORATION on this list?

Like other stocks, BAC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BANK OF AMERICA CORPORATION stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So BANK OF AMERICA CORPORATION technincal analysis shows the sell today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating BANK OF AMERICA CORPORATION stock shows the buy signal. See more of BANK OF AMERICA CORPORATION technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.