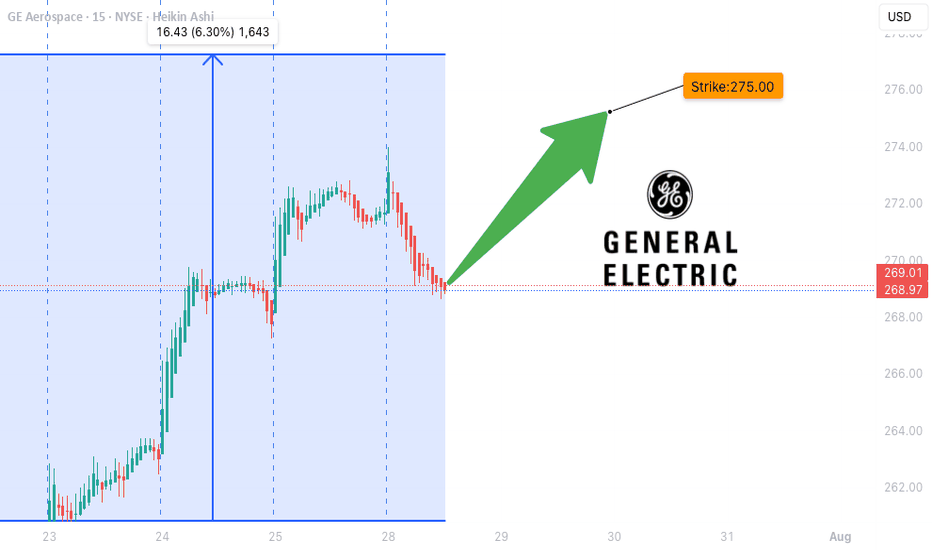

GE WEEKLY OPTIONS SETUP (2025-07-28)

### ⚙️ GE WEEKLY OPTIONS SETUP (2025-07-28)

**Mixed Signals, Bullish Flow – Can Calls Win This Tug-of-War?**

---

📊 **Momentum Breakdown:**

* **RSI:** Falling across models → ⚠️ *Momentum Weak*

* **Volume:** Weak 📉 = Low conviction from big players

* **Options Flow:** Call/Put ratio favors bull

Key facts today

On August 5, 2025, GE Aerospace reported Q2 earnings of $1.66 per share and revenue of $10.15 billion, exceeding estimates. A quarterly dividend of $0.36 was also declared.

On August 6, GE Aerospace secured a deal with Cathay Pacific for GE9X engines to power 14 Boeing 777-9 aircraft, totaling 35 planes, along with a maintenance agreement.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

135.38 MXN

136.27 B MXN

806.91 B MXN

1.06 B

About GE Aerospace

Sector

Industry

CEO

H. Lawrence Culp

Website

Headquarters

Evendale

Founded

1878

FIGI

BBG000HVM436

GE Aerospace is an American aircraft company, which engages in the provision of jet and turboprop engines, as well as integrated systems for commercial, military, business, and general aviation aircraft. The firm's portfolio of brands includes Avio Aero, Unison, GE Additive, and Dowty Propellers. It operates through the Commercial Engines & Services and Defense & Propulsion Technologies segments. The Commercial Engines & Services segment is involved in the design, development, manufacturing, and servicing of jet engines for commercial airframes, as well as business aviation and aeroderivative applications. The Defense & Propulsion Technologies segment offers defense engines and critical aircraft systems. The company was founded by Thomas Alva Edison in 1878 and is headquartered in Evendale, OH.

Related stocks

GE watch $260-261: Key support to maintain strong UptrendGE has been in a strong uptrend for a couple of years now.

Earnings report dropped it to support zone at $260.00-261.05

This zone is now clearly visible to everyon, so Do-or-Die here.

Long entry here with tight stop loss just below zone.

======================================================

.

Soaring High: What Fuels GE Aerospace's Ascent?GE Aerospace's remarkable rise reflects a confluence of strategic maneuvers and favorable market dynamics. The company maintains a dominant position in the commercial and military aircraft engine markets, powering over 60% of the global narrowbody fleet through its CFM International joint venture an

GE Weekly Options Trade Setup – 07/14/2025 $290C | Exp. July 18

📈 GE Weekly Options Trade Setup – 07/14/2025

$290C | Exp. July 18 | Bullish Catalyst In Play

⸻

🔥 BULLISH MOMENTUM CONFIRMED

✅ All 5 major AI models (Grok, Claude, Gemini, Llama, DeepSeek) agree:

GE just broke out — strong momentum, price above MAs, MACD bullish.

📰 Catalyst: Citigroup Upgrade 💥

Pullback in GE AerospaceGE Aerospace has been rallying, and now it’s pulled back.

The first pattern on today’s chart is the steady advance in April and May that established GE at its highest levels since 2001. Is an accumulation phase underway?

Second is the May 23 close of $232.79. The industrial stock tested and held

GE AERO WHERE WILL THE PRICE GOTRENDS and Price targets marked.

Price appears to be in "danger zone" or high side with not many price targets left.

There are both support and rejection trends trading down in the short term.

These both lead to a support trend.

Good luck.

Follow for more charts like this.

Taking profit on GE Aerospace stock to buy in lower after summerIt's clear NYSE:GE has hit overbought, it's the perfect time to take profits now. Less stress managing stocks over the summer too lol...

$196 is the 0.618 level I'm aiming to re-enter, there's also decent support near that level $190 to $200

GE Weekly Options Trade – Bearish Setup After Breakdown (2025-0📉 GE Weekly Options Trade – Bearish Setup After Breakdown (2025-06-12)

Ticker: NYSE:GE | Strategy: 🔻 Naked PUT (Short Bias)

Bias: Moderately to Strongly Bearish

Confidence: 75% | Entry Timing: Market Open

Expiry: June 13, 2025 (Weekly)

🔍 Technical & Options Snapshot

• Trend:

– Daily: Bearish (be

GE Daily Chart: Corrective Pullback Towards Key Support LevelOverview:

GE has experienced a significant bullish run since early April, forming a well-defined ascending channel. However, recent price action indicates a potential corrective pullback after failing to sustain above the upper boundary of this channel. The stock is currently trading below the lowe

These 2 Signals Made Members 80% Profit!NYSE:GE has had a massive rejection off of Monthly chart rejection.

We issued an alert to members om June 6th 2025. We entered a 245 Put (July 3) $5 con

We closed out our contracts today at $9 and roughly 80% gain.

This chart demonstrates the power of multiyear monthly chart resistance. Trades

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

G

GE4373445

GE Capital International Funding Co. ULC 4.418% 15-NOV-2035Yield to maturity

4.89%

Maturity date

Nov 15, 2035

G

GE4373214

GE Capital International Funding Co. ULC 3.373% 15-NOV-2025Yield to maturity

4.57%

Maturity date

Nov 15, 2025

G

GE4297296

GE Capital International Funding Co. ULC 4.418% 15-NOV-2035Yield to maturity

3.94%

Maturity date

Nov 15, 2035

G

GE4297294

GE Capital International Funding Co. ULC 3.373% 15-NOV-2025Yield to maturity

1.38%

Maturity date

Nov 15, 2025

See all GE bonds

Curated watchlists where GE is featured.

Frequently Asked Questions

The current price of GE is 5,105.51 MXN — it has decreased by −1.41% in the past 24 hours. Watch GE AEROSPACE stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange GE AEROSPACE stocks are traded under the ticker GE.

GE stock has fallen by −0.22% compared to the previous week, the month change is a 10.20% rise, over the last year GE AEROSPACE has showed a 62.60% increase.

We've gathered analysts' opinions on GE AEROSPACE future price: according to them, GE price has a max estimate of 6,063.47 MXN and a min estimate of 4,797.88 MXN. Watch GE chart and read a more detailed GE AEROSPACE stock forecast: see what analysts think of GE AEROSPACE and suggest that you do with its stocks.

GE stock is 0.11% volatile and has beta coefficient of 1.55. Track GE AEROSPACE stock price on the chart and check out the list of the most volatile stocks — is GE AEROSPACE there?

Today GE AEROSPACE has the market capitalization of 5.37 T, it has increased by 5.94% over the last week.

Yes, you can track GE AEROSPACE financials in yearly and quarterly reports right on TradingView.

GE AEROSPACE is going to release the next earnings report on Oct 28, 2025. Keep track of upcoming events with our Earnings Calendar.

GE earnings for the last quarter are 31.14 MXN per share, whereas the estimation was 26.85 MXN resulting in a 15.95% surprise. The estimated earnings for the next quarter are 26.44 MXN per share. See more details about GE AEROSPACE earnings.

GE AEROSPACE revenue for the last quarter amounts to 190.41 B MXN, despite the estimated figure of 179.11 B MXN. In the next quarter, revenue is expected to reach 189.71 B MXN.

GE net income for the last quarter is 38.04 B MXN, while the quarter before that showed 40.42 B MXN of net income which accounts for −5.89% change. Track more GE AEROSPACE financial stats to get the full picture.

Yes, GE dividends are paid quarterly. The last dividend per share was 6.73 MXN. As of today, Dividend Yield (TTM)% is 0.47%. Tracking GE AEROSPACE dividends might help you take more informed decisions.

GE AEROSPACE dividend yield was 0.67% in 2024, and payout ratio reached 18.74%. The year before the numbers were 0.25% and 3.83% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 7, 2025, the company has 53 K employees. See our rating of the largest employees — is GE AEROSPACE on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. GE AEROSPACE EBITDA is 165.73 B MXN, and current EBITDA margin is 20.39%. See more stats in GE AEROSPACE financial statements.

Like other stocks, GE shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade GE AEROSPACE stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So GE AEROSPACE technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating GE AEROSPACE stock shows the buy signal. See more of GE AEROSPACE technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.