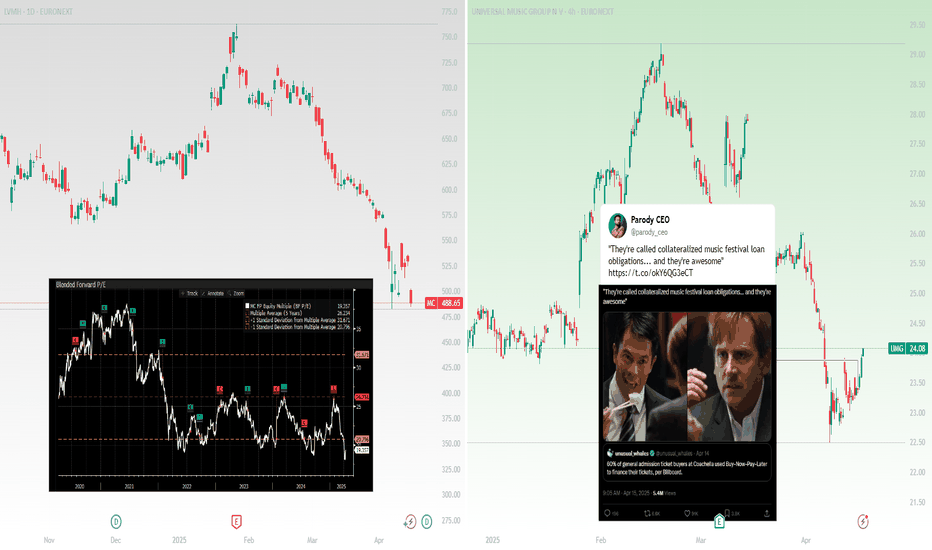

LVMH BUYLVMH is trading at around €468, well below its 2023 highs and at a significant discount to historical valuation multiples. The forward P/E is approximately 17x, versus a 5-year average of 24x. EV/EBITDA is under 10x, and the dividend yield is near 3%.

Fundamentals remain strong. LVMH continues to g

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

542.33 MXN

270.88 B MXN

1.83 T MXN

253.50 M

About LVMH

Sector

Industry

CEO

Bernard Arnault

Website

Headquarters

Paris

Founded

1971

ISIN

FR0000121014

FIGI

BBG007FJFGP7

LVMH Moët Hennessy Louis Vuitton SE engages in the manufacture of luxury goods. It operates through the following segments: Wines and Spirits, Fashion and Leather Goods, Perfumes and Cosmetics, Watches and Jewelry, Selective Retailing, and Other and Holding Companies. The Wines and Spirits segment is involved in the production and sale of champagne wines and sparkling wines, as well as distribution of vodka and white liquor. The Fashion and Leather Goods segment offers luggage items, bags, accessories, shoes, and clothes. The Perfumes and Cosmetics segment distributes make-up, perfume, and skin care products. The Watches and Jewelry segment manufactures luxury watches and accessories for men and women. The Selective Retailing segment is organized to promote an environment that is appropriate to the image and status of the luxury brands. The Other and Holding Companies segment pertains to the media division, which publishes newspapers and magazines, manages business and financial websites, and holds radio stations. The company was founded by Bernard Arnault on January 1, 1987 and is headquartered in Paris, France.

Related stocks

$LVMUYAnyone else noticing the nice potential long setup for $LVMUY. I have ran a fib on the monthly chart from ATL to ATH and current price is trading near the .50 fib. This could be a could chance for a stab at a reversal. There is obviously potential that this continues to slide further but with the pr

Head and Shoulders CompleteThe H&S target drop of 33% has been met. I believe we are in the final leg of the ABC correction. The question now is where does the final C leg land? We are sitting in the golden fib pocket, if $480 support is lost then I expect a drop to $400-410. This could be a great place to add for a long term

Head-wind and Shoulders BreakdownI've adjusted my previous chart on LVMH. I am still waiting for a reaction at the 0.786 Fib. Nothing good happens under the 200 week moving average, so there's no rush to buy this stock. Let's wait to see how the tariffs affect the bottom line and LVMH plans to save it's US business. The Asia segmen

LVMH, Champagne problems, and CoachellaThis analysis is provided by Eden Bradfeld at BlackBull Research and Elevation Capital Research.

Starting the day thinking about LVMH .

Soft set of numbers from the luxury house — noting Champagne sales sat largely flat (-1%) while Cognac was down 17% (the booze industry’s constant problem chi

Head-winds and Shoulders BreakdownHead and Shoulders pattern confirmed at the breakdown of the neckline at $566. I traded the relief rally in the ABC corrective pattern, which took us up to $764. That is where I flipped short and we are now in the C wave of the corrective pattern.

This brings opportunities for long term investors

To LVMH' or Not to LVMH'"Made in China" has a new ring to it! Who in the east at least, would have guessed that China not only manufactures cheap goods but also the luxury goods? Chinese manufactures have revealed trade secrets one of them being that China makes the luxury goods, ships it off to another country who then pl

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

A3LMWH

LVMH MOET HENNESSY LOUIS VUITTON SE 2023-07.09.33Yield to maturity

3.24%

Maturity date

Sep 7, 2033

A3LMWG

LVMH MOET HENNESSY LOUIS VUITTON SE 2023-07.09.29Yield to maturity

2.64%

Maturity date

Sep 7, 2029

See all MC/N bonds

Curated watchlists where MC/N is featured.

Frequently Asked Questions

The current price of MC/N is 10,263.30 MXN — it has decreased by −6.84% in the past 24 hours. Watch LVMH MOET HENNESSY VUITTON SE stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange LVMH MOET HENNESSY VUITTON SE stocks are traded under the ticker MC/N.

MC/N stock has fallen by −6.78% compared to the previous week, the month change is a −2.07% fall, over the last year LVMH MOET HENNESSY VUITTON SE has showed a −25.00% decrease.

We've gathered analysts' opinions on LVMH MOET HENNESSY VUITTON SE future price: according to them, MC/N price has a max estimate of 15,745.34 MXN and a min estimate of 10,059.52 MXN. Watch MC/N chart and read a more detailed LVMH MOET HENNESSY VUITTON SE stock forecast: see what analysts think of LVMH MOET HENNESSY VUITTON SE and suggest that you do with its stocks.

MC/N reached its all-time high on Apr 18, 2023 with the price of 17,974.55 MXN, and its all-time low was 230.50 MXN and was reached on Jan 31, 2008. View more price dynamics on MC/N chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

MC/N stock is 7.34% volatile and has beta coefficient of 1.52. Track LVMH MOET HENNESSY VUITTON SE stock price on the chart and check out the list of the most volatile stocks — is LVMH MOET HENNESSY VUITTON SE there?

Today LVMH MOET HENNESSY VUITTON SE has the market capitalization of 5.14 T, it has decreased by −2.28% over the last week.

Yes, you can track LVMH MOET HENNESSY VUITTON SE financials in yearly and quarterly reports right on TradingView.

LVMH MOET HENNESSY VUITTON SE is going to release the next earnings report on Jul 24, 2025. Keep track of upcoming events with our Earnings Calendar.

MC/N earnings for the last half-year are 228.36 MXN per share, whereas the estimation was 270.17 MXN, resulting in a −15.48% surprise. The estimated earnings for the next half-year are 273.01 MXN per share. See more details about LVMH MOET HENNESSY VUITTON SE earnings.

LVMH MOET HENNESSY VUITTON SE revenue for the last half-year amounts to 928.23 B MXN, despite the estimated figure of 913.43 B MXN. In the next half-year revenue is expected to reach 881.50 B MXN.

MC/N net income for the last half-year is 114.03 B MXN, while the previous report showed 142.77 B MXN of net income which accounts for −20.13% change. Track more LVMH MOET HENNESSY VUITTON SE financial stats to get the full picture.

LVMH MOET HENNESSY VUITTON SE dividend yield was 2.05% in 2024, and payout ratio reached 51.73%. The year before the numbers were 1.77% and 42.84% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 19, 2025, the company has 215 K employees. See our rating of the largest employees — is LVMH MOET HENNESSY VUITTON SE on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. LVMH MOET HENNESSY VUITTON SE EBITDA is 564.07 B MXN, and current EBITDA margin is 30.86%. See more stats in LVMH MOET HENNESSY VUITTON SE financial statements.

Like other stocks, MC/N shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade LVMH MOET HENNESSY VUITTON SE stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So LVMH MOET HENNESSY VUITTON SE technincal analysis shows the strong sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating LVMH MOET HENNESSY VUITTON SE stock shows the sell signal. See more of LVMH MOET HENNESSY VUITTON SE technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.