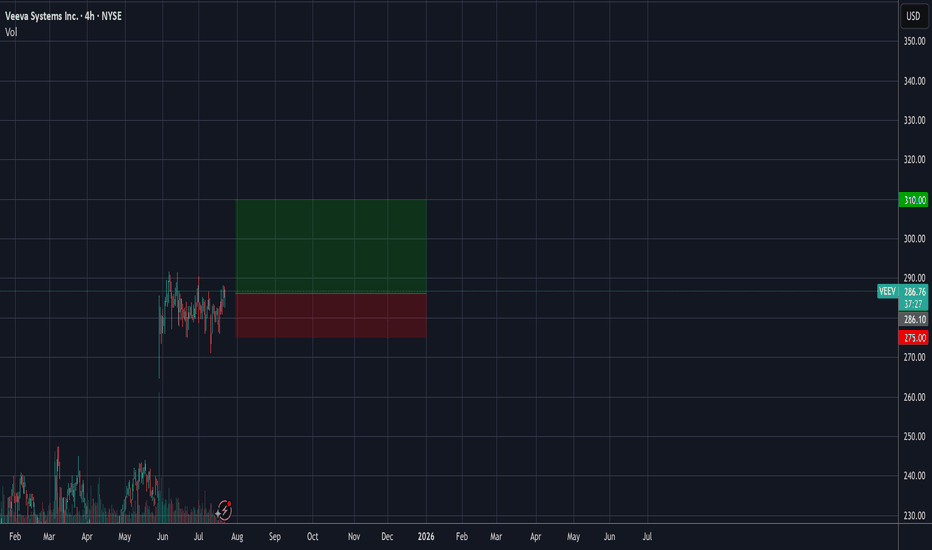

Rare combo of Ichimoku, clean flat base breakout, + fundamentalsChart Pattern Clean flat base, 6+ weeks tight, low volatility, clear breakout level at ~$291.69. Strong structure.

Ichimoku Trend Price above cloud, Kijun < Tenkan, bullish future cloud, Chikou above price. Full bullish alignment.

Momentum Indicators - RSI and MACD both showing strength or early c

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

94.41 MXN

14.80 B MXN

56.91 B MXN

149.32 M

About Veeva Systems Inc.

Sector

Industry

CEO

Peter P. Gassner

Website

Headquarters

Pleasanton

Founded

2007

FIGI

BBG00NJD0XN2

Veeva Systems, Inc. engages in the provision of industry cloud solutions for the global life sciences industry. Its solutions enable pharmaceutical and other life sciences companies to realize the benefits of modern cloud-based architectures and mobile applications for their most critical business functions, without compromising industry-specific functionality or regulatory compliance. The firm's customer relationship management solutions enable its customers to increase the productivity and compliance of their sales and marketing functions. Its regulated content management and collaboration solutions enable its customers to more efficiently manage regulated, content-centric processes across the enterprise. The company's customer master solution enables customers to more effectively manage complex healthcare provider and healthcare organization data. The company was founded by Mark Armenante, Peter P. Gassner, Doug Ostler, Mitch Wallace and Matthew J. Wallach on January 12, 2007, and is headquartered in Pleasanton, CA.

Related stocks

3/5/25 - $veev - i'd buy it in any other tape3/5/25 :: VROCKSTAR :: NYSE:VEEV

i'd buy it in any other tape

- 4% fcf yields

- growing small teens

- fact that they're in life cycle-mission critical functions means probably more insulated from "roll your own" AI solutions that are plaguing software/ specifically SaaS/cloud type multiples

- wou

Why we should not learn to time the market ?As you can see from the weekly chart, it has been going sideways since 2022 and assuming you bought it at 235 price level, the market has brought you nothing but disappointment on 3 disappointments.

You can see each time it reaches this level, the sellers are there to take profits or short it down

VEEV Veeva Systems Options Ahead of EarningsAnalyzing the options chain and the chart patterns of VEEV Veeva Systems prior to the earnings report this week,

I would consider purchasing the 220usd strike price Puts with

an expiration date of 2025-1-17,

for a premium of approximately $7.45.

If these options prove to be profitable prior to the e

Don't buy a stock just because someone recommend itWe are all motivated to do things out of own interests, whether we know about it , admit it or not. There will be and will continue to have analysts, brokerage firms, famous gurus, coaches, myself included sharing with you a particular stock and you may be tempted to go with them.

Before you do tha

Veeva Announces Fiscal 2025 First Quarter Results Shares drop 8%Veeva Systems Inc., ( NYSE:VEEV ) a leading provider of cloud solutions for the global life sciences industry, announced its fiscal 2025 first quarter results, which showed a 24% increase in revenues and a 29% increase in subscription services revenues. Operating income increased by 152% YoY to $155

5/30/24 - $veev - leaning +ve into print but need discount/ dip5/30/24 - vrockstar - NYSE:VEEV - have put this one on my short list of things i'd like to dip buy, even though i admit i think the risk is probably higher they beat and the stock retraces today's (software factor risk off) move. 31x PE isn't cheap. it's about 1.5x PEG at this rate - which is reas

VEEV Bullish trendVEEV is a fundamentally very strong stock

Right now its in a bull trend so entry can be made now

Entry : Current market price i.e 207

Stop loss : 199 or 182

TP 1 : 220

TP 2 : 225

TP 3 : 230

if it breaks the 230 level then we have further upside to

255

260

265

280

The key is to hold an

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where VEEV is featured.

Software stocks: US companies at our finger tips

49 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of VEEV is 5,396.00 MXN — it has increased by 2.00% in the past 24 hours. Watch VEEVA SYSTEMS INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange VEEVA SYSTEMS INC stocks are traded under the ticker VEEV.

VEEV stock has risen by 2.00% compared to the previous week, the month change is a 0.49% rise, over the last year VEEVA SYSTEMS INC has showed a 64.86% increase.

We've gathered analysts' opinions on VEEVA SYSTEMS INC future price: according to them, VEEV price has a max estimate of 7,125.45 MXN and a min estimate of 3,937.75 MXN. Watch VEEV chart and read a more detailed VEEVA SYSTEMS INC stock forecast: see what analysts think of VEEVA SYSTEMS INC and suggest that you do with its stocks.

VEEV reached its all-time high on Aug 10, 2021 with the price of 6,759.45 MXN, and its all-time low was 2,199.50 MXN and was reached on Mar 7, 2019. View more price dynamics on VEEV chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

VEEV stock is 1.97% volatile and has beta coefficient of 0.87. Track VEEVA SYSTEMS INC stock price on the chart and check out the list of the most volatile stocks — is VEEVA SYSTEMS INC there?

Today VEEVA SYSTEMS INC has the market capitalization of 883.33 B, it has increased by 0.94% over the last week.

Yes, you can track VEEVA SYSTEMS INC financials in yearly and quarterly reports right on TradingView.

VEEVA SYSTEMS INC is going to release the next earnings report on Aug 27, 2025. Keep track of upcoming events with our Earnings Calendar.

VEEV earnings for the last quarter are 38.66 MXN per share, whereas the estimation was 34.20 MXN resulting in a 13.02% surprise. The estimated earnings for the next quarter are 35.25 MXN per share. See more details about VEEVA SYSTEMS INC earnings.

VEEVA SYSTEMS INC revenue for the last quarter amounts to 14.89 B MXN, despite the estimated figure of 14.29 B MXN. In the next quarter, revenue is expected to reach 14.26 B MXN.

VEEV net income for the last quarter is 4.48 B MXN, while the quarter before that showed 4.05 B MXN of net income which accounts for 10.47% change. Track more VEEVA SYSTEMS INC financial stats to get the full picture.

No, VEEV doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 26, 2025, the company has 7.29 K employees. See our rating of the largest employees — is VEEVA SYSTEMS INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. VEEVA SYSTEMS INC EBITDA is 16.03 B MXN, and current EBITDA margin is 27.21%. See more stats in VEEVA SYSTEMS INC financial statements.

Like other stocks, VEEV shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade VEEVA SYSTEMS INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So VEEVA SYSTEMS INC technincal analysis shows the strong buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating VEEVA SYSTEMS INC stock shows the buy signal. See more of VEEVA SYSTEMS INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.