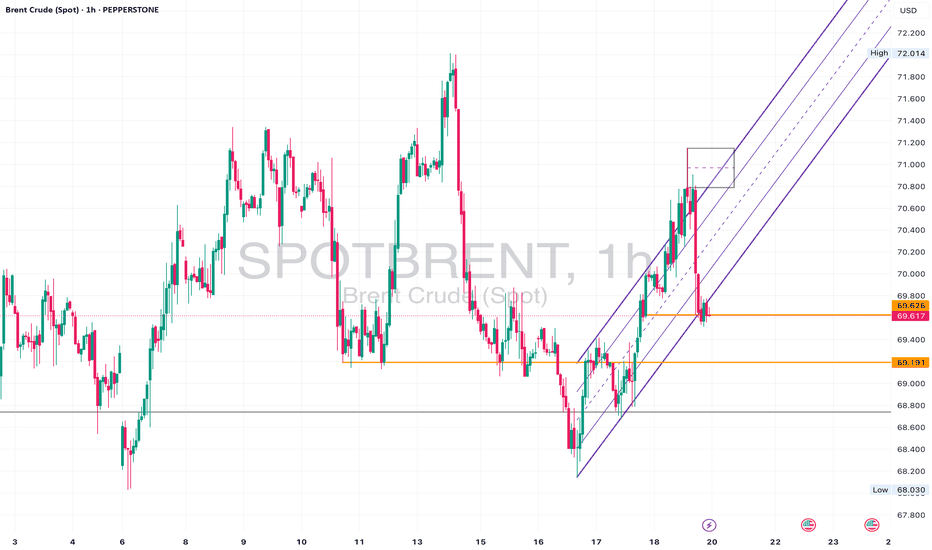

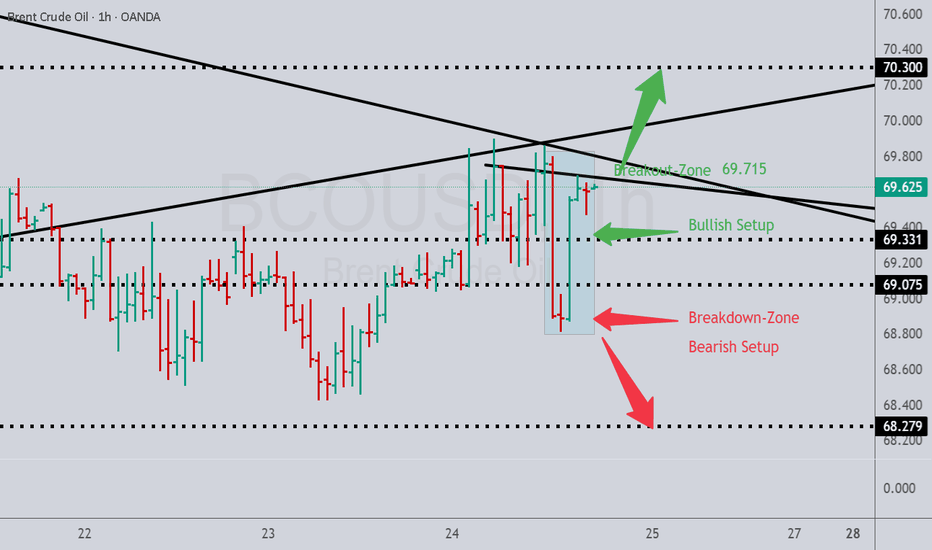

Brent UKOil - Neutral Slightly Bearish • Daily: Price is sitting above long-term trendline support, but momentum is waning.

• 4H: Structure looks indecisive with constant failures near 71.00.

• 1H: Recent break of the upward channel. Now retesting that zone from below.

⚠️ Watch For:

• Retest of 69.60–70.00 as resistance.

• Break an

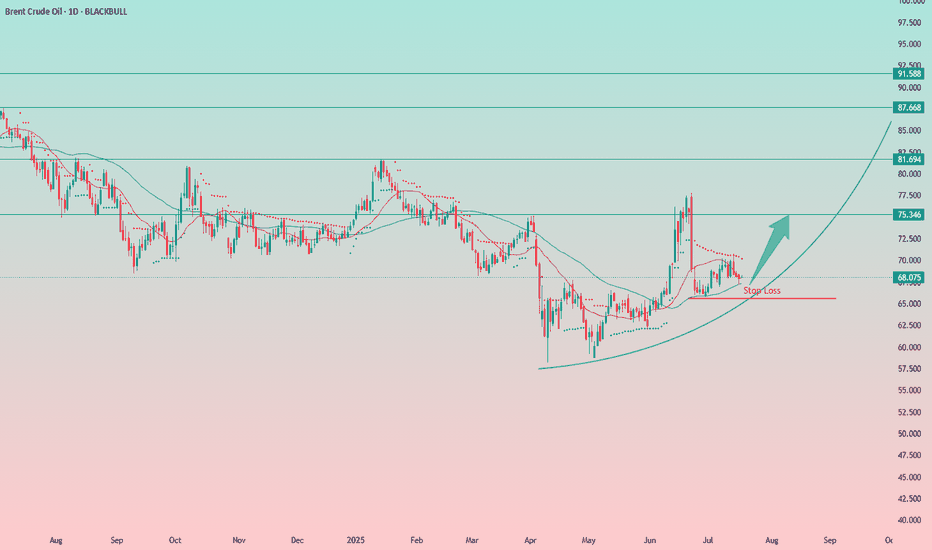

Crude Oil Setup in ProgressOil is in an uptrend, and I expect it to continue.

At the moment, the stop-loss would be too wide — around 3.5%, which is a bit too much for my portfolio, especially considering I already have a wide stop on palladium.

On the 1-hour chart, I’m watching for a possible entry slightly below the curre

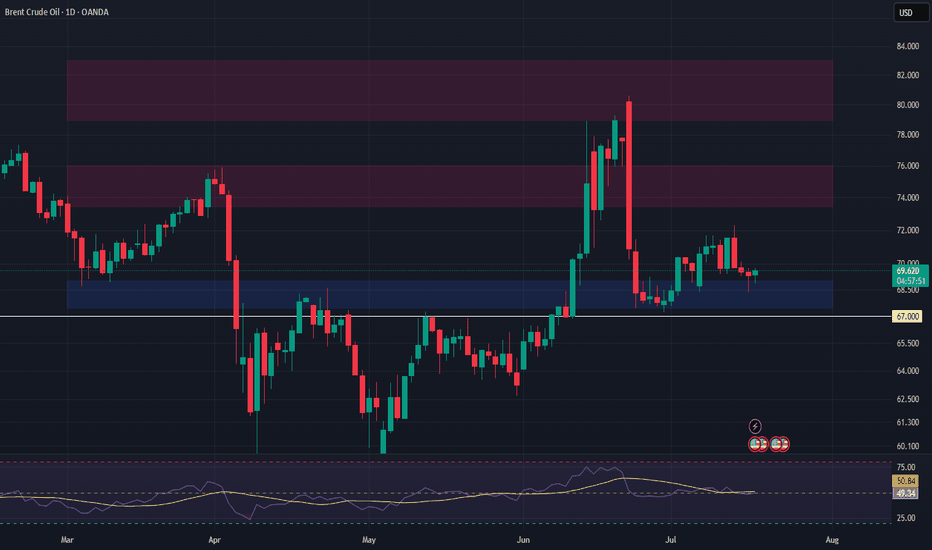

BCOUSD Long Swing Setup – Holding Support with Upside PotentialNYSE:BCO is currently sitting on a key support level, offering a potential long spot entry as buyers defend the $69.50 zone. A bounce from here could open the way for a move toward higher resistance levels.

📌 Trade Setup:

• Entry Zone: Around $69.50

• Take Profit Targets:

o 🥇 $73.50 – $76.00

o 🥈

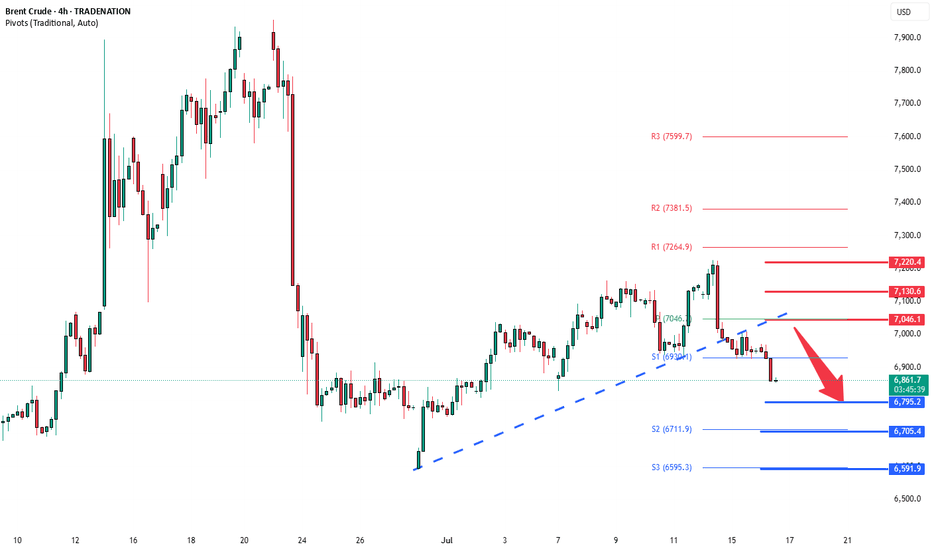

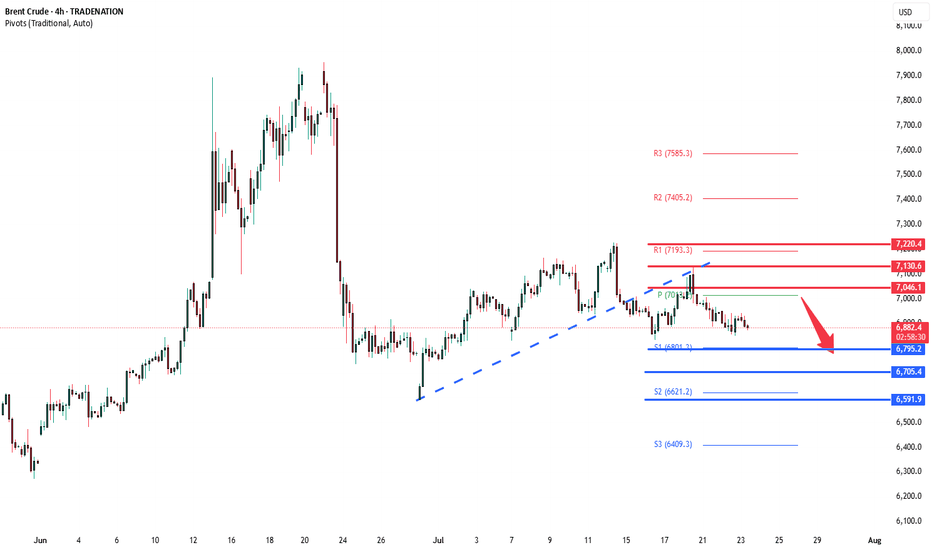

Brent Crude Oil loss of support now resistance at 7050Key Support and Resistance Levels

Resistance Level 1: 7050

Resistance Level 2: 7130

Resistance Level 3: 7220

Support Level 1: 6800

Support Level 2: 6700

Support Level 3: 6590

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a p

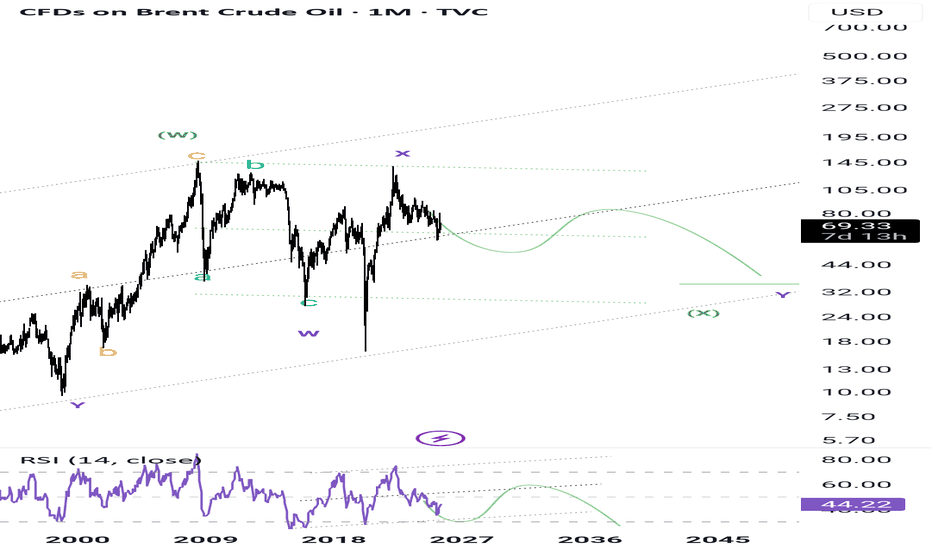

Wajani Investments analysis of BRENT AND WTI BRENT has formed a bearish flag. 80% of the time Leg1 always moves to equate Leg 2. The purple rectangle support turns resistance clarifying to false breakout of BRENT to the upside. However, if it breaks the flag to the upside, treat it as a change in trend.

Trading always carries risk, and this

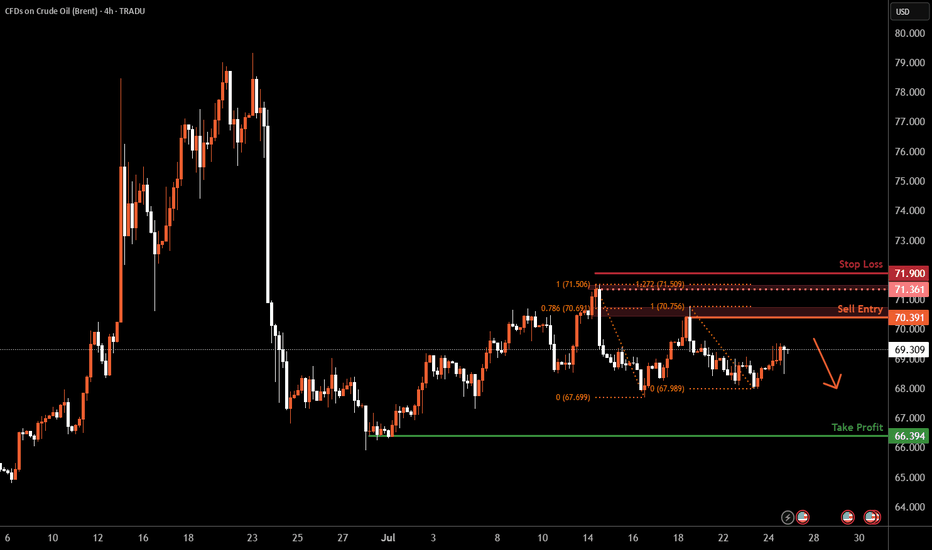

Brent Oil H4 | Heading into a swing-high resistanceBrent oil (UKOIL) is rising towards a swing-high resistance and could potentially reverse off this level to drop lower.

Sell entry is at 70.39 which is a swing-high resistance that aligns closely with the 78.6% Fibonacci retracement.

Stop loss is at 71.90 which is a level that sits above the 127.2

Brent Crude Oil capped by resistance at 7050 Key Support and Resistance Levels

Resistance Level 1: 7050

Resistance Level 2: 7130

Resistance Level 3: 7220

Support Level 1: 6800

Support Level 2: 6700

Support Level 3: 6590

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a p

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.