Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

53.75 INR

13.24 B INR

56.80 B INR

132.11 M

About COLGATE PALMOLIVE LTD.

Sector

Industry

CEO

Prabha Narasimhan

Website

Headquarters

Mumbai

Founded

1937

ISIN

INE259A01022

FIGI

BBG000CQ34B4

Colgate-Palmolive (India) Ltd. engages in the business of manufacturing and trading toothpaste, tooth powder, toothbrush, mouthwash, and personal care products. The firm also offers soaps, cosmetics, and toilet preparations. The company was founded on September 23, 1937 and is headquartered in Mumbai, India.

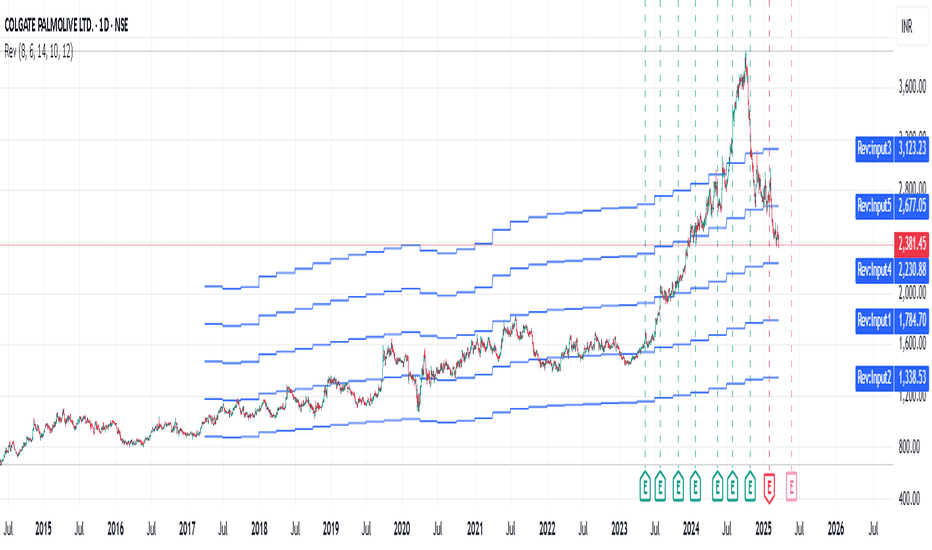

Neutral or sell COLPALThis is a clear case of raised valuations across most of the stocks. As seen in the Revenue Grid indicator, this stock was trading at 8 to 10 of Price to Revenue ratio, but from July 2023 it suddenly started going up and went to 18 times it's Revenue per share. Why? God knows! :)

Now naturally comi

Colgate Palmolive (India) Limited (COLGATEPALMOLIVE.10, NSE)

Trend Analysis:

Uptrend: From August to October 2024, the stock was in a clear uptrend, moving from around 2400 INR to a peak near 3400 INR. This is indicated by the series of higher highs and higher lows.

Downtrend: Post-October 2024, the stock entered a downtrend, dropping significantly until aro

longThe market has recently bounced from the 50% retracement level, presenting a great opportunity for investors to enter long positions. This pullback has created an attractive entry point for those looking to position themselves for future gains. I am currently long at 2,700, with a positive outlook f

COLGATE Swing Long SetupI'm watching Colgate for a potential long entry.

Here's the plan:

Entry Zone: 3548.8

Entry Price: Will take the entry only if a 15-minute candle breaks above 3548.8 . The high of that 15-minute candle will be my entry price.

Target: 3716

Stop Loss: 3465 (Stop loss will trigger only

COLPAL S/R Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (re

COLGATE! Time to shine??- Colgate gave a good breakout which was met by a long upper wick candle showing the presence of sellers at the crucial resistance zone.

- The price is now trying to break it. The structure does look good but given the volatility just after the breakout, it will be wise to wait for a break and suste

Colgate can shine your portfolio and Teeth. Colgate-Palmolive (India) Limited is an MNC India's leading provider of scientifically proven oral care products. The range includes toothpastes, toothpowder, toothbrushes and mouthwashes under the 'Colgate' brand, as well as a specialized range of dental therapies under the banner of Colgate Oral P

Lapu Star BreakoutA cup and handle price pattern on a security's price chart is a technical indicator that resembles a cup with a handle, where the cup is in the shape of a "u" and the handle has a slight downward drift.

The cup and handle is considered a bullish signal, with the right-hand side of the pattern typic

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Related stocks

Frequently Asked Questions

The current price of COLPAL is 2,684.15 INR — it has increased by 0.52% in the past 24 hours. Watch COLGATE-PALMOLIVE (INDIA) LTD. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange COLGATE-PALMOLIVE (INDIA) LTD. stocks are traded under the ticker COLPAL.

COLPAL stock has risen by 5.55% compared to the previous week, the month change is a 10.83% rise, over the last year COLGATE-PALMOLIVE (INDIA) LTD. has showed a 1.05% increase.

We've gathered analysts' opinions on COLGATE-PALMOLIVE (INDIA) LTD. future price: according to them, COLPAL price has a max estimate of 3,645.00 INR and a min estimate of 2,000.00 INR. Watch COLPAL chart and read a more detailed COLGATE-PALMOLIVE (INDIA) LTD. stock forecast: see what analysts think of COLGATE-PALMOLIVE (INDIA) LTD. and suggest that you do with its stocks.

COLPAL reached its all-time high on Oct 4, 2024 with the price of 3,893.00 INR, and its all-time low was 50.60 INR and was reached on May 17, 2004. View more price dynamics on COLPAL chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

COLPAL stock is 2.41% volatile and has beta coefficient of 0.78. Track COLGATE-PALMOLIVE (INDIA) LTD. stock price on the chart and check out the list of the most volatile stocks — is COLGATE-PALMOLIVE (INDIA) LTD. there?

Today COLGATE-PALMOLIVE (INDIA) LTD. has the market capitalization of 722.61 B, it has increased by 3.19% over the last week.

Yes, you can track COLGATE-PALMOLIVE (INDIA) LTD. financials in yearly and quarterly reports right on TradingView.

COLGATE-PALMOLIVE (INDIA) LTD. is going to release the next earnings report on May 22, 2025. Keep track of upcoming events with our Earnings Calendar.

COLPAL earnings for the last quarter are 11.90 INR per share, whereas the estimation was 12.44 INR resulting in a −4.31% surprise. The estimated earnings for the next quarter are 13.22 INR per share. See more details about COLGATE-PALMOLIVE (INDIA) LTD. earnings.

COLGATE-PALMOLIVE (INDIA) LTD. revenue for the last quarter amounts to 14.62 B INR, despite the estimated figure of 14.96 B INR. In the next quarter, revenue is expected to reach 15.19 B INR.

COLPAL net income for the last quarter is 3.23 B INR, while the quarter before that showed 3.95 B INR of net income which accounts for −18.29% change. Track more COLGATE-PALMOLIVE (INDIA) LTD. financial stats to get the full picture.

COLGATE-PALMOLIVE (INDIA) LTD. dividend yield was 1.77% in 2023, and payout ratio reached 98.63%. The year before the numbers were 2.59% and 101.30% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Apr 24, 2025, the company has 4.91 K employees. See our rating of the largest employees — is COLGATE-PALMOLIVE (INDIA) LTD. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. COLGATE-PALMOLIVE (INDIA) LTD. EBITDA is 19.92 B INR, and current EBITDA margin is 33.96%. See more stats in COLGATE-PALMOLIVE (INDIA) LTD. financial statements.

Like other stocks, COLPAL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade COLGATE-PALMOLIVE (INDIA) LTD. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So COLGATE-PALMOLIVE (INDIA) LTD. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating COLGATE-PALMOLIVE (INDIA) LTD. stock shows the buy signal. See more of COLGATE-PALMOLIVE (INDIA) LTD. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.