Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

18.00 INR

9.43 B INR

166.63 B INR

179.07 M

About UNO MINDA LTD

Sector

Industry

CEO

Ravi Mehra

Website

Headquarters

Gurgaon

Founded

1992

ISIN

INE405E01023

FIGI

BBG000BSTSZ4

UNO Minda Ltd. engages in the manufacture of auto components, including electrical parts and accessories; and provision of ancillary services. Its products include switches, horns and electronic, and components and lightings for automobiles. The company was founded by Shadi Lal Minda on September 16, 1992 and is headquartered in Gurgaon, India.

Related stocks

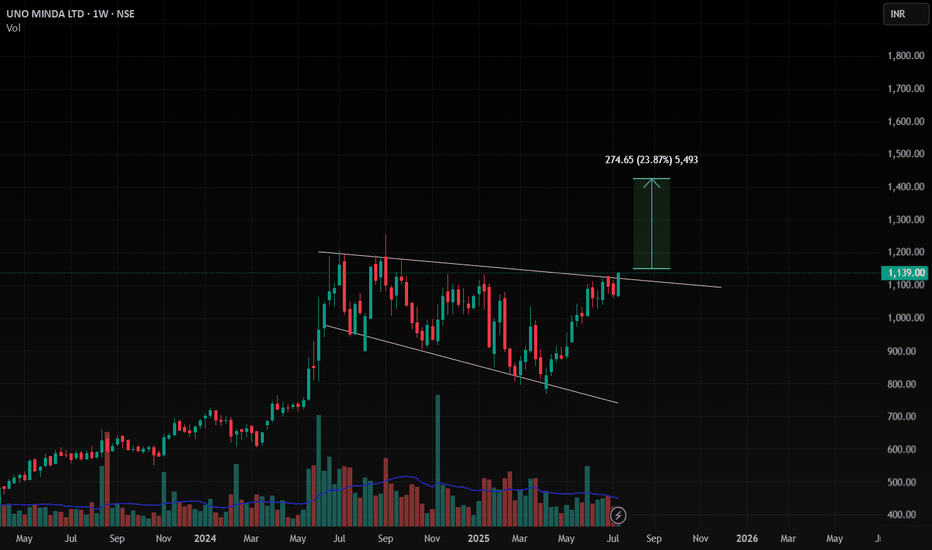

Technical Analysis – UNO MINDA LTD (June 27, 2025)UNO MINDA is showing strong bullish momentum after forming a base and reclaiming the 200 EMA. The breakout from the falling channel and consolidation near resistance suggest strength. As long as it sustains above ₹1020, accumulation in the 1100–1110 range is favorable for a move toward ₹1300+

Wee

Uno Minda Ltd – Coiled for a Breakout🚗 Uno Minda Ltd – Coiled for a Breakout After 38% Correction!

📉 Stock Background & Current Structure:

Uno Minda Ltd, a key player in the automobile components sector, has corrected nearly 38% from its all-time high of ₹1,255. The recent low was recorded around ₹867, which is close to a key swing lev

"UnoMinda" at the cusp of breakout! "UnoMinda" is a great counter to go Long on with high probability and great risk - reward ratio! The stock is about to breakout from a Cup Pattern. The price is at the cusp of breakout which is giving more confidence to enter the trade on Long Side.

#SniperTrade #Momentum #Options #CapitalMarkets

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

775UNOML27

UNOML-7.75%-04-1-27-PVTYield to maturity

—

Maturity date

Jan 4, 2027

785UML27

UML-7.85%-29-4-27-PVTYield to maturity

—

Maturity date

Apr 29, 2027

775UNOML26

UNOML-7.75%-24-1-26-PVTYield to maturity

—

Maturity date

Dec 24, 2026

788UML27

UML-7.88%-6-8-27-PVTYield to maturity

—

Maturity date

Aug 6, 2027

785UML27A

UML-7.85%-26-2-27-PVTYield to maturity

—

Maturity date

Feb 26, 2027

See all UNOMINDA bonds

Frequently Asked Questions

The current price of UNOMINDA is 1,082.85 INR — it has decreased by −2.20% in the past 24 hours. Watch UNO MINDA LIMITED stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange UNO MINDA LIMITED stocks are traded under the ticker UNOMINDA.

UNOMINDA stock has risen by 4.92% compared to the previous week, the month change is a −1.84% fall, over the last year UNO MINDA LIMITED has showed a 7.64% increase.

We've gathered analysts' opinions on UNO MINDA LIMITED future price: according to them, UNOMINDA price has a max estimate of 1,350.00 INR and a min estimate of 770.00 INR. Watch UNOMINDA chart and read a more detailed UNO MINDA LIMITED stock forecast: see what analysts think of UNO MINDA LIMITED and suggest that you do with its stocks.

UNOMINDA reached its all-time high on Sep 2, 2024 with the price of 1,252.85 INR, and its all-time low was 2.40 INR and was reached on Sep 22, 2004. View more price dynamics on UNOMINDA chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

UNOMINDA stock is 2.64% volatile and has beta coefficient of 1.38. Track UNO MINDA LIMITED stock price on the chart and check out the list of the most volatile stocks — is UNO MINDA LIMITED there?

Today UNO MINDA LIMITED has the market capitalization of 622.12 B, it has increased by 1.98% over the last week.

Yes, you can track UNO MINDA LIMITED financials in yearly and quarterly reports right on TradingView.

UNO MINDA LIMITED is going to release the next earnings report on Nov 18, 2025. Keep track of upcoming events with our Earnings Calendar.

UNOMINDA earnings for the last quarter are 5.10 INR per share, whereas the estimation was 4.10 INR resulting in a 24.43% surprise. The estimated earnings for the next quarter are 5.29 INR per share. See more details about UNO MINDA LIMITED earnings.

UNO MINDA LIMITED revenue for the last quarter amounts to 44.55 B INR, despite the estimated figure of 44.55 B INR. In the next quarter, revenue is expected to reach 49.70 B INR.

UNOMINDA net income for the last quarter is 2.91 B INR, while the quarter before that showed 2.66 B INR of net income which accounts for 9.20% change. Track more UNO MINDA LIMITED financial stats to get the full picture.

UNO MINDA LIMITED dividend yield was 0.26% in 2024, and payout ratio reached 13.71%. The year before the numbers were 0.29% and 13.10% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 9, 2025, the company has 33.38 K employees. See our rating of the largest employees — is UNO MINDA LIMITED on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. UNO MINDA LIMITED EBITDA is 20.09 B INR, and current EBITDA margin is 10.71%. See more stats in UNO MINDA LIMITED financial statements.

Like other stocks, UNOMINDA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade UNO MINDA LIMITED stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So UNO MINDA LIMITED technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating UNO MINDA LIMITED stock shows the buy signal. See more of UNO MINDA LIMITED technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.