Top 4 Buy Signals Lighting Up Mastercard (MA) 🚀 Top 4 Buy Signals Lighting Up Mastercard (MA) | Rocket Booster Strategy

Mastercard Inc. (MA) is showing explosive potential, and it’s not just one signal—it’s a whole confluence of confirmations. When

you align this much market momentum, you don’t ignore it. Let’s break down how Rocket Booster

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

11.784 CHF

11.69 B CHF

25.57 B CHF

820.94 M

About Mastercard Incorporated

Sector

Industry

CEO

Michael E. Miebach

Website

Headquarters

Purchase

Founded

1966

FIGI

BBG006TLRWK6

Mastercard, Inc. is a technology company, which engages in the provision of payment solutions for the development and implementation of credit, debit, prepaid, commercial, and payment programs through its brands including Mastercard, Maestro, and Cirrus. It also offers cyber and intelligence solutions. The company was founded in November 1966 and is headquartered in Purchase, NY.

Related stocks

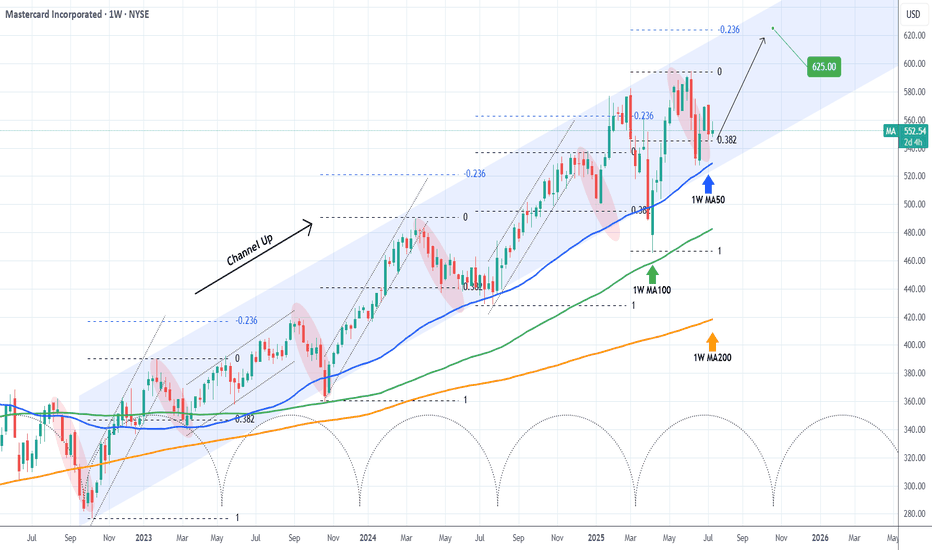

MASTERCARD Best buy entry now. Target $625.Mastercard (MA) has been trading within almost a 3-year Channel Up that only broke (but recovered naturally) during Trump's trade war. Still, the 1W MA100 (green trend-line) contained the downfall, as it always had.

Normally the Bearish Legs of this pattern tend to find Support on the 1W MA50 (blue

Mastercard Could Face ResistanceMastercard fell hard in June on the threat of stablecoin competition. Now, after a rebound, some traders may expect another push to the downside.

The first pattern on today’s chart is the selloff that began on June 13 when the Wall Street Journal reported that major retailers were considering sta

Who will win? Crypto or Dollar?How Stablecoin Payments Can Hurt Visa & Mastercard

Bypassing the Interchange System

-Stablecoins allow peer-to-peer or business-to-consumer payments without using credit/debit card rails.

-Visa & Mastercard earn billions from interchange fees (0.1%–3% per transaction). If people pay directly vi

Mastercard and Visa Shares Decline Due to Stablecoin BillMastercard (MA) and Visa (V) Shares Decline Due to Stablecoin Bill

Yesterday, we reported that the US Senate had passed the GENIUS stablecoin bill, which establishes a legal framework for regulating the stablecoin market. This development led to a sharp rise in the share price of cryptocurrency ex

A whole new type of cash back offer - LONG at 562.03I've posted ideas about MA before. I will continue posting buy ideas about MA until the final breath leaves my body. The average credit card APR is 24.3% - I think this trade can do better. Around 60% APR on average, with a good chance at 270%+ APR.

MA is in a multi-year uptrend, only 2 days re

Mastercard: Approaching the Top of Wave BMastercard has rebounded after a brief cooling period, and we now expect turquoise wave B to complete just below resistance at $620. Once that top is in, wave C should drive a meaningful retracement, ending with the low of magenta wave (4). Alternatively, if turquoise wave alt.(4) has already bottom

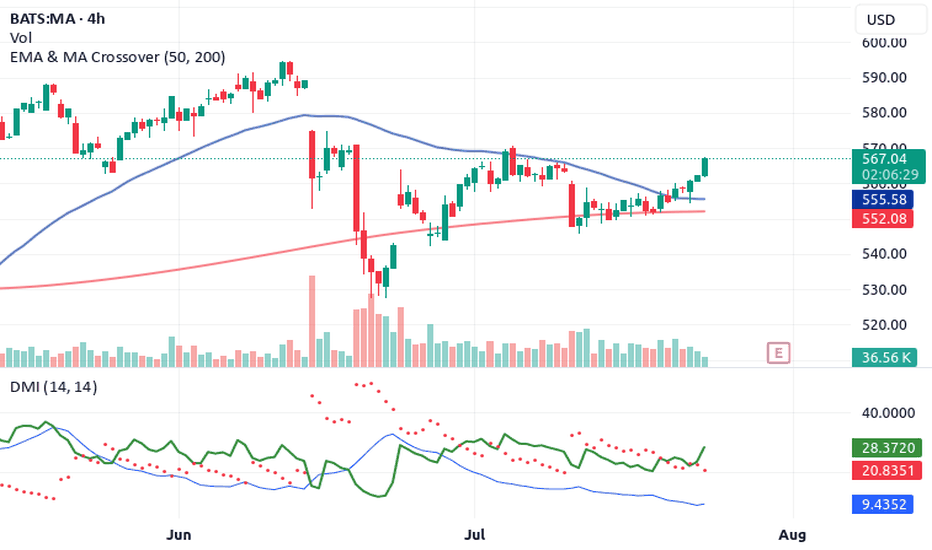

Market sentiment remains bullish**Direction:** **LONG**

**LONG Targets:**

- **T1 = $562.00**

- **T2 = $572.00**

**Stop Levels:**

- **S1 = $540.00**

- **S2 = $525.00**

---

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MA5142291

Mastercard Incorporated 2.95% 15-MAR-2051Yield to maturity

6.53%

Maturity date

Mar 15, 2051

US57636QAL8

MASTERCARD 19/49Yield to maturity

6.23%

Maturity date

Jun 1, 2049

MA4602133

Mastercard Incorporated 3.95% 26-FEB-2048Yield to maturity

6.06%

Maturity date

Feb 26, 2048

MA4970638

Mastercard Incorporated 3.85% 26-MAR-2050Yield to maturity

5.98%

Maturity date

Mar 26, 2050

US57636QAH7

MASTERCARD 2046Yield to maturity

5.97%

Maturity date

Nov 21, 2046

MA6009559

Mastercard Incorporated FRN 15-MAR-2028Yield to maturity

4.76%

Maturity date

Mar 15, 2028

MA5885400

Mastercard Incorporated 4.55% 15-JAN-2035Yield to maturity

4.73%

Maturity date

Jan 15, 2035

MA5808459

Mastercard Incorporated 4.875% 09-MAY-2034Yield to maturity

4.63%

Maturity date

May 9, 2034

MA5302962

Mastercard Incorporated 2.0% 18-NOV-2031Yield to maturity

4.54%

Maturity date

Nov 18, 2031

MA5552138

Mastercard Incorporated 4.85% 09-MAR-2033Yield to maturity

4.46%

Maturity date

Mar 9, 2033

MA5142474

Mastercard Incorporated 1.9% 15-MAR-2031Yield to maturity

4.41%

Maturity date

Mar 15, 2031

See all M4I bonds

Curated watchlists where M4I is featured.

Frequently Asked Questions

The current price of M4I is 454.793 CHF — it has decreased by −2.83% in the past 24 hours. Watch MASTERCARD INCORPO stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange MASTERCARD INCORPO stocks are traded under the ticker M4I.

M4I stock has risen by 0.28% compared to the previous week, the month change is a 0.78% rise, over the last year MASTERCARD INCORPO has showed a 13.48% increase.

We've gathered analysts' opinions on MASTERCARD INCORPO future price: according to them, M4I price has a max estimate of 558.65 CHF and a min estimate of 455.02 CHF. Watch M4I chart and read a more detailed MASTERCARD INCORPO stock forecast: see what analysts think of MASTERCARD INCORPO and suggest that you do with its stocks.

M4I stock is 2.91% volatile and has beta coefficient of 0.83. Track MASTERCARD INCORPO stock price on the chart and check out the list of the most volatile stocks — is MASTERCARD INCORPO there?

Today MASTERCARD INCORPO has the market capitalization of 417.06 B, it has decreased by −1.08% over the last week.

Yes, you can track MASTERCARD INCORPO financials in yearly and quarterly reports right on TradingView.

MASTERCARD INCORPO is going to release the next earnings report on Oct 23, 2025. Keep track of upcoming events with our Earnings Calendar.

M4I earnings for the last quarter are 3.29 CHF per share, whereas the estimation was 3.20 CHF resulting in a 2.99% surprise. The estimated earnings for the next quarter are 3.47 CHF per share. See more details about MASTERCARD INCORPO earnings.

MASTERCARD INCORPO revenue for the last quarter amounts to 6.45 B CHF, despite the estimated figure of 6.29 B CHF. In the next quarter, revenue is expected to reach 6.85 B CHF.

M4I net income for the last quarter is 2.94 B CHF, while the quarter before that showed 2.90 B CHF of net income which accounts for 1.13% change. Track more MASTERCARD INCORPO financial stats to get the full picture.

Yes, M4I dividends are paid quarterly. The last dividend per share was 0.60 CHF. As of today, Dividend Yield (TTM)% is 0.52%. Tracking MASTERCARD INCORPO dividends might help you take more informed decisions.

MASTERCARD INCORPO dividend yield was 0.52% in 2024, and payout ratio reached 19.73%. The year before the numbers were 0.56% and 20.03% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 5, 2025, the company has 35.3 K employees. See our rating of the largest employees — is MASTERCARD INCORPO on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. MASTERCARD INCORPO EBITDA is 14.91 B CHF, and current EBITDA margin is 60.68%. See more stats in MASTERCARD INCORPO financial statements.

Like other stocks, M4I shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MASTERCARD INCORPO stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So MASTERCARD INCORPO technincal analysis shows the buy rating today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating MASTERCARD INCORPO stock shows the buy signal. See more of MASTERCARD INCORPO technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.