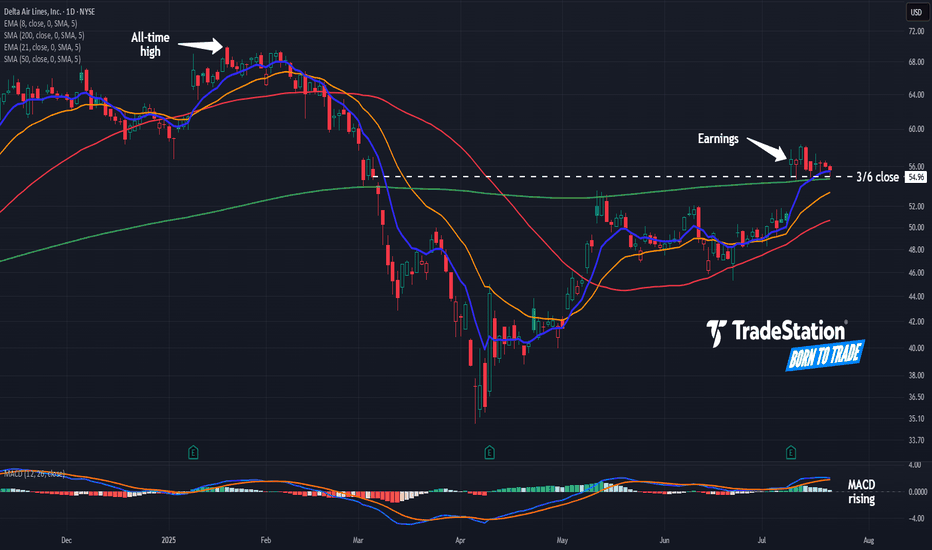

Delta Airlines: Where’s the Pullback?Delta Airlines rallied two weeks ago on strong earnings, and some traders may see further upside.

The first pattern on today’s chart is the tight consolidation pattern since July 10. The lack of pullback could reflect a lack of selling pressure in the transport stock.

Second, DAL has remained abov

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

5.516 CHF

3.14 B CHF

55.98 B CHF

650.52 M

About Delta Air Lines, Inc.

Sector

Industry

CEO

Edward Herman Bastian

Website

Headquarters

Atlanta

Founded

1928

FIGI

BBG007FJNW37

Delta Air Lines, Inc. engages in the provision of scheduled air transportation for passengers and cargo. It operates through the Airline and Refinery segments. The Airline segment provides scheduled air transportation for passengers and cargo. The Refinery segment provides jet fuel to the airline segment. The company was founded by Collett Everman Woolman in 1928 and is headquartered in Atlanta, GA.

Related stocks

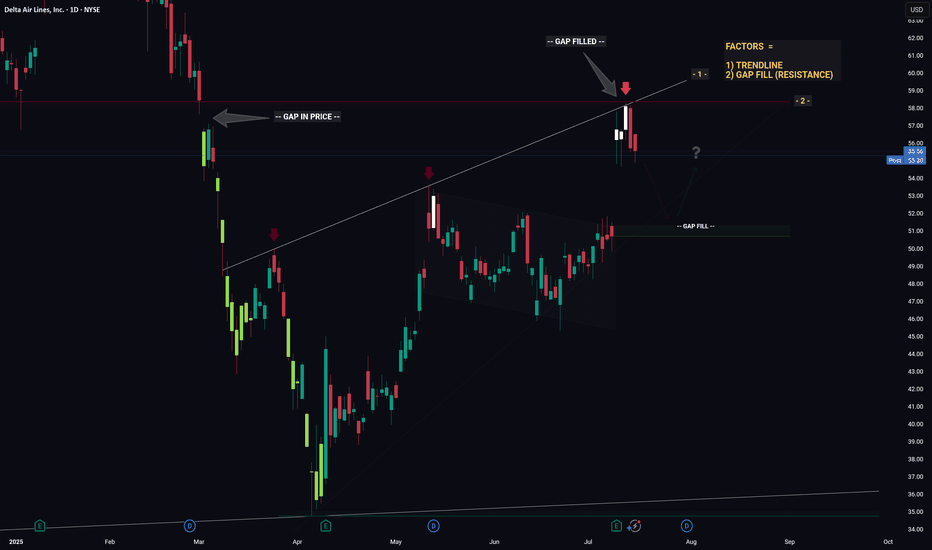

DELTA - Converging Levels Creates Huge Resistance - Retrace?Hello Traders!

Whichever Hedge Fund that is responsible for the recent price action in DELTA mustve been in a generous mood... because theyre giving us an excellent hint as to what price will likely do next.

And what hint might that be you ask...

1) Trendline (connecting the recent highs)

2) Gap

Delta Air Lines, Inc. (DAL) on the verge of testing resistanceAs shown in the chart studies, premarket trading for the DAL stock indicates that price is trading 10% in the green, breaking through key resistances at the 3M level of US$51.80. Overhead, attention will now be on two barriers of resistance: the 1M level at US$57.51 and the 3M base at US$60.16.

FP

Delta Air Lines: Potential BreakoutDelta Air Lines has squeezed into a tight range, and some traders may think it’s breaking out.

The first pattern on today’s chart is the series of lower highs since May 13. DAL closed above that falling trend line last Friday, which could mean the resistance has been overcome.

The move resulted in

Delta Airlines - Long Term FlyerHey, all. Pretty intense idea here, but I am a buyer of NYSE:DAL at these levels. Obviously, the chart looks awful from a recent performance perspective. However, if you take a long term view, we could actually be rebalancing after an initial range expansion to the upside. Just like NASDAQ:RIVN ,

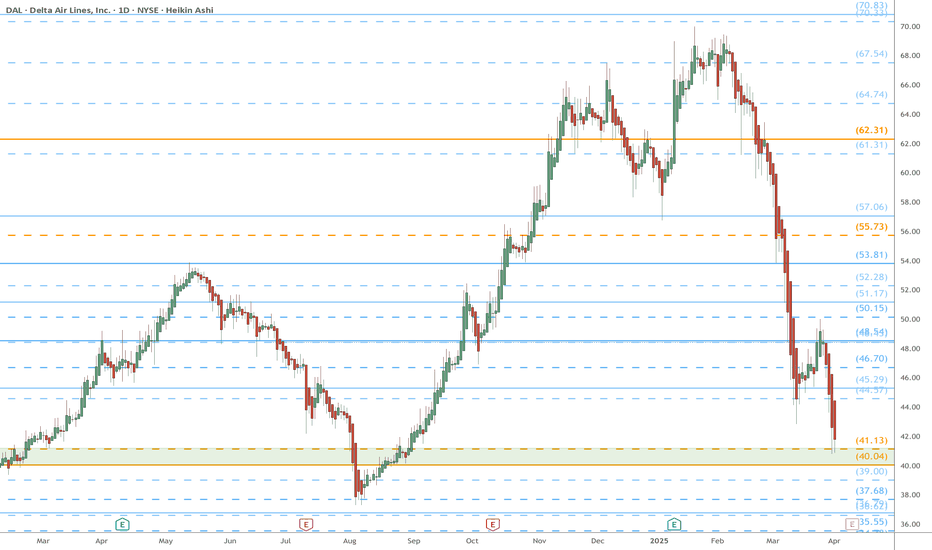

DAL watch $48.5x: Key Resistance might give us a Dip BuyDAL and airline sector has been flying (lol)

Currently testing a DoubleFib Resistance.

We should see a dip soon for possible buys.

$ 48.43 - 48.54 is the resistance to watch.

$ 46.70 is the first good support of interest.

$ 45.29 is a MUST Hold or bulls are done for.

.

Previous Chart with the Big

DAL WILL PAY US!!!Watching DAL for potential continuation to the downside. Price is still holding under key resistance and failing to reclaim structure. If we see a retracement toward the $40.30–$40.80 zone, I’ll be looking for rejection and confirmation to enter short.

Day trading targets are $39.10, $38.60, and $3

Breaking: Delta Air Lines, Inc. (NYSE: $DAL) Surged 8% TodayShares of Delta Airlines, Inc (NYSE: NYSE:DAL ) surges 8% today after the company reported adjusted earnings per share (EPS) of $0.46 on operating revenue of $14.04 billion. Analysts polled by Visible Alpha had forecast $0.39 and $13.89 billion, respectively.

The company which provides scheduled

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

DAL5000237

Delta Air Lines, Inc. 7.375% 15-JAN-2026Yield to maturity

5.46%

Maturity date

Jan 15, 2026

DAL4277695

Delta Air Lines, Inc. 3.875% 30-JUL-2027Yield to maturity

5.10%

Maturity date

Jul 30, 2027

DAL6094663

Delta Air Lines, Inc. 5.25% 10-JUL-2030Yield to maturity

5.00%

Maturity date

Jul 10, 2030

DAL4900990

Delta Air Lines, Inc. 3.75% 28-OCT-2029Yield to maturity

4.92%

Maturity date

Oct 28, 2029

DAL6094662

Delta Air Lines, Inc. 4.95% 10-JUL-2028Yield to maturity

4.71%

Maturity date

Jul 10, 2028

DAL4962233

Delta Air Lines, Inc. 2.5% 10-JUN-2028Yield to maturity

4.65%

Maturity date

Jun 10, 2028

DAL4277694

Delta Air Lines, Inc. 3.625% 30-JUL-2027Yield to maturity

4.64%

Maturity date

Jul 30, 2027

DAL4622961

Delta Air Lines, Inc. 4.375% 19-APR-2028Yield to maturity

4.62%

Maturity date

Apr 19, 2028

DAL4962232

Delta Air Lines, Inc. 2.0% 10-JUN-2028Yield to maturity

4.12%

Maturity date

Jun 10, 2028

See all OYC bonds

Curated watchlists where OYC is featured.

Frequently Asked Questions

The current price of OYC is 45.051 CHF — it has decreased by −0.52% in the past 24 hours. Watch DELTA AIRLINES INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange DELTA AIRLINES INC stocks are traded under the ticker OYC.

OYC stock has fallen by −0.06% compared to the previous week, the month change is a 14.39% rise, over the last year DELTA AIRLINES INC has showed a 12.62% increase.

We've gathered analysts' opinions on DELTA AIRLINES INC future price: according to them, OYC price has a max estimate of 72.16 CHF and a min estimate of 47.31 CHF. Watch OYC chart and read a more detailed DELTA AIRLINES INC stock forecast: see what analysts think of DELTA AIRLINES INC and suggest that you do with its stocks.

OYC stock is 0.52% volatile and has beta coefficient of 1.27. Track DELTA AIRLINES INC stock price on the chart and check out the list of the most volatile stocks — is DELTA AIRLINES INC there?

Today DELTA AIRLINES INC has the market capitalization of 28.48 B, it has increased by 12.92% over the last week.

Yes, you can track DELTA AIRLINES INC financials in yearly and quarterly reports right on TradingView.

DELTA AIRLINES INC is going to release the next earnings report on Oct 9, 2025. Keep track of upcoming events with our Earnings Calendar.

OYC earnings for the last quarter are 1.67 CHF per share, whereas the estimation was 1.63 CHF resulting in a 1.91% surprise. The estimated earnings for the next quarter are 1.19 CHF per share. See more details about DELTA AIRLINES INC earnings.

DELTA AIRLINES INC revenue for the last quarter amounts to 12.30 B CHF, despite the estimated figure of 12.27 B CHF. In the next quarter, revenue is expected to reach 11.89 B CHF.

OYC net income for the last quarter is 1.69 B CHF, while the quarter before that showed 212.46 M CHF of net income which accounts for 695.42% change. Track more DELTA AIRLINES INC financial stats to get the full picture.

Yes, OYC dividends are paid quarterly. The last dividend per share was 0.13 CHF. As of today, Dividend Yield (TTM)% is 1.10%. Tracking DELTA AIRLINES INC dividends might help you take more informed decisions.

DELTA AIRLINES INC dividend yield was 0.83% in 2024, and payout ratio reached 9.37%. The year before the numbers were 0.50% and 2.79% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 26, 2025, the company has 103 K employees. See our rating of the largest employees — is DELTA AIRLINES INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. DELTA AIRLINES INC EBITDA is 6.56 B CHF, and current EBITDA margin is 13.80%. See more stats in DELTA AIRLINES INC financial statements.

Like other stocks, OYC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade DELTA AIRLINES INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So DELTA AIRLINES INC technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating DELTA AIRLINES INC stock shows the buy signal. See more of DELTA AIRLINES INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.