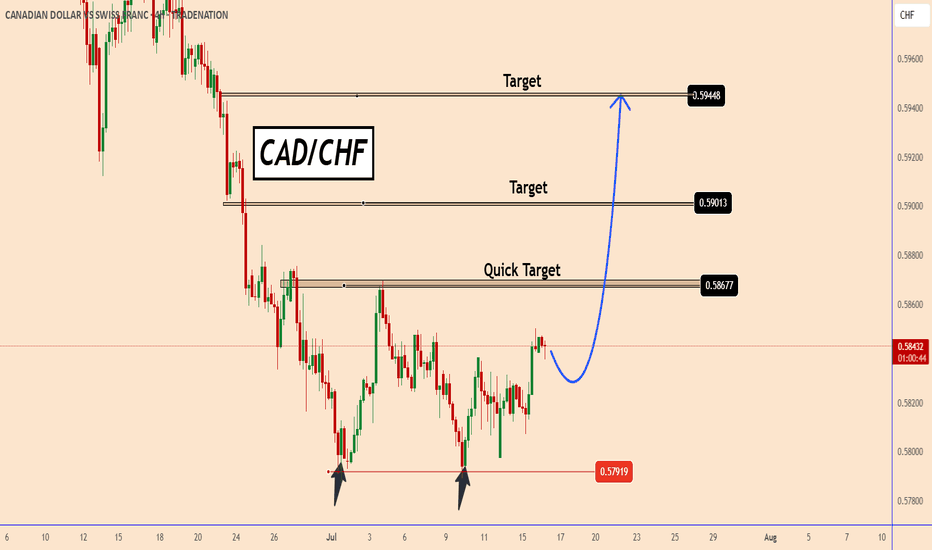

CADCHF found strong support zone near 0.5790CADCHF found a strong support zone near 0.5790

The chances are that the price already completed a doubt bottom pattern. It is not confirmed yet but the support zone is already too strong.

The price may face a strong resistance near the first target 0.5870 that is also the strongest target. Once t

About CANADIAN DOLLAR VS SWISS FRANC

The Canadian Dollar vs. Swiss Franc pair is often recognized as a carry trade vehicle because of the relationship between a low yielding, safety geared currency (CHF) and a higher yielding, growth related one (CAD). The CHF is considered to be safety geared and low yielding because of its reputation as a safe harbor and haven for foreigners depositing their wealth in a foreign private banking system. The CAD is considered to be a commodity currency because of its exporting of natural resources which makes it sensitive to investors' outlooks on global economic growth.

Related currencies

CAD/CHF: Break, Retest and Go?The market is in a strong downtrend, moving inside a visible steep channel. Price recently pulled back into a previous support-turned-resistance zone. This move appears corrective in nature, with sellers likely waiting for signs of exhaustion before re-entering in the direction of the existing trend

CADCHF Sellers In Panic! BUY!

My dear friends,

CADCHF looks like it will make a good move, and here are the details:

The market is trading on 0.5811 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the ma

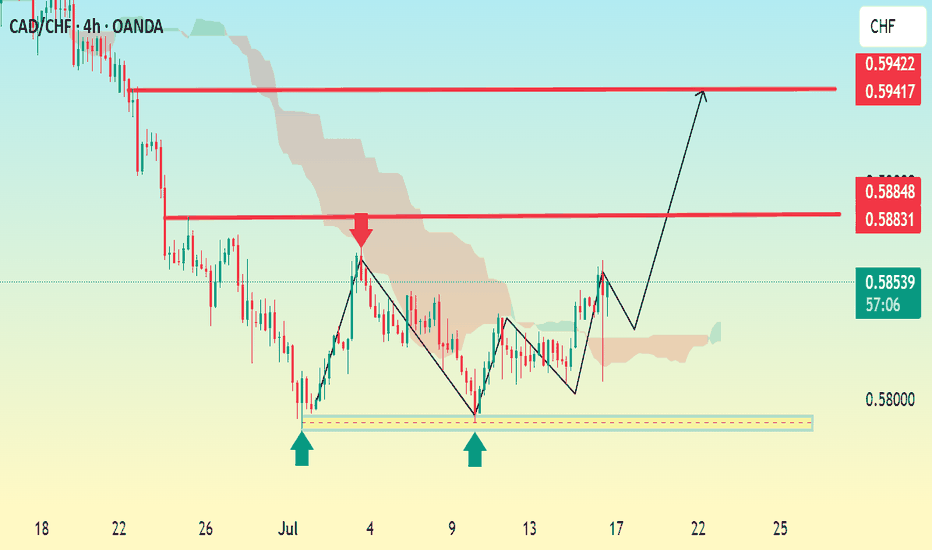

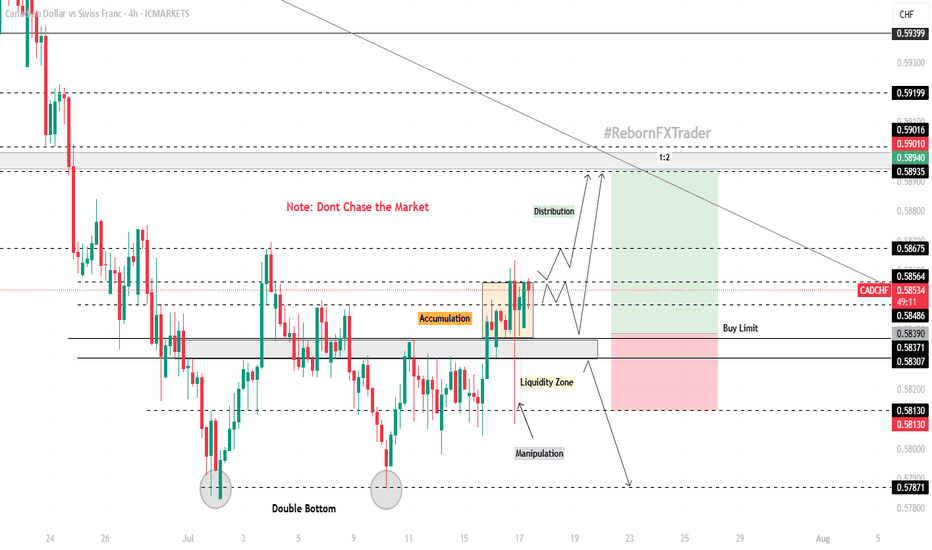

CADCHF Buying Opportunity after Strong Support CADCHF is currently respecting a strong support zone, indicating a potential bullish reversal pattern in development. The structure suggests that most of the downward pressure may be exhausted, and buyers could begin to take control.

Price action shows signs of completing a doubt/uncertainty patter

CAD/CHF 4H Bullish Reversal Setup The pair has formed a double bottom pattern around the 0.5800 level (highlighted by the blue arrows), indicating strong support and a potential bullish reversal.

Price has broken the short-term bearish trendline and is now retracing slightly, possibly to retest the breakout zone or neckline of the

CAD/CHF 4H Technical and Fundamental AnalysisCAD/CHF 4H Technical and Fundamental Analysis

CAD/CHF has shown bullish potential this week, supported by strengthening fundamentals and a technical breakout. From a macro perspective, the Canadian dollar (CAD) continues to benefit from rising crude oil prices, a key Canadian export. With WTI crude

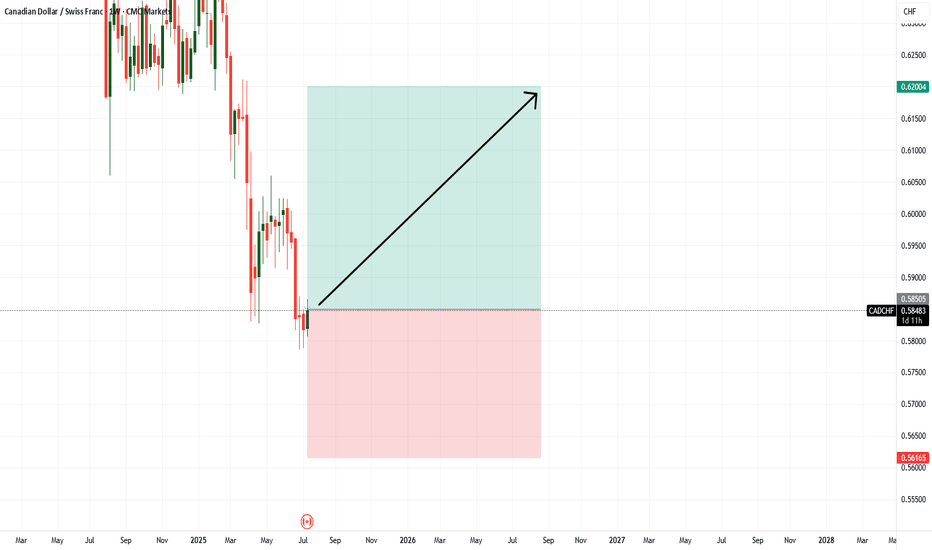

CRT on Weekly timeframe / Bullish 🎯 Trade Idea:

If you're already in: Good entry, but keep a tight stop below 0.5770.

If you're not in yet: Wait for a bullish confirmation candle (engulfing, hammer, etc.) on the daily or weekly before entering.

TP Zones:

TP1: 0.5900 (minor resistance)

TP2: 0.6040 (ke

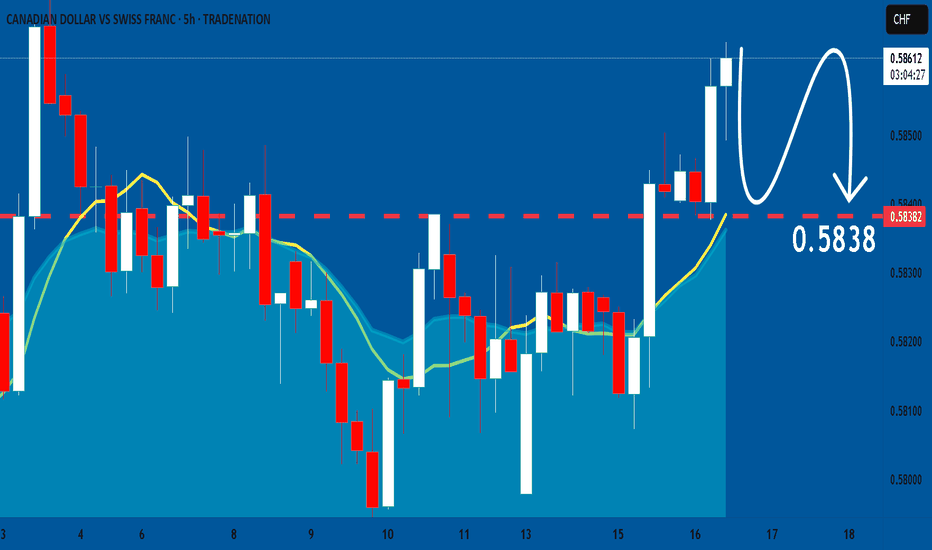

CADCHF: Bearish Continuation

Looking at the chart of CADCHF right now we are seeing some interesting price action on the lower timeframes. Thus a local move down seems to be quite likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤

CADCHF BUY BIASConfluence 1 - “Daily Low Sweep”

• A liquidity sweep of a previous daily low occurred.

• This move typically indicates stop hunts and smart money accumulation, potentially setting up for a bullish reversal.

Confluence 2. Demand Zone (Grey Box)

• Area where price reacted after the sweep.

• Range

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The value of the CADCHF pair is quoted as 1 CAD per x CHF. For example, if the pair is trading at 1.50, it means it takes 1.5 CHF to buy 1 CAD.

CADCHF is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade CADCHF right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.