SOYBEAN; Heikin Ashi Trade Idea📈 Hey Traders!

Here’s a fresh outlook from my trading desk. If you’ve been following me for a while, you already know my approach:

🧩 I trade Supply & Demand zones using Heikin Ashi chart on the 4H timeframe.

🧠 I keep it mechanical and clean — no messy charts, no guessing games.

❌ No trendlines, no fixed sessions, no patterns, no indicator overload.

❌ No overanalyzing market structure or imbalances.

❌ No scalping, and no need to be glued to the screen.

✅ I trade exclusively with limit orders, so it’s more of a set-and-forget style.

✅ This means more freedom, less screen time, and a focus on quality setups.

✅ Just a simplified, structured plan and a calm mindset.

💬 Let’s Talk:

💡Do you trade supply & demand too ?

💡What’s your go-to timeframe ?

💡Ever tried Heikin Ashi ?

📩 Got questions about my strategy or setup? Drop them below — ask me anything, I’m here to share.

Let’s grow together and keep it simple. 👊

ZSQ2026 trade ideas

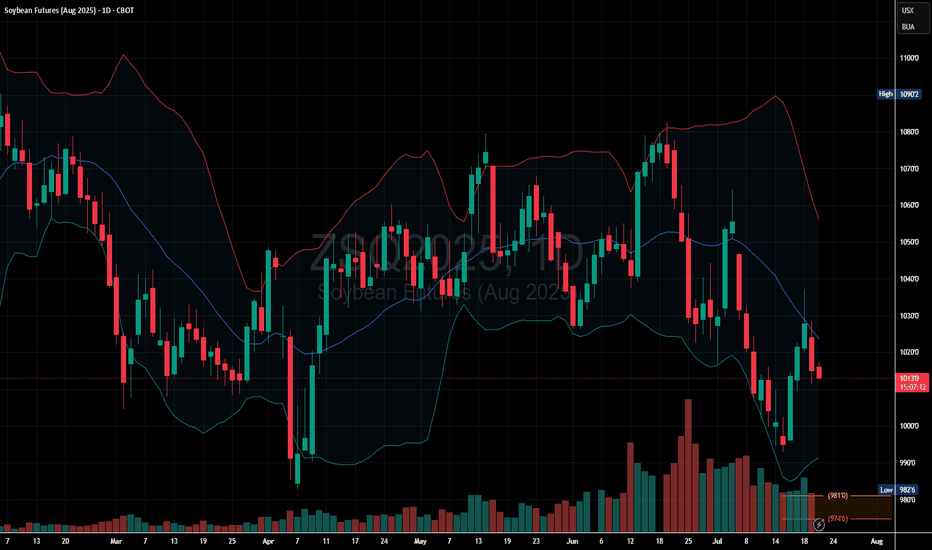

ZSQ2025 Slips Below Mid-Band: Downtrend in Motion

The price is trading below the midline of the Bollinger Bands, indicating weakness and bearish momentum.

Recent candles show lower highs and lower lows, a classic bearish structure.

Price has rejected the midline recently and is leaning back toward the lower band, a common setup in bearish continuations.

Soybeans and Rain: Moisture’s Market Impact on the Bean Trade1. Introduction: Moisture & Market Momentum

Soybeans, often referred to as “the oilseed king,” are a cornerstone of global agriculture. As a leading source of protein for both humans and animals, their price fluctuations affect industries ranging from food production to biofuels. One key variable traders often monitor? Rainfall. 🌧️

Moisture plays a critical role in soybean development, influencing yield and quality from the moment the seed is sown. It’s no surprise that many market participants assume a strong correlation between rainfall and price behavior. But is that assumption truly supported by data?

In this article, we analyze how varying precipitation levels impact weekly soybean futures returns. As you'll see, the results might not be as clear-cut as you’d expect—but they still offer meaningful insights.

2. Biological Realities: Soybeans’ Water Needs

Soybeans thrive under specific conditions. While they’re generally resilient, rainfall—or the lack thereof—can tip the balance between bumper harvests and disappointing yields.

During early vegetative stages, sufficient moisture ensures healthy root development. Later, during the pod-fill phase, rainfall becomes even more essential. Too little water at this point leads to incomplete pods or aborted seeds. On the flip side, too much rain can invite fungal diseases and delay harvests, especially in lower-lying regions.

In countries like Brazil and Argentina, soybean fields often face seasonal extremes, while the U.S. Midwest typically enjoys more consistent conditions—though droughts and floods have both hit the Corn Belt in recent years. These environmental realities create natural volatility in both yield and pricing expectations.

3. Methodology: How We Analyzed Weather vs. Futures

To explore the potential connection between rainfall and soybean futures prices, we collected weekly weather data for major soybean-growing cities across the globe. Each week’s precipitation was categorized using a normalized percentile system:

Low Rainfall: below the 25th percentile

Normal Rainfall: between the 25th and 75th percentiles

High Rainfall: above the 75th percentile

We then matched this data against weekly returns of standard soybean futures (ZS) and micro soybean futures (MZS), both traded on the CME Group.

This allowed us to compare average price behavior in different rainfall scenarios—and test whether there was any statistically significant difference between dry and wet weeks.

4. Statistical Findings: Is There a Signal in the Noise?

When examining the data, the initial visual impression from boxplots was underwhelming—return distributions across rainfall categories looked surprisingly similar. However, a deeper dive showed that the difference in mean returns between low and high precipitation weeks was statistically significant, with a p-value around 0.0013.

What does that mean for traders? While the signal may not be obvious to the naked eye, statistically, rainfall extremes do impact market behavior. However, the magnitude of impact remains modest—enough to be part of your strategy but not enough to drive decisions in isolation.

Soybean prices appear to be influenced by a mosaic of factors, with precipitation being just one tile in that complex picture.

5. Charting the Relationship: Visual Evidence

While statistical tests gave us the green light on significance, we know traders love to “see” the story too. Boxplots of weekly soybean futures returns segmented by rainfall categories offered a subtle narrative:

Low-precipitation weeks showed slightly higher average returns and tighter interquartile ranges.

High-precipitation weeks had broader return distributions and more frequent downside outliers.

Normal weeks exhibited relatively stable behavior, reinforcing the idea that the market reacts most during extremes.

This kind of visualization may not scream alpha at first glance, but it reinforces the idea that precipitation events—particularly dry spells—tend to nudge prices upward, possibly as market participants price in production risk.

6. Trading Implications: Positioning Around Weather

Here’s where things get practical. While weather alone won’t dictate every trading decision, it can be a key filter in a broader strategy. For soybean traders, rainfall data can help inform:

Bias assessment: Low-precipitation weeks may suggest bullish tendencies.

Risk control: Expect wider return distributions in high-precip weeks—adjust stops or contract sizing accordingly.

Event trading: Pair weather anomalies with technical signals like trendline breaks or volume surges for potential setups.

It’s also worth noting that weekly weather forecasts from reputable sources can serve as a forward-looking indicator, giving traders a head start before the market fully reacts.

7. Margin Efficiency with Micro Soybeans

For traders looking to scale into soybean exposure without the capital intensity of full contracts, the CME Group’s micro-sized futures offer a compelling alternative.

📌 Contract Specs for Soybean Futures (ZS):

Symbol: ZS

Contract size: 5,000 bushels

Tick size: 1/4 of one cent (0.0025) per bushel = $12.50

Initial margin: ~$2,100 (varies by broker and volatility)

📌 Micro Soybean Futures (MZS):

Symbol: MZS

Contract size: 500 bushels

Tick size: 0.0050 per bushel = $2.50

Initial margin: ~$210

These smaller contracts are perfect for strategy testing, risk scaling, or layering exposure around key macro events like WASDE reports or weather disruptions. For traders aiming to build weather-aligned positions, MZS is a powerful tool to balance conviction with capital efficiency.

8. Wrapping It All Together

Rain matters. Not just in fields, but in futures prices too. While soybean markets may not overreact to every drizzle or downpour, extreme rainfall conditions—especially drought—can leave noticeable footprints on price action.

For traders, this means opportunity. By incorporating precipitation metrics into your workflow, you unlock a new layer of context. One that doesn’t replace technical or fundamental analysis, but enhances both.

And remember: this article is just one piece of a larger exploration into how weather affects the commodity markets. Make sure you also read prior installments.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Soybeans Loading a Bounce? Demand Zone + COT1. Price Action & Technical Structure

Price has bounced off a strong daily demand zone (1011–969).

Today’s daily candle shows a clear rejection wick from the low, and RSI is signaling a potential reversal.

The market is trading inside a falling channel, currently near the lower boundary — setting up a possible breakout move.

Technical Targets:

• First upside target: 1039–1049

Invalidation: daily close below 990, which would confirm structural breakdown.

2. COT Report – Soybeans Futures (as of July 9, 2025)

• Non-Commercials:

+11,539 spreads | +7,017 shorts | –7,520 longs → Slight bearish pressure, though spreads suggest growing speculative complexity.

• Commercials:

+7,876 longs | –9,084 shorts → Moderate commercial bullish bias.

• Open Interest:

+8,076 contracts → Market activity increasing.

Overall COT positioning is neutral to slightly bullish, with growing signs of accumulation around the 1000 level.

3. Seasonality – MarketBulls

Historically, July is one of the weakest months for Soybeans:

• –44.82 (20Y avg)

• –36.86 (15Y avg)

• –34.74 (10Y avg)

However, early August shows signs of seasonal recovery, and price action is already diverging from typical seasonal behavior.

This makes a deeper breakdown less likely — we could be nearing the end of the seasonal weakness.

Operational Takeaway

Current Bias: Neutral-to-Bullish

Confluence of signals supports the idea of a technical rebound:

✅ Bullish reaction candle in demand

✅ Fibonacci support + lower trendline touch

✅ COT data stabilizing with rising open interest

✅ Seasonal weakness possibly exhausted

Oversupply Meets Tepid Demand Weighing Down on Soybean MealSoybean meal futures rose in mid-June amid Israel-Iran tensions but retreated after a ceasefire. Even a 129% month-on-month surge in China’s May soybean imports failed to support prices.

Spike in import volumes is a consequence of normalisation in customs clearance and a rebound in crushing plant activity. In April, imports plunged to a decade low of 6.08 million metric tonnes due to delayed Brazilian shipments and port congestion. June imports are expected to remain elevated (~12 million tonnes), fuelling oversupply concerns.

Rising soybean oil prices, driven by higher crude and seasonal biofuel demand, have led to increased crushing, further boosting meal supply.

China’s terminal feed factories are working through high inventories, dampening near-term demand. With China accounting for two-thirds of global bean imports, anaemic demand is a solid bearish price driver.

Elevated supply and tepid Chinese demand pose downside risk for soybean meal prices in the near term.

TECHNICAL SIGNALS POINT TO BEARISHNESS AS WELL

Bearish momentum in soybean meal has strengthened, with prices sliding sharply since 23/Jun. A death cross formed on 25/Jun, as the 21-day Displaced Moving Average (DMA) crossed below the 9-day DMA amplifying bearish sentiments.

Additionally, prices fell below the 50-day DMA on 24/Jun and have remained below it, reinforcing the downward trend.

Bearish MACD and a weakening RSI signal continued weakening of meal prices.

OPTIONS MARKET SIGNAL BULLISHNESS IN THE MEDIUM TERM

For the week ending 16/Jun, Managed Money’s net long positioning in soybean meal futures fell by 23.4%, reflecting an 11% drop in longs and an 8.9% rise in shorts.

Soybean meal's implied volatility has risen since 25/Jun, with skew picking up from 27/Jun, despite falling prices. This points to rising uncertainty & potential for wider price swings.

Source: CME CVOL

Option open interest points to muted activity in the near term. However, Overall open-interest put-call-ratio point to bullishness.

Source: CME QuikStrike

Strong call OI buildup from July to November signals medium-term recovery hopes.

HYPOTHETICAL TRADE SETUP

The downtrend in soybean meal futures looks set to persist, with both technical and fundamental signals reinforcing bearish sentiment.

While rising IV, skew, and an oversold RSI hint at a possible near-term bounce, any mean reversion is likely to be short-lived without a shift in underlying fundamentals.

Seasonally, July–August tends to mark seasonal lows as inventory builds pressure prices further, particularly in China.

This paper posits a tactical short on CME Micro Soybean Meal August futures (MZMQ25 expiring on 25th Jul), targeting a decline in prices.

Investors can use the CME Micro Soybean Meal Futures, which are sized at one-tenth (10 short tons) of standard contracts (which are 100 short tons). This allows for a cost-effective method to express a short-term bearish stance. As of 27th Jun, the minimum exchange margin on this contract is USD 170 per lot.

• Entry: USD 284.5/Short Ton

• Potential Profit: USD 264.5/Short Ton (284.5– 264.5= 20) x 10 = USD 200

• Potential Stop-Loss: USD 297/Short Ton (284.5- 297 = -12.5) x 10 = USD 125

• Hypothetical Reward-to-Risk Ratio: 1.6x

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme .

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER, the link to which is provided in our profile description.

Soybeans Crashing Into Demand — Reversal Coming or Trap?1. COT REPORT — Updated June 17, 2025

📌 Non-Commercials (Speculators)

Long: +5,661 → 195,984

Short: -9,226 → 110,761

✅ Net Long Increase: A clear bullish shift in speculative positioning (+14,887 net contracts). This is an early indication of a sentiment reversal.

📌 Commercials (Hedgers / Producers)

Long: +6,023

Short: -5,806

➡️ The decrease in net shorts suggests improving confidence among institutional players.

📌 Total Open Interest: 846,169 (down by 12,776)

❗ This slight drop may be linked to position rotation or partial profit-taking.

2. NET POSITIONS CHART INSIGHT

Commercial traders remain structurally net short, but their exposure has been gradually declining since March.

Non-commercial traders have increased their net long positions since April, aligned with the price's technical recovery.

The current price is trading near the historical mean, indicating neutral conditions with potential room for further upside.

🕰️ 3. SEASONALITY OUTLOOK

The June–July period has historically been bearish:

June Average Performance:

Last 5 years: -39.61

Last 2 years: -38.71

July Average Performance:

Last 20 years: -44.82

Last 2 years: -34.73

📉 August and September typically continue this seasonal downtrend.

🟨 Caution is advised on initiating long positions during this phase.

📊 4. TECHNICAL OUTLOOK —

Current Structure:

Rising channel has broken to the downside with a strong bearish impulse candle.

RSI is neutral but previously showed bearish divergence.

Key Support Zones:

1035–1025: Intermediate support area already tested.

1012–994: Golden Pocket aligned with a demand block — likely target zone with high potential for reaction.

Possible Scenarios:

🔴 Bearish Continuation: A retracement followed by a move down into the 994–1000 range, where a tactical long setup may emerge.

🔵 Bull Trap and Reversal: A rapid recovery above 1050, potentially triggering a continuation to 1080 (range top).

5. EXECUTION SUMMARY

Primary Bias: Bearish in the short term

🎯 Target Zone: 994–1000

🛑 Invalidation Level: Weekly close above 1055

Tactical Long Setup: Monitor price action at 994–1000 for bullish reaction.

Macro context and speculative positioning suggest a structural bottom may develop in Q3 2025, but current conditions are not yet favorable for a full swing position.

Soybeans and Heat: Subtle Signals in a Volatile Market1. Introduction

Soybeans aren't just a staple in livestock feed and global cuisine—they’re also a major commodity in futures markets, commanding serious attention from hedgers and speculators alike. With growing demand from China, unpredictable yields in South America, and increasing climatic instability, the behavior of soybean prices often reflects a deeper interplay of supply chain stress and environmental variability.

Among the many weather variables, temperature remains one of the most closely watched. It’s no secret that extreme heat can harm crops. But what’s less obvious is this: Does high temperature truly move the soybean market in measurable ways?

As we’ll explore, the answer is yes—but with a twist. Our deep dive into decades of data reveals a story of statistical significance, but not dramatic deviation. In other words, the signal is there, but you need to know where—and how—to look.

2. Soybeans and Climate Sensitivity

The soybean plant’s sensitivity to heat is well documented. During its flowering and pod-setting stages, typically mid-to-late summer in the U.S., soybean yields are highly vulnerable to weather fluctuations. Excessive heat during these windows—particularly above 30ºC (86ºF)—can impair pod development, lower seed count, and accelerate moisture loss from the soil.

The optimal range for soybean development tends to hover between 20ºC to 30ºC (68ºF to 86ºF). Within this window, the plant thrives—assuming adequate rainfall and no pest infestations. Go beyond it for long enough, and physiological stress builds up. This is precisely the kind of risk that traders price into futures markets, often preemptively based on forecasts.

Yet, trader psychology is just as important as crop biology. Weather alerts—especially heatwaves—often drive speculative trading. The market may anticipate stress well before actual yield reports come out. This behavior is where we see the beginnings of correlation between temperature and market movement.

3. Quantifying Weather Impact on Soybean Futures

To test how meaningful these heat-driven narratives are, we categorized weekly temperatures into three buckets:

Low: Below the 25th percentile of weekly temperature readings

Normal: Between the 25th and 75th percentile

High: Above the 75th percentile

We then calculated weekly returns of Soybean Futures (ZS) across these categories. The results?

Despite the modest visual differences in distribution, the statistical analysis revealed a clear pattern: Returns during high-temperature weeks were significantly different from those during low-temperature weeks, with a p-value of 3.7e-11.

This means the likelihood of such a difference occurring by chance is effectively zero. But here’s the catch—the difference in mean return was present, yes, but not huge. And visually, the boxplots showed overlapping quartiles. This disconnect between statistical and visual clarity is exactly what makes this insight subtle, yet valuable.

4. What the Data Really Tells Us

At first glance, the boxplots comparing soybean futures returns across temperature categories don’t scream “market-moving force.” The medians of weekly returns during Low, Normal, and High temperature periods are closely clustered. The interquartile ranges (IQRs) overlap significantly. Outliers are present in every category.

So why the statistical significance?

It’s a matter of consistency across time. The soybean market doesn’t suddenly explode every time it gets hot—but across hundreds of data points, there’s a slightly more favorable distribution of returns during hotter weeks. It’s not dramatic, but it’s reliable enough to warrant strategic awareness.

This is where experienced traders can sharpen their edge. If you’re already using technical analysis, seasonal patterns, or supply-demand forecasts, this weather-based nuance can serve as a quiet confirmation or subtle filter.

5. Why This Still Matters for Traders

In markets like soybeans, where prices can respond to multiple fundamental factors—currency shifts, export numbers, oilseed competition—small weather patterns might seem like background noise. But when viewed statistically, these small effects can become the grain of edge that separates average positioning from smart exposure.

For example:

Volatility tends to rise during high-heat weeks, even when average return shifts are small.

Institutional players may rebalance positions based on crop health assumptions before USDA reports arrive.

Weather trading algos can push prices slightly more aggressively during risk-prone periods.

In short, traders don’t need weather to predict price. But by knowing what weather has historically meant, they can adjust sizing, bias, or timing with greater precision.

6. Contract Specs: Standard vs. Micro Soybeans

Accessing the soybean futures market doesn’t have to require big institutional capital. With the launch of Micro Soybean Futures (MZS), traders can participate at a more granular scale.

Here are the current CME Group specs:

📌 Contract Specs for Soybean Futures (ZS):

Symbol: ZS

Contract size: 5,000 bushels

Tick size: 1/4 of one cent (0.0025) per bushel = $12.50

Initial margin: ~$2,100 (varies by broker and volatility)

📌 Micro Soybean Futures (MZS):

Symbol: MZS

Contract size: 500 bushels

Tick size: 0.0050 per bushel = $2.50

Initial margin: ~$210

The micro-sized contract allows traders to scale into positions, especially when exploring signals like weather impact. It also enables more nuanced strategies—such as partial hedges or volatility exposure—without the capital intensity of full-size contracts.

7. Conclusion: A Nuanced Edge for Weather-Aware Traders

When it comes to soybeans and temperature, the story isn’t one of obvious crashes or dramatic spikes. It’s a story of consistent, statistically measurable edges that can quietly inform better trading behavior.

Yes, the return differences may look small on a chart. But over time, in leveraged markets with seasonality and fundamental noise, even a few extra basis points in your favor—combined with smarter sizing and timing—can shift your performance curve meaningfully.

Using tools like Micro Soybean Futures, and being aware of technical frameworks, traders can efficiently adapt to subtle but reliable signals like temperature-based volatility.

And remember: this article is just one piece in a multi-part series exploring the intersection of weather and agricultural trading. The next piece might just provide the missing link to complete your edge. Stay tuned. 🌾📈

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Bullish Undercurrents Build in Soybean Oil MarketSoybean oil futures have rebounded nearly 14% in June, following a 5.7% drop in May, supported by tightening global supply, resilient demand, expanding biodiesel use, and steady U.S. production with some planting delays.

Severe drought in Brazil and Argentina, who together account for 45% of global soybean exports, has slashed yields by roughly 15%, tightening supply chains and boosting prices.

Strong Chinese demand, both for food and hog herd rebuilding, continues to be a major price driver. China imports nearly 18.5 million tons of soybean oil annually and remains the world’s largest consumer.

The USDA’s June WASDE report underscored a bullish backdrop: U.S. production is steady at 4.34 billion bushels for 2025–26, but ending stocks are projected to fall to 295 million bushels, down from 350 million in 2024–25, signalling a tighter domestic supply.

Adding to the bullish momentum, crude oil prices surged on 13/Jun amid escalating Israel-Iran tensions, indirectly supporting soybean oil due to its role in biodiesel production. Higher crude prices enhance biodiesel’s competitiveness, boosting demand for soybean oil as a feedstock.

Soybean oil futures also jumped after the EPA proposed higher-than-expected biofuel blending mandates. The Trump administration’s proposal, seen as a major win for the biofuels industry, is expected to significantly increase domestic soybean crush demand in 2026 and 2027.

TECHNICAL SIGNALS POINT TO BULLISH REVERSAL

Technical indicators suggest weakening bearish momentum in soybean oil. Since early June, prices have climbed above the 9-day, 21-day, and 50-day moving averages after starting the month below them.

Though the 9-day MA is still below the 21-day, the narrowing gap signals strengthening momentum and a possible bullish crossover.

The MACD and RSI indicate that selling pressure has subsided, with momentum now tilting bullish. If this strength persists, the uptrend in soybean oil futures could gain further traction.

OPTIONS DATA SIGNALS GROWING BULLISH MOMENTUM

For the week ending 10/Jun, Managed Money’s net long positioning in soybean oil futures fell by 22.6%, reflecting a 13% drop in longs and a 7.1% dip in shorts.

Rising implied volatility alongside prices and a positive skew suggest growing bullish sentiment, as market participants position for potential upside in soybean oil futures.

Source: CME CVOL

The rise in call OI across near-term contracts suggests growing bullish sentiment for soybean oil prices.

Source: CME QuikStrike

While selective increase in put OI reflects cautious hedging, pointing to expectations of further upside with some near-term uncertainty.

HYPOTHETICAL TRADE SETUP

Bullish fundamentals driven by rising Chinese demand, supply disruptions in South America, and a sharp uptick in crude oil, combined with supportive technical indicators and skewed options positioning, suggest further upside potential for soybean oil futures.

This paper posits a tactical long on CME Micro Soybean Oil August futures (MZLQ25 expiring on 25th July), targeting an uptrend in prices.

Investors can position against this backdrop using the CME Micro Soybean Oil Futures, which are sized at one-tenth (6,000 pounds) of standard contracts (which are 60,000 pounds). This allows for a cost-effective method to express a short-term bearish stance. As of 16th June, the minimum exchange margin on this contract is USD 190 per lot.

• Entry: USc 51/Pound

• Potential Profit: USc 57/Pound (57– 51= 6) x 6000/100 = USD 360

• Stop-Loss: USc 47.3/Pound (47.3- 51 = -3.7) x 6000/100 = USD 222

• Reward-to-Risk Ratio: 1.62x

In collaboration with the CME Group, TradingView has launched The Leap trading competition. New and upcoming traders can hone and refine their trading skills, test their trading strategies, and feel the thrill of futures trading with a vibrant global community through this paper trading competition sponsored by CME Group using virtual money and real time market data.

The competition lasts another 14 days. Please join the other 54,500 participants who are actively honing their trading skills using virtual money. Click here to learn more.

#TheFuturesLeap #Microfutures

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme .

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER, the link to which is provided in our profile description.

Bearishness Persist in Soybeans Despite Rebound HopesSince mid-May, soybean prices have traded sideways, whipsawed by weather shifts, trade tensions, and fluctuating demand cues.

Soybean prices began rallying on May 19, driven by optimism over U.S. trade deals, crop damage in Argentina from heavy rains, and strong soybean oil prices.

However, the momentum soon faded as U.S.-EU trade tensions resurfaced. Prices came under further pressure from weak export demand, rising competition from South America, and bearish U.S. biofuel mandates.

By 02/Jun, soybeans had fallen to a six-week low, weighed down by favorable U.S. crop weather, improved Brazilian production forecasts, and renewed U.S.-China tensions.

Over the last week, Bean prices inched higher, supported by firmer soybean oil prices and hopes of renewed US-China trade talks.

However, sentiment remains cautious amid policy uncertainty and robust planting progress. According to USDA data , 84% of the U.S. soybean crop was planted as of 1/Jun, above the five-year average of 80%.

TECHNICALS SIGNAL PERSISTENT BEARISH TREND WITH SLIGHT CHANCES OF A REVERSAL

On 2/Jun, soybean futures formed a bearish death cross, signalling potential downside momentum. Although prices have since rebounded, bearishness persists with the 21-day MA acting as a strong resistance.

The MACD reflects ongoing but easing bearish momentum, while the RSI sits just below its 14-day average, close to the neutral zone. These indicators suggest that price momentum is currently subdued.

OPTIONS DATA POINT TO MIXED SENTIMENT

For the week ending 27/May, Managed Money’s net long positioning in soybean futures surged by 190%, reflecting a 12.9% gain in longs and a 10% fall in shorts.

Despite the recent pullback in futures, skew (Up Var minus Down Var) has reached a YTD high, signalling higher demand for calls relative to puts.

Source: CME CVOL

Open Interest (“OI”) trends over the past week point to increased bearish positioning, with near-term contracts showing a notable rise in put OI. Longer-dated contracts reflect a similar pattern, although contracts expiring in July (OZSN5) and September (OZSU5) were notable exceptions.

Source: CME QuikStrike

HYPOTHETICAL TRADE SETUP

Despite some bullish drivers (US-China trade talks & Argentina crop risks), bearish forces prevail. These include strong US bean planting, improved Brazil forecasts, policy uncertainty, and rising put open interest in the near term.

Traders can express this view using CME Micro Soybean Futures, which are sized at one-tenth of standard contracts. This allows for a cost-effective way to express a short-term bullish stance.

Considering these dynamics, this paper posits a short position on CME Micro Soybean August futures (MZSQ25, expiring on 25/Jul).

• Entry: USc 1,048.5/Bushel

• Potential Profit: USc 1,027/Bushel (1,048.5 – 1,027 = 21.5) x 500/100 = USD 107.5

• Stop-Loss: USc 1,062/Bushel (1,048.5 – 1,062 = -13.5) x 500/100 = USD 67.5

• Reward-to-Risk Ratio: 1.6x

In collaboration with CME Group, TradingView has launched The Leap trading competition. Through this paper trading competition sponsored by CME Group using virtual money and real-time market data, new and upcoming traders can hone and refine their trading skills, test their trading strategies, and feel the thrill of futures trading with a vibrant global community.

The competition lasts another 21 days. Please join the other 42,700 participants who are actively honing their trading skills using virtual money. Click here to learn more.

#TheFuturesLeap #Microfutures

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme .

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER, the link to which is provided in our profile description.

Bean Oil Retreats From Rally. What’s Next?Soybean oil futures are easing after a stunning 24.5% rally from 24/Mar to 14/May. The surge was driven by rising biofuel mandates and renewable diesel output, which boosted domestic soybean crushing and tightened supplies.

Additionally, the May WASDE report highlighted soybean oil’s key role in renewable diesel growth. U.S. domestic use is projected to rise in 2025/26, with biofuel feedstock demand reaching 13.9 billion pounds, 44.7% of total supply.

The rally ended on 15/May, with soybean oil futures tanking 5.7% amid concerns over the EPA’s biofuel mandate.

Reports suggested the agency may propose a lower biomass-based diesel target of 4.6 billion gallons, well below the industry’s 5.25 billion request, raising fears of feeble future soybean oil demand.

Soybean oil prices extended losses during the last week of May as a sharp drop in crude oil prices threatened to reduce demand for biofuel, weakening the price support.

TECHNICAL SIGNALS CONFIRM BEARISH FUNDAMENTALS

Technical indicators point to growing bearish momentum in soybean oil futures. A death cross occurred on 28/May, with the 21-day MA crossing above the 9-day MA, while prices remain below the monthly pivot.

On 30/May, futures broke below the 50-day MA for the first time since 27/Mar, though they still trade above the 100- and 200-day MAs.

Momentum indicators suggest a weakening outlook for soybean oil prices, with the MACD signalling a bearish trend since 16 May and the RSI holding below both its neutral level and 14-day MA.

OPTIONS DATA POINT TO PERSISTENT BEARISHNESS IN THE NEAR TERM

For the week ending 20th May, Managed Money’s net long positioning in soybean oil futures fell by 15%, reflecting a 5.3% drop in longs and an 8.1% rise in shorts, signalling the beginning of a bearish sentiment.

Implied volatility hit its 2025 high on 15/May, reflecting heightened uncertainty around biofuel policy. While IV has eased since 27/May, it remains well above normal levels, pointing to continued risk of sharp price swings.

Source: CME CVOL

Skew has declined but stays positive, suggesting traders are still pricing in greater demand for upside protection.

Source: CME QuikStrike

Over the past week, OI trends show bearish positioning in near to mid-term contracts except for options expiring on 30/May.

HYPOTHETICAL TRADE SETUP

Bearish fundamentals driven by questionable demand for biofuels and feeble crude oil prices, paired with technical breakdowns and skewed option positioning, point to further downside in soybean oil futures.

This paper posits a tactical short on CME Micro Soybean Oil July futures (MZLN25 expiring on 20th June), targeting continued near-term weakness.

Investors can position against this backdrop using the CME Micro Soybean Oil Futures, which are sized at one-tenth (6,000 pounds) of standard contracts (which are 60,000 pounds). This allows for a cost-effective method to express a short-term bearish stance. As of 2nd June, the minimum exchange margin on this contract is USD 190 per lot.

• Entry: USc 48/Pound

• Potential Profit: USc 44.8/Pound (48 – 44.8 = 3.2) x 6000/100 = USD 192

• Stop-Loss: USc 49.9/Pound (48 – 49.9 = -1.9) x 6000/100 = USD 114

• Reward-to-Risk Ratio: 1.7x

In collaboration with the CME Group, TradingView has launched The Leap trading competition. New and upcoming traders can hone and refine their trading skills, test their trading strategies, and feel the thrill of futures trading with a vibrant global community through this paper trading competition sponsored by CME Group using virtual money and real time market data.

The competition lasts another 27 days. Please join the other 15,000 participants who are actively honing their trading skills using virtual money. Click here to learn more. #TheFuturesLeap

#Microfutures

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme .

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER, the link to which is provided in our profile description.

Has the Soybean Market Just Formed a Bottom? Hey traders so today noticed that on Soybeans there is what is known as an Inverted Head & Shoulders Chart Pattern. This is why I believe you don't need indicators because if you know how to spot these patterns then you will find trade opportunites. If you are new to chart patterns check out some of my other videos I have covered them there before and will also make more in future videos.

So the way you trade the Head and Shouders top is you measure the distance from the top of the head to the neckline then project that target higher. But your stop loss above the right shoulder or the head. However this is an inverted Head and Shoulders so it is the opposite.

Now I am not a farmer and never have even visited a farm although I would love too one day to see all this in action! I will say I have played the game farming simulator though. So I have a little knowledge. 😃

All joking aside so I have no idea every single thing that can influence the price of these grain markets. I do know that Weather, Supply and Demand can be a major factor. Also seasonally grains normally rise during the planting season which is now.

However regardless of your fundamental knowledge you can still trade the technical analysis formation alot of times fundamentals are already priced in the charts. So the signal to trade the formation when the market breaks the neckline which is now has!

Always use Risk Management! (just in case your wrong in your analysis)

Hope This Helps Your Trading

Clifford

Soybeans at the Spear Tip of Trade ConflictsCBOT: Micro Soybean Futures ( CBOT_MINI:MZS1! )

What’s the import duty China levied on U.S. soybeans? This is a million-dollar question.

Below is a timeline of how dramatically the tariff changed over the past few months:

• At the start of the year, China levied a 3% tariff on soybeans originated from the U.S.

• On March 10th, as a retaliatory method against U.S. tariffs, China raised the soybean import duty by 10%, making the total tariff at 13%.

• On April 4th, with additional tariff imposed, the soybean import duty is now 34%.

• On April 8th, a new wave of retaliation put the soybean duty to 84%.

• On April 11th, the soybean tariff is raised to a staggering 125%.

• U.S. and China held trade negotiation in Switzerland. The soybean tariff is temporarily reduced to 23% beginning May 14th.

Trade conflict is now the key driver in CBOT soybean futures. Raising tariffs caused soybean prices to fall sharply in both March and April. Rumors of trade negotiation, weeks before the actual tariff reduction, triggered a big rebound in April through May.

The WASDE Report

On May 12th, the US Department of Agriculture (USDA) released the latest World Agricultural Supply and Demand Estimates (WASDE) report.

U.S. soybean expectations for 2025/26 show a slight decline in supply, higher crushes, lower exports and lower ending stocks compared to 2024/25. U.S. soybean production is expected to fall to 4.34 billion bushels. Soybean supplies are down less than 1% from 2024/25 due to higher initial stocks but lower imports and production.

Global trade in soybeans reflects an acceleration in demand for protein meal consumption. Higher opening stocks and higher soybean production in South America increased export supplies. As a result, the U.S. share of global soybean exports is expected to fall to 26% from 28% last year, despite increased global demand. As a result, U.S. soybean exports are expected to be 1.815 billion bushels, down 35 million bushels from 2024/25.

The May WASDE report is considered neutral. The market reaction has been mute.

Trading with Micro Soybean Futures

The latest CFTC Commitments of Traders report shows that, as of May 13th, CBOT soybean futures have total open interest of 822,498 contracts.

• Managed Money has 136,702 in long, 81,035 in short, and 122,315 in spreading

• Compared to the previous week, long positions were up by 10,457 (+8.3%) while shorts were down by 3,482 (-4.5%)

• The long-short ratio of 1.7-to-1 as well as the position change pattern show that the “Small Money” has turned more bullish on soybeans

The agreement between US and China, while temporary in nature, gives hope to future tariff reduction. The trade negotiation is ongoing in the next 90 days. Depending on the result, China’s tariff on U.S. soybean could go up, go down, or remain at 23%.

To express a view on the future direction of soybean tariff, CBOT Micro Soybean Futures ($MZS) could be used to form a trading strategy.

• At 23% tariff, US soybeans are at the price disadvantage to South American beans. If the tariff were to go up or even just stay the same, US farmers will lose market share in soybean exports. Therefore, short soybeans if the expectation is no trade deal.

• On the other hand, a reduction of tariff level would benefit the better-quality U.S. beans. Therefore, long soybeans if the view is for lowered tariff.

The August contract MZSQ5 is tradeable through August 22nd. This contract expires after the negotiation deadline and could be used for an event-driven strategy.

The contract size of the micro soybean futures (MZS) is 500 bushels, or just 1/10 of the benchmark standard soybean futures (ZS). At Friday closing price of 10.455, each MZS contract has a notional value of $5,227.5. The minimum margin is $205 for the August contract at the time of this writing.

Hypothetically, if August soybean price goes up to $12 due to a favorable trade deal, a long futures position will gain $772.50 (= (12-10.455) * 500).

If August soybean price fell to $9 as the trade talk broke down, a short futures position will gain $727.50 (= (10.455 - 9) * 500).

The risk of futures trading is to be on the wrong side of the price direction. To hedge the downside risk, the trader could set a stoploss at his order. For example,

• A stop loss at $10 for a long order would set the maximum loss to $227.50 (= (10-10.455) x 500).

• A stop loss at $11 for a short order would set the maximum loss to $272.50 (= (10.455-11) x 500).

Happy Trading.

Disclaimers

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

CME Real-time Market Data help identify trading set-ups and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Soybeans: The Global Protein Powerhouse🟡 1. Introduction

Soybeans might not look like much at first glance — small, round, unassuming. But behind every bean lies a global story of protein demand, export flows, and economic policy.

They feed livestock, fuel vehicles, nourish entire populations, and move markets. In fact, soybeans sit at the intersection of agriculture, industry, and geopolitics — making them one of the most actively traded and strategically watched commodities in the world.

If you’re looking to understand how soybeans move markets — and how you can trade them effectively — this article is your starting point.

🌍 2. Why the World Cares About Soybeans

Few agricultural commodities carry the weight soybeans do. Their importance spans both the food and energy sectors — and their global footprint is enormous.

Here’s why they matter:

Protein Meal: After processing, about 80% of the soybean becomes high-protein meal used to feed poultry, pigs, and cattle.

Soybean Oil: Roughly 20% is extracted as oil — a key ingredient in cooking, industrial products, and increasingly, biodiesel.

Biofuels: As the push for renewable energy grows, soybean oil plays a major role in sustainable fuel strategies.

Top producers:

United States — historically the world’s largest producer.

Brazil — now rivals or exceeds U.S. production in some years.

Argentina — a dominant player in soybean meal and oil exports.

Top importers:

China — imports over 60% of globally traded soybeans.

EU, Mexico, Japan — also large buyers.

Soybeans are a bridge commodity — connecting livestock feed, food manufacturing, and renewable energy. That’s why traders from Chicago to Shanghai watch every yield forecast and export announcement closely.

💹 3. CME Group Soybean Contracts

Soybeans trade on the CME Group’s CBOT platform, with two main futures products:

o Standard Soybeans

Ticker: ZS

Size = 5,000 bushels

Tick = 0.0025 = $12.50

Margin = ~$2,150

o Micro Soybeans

Ticker: MZS

Size = 500 bushels

Tick = 0.0050 = $2.50

Margin = ~$215

Soybean futures are among the most actively traded agricultural contracts, offering deep liquidity, tight spreads, and excellent volatility for strategic traders. Keep in mind that margins are subject to change — always confirm with your broker. Micro contracts are ideal for scaling in/out of trades or learning market structure without large capital risk.

📅 4. The Soybean Calendar

Soybeans follow a seasonal cycle that creates rhythm in the market — and a potential edge for informed traders.

In the United States:

🌱 Planting: Late April to early June

☀️ Pod development / blooming: July and early August (weather-sensitive)

🌾 Harvest: September through November

In Brazil:

🌱 Planting: October to December

🌾 Harvest: February through April

This staggered calendar means that soybean markets have multiple weather risk windows each year. It also means the export flows and global pricing dynamics shift between the Northern and Southern Hemispheres throughout the calendar year.

That’s why soybeans tend to have two major volatility windows — mid-summer (U.S. crop concerns) and early Q1 (South American weather). Traders often build seasonal strategies around these patterns — buying weakness before key USDA reports, fading rallies during overbought harvests, or trading futures spreads between U.S. and Brazilian supply flows.

🔄 5. How Soybeans Are Traded Globally

Soybeans move through a complex international web of growers, crushers, exporters, and consumers. As a trader, understanding this flow is essential — because each node introduces price risk, opportunity, and reaction points.

Key players:

o Hedgers:

U.S. and Brazilian farmers hedge production risk using futures or options on futures.

Exporters hedge shipping schedules against fluctuating basis and FX risk.

o Crushers:

Companies like Cargill or Bunge buy soybeans to crush into meal and oil.

Crush margin (aka “board crush”) affects demand and influences futures spreads.

o Speculators:

Institutional funds trade soybeans as a macro or relative value play.

Retail traders use micro contracts (MZS) to capture directional or seasonal moves.

o China:

Its purchasing pace (or sudden cancellations) can move markets dramatically.

Announcements of bulk U.S. purchases could trigger short-covering rallies.

Additionally, soybeans are sometimes traded indirectly via their by-products:

Soybean Meal (ZM)

Soybean Oil (ZL)

These contracts often lead or lag ZS based on demand shifts in feed or fuel.

📈 6. What Makes Soybeans Unique to Trade

Compared to wheat and corn, soybeans are:

More weather-sensitive during July and August (especially to drought and heat).

More globally integrated, thanks to China’s dominant import role.

More complex, due to crush dynamics and multiple end-use markets.

This multifaceted nature is why many professional traders monitor soybeans, even if they aren’t actively trading them every week.

📌 7. Summary / Takeaway

Soybeans are one of the most important — and most tradable — commodities in the world. They feed livestock, fuel industry, and anchor the agricultural markets across two hemispheres.

Their unique role in food, fuel, and feed makes them more than just another contract — they’re a barometer for global health, demand, and policy.

Whether you’re trading the standard ZS contract or getting started with MZS, mastering soybeans means understanding weather, trade flows, product demand, and seasonality.

🧭 This article is part of our agricultural futures trading series.

📅 Watch for the next release: “Weather and Corn: A Deep Dive into Temperature Impact”

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Soybean Surge: Is the Momentum Ripe for More Gains?Soybean futures hit a 2025 low on 7th April in response to President Trump’s sweeping tariffs. Since then, they have rallied 8.4%, staging a strong rebound.

The first leg of the rally (7–11 April) was driven by front-loaded U.S. exports, a weaker dollar, and Trump pausing tariff hikes on 9th April. Prices moved sideways, buoyed by Argentine supply disruption balancing out favourable U.S. planting weather & a bumper harvest in South America.

Momentum resumed on 12th May after the U.S. & China agreed to a 90-day mutual tariff reduction. The latest WASDE report added fuel, showing tighter supplies & lower ending stocks. The USDA now projects 2025/26 US ending stocks to fall 15.7% YoY to 295 million bushels.

On 14th May, futures reached a nine-month high, lifted by a proposal to extend the biofuel tax credit, which augurs well for stronger demand for soybeans.

TECHNICAL SIGNALS CONFIRM BULLISH FUNDAMENTALS

Soybean futures confirmed a bullish golden cross on 11th April, as the 9-day moving average crossed above the 21-day. The rally gained traction after prices found support at the 21-day average on 9th May, reigniting the strong upward momentum.

MACD shows fading bullish momentum, and RSI has dipped below its 14-day average. However, this consolidation could set the stage for a potential rebound as technical pressure eases.

OPTIONS DATA POINT TO SOFTENING OF BULLISHNESS IN THE NEAR TERM

For the week ending 6th May, Managed Money’s net long positioning in soybean futures fell by 42.8%, reflecting a 6.8% drop in longs and a 10.6% rise in shorts, signalling a weakening bullish sentiment.

Soybean futures and options implied volatility spiked in early April as prices and skew dropped. From 9th April, both price and skew began rising while IV gradually declined. This suggests stabilising sentiment and reduced demand for downside protection in soybeans.

Source: CME CVOL

OI trends over the past week indicate bearish positioning in near-term contracts, marked by an outsized increase in puts. In contrast, longer-dated contracts saw a significant rise in call OI, while put OI declined.

Source: CME QuikStrike

HYPOTHETICAL TRADE SETUP

This paper posits a long position on the CME Micro Soybean July futures (MZSN25, expiring on 20th June) given strong technicals, reduced tariffs, & a bullish WASDE report. The rebound since 7th April, coupled with optimism from U.S.-China trade talks and biofuel tax credit extension, hints at continued upside potential.

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme .

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

Food Prices Since Liberation Day - Is Up with Tariffs or PausedWhat is happening to the food prices since liberation day.

Soybeans are a benchmark for food prices — not only because China and many of us consume large quantities, but also because the U.S. exports a significant amount to China.

After the Liberation Day announcement on 2nd April, soybean prices initially dropped but quickly rebounded and surged higher.

Even after a successful trade agreement between the U.S. and China — which reduced reciprocal tariffs for 90 days — soybean prices continued to climb.

So why do food prices seem to trend higher, whether tariffs are in place or paused?

Micro Soybean Futures

Ticker: MZS

Minimum fluctuation:

0.0050 per bushel = $2.50

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Trading the Micro: www.cmegroup.com

China for Soyabean - not easily replaceableRead this article here www.reuters.com

When one market has been your largest buyer, it is not easy to find replacement in a short period of time or maybe not for a long , long time. This happens in the case of US selling soyabeans to China. With the tariffs since 2018, China has been sourcing for alternative suppliers like Brazil and other countries to buy soyabean.

This has caused the demand for soyabeans to falter drastically. Now, the tide might change and we can see the end of the bearish trend line in the chart. Of course, the price can hit multiple times on the resistance line and continue to head south OR breakout and rally from here for which i am going to nibble some LONG position.

As usual, please DYODD

SOYBEAN, Weekly Supply/Demand+fundamentals we are kicking of the year with a clear technical rejection from $1050 to $1112 weekly supply zone. Price pushed agressively into this area and has now printed multiple rejection candles on the daily, confirming the zones strength.

fundamentals are showing bearish positioning aligned with the technical setup.

entry wil be at market open. first target is at break of recent support and if fundamentals stil support the bias by then we wil also aim for target two.

simple structure, clean confirmation. lets see if price delivers.

Soybeans (MZS) | Long Setup | Seasonal Edge | (April 2025)Soybeans (ZS/MZS) | Long Setup | Seasonal Edge + Profile Support | (April 2025)

1️⃣ Quick Insight:

Currently watching Soybeans (ZS) and the micro contract MZS for a potential long setup. Price is approaching the value area low from the volume profile — a key support zone where buyers previously stepped in aggressively. This zone aligns with seasonal strength, making it a high-probability area to consider long positions.

2️⃣ Trade Parameters:

Bias: Long

Entry: Around value area low (Profile support)

Confirmation: Buyer volume + hold above structure

Stop Loss: Below recent swing low / invalidation of value zone

TP1: Based on Fibonacci targets

TP2: Depends on price reaction and volume continuation

Seasonal Edge: Historically, Soybeans rally from mid-April through end of April — adding confidence to the long setup.

3️⃣ Why I’m Buying:

Price reacting at value area low (volume profile)

Buyer aggression seen on recent candles

Seasonal tendency supports bullish direction during this time of year

Fibonacci projections give upside targets in line with previous wave structure

Bonus Insight – Gold:

Simultaneously watching Gold (XAU/USD) for a potential short, depending on how it behaves at resistance. If we get rejection signals, I may hedge or even rotate capital from metals into agri (Soybeans) as part of a short-term rotation play.

Please LIKE, FOLLOW, SHARE and COMMENT to support! Drop your chart ideas or setups below so we grow together.

Disclaimer: This is not financial advice. Do your own research and manage risk.