CHFJPY I Weekly CLS I Model 1 I Target 50% and Full CLS HighYo Market Warriors ⚔️

Fresh outlook drop — if you’ve been riding with me, you already know:

🎯My system is 100% mechanical. No emotions. No trend lines. No subjective guessing. Just precision, structure, and sniper entries.

🧠 What’s CLS?

It’s the real smart money. The invisible hand behind $7T/d

About Swiss Franc / Japanese Yen

The Swiss Franc vs. the Japanese Yen. After reaching its low in 2008 this pair has steadily traded higher mainly due to aggressive Japanese monetary easing. Also, due to low interest rates and different financial properties these currencies are considered to be safe haven and funding currencies.

Related currencies

CHFJPY BUY OPPORTUNITY Price is set to go bullish from the current price . We’re looking forward to buying from the currenT market price as a pullback in the H4 timeframe completes. Leaving a reversal candlestick pattern (bullish Engulfing) at the pullback support level. A buy opportunity is envisaged from the current mar

CHFJPY: Pullback From Resistance Confirmed?! 🇨🇭🇯🇵

CHFJPY may retrace from a key daily horizontal resistance.

A breakout of a support line of a consolidation range

on that on an hourly time frame provides a strong intraday confirmation.

Goal - 182.42

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer pr

CHFJPY: Bearish Continuation is Expected! Here is Why

The price of CHFJPY will most likely collapse soon enough, due to the supply beginning to exceed demand which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤

CHF_JPY RISKY LONG|

✅CHF_JPY has retested a key support level of 182.800

And as the pair is already making a bullish rebound

A move up to retest the supply level above at 183.700 is likely

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and r

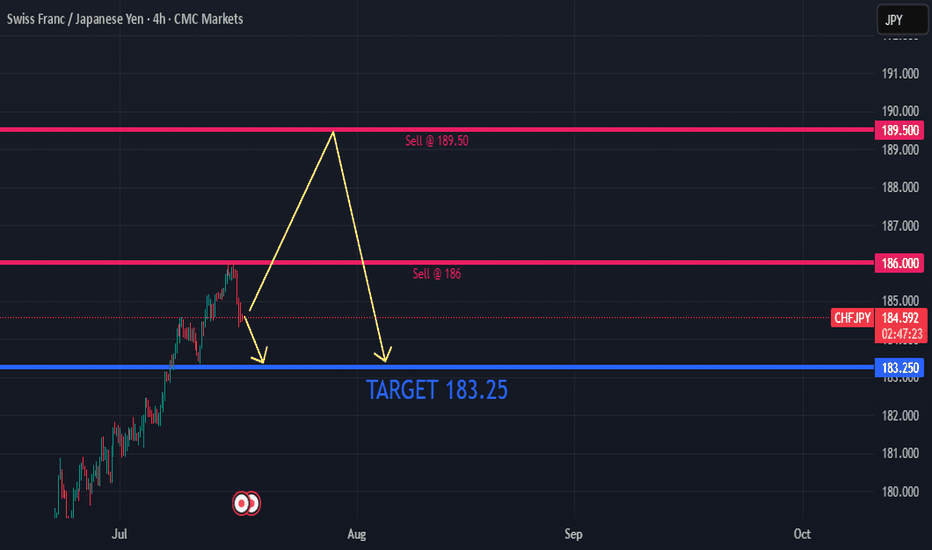

CHF/JPY Finally Broke Sideway Area , Breakout Confirmed ?Here is my 4H Chart on CHF/JPY , As we see we have a clear breakout after this long time in sideway after this huge movement to upside without any correction , so the price will go down for sometime in the next few days maybe weeks , we are looking for short setups only now , and we have a very good

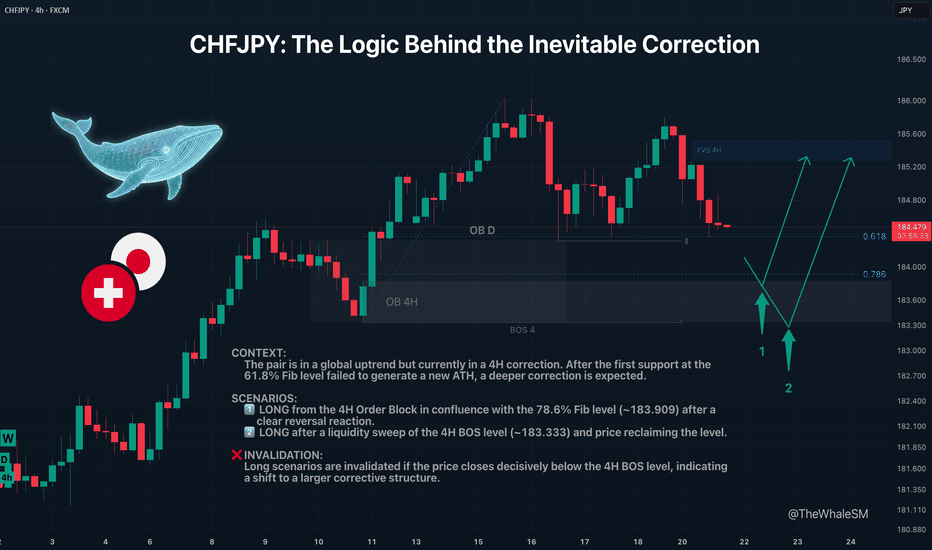

CHFJPY: The Logic Behind the Inevitable CorrectionCHFJPY recently bounced from what seemed like a perfect support level. Many likely saw this as a buy signal. But when the price failed to make a new high, it sent a clear warning: the correction isn't over yet.

This analysis dives into why that first bounce was a trap and where the next institu

CHF/JPY SELLERS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

We are going short on the CHF/JPY with the target of 181.383 level, because the pair is overbought and will soon hit the resistance line above. We deduced the overbought condition from the price being near to the upper BB band. However, we should use low risk here because the 1W

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of CHFJPY is 182.550 JPY — it has decreased by −0.03% in the past 24 hours. See more of CHFJPY rate dynamics on the detailed chart.

The value of the CHFJPY pair is quoted as 1 CHF per x JPY. For example, if the pair is trading at 1.50, it means it takes 1.5 JPY to buy 1 CHF.

The term volatility describes the risk related to the changes in an asset's value. CHFJPY has the volatility rating of 0.25%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The CHFJPY showed a −0.48% fall over the past week, the month change is a −0.26% fall, and over the last year it has increased by 7.34%. Track live rate changes on the CHFJPY chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

CHFJPY is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade CHFJPY right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with CHFJPY technical analysis. The technical rating for the pair is buy today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the CHFJPY shows the buy signal, and 1 month rating is buy. See more of CHFJPY technicals for a more comprehensive analysis.