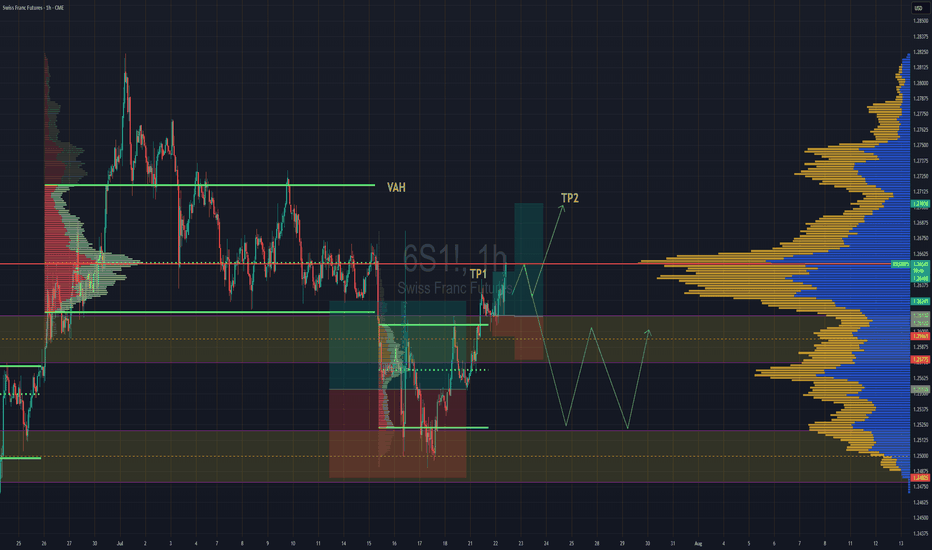

Swiss Gaining Momentum Against The DollarSwiss futures gaining strength against the dollar. We have broken back into previous rotation that was somewhat balanced, but still leaning towards a "b" style volume profile . If we are able to get above the POC, then we''ll go straight for TP2 close to Value are high.

If the POC is really strong and we reject hard from the POC then we might lose the value area and fall back down to previous value area to continue consolidation there until further notice.

6SH2021 trade ideas

Awaiting Breakout **Martingale Friendly**6S (Swiss Franc Futures) on the 1H chart is coiling within a tight range following a multi-day consolidation. Price action shows signs of compression near the mid-range, potentially gearing up for expansion. The current setup features a bullish R:R of ~1.8, with the entry positioned near support and a clearly defined stop. The trade aims to capitalize on volatility release above 1.2220 or failure below 1.2130.

This is a classic volatility breakout play, framed within a mean-reversion environment. Confirmation from macro catalysts or volume delta would strengthen conviction.

Swiss Shield: Buy the DipThe tariff agreement that seemingly fell from the Geneva sky earlier this month convinced investors to pivot toward risk-linked assets, allowing the Swiss currency to retreat temporarily. However, the Franc’s safe-haven status, combined with the fragile balance currently settling over the markets, leads us to view this pullback as a tactical opportunity to buy at attractive levels.

Fundamental Analysis

While there are indeed factors that could support a continued weakening of the Franc, such as the interest rate differential between the U.S. and Switzerland, which might spark carry trade flows in favor of the dollar, experienced investors know better than to rely solely on interest rates to navigate the complexities of currency markets. Beneath the surface lies a dense web of competing incentives and mechanisms.

True, the Swiss National Bank (SNB) has repeatedly warned of a possible return to negative rates since the beginning of the year, and is due to announce its next policy decision on June 19. The market currently expects a 25-basis-point rate cut, from 0.25% to 0%, prompted by persistently weak inflation data.

And yet, the Swiss Franc has gained nearly 8% in 2025, proof that the erratic trade stance of the White House and the unpredictable temperament of its new occupant are outweighing rate differentials and continuing to boost safe-haven demand, with the Franc at the top of the list.

Despite this week’s much-publicized announcements, which so far apply only for 90 days, the medium-term outlook remains highly unstable. Trying to guess the next provocation from the U.S. president is anyone’s game. Of course, interpreting market price action is never straightforward, but that task becomes even murkier when populism takes root at the highest levels of decision-making.

It’s also worth remembering that U.S. tariffs remain historically high despite the recent agreement with China. According to Yale’s research lab, and based on some fairly sophisticated modeling, the effective U.S. tariff rate is still at its highest level since 1934.

In this environment, the Swiss Franc seems well-positioned to retain favor among currency traders as part of a classic fly-to-quality move in times of uncertainty.

The main risk here lies in the SNB's willingness, or lack thereof, to actively weigh on the Franc in an attempt to revive sluggish inflation. But for now, it's far from clear that the central bank is prepared to return to such controversial tactics, especially given its past accusations of exchange rate manipulation.

Technical Analysis

From a technical standpoint, the Franc’s recent retreat has opened up a compelling buying opportunity. Earlier this week, prices dropped to around 1.1850, precisely filling a low-volume area that hadn’t been revisited since April 10.

Upon hitting this support, algorithmic strategies that specialize in gap-filling stepped in aggressively, with rising volume confirming the reaction. The rebound could continue, especially with reported corporate interest accumulating in the 1.1950–1.1980 zone, according to various trading chat channels.

The next significant resistance stands around 1.2250, a level that has repeatedly capped upward moves since April 23.

Sentiment Analysis

Starting with the CFTC Commitment of Traders (COT) report, asset managers have remained net short on the Franc for several years. However, this positioning is typically driven by hedging needs, such as covering equity portfolios, rather than directional conviction. As historical data shows, these short exposures rarely prevent the Swiss currency from rallying.

On the retail side, aggregated data from various FX/CFD brokers shows that individual traders, whose positioning is often used as a contrarian indicator, remain heavily long USD/CHF, and therefore short the Franc. In some cases, this proportion exceeds 90%. Such crowding could provide fuel for a short squeeze if the market turns.

Finally, the VIX has drifted back below the psychological 20 mark following recent developments, after previously surging above 50 last month, levels not seen since the pandemic. This presents a paradox: on one hand, volatility appears to be easing, but on the other, the broader situation remains unstable, with markets hanging on every word from Donald Trump.

Trade Idea

In summary, the fundamental, technical, and sentiment-based analyses all suggest that the recent dip to 1.1850 was more likely an emotional overreaction to headlines than the beginning of a structural downtrend. Despite some headwinds, notably the SNB’s close attention to the exchange rate, the Franc’s safe-haven appeal continues to outweigh other catalysts in a market where volatility remains fragile and unstable.

Entry: Long Swiss Franc futures (6SM5) at current levels

Stop: Daily close below 1.1850, which would invalidate the key support based on volume profile structure

Target: 1.2250, a resistance level that has already been tested multiple times since late April, offering a solid risk/reward setup.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: tradingview.com/cme/.

This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Dollar Decline Against All Major CurrenciesThe Dollar’s decline didn’t start with the recent ‘Liberation Day’ tariffs. In fact, it has been gradually weakening since the 1970s.

More recently, however, the Dollar has lost value against many currencies since January. Why is that?

Why have the USD/CHF and USD/SGD strengthened against the US Dollar over the past few decades? One reason is that both countries have managed their money supply with discipline. For example, as of end-2024, Switzerland’s net federal debt stood at 141 billion Swiss franc, their debt to GDP ratio at 17.2%.

In contrast, the United States has expanded its national debt at an alarming rate. Some might point out that Japan’s debt-to-GDP ratio is even higher—around 230%. That is why the Japanese Yen has also been in decline for decades.

Why does printing more money through QE and increasing the money supply weaken a currency?

Just imagine in a close economy with 10 people and 1 central bank. If the central bank printed $100 and distributed equally to the 10, each of them will receive $10 to buy 10 available cheesecakes.

But now the central bank decided to print $1,000 and each person will have $100 to buy 10 available cheesecakes.

The global economy is not a close, but an open system.

When the US and other major economies printed massive amounts of money, they didn’t just inflate their own economies—they exported inflation worldwide. This contributes to rising cost of living not all around the world.

In my view, Gold is also a currency pair against the US at the start of 1971. The moment dollar unpeg itself from gold, gold appreciates. With each QE, we can see how the currencies have diluted with gold and inflation appreciating over these years.

Why different currencies have started to appreciate against the USD since January this year?

We can see all the currencies have either reached its bottomed in January and started moving higher or it formed a reversal pattern like the Aussie dollar and the Dollar Yuan, in this case with this inverted hammer, it is indicating Dollar Yuan to reverse downward, meaning dollar coming off and yuan to appreciate.

January was President Trump inauguration and February was when he rolled out tariffs against Canada, Mexico and China, and the market do not like that and has been selling the USD against the rest of the currencies?

If US has printed the so much money, but why other than Swiss franc and Singapore Dollar, many other currencies have been depreciating against dollars over the past decades?

I’d like to hear your thoughts on this.

Euro FX Futures & Options

Ticker: 6E

Minimum fluctuation:

0.000050 per Euro increment = $6.25

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Trading the Micro: www.cmegroup.com

Swiss Franc Futures ShortAfter the recent market volatility caused by tariffs, the Swiss Franc skyrocketed and forced retail shorts to cover. Now those same retail traders have opened long positions at a similar rate. If the market begins to reverse these late retail longs will be forced to close. Therefore, a short position in the Swiss Franc is currently an asymmetric trading opportunity.

Why Has the USD Been Falling?Dollar has lost value against many currencies since January. Why is that?

The Dollar’s decline didn’t start with the recent ‘Liberation Day’ tariffs. In fact, it has been gradually weakening since the 1970s.

U.S. Treasury Futures & Options

Ticker: 6E

Minimum fluctuation:

0.000050 per Euro increment = $6.25

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Trading the Micro: www.cmegroup.com

CHF Supply Demand Trade SetupSee picture for analysis.

-DXY had long-term weak fundamentals + Technicals which will be bullish for CHF and other currencies.

-Price broke downward trend line

-Price removed opposing pivto supply zones structure

-Demand created

Options:

1) possible buy back into 1hr demand

2) Wait for price to reutn the wait for lower-timeframe confirmation buy setups.

Support for CADCHF A **quiet day for our CADCHF**—no major moves so far.

I only notice a **slightly weaker tone on CHF**, or more precisely, those **three wicks on the future** suggest a **price rejection**.

Also, at the moment, the **volume delta is in favor of CAD**.

If no other data changes the picture, I’d expect **confirmed support around 0.586** for CADCHF, with a potential **break above the H1 EMA50** later this afternoon.

Swiss Franc LongRetail traders are currently in a crowded short position with price beginning to reverse. We aim to capture the losses of retail traders in a short squeeze. Additionally, a Swiss Franc long position could work in both a risk-on and risk-off environment given its long standing reputation as a safe haven currency.

Swiss Franc Futures Decline Amid Weaker US Dollar:Market InsightThe CHF Swiss Franc futures pair experienced a decline to approximately 1.308 during the early European trading session on Monday. This weakening can be primarily attributed to the broad softness of the US Dollar (USD), which has been under pressure lately. After an initial reversal at the pivotal level of 108.000, the US Dollar Index (DXY) managed to recover some ground, indicating a volatile session ahead for currency traders.

Today's market attention is squarely focused on a series of significant economic events that could influence currency valuations. Notably, European Central Bank (ECB) President Christine Lagarde is scheduled to deliver a speech that many analysts anticipate will provide insights into the central bank's future policy direction. Given the current economic climate in Europe, her comments are likely to be closely scrutinized by market participants looking for hints on interest rate adjustments and other monetary policy considerations.

Additionally, the release of the US ISM Manufacturing Purchasing Managers' Index (PMI) later today is another critical data point that traders are monitoring. The PMI serves as a vital barometer for the health of the manufacturing sector, and its results can significantly sway market sentiment. A stronger-than-expected PMI reading could lend support to the USD, particularly in light of the Federal Reserve's cautious stance in recent months. A resilient manufacturing sector may fuel speculation about potential interest rate hikes, thus supporting the US dollar.

As the market digests these developments, a bearish sentiment appears to be forming for the CHF futures pair. The combination of a weaker Swiss Franc and the possibility of a stable or strengthening US Dollar suggests that traders may be looking to position themselves for a further decline in the CHF/USD relationship. In the current environment of uncertainty and varied economic signals, currency traders must remain vigilant, ready to adapt to rapid changes that could arise from today's pivotal events.

In summary, the interplay between the Swiss Franc and the US Dollar is accentuated by current macroeconomic factors, including central bank communications and key economic releases. With a bearish setup on the horizon and investors keenly anticipating these market-moving events, today's trading session promises to be both challenging and potentially rewarding for those engaged in forex trading.

✅ Please share your thoughts about CHF Futures in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

Weekly FOREX Forecast: BUY USD vs EUR GBP AUD NZD CAD CHf JPYThis is an outlook for the week of Nov 11-15th.

In this video, we will analyze the following FX markets: EUR, GBP, AUD, NZD, CAD, CHF and JPY.

The USD is strong and showing no signs of weakness. But price is at the highs, so there is potential for a pullback to start at any time.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

WEEKLY FOREX FORECAST July 8-12th: FX PAIRS UPDATES!We are updating the Weekly Forecasts for FX Pairs I posted last Saturday.

Click the link below to check out the video in case you missed it.

Was the analysis accurate? Did we reach our targets?

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

WEEKLY FOREX FORECAST June 8-12th Part 2: FX PairsThis is Part 2 of the Weekly Forex Forecast.

In this video, we will cover:

USD Index, EUR, GBP, CAD, AUD, NZD, CHF, JPY

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

WEEKLY FOREX FORECAST: UPDATES! DXY, EUR, GBP....Welcome to another Weekly Forex Forecast Update video.

In this video, we will cover the forecasts given in the Weekly Forecast, and allow you to

gauge the accuracy of the analysis.

USD Index, EUR, GBP, AUD, CAD, NZD, CHF

Like and subscribe if you like the video. Thank you!

May profits be upon you.

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

WEEKLY FOREX FORECAST: DXY, EUR, GBP, CAD, AUD, NZD, CHFWelcome to another Weekly Forex Forecast.

In this video, we will cover:

USD Index

EUR

GBP

AUD

CAD

NZD

CHF

Like and subscribe if you like the video. Thank you!

May profits be upon you.

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Swiss Franc Long IdeaA potential Long opportunity in Swiss Franc. The "Swissie" has tended to make a seasonal bottom in May and is currently bouncing of support (demand) on the weekly chart.

The 4H chart then appears to show a potential accumulation schematic. The breakout above the range aligns with our bullish, seasonal bias as mentioned above. We are monitoring to initiate a long position if price pulls back into the range below 1.106. This would be a test of the schematic. If price trades below the Spring at 1.090, the idea is invalidated.

CHF - Futures - 14/5/20241. CHF - Swiss Franc

COT Report: 58,283 net positions as of 04/30/24 - Yearly high

Fundamentals:

Swiss Central Bank Rates: 1.50%

Positive CPI Report for CHF (Forecast 0.1%, Actual 0.3%)

Negative USD Non-Farm Employment Change (Forecast 238k, Actual 175k)

Summary:

Recent downtrend following the Swiss Bank's interest rate reduction from 1.75% to 1.50%.

Signs of potential CHF strengthening post Non-Farm Payroll week.

Previous is the as the same trade but this is an update, We have entered long after last nights Core PPI news

CHF (Swiss Franc Futures, CHFUSD)... BULLISH!The Monthly +FVG was filled, then the CISD was formed.

Price traded through the BB, forming the +FVG on the way.

I am expecting the BB+FVG to hold, and price to move higher from here next week.

Like and Subscribe if you'r picking up what I'm putting down.

Thank you for viewing.

CHF - Futures - 6/5/20241. CHF - Swiss Franc

COT Report: 58,283 net positions as of 04/30/24 - Yearly high

Fundamentals:

Swiss Central Bank Rates: 1.50%

Positive CPI Report for CHF (Forecast 0.1%, Actual 0.3%)

Negative USD Non-Farm Employment Change (Forecast 238k, Actual 175k)

Summary:

Recent downtrend following the Swiss Bank's interest rate reduction from 1.75% to 1.50%.

Signs of potential CHF strengthening post Non-Farm Payroll week.