Related commodities

4/8/25 Can Bears Create FT Selling or Not?

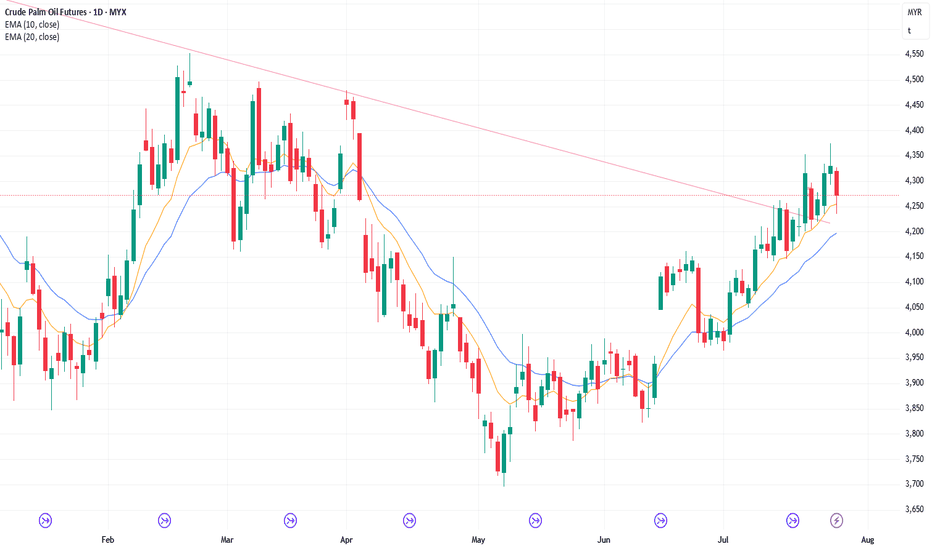

Friday’s candlestick (Aug 1) was a bull bar closing bear its high with a long tail below.

In our last report, we said traders would see if the bears could create a strong follow-through bear bar closing near its low, or if the market would trade lower, but close with a long tail below or a bull

5/8/25 Can Bulls Get A Bull Bar Above 20-Day EMA?

Monday’s candlestick (Aug 4) was a bull doji closing around the middle of its range with prominent tails.

In our last report, we said the market may gap down at the open. Traders would see if the bears could create follow-through selling, closing the day near its low, or if the market would lac

28/7/25 Minor Pullback or Something Stronger?

Friday’s candlestick (Jul 25) was a bear bar closing slightly below the middle of its range with a long tail below.

In our last report, we stated that traders would assess whether the bulls could generate follow-through buying or if the bears would create a strong pullback, which would close th

8/8/25 Bulls Need Follow-through Buying

Thursday’s candlestick (Aug 6) was a bear bar closing in its lower half with prominent tails above and below.

In our last report, we stated that traders would determine whether the current pullback would remain sideways and overlap with Wednesday's range or if the bears would be able to create

7/8/25 Weak Sideways PB or Retest 20-Day EMA?

Wednesday’s candlestick (Aug 5) was a bear doji closing in its upper half with a long tail below.

In our last report, we said traders would see if the bulls could create follow-through buying, even if it is just a bull doji, or if the market would reverse down sharply below the 20-day EMA inste

6/8/25 Follow-through Buying or Reverse Down?

Tuesday’s candlestick (Aug 5) was a big bull bar closing near its high and far above the 20-day EMA.

In our last report, we said traders would see if the bulls could create a strong bull bar closing above the 20-day EMA, or if the market would trade higher but close with a long tail above and b

FCPO should reverse as it reached 2.618

### **1. Overall Market Context**

* Current price: **4,285 MYR**

* Recent high: **4,286 MYR**

* Market shows a **sharp rebound** after a 5-wave downward Elliott sequence.

* Current trend: **Short-term bullish reversal** after completing a possible Elliott Wave 5 down.

---

### **2. Elliott Wave

1/8/25 Will Weekly Candlestick Close Near Low or Long Tail Below

Thursday’s candlestick (Jul 31) was a bear bar closing near its low.

In our last report, we said traders would see if the bears could create a strong retest of the July 29 low, or if the market would trade slightly lower, but find support around the 20-day EMA instead.

The market traded lower

31/7/25 Still Sideways to Down Pullback Phase

Wednesday’s candlestick (Jul 30) was a small bull bar with a prominent tail above.

In our last report, we said traders would see if the bulls could create a retest of the July 24 high and a breakout above, or if the market would trade slightly higher but stall around or below the July 24 high,

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of USD Malaysian Crude Palm Oil Calendar Futures (Dec 2026) is 998.00 USD — it has fallen −0.25% in the past 24 hours. Watch USD Malaysian Crude Palm Oil Calendar Futures (Dec 2026) price in more detail on the chart.

Track more important stats on the USD Malaysian Crude Palm Oil Calendar Futures (Dec 2026) chart.

The nearest expiration date for USD Malaysian Crude Palm Oil Calendar Futures (Dec 2026) is Dec 31, 2026.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell USD Malaysian Crude Palm Oil Calendar Futures (Dec 2026) before Dec 31, 2026.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for USD Malaysian Crude Palm Oil Calendar Futures (Dec 2026). Today its technical rating is buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of USD Malaysian Crude Palm Oil Calendar Futures (Dec 2026) technicals for a more comprehensive analysis.