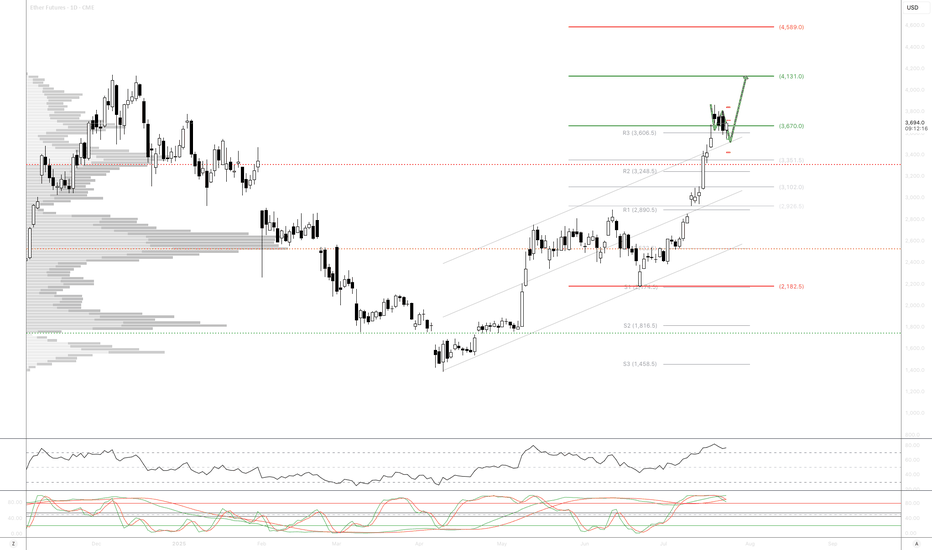

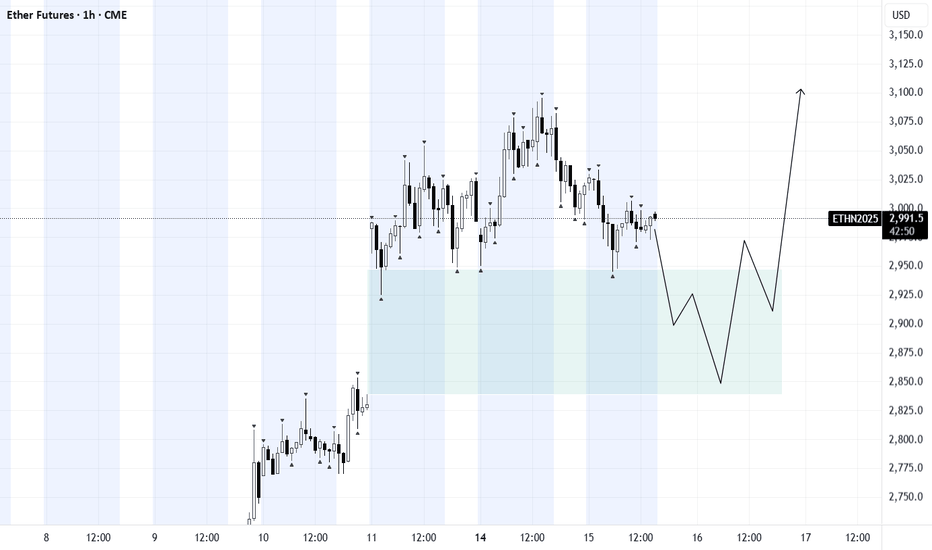

ETH/USD Breaking Higher, Can Fill The Gap? Hey traders,

Some of the altcoins are recovering very nicely today, with Ethereum being no exception. In fact, we’ve seen a pretty nice consolidation on ETH over the last three weeks, and it looks like it’s breaking to the upside right now. I wouldn’t be surprised to see more gains unfolding into

Related futures

Quantum Solutions BTC Rises Amid Yen Weakness Strategic BITDPSAs Japan’s yen continues to slide against the U.S. dollar, Quantum Solutions, a Japanese technology firm, is doubling down on Bitcoin exposure — a move that reflects a broader trend among Asian firms seeking digital assets as a hedge. For companies like BITDPS, these market shifts present a unique o

MEV Bot Exploit by MIT-Educated Brothers Leads to $25M CryptoIn the dynamic world of crypto trading, where cutting-edge innovation meets finance, abuses are inevitable. One of the most prominent cases of the year involves brothers Anton and James Peraire-Bueno, MIT graduates accused of exploiting Maximal Extractable Value (MEV) strategies to siphon off $25 mi

Pi Network Faces Scrutiny as Market Cap Hits $3.4BPi Network, the mobile-first crypto project that attracted millions of users with its "mine-on-your-phone" concept, is facing growing scrutiny as its market capitalization has surged to $3.4 billion, despite lingering concerns over its actual utility and use cases. As hype continues to propel its va

ETH Risk 15% Correction After Fall Below $2,000 What’s Next?Ethereum (ETH), the second-largest cryptocurrency by market cap, has recently fallen below the key $2,000 support level, both technically and psychologically important. This move has fueled bearish sentiment and triggered forecasts of a possible further decline to the $1,700 zone—representing a pote

XRP Whales Move $759 Million in Tokens Paribas Group AnalysisAn extraordinary on-chain event has captured traders' attention: wallets holding significant XRP balances—commonly referred to as “whales”—have transferred a total of $759 million worth of XRP in recent blocks. Paribas Group investigates the motives, potential market impact, and strategic context be

Building a Future for RWAs and Multichain DeFi: A Strategic OutlThe intersection of real-world assets (RWAs) and decentralized finance (DeFi) has become one of the most transformative trends in the blockchain space. As traditional financial institutions explore blockchain integration, and DeFi continues to mature, tokenized RWAs—like real estate, bonds, and comm

Aave proposal tolaunch centralized lending on Kraken’s Ink movesAave’s community overwhelmingly approved a proposal to license a centralized version of its lending protocol for deployment on Kraken’s Ink blockchain.

A proposal for the decentralized finance (DeFi) lending protocol Aave to launch a centralized version of its service on the crypto exchange Kraken’s

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of Ether Futures (Mar 2026) is 3,840.5 USD — it has fallen −2.74% in the past 24 hours. Watch Ether Futures (Mar 2026) price in more detail on the chart.

Track more important stats on the Ether Futures (Mar 2026) chart.

The nearest expiration date for Ether Futures (Mar 2026) is Mar 27, 2026.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Ether Futures (Mar 2026) before Mar 27, 2026.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Ether Futures (Mar 2026) this number is 72.00. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Ether Futures (Mar 2026) shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Ether Futures (Mar 2026). Today its technical rating is buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Ether Futures (Mar 2026) technicals for a more comprehensive analysis.