ES Futures — Week Ahead Playbook (Aug 11–15)Macro Drivers to Watch

Tue Aug 12 @ 8:30 AM ET — CPI (July)

Key inflation print; expect sharp vol expansion in NY AM.

Wed Aug 13 @ 2:00 PM ET — FOMC Minutes

Insight into Fed’s July 29–30 meeting tone.

Fri Aug 15 @ 8:30 AM ET — PPI (July) + Retail Sales (July)

Two high-impact releases within minute

Related futures

ES - August 13th - Daily Trade PlanWe built an overnight base between 6462 and 6475. We broke out of this and have grinded higher into the 6484 target we have been looking for this week. PPI coming out this am and we could keep grinding higher or Ideally we get a loss of 6462 and reclaim to setup a nice opportunity for 10+ points and

Nasdaq’s All Time HighsLiquidity moves liquidity.

Expansion, Retracement, Reversal, Consolidation

Market is doing 1 of these 4

Expansion is determined by where liquidity sits and where it is going. Price delivery is upmost important when receiving bias and narrative

Seeing where price is coming from is just as importan

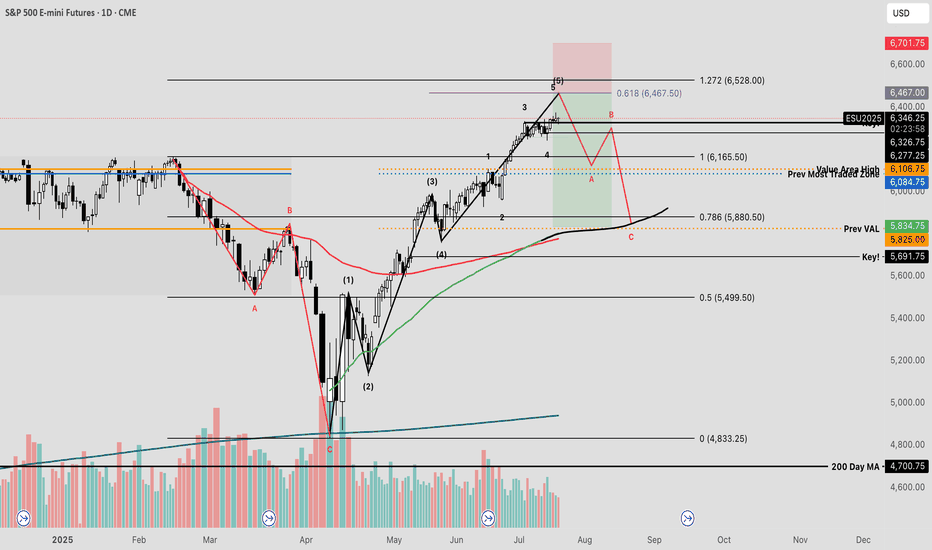

SPY The Final Countdown Since the April lows, equity markets have exhibited strong performance, with many stocks appreciating by nearly 100%—some even exceeding that threshold. Given the velocity of this rally, a corrective pullback may be imminent before the broader uptrend resumes.

The current reading on the Fear & Gree

ES Fails to Break ATH – Possible Reversal Ahead?

The S&P 500 futures (ES) made another attempt at the all-time high but failed to push through. This rejection at resistance could signal potential exhaustion from buyers.

Key points I’m watching:

Strong rejection at ATH zone.

Momentum slowing on shorter timeframes.

Increased selling pressure

Day 3 — Trading Only S&P 500 FuturesDay 3 — Trading Only S&P Futures

Daily P/L: -142.87

Sleep: 7 hours

Emotions: Headache & stress from the morning

:thought_balloon: Today’s Trade thoughts:

I made a typo when i was putting some orders in from last night that triggered and started the day -300 so I spent most of today just grinding i

Day 7 Trading Only S&P Futures — Trusting Structure Over GreedWelcome to Day 7 of Trading Only S&P Futures!

Today was a mixed day with a small loss of -$16.65. I started strong, up $133 early on, but after a big push up, I expected the market structure to flip bearish and missed a key long entry. Later, I shorted the 6451 resistance but let greed get the best

Day 2 — Trading Only S&P Futures — -$100, Grinding Back from Los Day 2 — Trading Only S&P Futures

Daily P/L: -100

Sleep: 8 hours

Emotions: Good

:thought_balloon: Today’s Trade thoughts:

I rushed into a trade thinking 6330 was going to be a good area of support to buy and oversized my position going 5 mes deep in my first trade and adding 5 more at the 48 min M

Corrective Dip or New Downtrend on the S&P 500 Futures?🟣 1. Impulses vs. Corrections – The Classical View

When price trends, it doesn't move in a straight line. Instead, it alternates between directional movements called impulses and counter-directional pauses or retracements known as corrections. Most analysts define an impulse as a sharp, dominant m

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The nearest expiration date for E-mini S&P 500 Futures (Mar 2024) is Mar 15, 2024.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell E-mini S&P 500 Futures (Mar 2024) before Mar 15, 2024.