Related futures

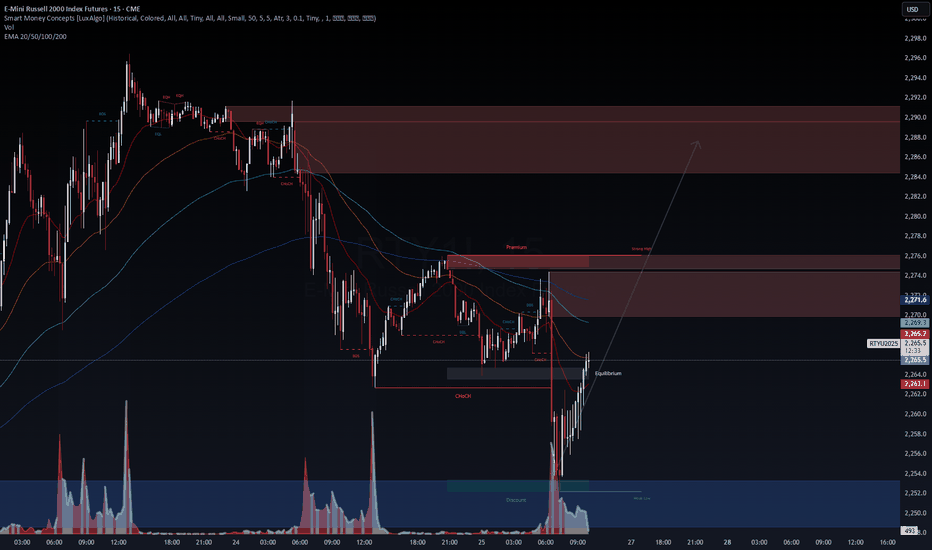

RUT vs IWM – VolanX Sees the Same PulseThe Russell 2000 (RUT) is echoing IWM’s footprint with precision. Both charts are cycling through a similar Smart Money Concepts (SMC) structure – BOS, CHoCH, and strong liquidity grabs.

VolanX reads this as accumulation in the discount zone, preparing for a premium drive toward 2,288+.

Equilibrium

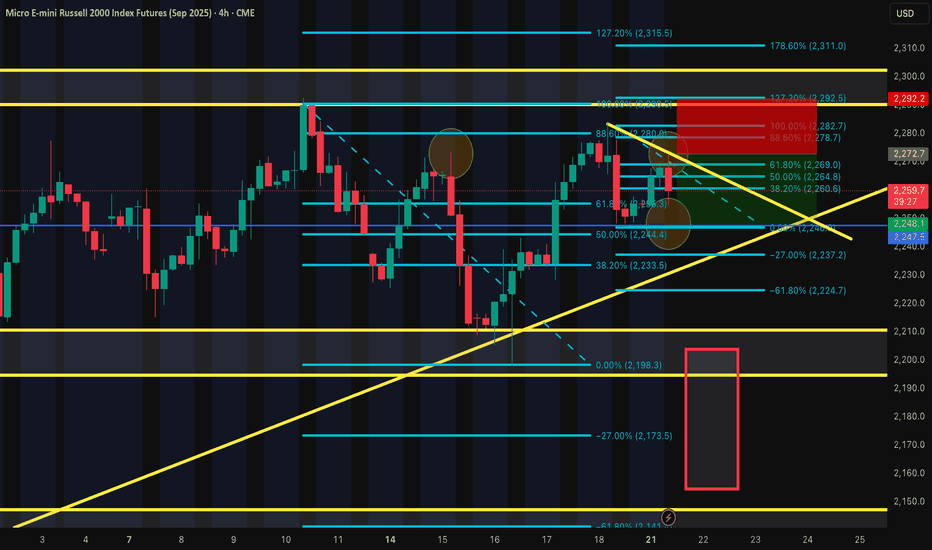

RTY : Key levelsHere are the key levels that the market will be interested in. From ~2.206 you can take scalping longs. Also interesting longing levels are forming now. I will let you know when they are formed and when they will be in play.

⚠️ VOLATILITY WARNING ⚠️

Trading around major news can be extremely unp

RTY & YM DOWNMVP SYSTEM

MOMENTUM- The RSI broke below the uptrend line

VOLUME- large volume bearish candle

PRICE - multi top, rounded

ES & NQ also have bearish engulfing candles but the rsi has not broken the uptrend channel. When that occurs, all of the MVP rules will be met for a down position.

So peopl

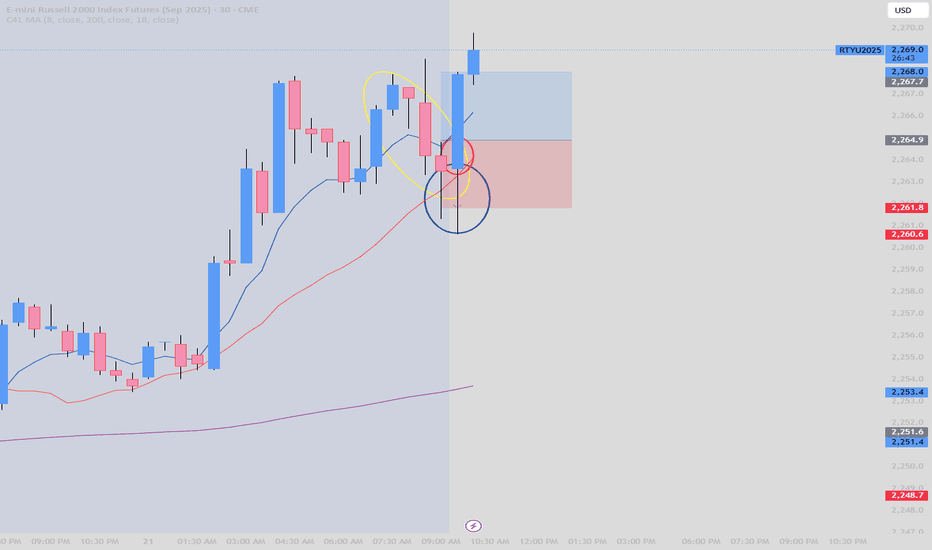

07/21 Trade for RussellPatience is key.

1. Variation (Yellow): Wait for the downside to end and the wick to confirm the rejection to the downside and buy when its on the way up.

2.Wick(Blue): I had to adjust the time frames for confirmation so I used 15min and 30min to adjust my entry.

3.Volume: I had the strengt

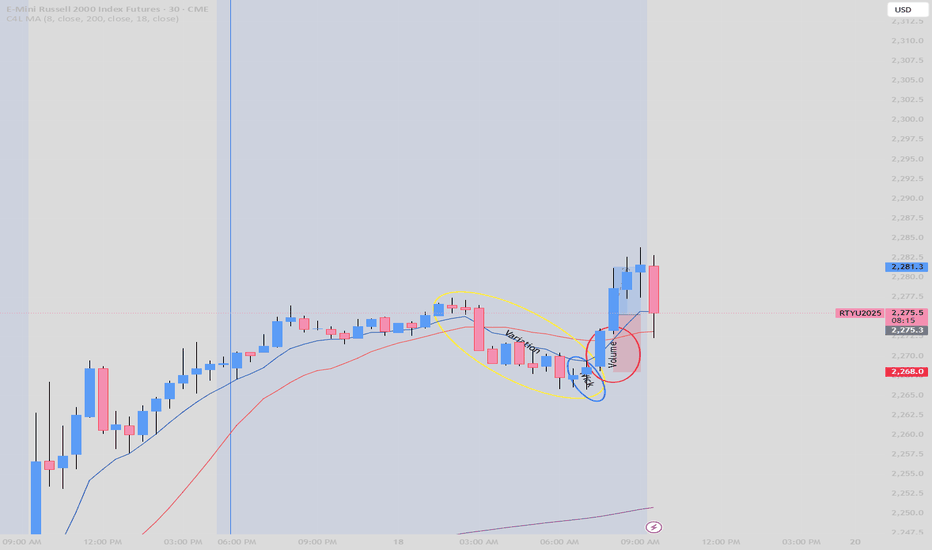

07/18 Trade Russel1. Variation: As we can see over and over again the bears(sellers) were losing momentum so I had to wait for their downfall.

Variation in this strategy in simple words is basically when you see a mix of bearish and bullish candles but on a downtrend. The whole point of the strategy is to buy when

07/10 Trade with RTYUThe strategy is simple.

1. Variation: We need to wait for variation to the down side (bearish trend losing strength). As soon as I saw that the momentum with the Bears ( selling action) was coming to an end I waited for the second step in the strategy which is.....

2. Rejection Wick We need to

RUSSELL 2000 STILL IN BUY ZONE!Hey Traders so here we can see that it's building support levels and holding. So imo this is a bullish sign if Nasdaq 100 continues to rise I think it should push Russell higher as Nasdaq normally leads the market.

So if you are bullish make sure you put your stop below a good support level.

If be

28% Profits Possible for Small CapsIt appears that small caps (and major large-cap stocks) are at a crucial point currently. The price breaking out of the bump-and-run pattern to the upside, combined with a neutral Fear and Greed Index, suggests a potential continuation of the bull run. The target is approximately $2,750, regardless

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of E-mini Russell 2000 Index Futures (Sep 2025) is 2,173.1 USD — it has fallen −1.96% in the past 24 hours. Watch E-mini Russell 2000 Index Futures (Sep 2025) price in more detail on the chart.

The volume of E-mini Russell 2000 Index Futures (Sep 2025) is 340.94 K. Track more important stats on the E-mini Russell 2000 Index Futures (Sep 2025) chart.

The nearest expiration date for E-mini Russell 2000 Index Futures (Sep 2025) is Sep 19, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell E-mini Russell 2000 Index Futures (Sep 2025) before Sep 19, 2025.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For E-mini Russell 2000 Index Futures (Sep 2025) this number is 422.44 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for E-mini Russell 2000 Index Futures (Sep 2025) shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for E-mini Russell 2000 Index Futures (Sep 2025). Today its technical rating is sell, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of E-mini Russell 2000 Index Futures (Sep 2025) technicals for a more comprehensive analysis.