Contract highlights

Related commodities

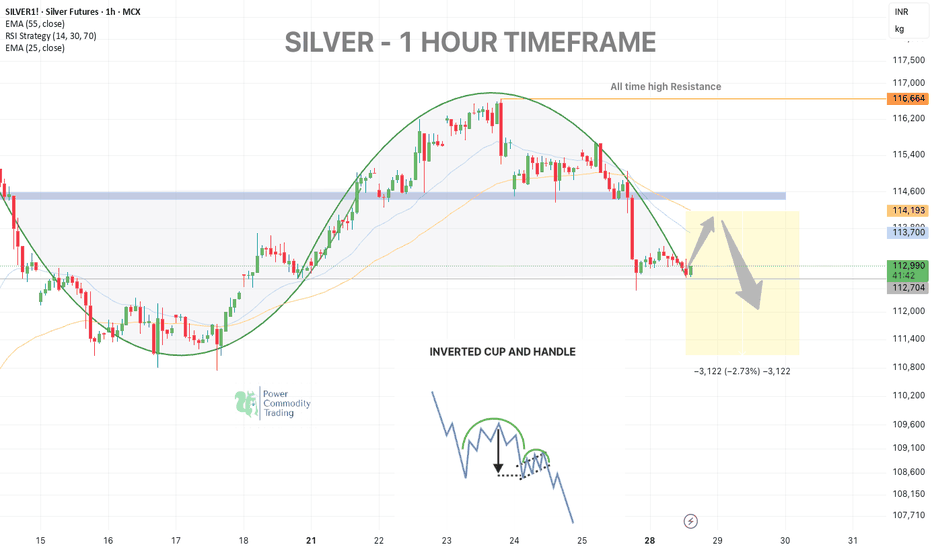

SILVER WEEKLY UPDATE - Dead Cat Bounce Setup📉 SILVER – 1H TIMEFRAME - Inverted cup and handle pattern

Silver tested support around 112,800–113,000 after a rounded top formation, rejecting the key EMA zones (25 & 55) and the previous demand-turned-supply zone.

🟠 Scenario Unfolding:

Expecting a short-term bounce towards 113,750–114,200 (EMA c

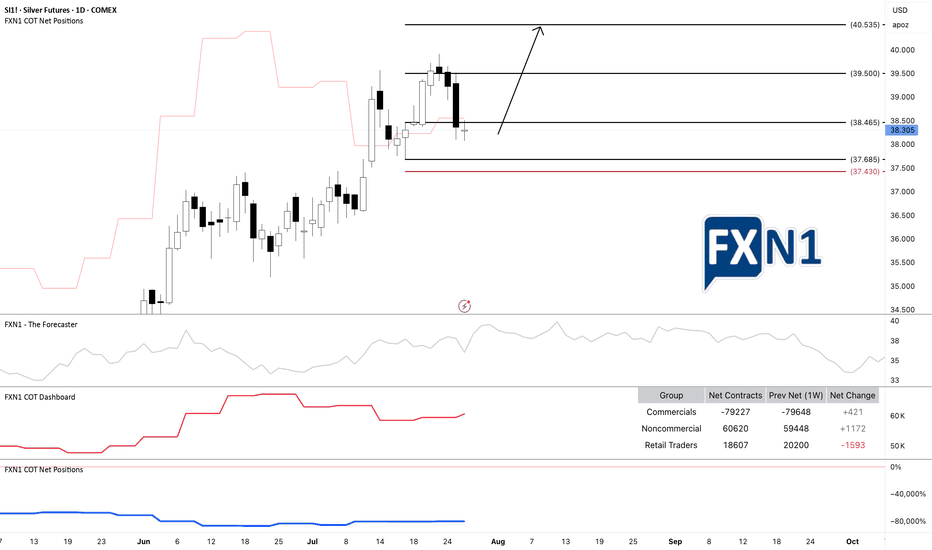

Silver Near $40: Deficits and Demand Fuel the RallySilver prices surged to multi-year highs in July 2025, driven by an extraordinary convergence of bullish factors, pushing prices above $39 per ounce, levels last seen in 2011.

Silver’s rally, supported by robust industrial demand and safe-haven inflows, aligns with traditional patterns as the U.S.

SI1!: Silver Demand Zone: Possible Bullish ContinuationI am currently observing a potential long-term continuation on SI1! Silver (XAG/USD), as the Commitment of Traders (COT) data indicates an increase in positions from both commercial and non-commercial traders. The price is approaching a demand zone on the daily chart, suggesting a possible bullish m

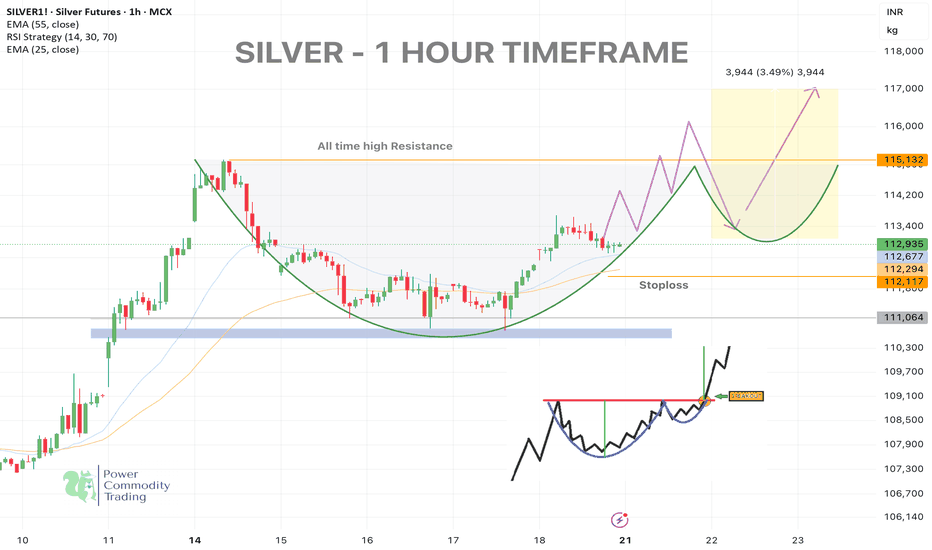

CUP & HANDLE + ROUNDED BOTTOM IN SILVERSilver (MCX: SILVER1!) – 1 Hour Chart Analysis

🔍 Pattern Formation: Cup and Handle + Rounded Bottom

Silver has formed a classic Cup and Handle pattern on the 1H timeframe, indicating a potential bullish breakout above the neckline near 115132 (all-time high resistance).

A smooth rounded bottom co

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The nearest expiration date for Silver Futures (Jun 2017) is Jun 28, 2017.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Silver Futures (Jun 2017) before Jun 28, 2017.