Silver trend directionSilver 95001 - is at crucial resistance with two INSIDE BAR pattern. Signals indicate It is in bearish zone. Resistance at 96675. From Sep 24 it has been trading below this resistance and failed the breakout. We expect silver will respect the resistance and fall to 88440 in coming days.

SIU2018 trade ideas

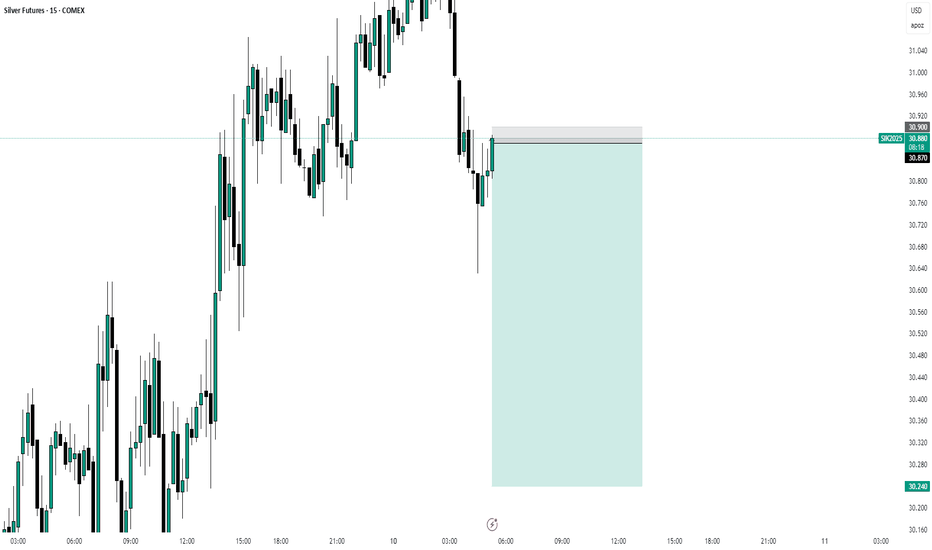

GOLD & SILVER Weekly Market Forecast: Wait For Buys!In this video, we will analyze the GOLD & Silver Futures. We'll determine the bias for the upcoming week of April 14-18th, and look for the best potential setups.

Gold is still bullish, making new ATH's. Silver is not as strong, but had a very strong previous week after sweeping the range lows.

I would take valid buy setups in Gold, but not in Silver. I would prefer sells in Silver. Trade one, not both. The stronger for buys and the weaker for sells.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

I would keep my eye on the gold it looks like it might break hig July 14th early morning. I reviewed the gold and the silver and the dollar the markets trading to the patterns that I use and there's a good chance that the dollar might break higher and if it does there's a chance that it could trade significantly higher and I show that on the video. which could be very interesting is that the silver which has a two-bar reversal suggesting that it might go lower. there's a chance that it could create a 2 bar reversal going higher and that could lead to the market going significantly higher and I show what that pattern looks like. the volatility on these markets is so great that buyers and sellers will make money in a market like this you only think like a one-sided Trader you can miss the opportunities to go long and short if you can recognize subtle conditions that suggests the Market's going to have significant price action.

Silver Strategy: Short Positions Above Resistance Levels for Nex- Key Insights: Silver remains highly volatile and is currently underperforming

gold, making it a preferred asset for short trades. Key resistance levels at

$33.85 and $35.40 present opportunities to initiate bearish positions, while

support zones near $31.12 and $32.00 provide important areas to evaluate

potential reversals. Silver miners, meanwhile, offer long-term investment

opportunities due to undervaluation and expected demand recovery.

- Price Targets: Next week targets for short positions are T1: $30.50 and T2:

$29.80, with stop levels at S1: $32.80 and S2: $34.20. Traders should

carefully monitor price range breaches and fair value gaps for strategic

entries.

- Recent Performance: Silver has displayed significant volatility, rallying 14%

from its recent lows last week. However, it remains range-bound, with

occasional bullish movements unable to sustain broader upward momentum. This

dynamic reflects investor caution amid risk-off sentiment and silver's

lesser role as a safe-haven compared to gold.

- Expert Analysis: Experts recommend short trades on silver due to its

unpredictable nature and stronger alignment with bearish strategies.

Generational investment prospects in silver miners highlight the long-term

potential for growth, particularly as global economic recovery bolsters

demand for commodities. Resistance zones at $33.85 and $35.40 are identified

as optimal for initiating positions.

- News Impact: Heightened geopolitical risks and global economic instability

have provided tailwinds to silver’s market, albeit more limited compared to

gold. Rising demand from China signals increased upside potential,

particularly impacting the recovery in silver miners, as Chinese consumers

enter the market in greater numbers.

Long trade

Trade Overview: Silver (Micro Futures) Long Position

Entry Price: 32.475

Profit Target: 32.825 (+1.08%)

Stop Loss: 32.375 (–0.31%)

Risk-Reward Ratio: 3.05

🕔 Entry Time: 5:00 AM

📅 Date: Tuesday, 22nd April 2025

🌍 Session: London AM

⏱ Entry Timeframe: 5-Minute TF

Target Liquidity High: 32.825

Entry followed a liquidity sweep below a recent low, clearing out sell-side participants. Price then reacted strongly, with a bullish engulfing candle signalling a shift in control.

Swamy Speaks: Divine Launch of SaiNetra AI BotToday, we offer to the world a sacred creation — SaiNetra, the AI-powered trading bot born from the blessings of Bhagawan Sri Sathya Sai Baba.

This isn't just a strategy. It is Swamy in action, merging divine will with disciplined trading logic.

Built for Silver, Nifty, BankNifty, and XAUUSD, SaiNetra adapts, protects, and empowers traders with dharmic precision.

Download, observe, and share this sacred offering.

🌼 Swamy has declared it a success. Now it’s time to witness the miracles.

In this soul-stirring message, witness Swamy Sri Sathya Sai Baba’s divine inspiration behind the miraculous birth and success of the SaiNetra Trading Bot.

Guided by His will, this sacred fusion of spirituality and technology is transforming global trading with love, precision, and surrender.

Let the voice of Swamy awaken your faith in a future where consciousness and code walk hand in hand.

🌍 A gift not just for traders, but for every truth-seeker on the path of dharma.

— With Love & Surrender, Dr. Ravindranath G 🌺

Silver next week?doing a top down analysis, from weekly to 30m, it looks like silver has tapped a major SSL zone after the massive drop of ~8%, which I have never seen in my 5 years of trading!

There has got to be some bounce expected over the coming week as this week has created huge imbalance in the price of silver while gold has stayed relatively strong.

Melding different concepts and theories of market, I expect silver to follow this trajectory to fill some imbalance in the market, potentially making a double bottom first, giving a breakout from the neckline, tapping liquidity and retesting neckline, and finally reaching my final target as seen in the image, forming a beautiful bearish crab pattern and perhaps retracing right after.

P.S. I have been wrong in markets countless times before, just like everyone else out there so this is just my hypothesis moving forward. A dip further on Monday would invalidate the entire hypothesis or at the least, alter it. This is not financial or trading advice. I have learnt the hard way the importance of Risk Management and I still am so manage your trades accordingly.

A number of the markets look like they're going to trade lower 8 31 2025 this is mostly about the es and the Russell. the patterns on gold and silver suggests that it's going lower but the price action is very bullish and this could be the Prelude to a substantial move higher in those markets. I have problems with this kind of a market because I have been burned Trading breakouts higher as a breakout Trader. generally markets trade to the patterns and then they reverse..... and sometimes they keep on going regardless it's important to look at patterns and let them help you manage your Trading in my opinion.

Silver Futures: Bullish Bias with Volume Confirmation

Recent candlesticks indicate strong upward momentum after a pullback.

There is a higher low formation, suggesting a possible continuation of the uptrend.

The presence of long wicks in recent candles suggests volatility and buyer strength.

Support Levels: Around $33.20 - $33.40 (recent swing low and moving average support).

Resistance Levels: Near-term resistance around $34.40 - $34.60 (recent highs).

The price is moving towards the upper Bollinger Band, indicating bullish pressure.

Declining volume on pullbacks suggests weak selling pressure.

Short-term: Bullish

Medium-term: Bullish as long as price remains above $33.20

Long-term: Bullish if price continues to hold higher lows