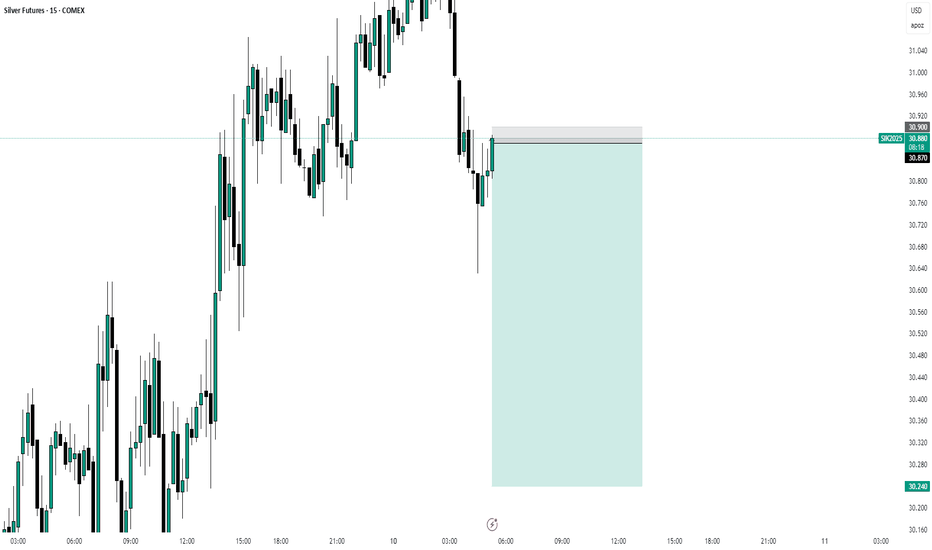

GOLD & SILVER Weekly Market Forecast: Wait For Buys!In this video, we will analyze the GOLD & Silver Futures. We'll determine the bias for the upcoming week of April 14-18th, and look for the best potential setups.

Gold is still bullish, making new ATH's. Silver is not as strong, but had a very strong previous week after sweeping the range lows.

I

I would keep my eye on the gold it looks like it might break hig July 14th early morning. I reviewed the gold and the silver and the dollar the markets trading to the patterns that I use and there's a good chance that the dollar might break higher and if it does there's a chance that it could trade significantly higher and I show that on the video. which could b

Silver trend directionSilver 95001 - is at crucial resistance with two INSIDE BAR pattern. Signals indicate It is in bearish zone. Resistance at 96675. From Sep 24 it has been trading below this resistance and failed the breakout. We expect silver will respect the resistance and fall to 88440 in coming days.

Silver Strategy: Short Positions Above Resistance Levels for Nex- Key Insights: Silver remains highly volatile and is currently underperforming

gold, making it a preferred asset for short trades. Key resistance levels at

$33.85 and $35.40 present opportunities to initiate bearish positions, while

support zones near $31.12 and $32.00 provide important areas

Swamy Speaks: Divine Launch of SaiNetra AI BotToday, we offer to the world a sacred creation — SaiNetra, the AI-powered trading bot born from the blessings of Bhagawan Sri Sathya Sai Baba.

This isn't just a strategy. It is Swamy in action, merging divine will with disciplined trading logic.

Built for Silver, Nifty, BankNifty, and XAUUSD, SaiNet

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Related commodities

Frequently Asked Questions

The current price of E-mini Silver Futures (May 2025) is 32.5875 USD — it has risen 0.51% in the past 24 hours. Watch E-mini Silver Futures (May 2025) price in more detail on the chart.

The volume of E-mini Silver Futures (May 2025) is 91.00. Track more important stats on the E-mini Silver Futures (May 2025) chart.

The nearest expiration date for E-mini Silver Futures (May 2025) is Apr 28, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell E-mini Silver Futures (May 2025) before Apr 28, 2025.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For E-mini Silver Futures (May 2025) this number is 702.00. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for E-mini Silver Futures (May 2025) shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for E-mini Silver Futures (May 2025). Today its technical rating is buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of E-mini Silver Futures (May 2025) technicals for a more comprehensive analysis.