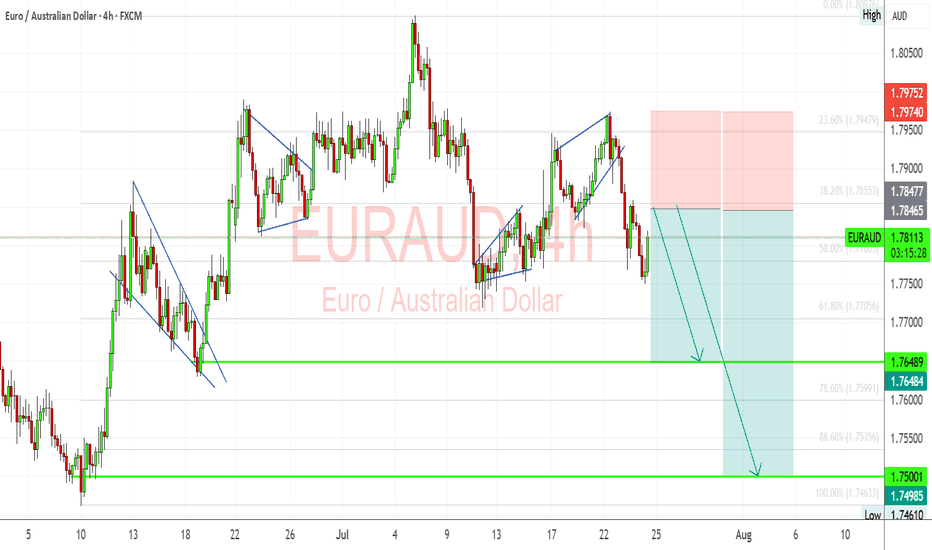

EURAUD Breakdown: Bearish Continuation Ahead of ECBEURAUD is showing signs of renewed downside pressure as fundamental and technical forces align in favor of Australian dollar strength. With the European Central Bank expected to hold rates steady and provide a cautious growth outlook, the euro remains vulnerable. Meanwhile, upside surprises in Austr

About Euro / Australian Dollar

The Euro vs. the Australian Dollar. This pair is considered to be a great barometer for global risk. In 2012, during the European sovereign debt crisis the EURAUD reached its low. Since then, due to the European Central Bank’s policy of Outright Monetary Transactions (OTM or the “whatever it takes” measure ) the pair has recovered substantially.

Related currencies

EURAUD Short Trade Setup Targeting 1.76806 with Stop at 1.79902This is a 1-hour EUR/AUD trading chart showing a short (sell) setup. The entry is near the current price level, with a target at 1.76806 and a stop loss at 1.79902. The green arrow indicates the expected downward move, while the red arrow shows the risk of upward movement if the trade goes against t

EUR/AUD: Short Setup Forming—Is the Downside Just Beginning?EUR/AUD is flashing the early signs of a new short trading opportunity, with the latest chart pointing toward a fresh move lower as the corrective phase may be wrapping up.

What the Current Structure Shows (Primary Scenario)

Corrective Pattern Complete: The strong advance off the May 14th, 2025 low

EURAUD Ready to Bounce? Key Support & Fundamentals Aligned!Today I want to share a Long position idea on EURAUD ( OANDA:EURAUD ) with you.

From a fundamental perspective , both the Euro (EUR) and Australian Dollar (AUD) are currently under pressure. However, the Aussie appears fundamentally weaker in the short term, making the EURAUD Long setup m

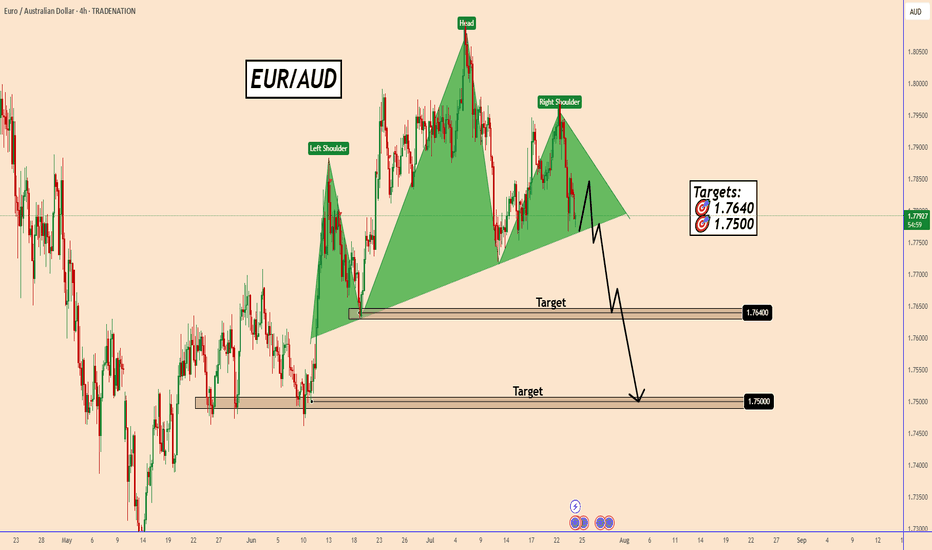

EURAUD is poised to confirm a bearish Head & Shoulders pattern.EURAUD is poised to confirm a bearish Head & Shoulders pattern.

The price could move higher today on hopes that the ECB can share some positive news on the economy and interest rates.

The European Central Bank is expected to keep interest rates unchanged, ending a seven-year streak of cuts.

If

Loss of Momentum Pattern Into StructureSimilar to the OANDA:GBPJPY that I shared, the OANDA:EURAUD has put in a pretty aggressive and direct move into a previous level of structure. However, what makes this opportunity different than "the beast" is that as price approach our level of resistance we started to put in a rising channel w

EUR/AUD Confirmed Downside Direction,Short Setup To Get 150 PipsHere is My 2H T.F Chart and if we have a look we will see that we have a very good breakout after this sideways movement , the price finally closed below my res and we have a good confirmation with 4H Bearish candle closure below my res so i`m waiting the price to go back to retest this broken res

EURAUD – Looking to Fade the Rally at Resistance (Counter-Trend EURAUD – Looking to Fade the Rally at Resistance (Counter-Trend Short Idea)

Sometimes markets climb too far, too fast — and that’s when opportunity knocks. EURAUD has been riding a strong uptrend, but it’s now stalling at a key resistance zone. Both the Euro and the Aussie are fundamentally soft, a

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of EURAUD is 1.78972 AUD — it has decreased by −0.24% in the past 24 hours. See more of EURAUD rate dynamics on the detailed chart.

The value of the EURAUD pair is quoted as 1 EUR per x AUD. For example, if the pair is trading at 1.50, it means it takes 1.5 AUD to buy 1 EUR.

The term volatility describes the risk related to the changes in an asset's value. EURAUD has the volatility rating of 0.59%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The EURAUD showed a 0.90% rise over the past week, the month change is a −0.84% fall, and over the last year it has increased by 6.72%. Track live rate changes on the EURAUD chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

EURAUD is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade EURAUD right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with EURAUD technical analysis. The technical rating for the pair is strong buy today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the EURAUD shows the buy signal, and 1 month rating is buy. See more of EURAUD technicals for a more comprehensive analysis.