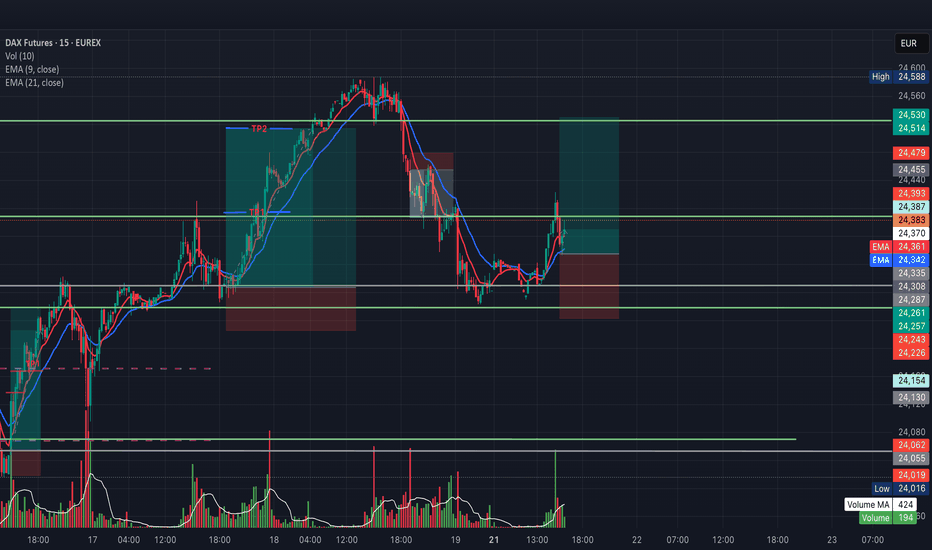

DAX Futures (FDAX1!) – Intraday Long Setup from SupportInstrument: FDAX1! (DAX Futures – EUREX)

Chart: 15 mins

Type: Intraday / Day Trade

DAX Futures is holding support near 24,259 after a recent pullback. Watching for a potential bounce if price remains above this level, with a move toward intraday highs as a possible target.

This setup is valid only

Related futures

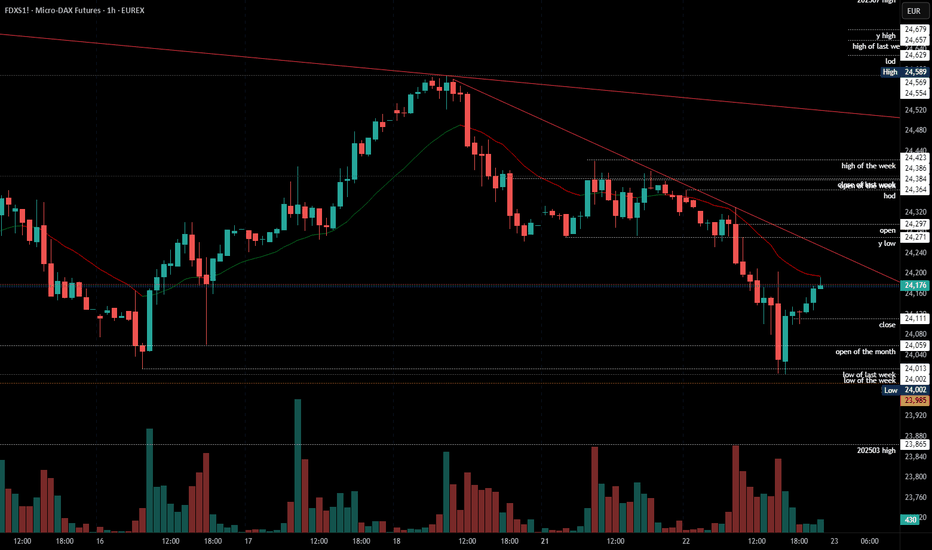

2025-07-22 - priceactiontds - daily update - daxGood Evening and I hope you are well.

comment: Bears had two legs down and the reversal from 24000 was strong enough to doubt this can go below 24000. I do expect some form of re-test of 24000 but the buying since then was insane again. Not a single 1h bar dropped below the prior one.

current mar

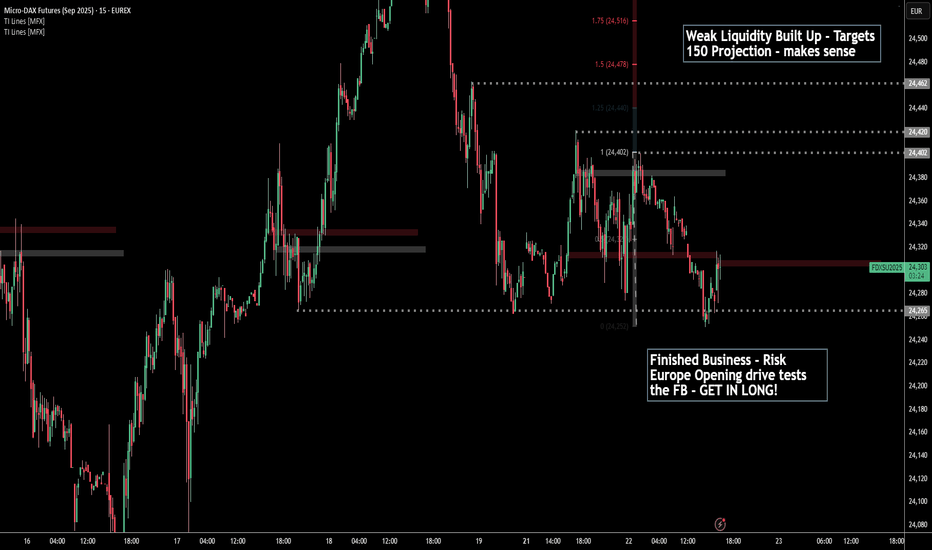

Finished Business TEST - LONGEurope Opening Drive shows a test of Finished Business

Above we have Multiple liquidity levels for Instos to take profits of their LONGS.

Also 150 projection (next distributions POC) marries up where the weak liquidity is.

GET IN and ride risk behind the demand auctions all the way.

FDAX Today 1. Wave (3) likely near completion:

Price hit the 1.618 extension of Wave 1, which is textbook for a Wave 3 target.

There’s also confluence with the 23.6% retracement from the previous swing high (24,703), and we're near a Bearish FVG + Order Block zone.

High-probability zone for a short-term reje

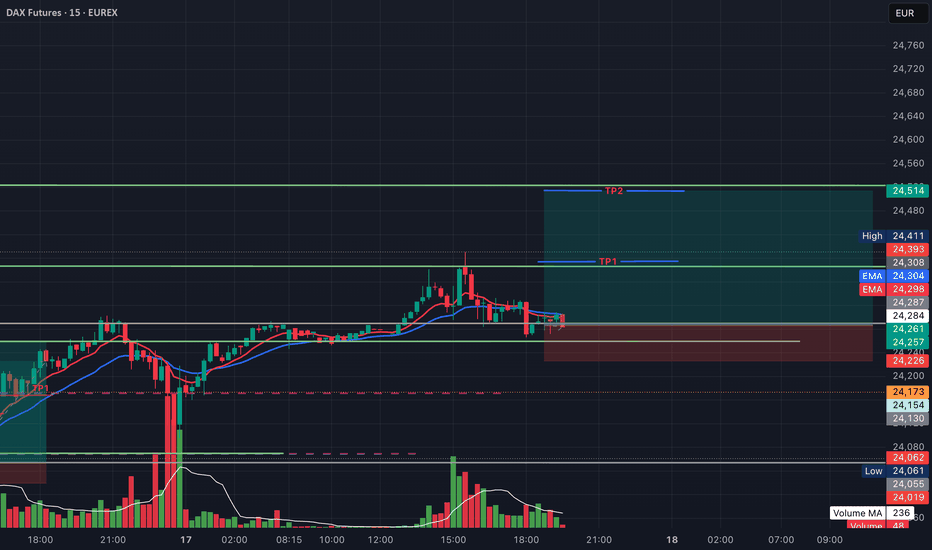

DAX Futures (FDAX1!) – Intraday Long Setup from Support with TP1Instrument: FDAX1! (DAX Futures – EUREX)

Chart: 15 mins

Type: Intraday / Day Trade

DAX Futures is holding support near 24,259 after a recent pullback. Watching for a potential bounce if price remains above this level, with a move toward intraday highs as a possible target.

This setup is valid unt

2025-07-17 - priceactiontds - daily update - daxGood Evening and I hope you are well.

comment: Selling down from 24400 to 24300 on high volume and the bears just gave up and market showed where it really wants to go. Almost without resistance we just grinded higher for 24500. No more obvious resistance until ath.

current market cycle: bull tren

2025-07-15 - priceactiontds - daily update - daxGood Evening and I hope you are well.

comment: Very important day tomorrow. If we trade below 24000, this means we saw leg 1 from 24749 down to 24100 and leg 2 could lead us to 23500 or lower. Until we have clearly broken below 24000, I remain neutral but hopeful we can finally go lower again.

cur

#202528 - priceactiontds - weekly update - daxGood Evening and I hope you are well.

comment: Third leg up is done and now it’s all about how long do we need for a lower low below 23680 again. For now I don’t know since we have another risk-off news but of them were bought the past 3 months, so I remain skeptical. Too early for shorts but I thi

DAX Futures FDAX1!) Imbalance Fill Before Bullish Continuation?Analysis Summary:

1. Current pullback after a strong impulse move suggests a short-term retracement.

2. The imbalance zone (highlighted in red) around 23,970–24,010 may act as a magnet.

3. Alternatively, price may continue lower to tap into 4H demand / liquidity zone before reversing upward.

📌 Ed

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Frequently Asked Questions

The current price of Mini-DAX Futures is 25,181 EUR — it has fallen −2.58% in the past 24 hours. Watch Mini-DAX Futures price in more detail on the chart.

Track more important stats on the Mini-DAX Futures chart.

The nearest expiration date for Mini-DAX Futures is Mar 17, 2028.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Mini-DAX Futures before Mar 17, 2028.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Mini-DAX Futures this number is 0.00. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Mini-DAX Futures shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Mini-DAX Futures. Today its technical rating is strong sell, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Mini-DAX Futures technicals for a more comprehensive analysis.