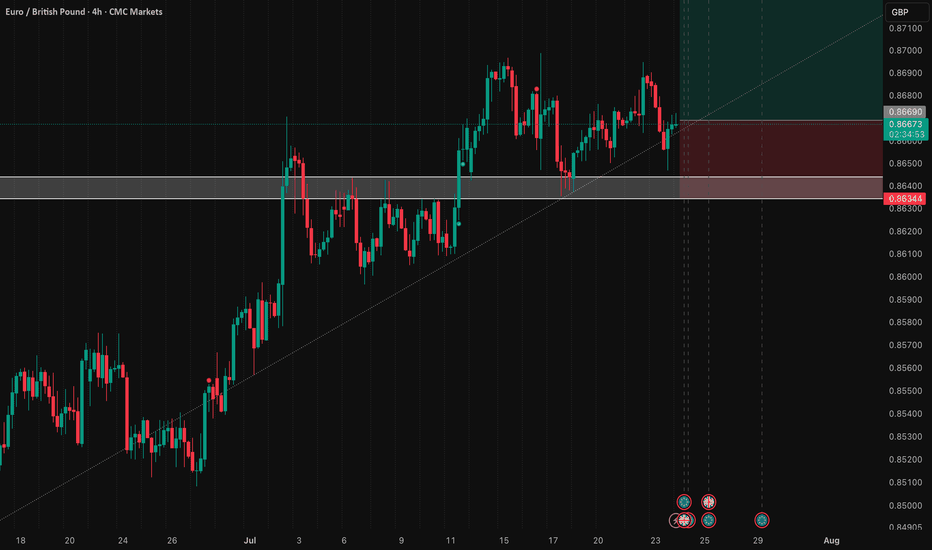

EURGBP Is Rising Further After UK Retail Sales missed estimatesEURGBP Is Rising Further After UK Retail Sales missed estimates

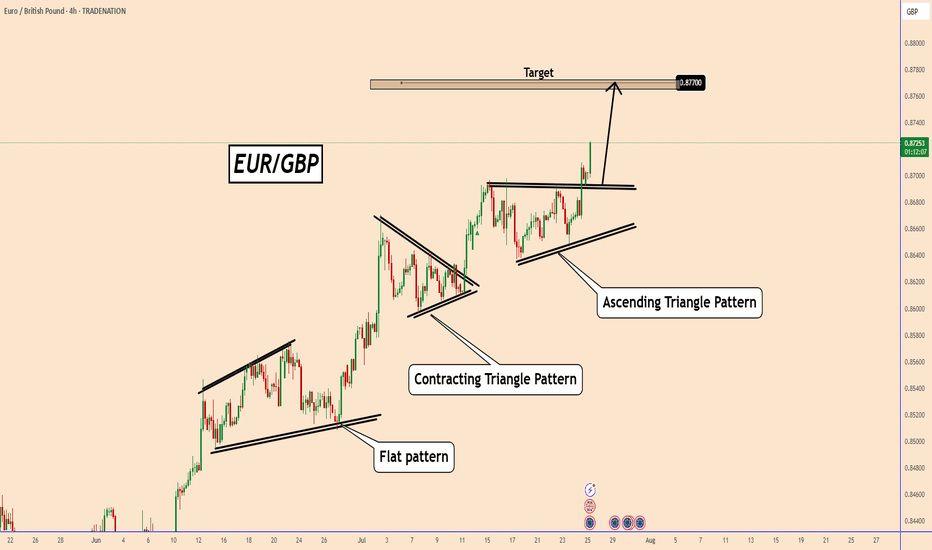

EURGBP already broke out from an Ascending Triangle pattern after it spent some time in accumulation and without direction the price is rising today.

This is the third and clear bullish pattern that EURGBP broke out and the chances

About Euro / British Pound

The Euro vs the British Pound. This pair represents a cross between the two largest economies in Europe, the Euro Zone and the United Kingdom. The pair is greatly less volatile than other Euro or Pound based crosses because of the economic closeness and interdependence between the two. Changes in monetary policy between the Bank of England and the European Central Bank can make this pair extremely sensitive.

Related currencies

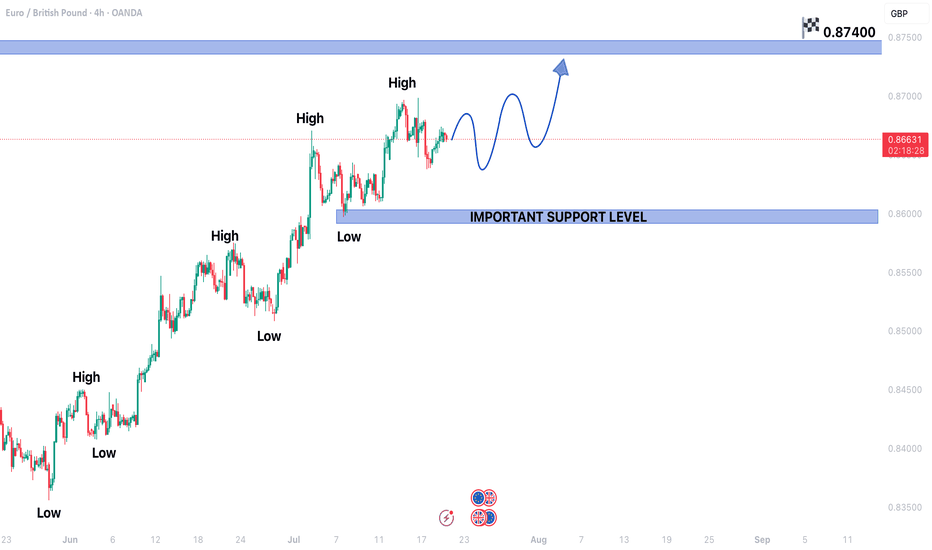

EURGBP CONTINUING BULLISH TREND STRUCTUREEURGBP CONTINUING BULLISH TREND STRUCTURE IN 4H TIME FRAME.

Price is currently in a secondary trend.

Price is expected to end the secondary trend and start primary trend again.

On higher side market may hit the targets of 0.87400

On lower side 0.85950 may act as a key support level.

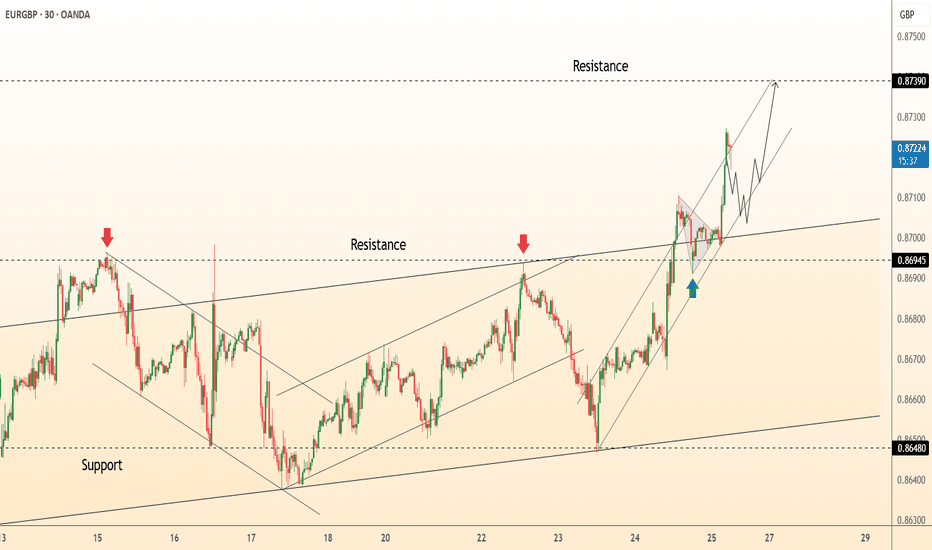

DeGRAM | EURGBP exited the channel📊 Technical Analysis

● Breakout: price burst from the July descending wedge, reclaimed 0.8695 former cap, and is now riding a steep intraday channel of higher-highs; the channel mid-line aligns with the broken wedge roof, adding fresh support.

● A pennant is consolidating just above 0.8695; its me

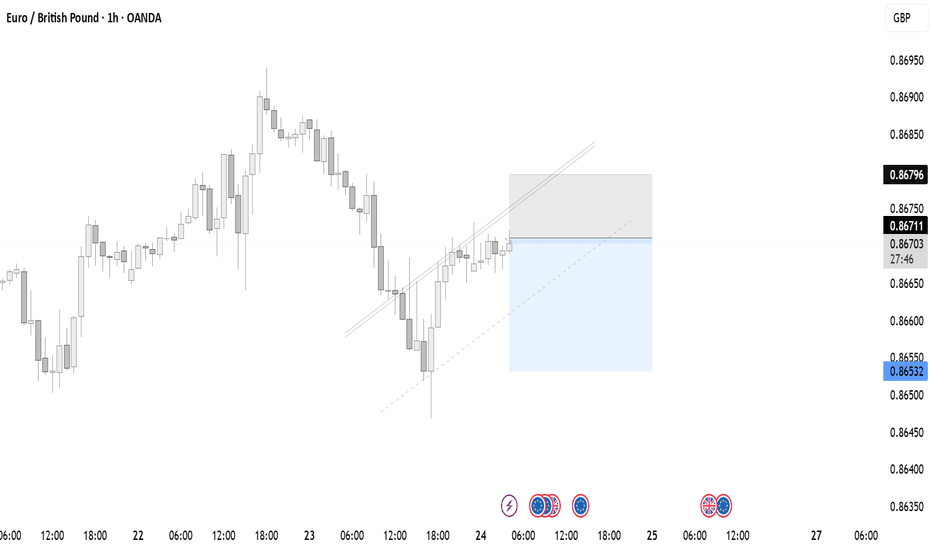

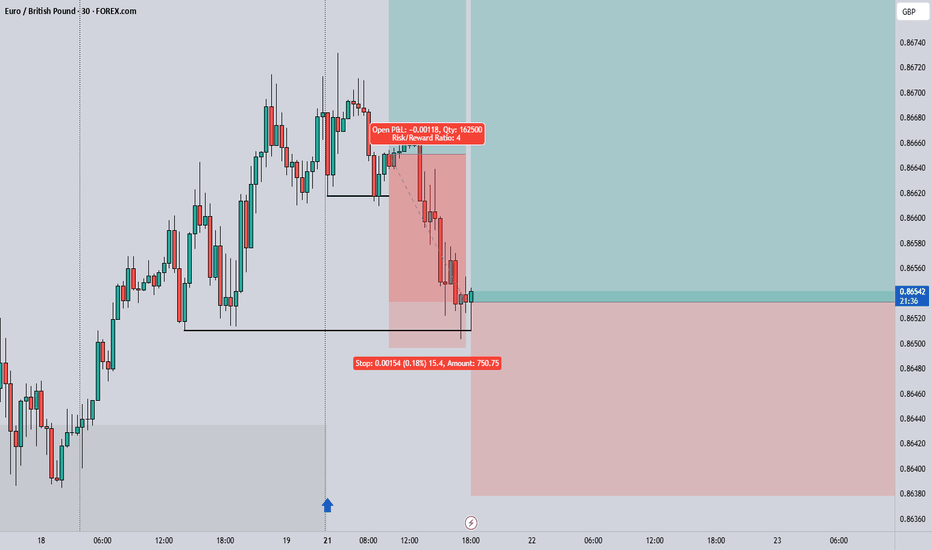

EUR/GBP: Bullish Stance Above 0.8640This signal outlines a tactical long entry on EUR/GBP, positioning for a bullish resolution from today's major fundamental events.

📰 Fundamental Thesis

This position is taken ahead of the two primary market movers: the ECB rate decision and the UK PMI data. The core thesis is that the ECB policy s

EURGBP Analysis : Bullish Setup + Support & Reversal Zone Ahead🔍 Overview:

This analysis explores a well-developed Mid-Market Cycle (MMC) pattern playing out on the EUR/GBP 8H chart. The price action has transitioned from accumulation to markup, forming a classic cup-shaped recovery structure supported by a parabolic ARC curve. With strong volume contraction,

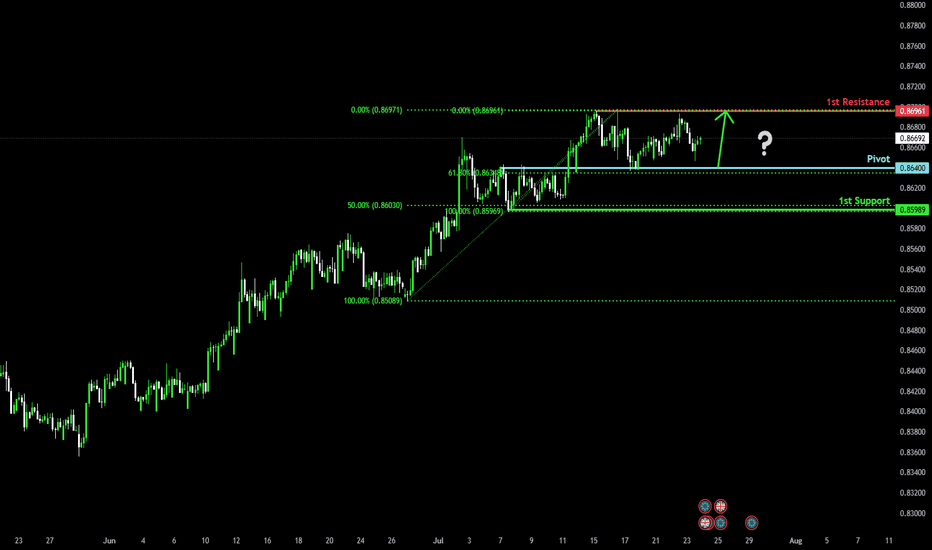

Bullish bounce off overlap support?EUR/GBP is falling towards the pivot, which has been identified as an overlap support and could bounce to the 1st resistance, which acts as a swing high resistance.

Pivot: 0.8640

1st Support: 0.8598

1st Resistance: 0.8696

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of EURGBP is 0.87395 GBP — it has increased by 0.44% in the past 24 hours. See more of EURGBP rate dynamics on the detailed chart.

The value of the EURGBP pair is quoted as 1 EUR per x GBP. For example, if the pair is trading at 1.50, it means it takes 1.5 GBP to buy 1 EUR.

The term volatility describes the risk related to the changes in an asset's value. EURGBP has the volatility rating of 0.53%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The EURGBP showed a 0.97% rise over the past week, the month change is a 2.46% rise, and over the last year it has increased by 4.09%. Track live rate changes on the EURGBP chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

EURGBP is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade EURGBP right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with EURGBP technical analysis. The technical rating for the pair is strong buy today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the EURGBP shows the strong buy signal, and 1 month rating is strong buy. See more of EURGBP technicals for a more comprehensive analysis.