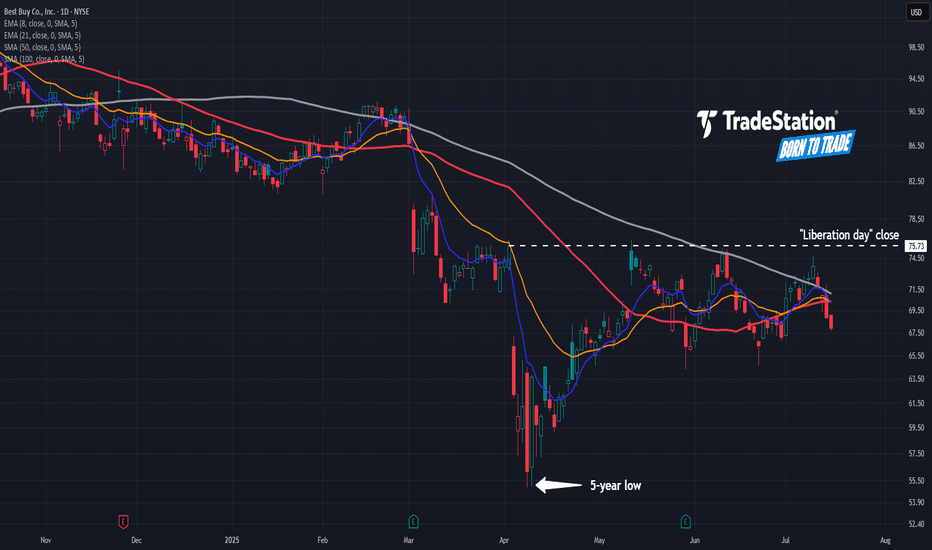

Best Buy’s Lower HighsBest Buy fell sharply on “Liberation Day.” Now, after a modest rebound, some traders may see further downside risk.

The first pattern on today’s chart is July 10’s peak of $74.75. That was below the June high, which in turn was under May’s high. Such a succession of lower highs could indicate a bea

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.64 EUR

894.99 M EUR

40.09 B EUR

195.42 M

About Best Buy Co., Inc.

Sector

Industry

CEO

Corie Sue Barry

Website

Headquarters

Richfield

Founded

1966

FIGI

BBG00PG1KSD6

Best Buy Co., Inc. engages in the provision of consumer technology products and services. It operates through two business segments: Domestic and International. The Domestic segment includes operations in all states, districts, and territories of the U.S., operating under various brand names, including Best Buy, Best Buy Mobile, Geek Squad, Magnolia Audio Video, Napster, and Pacific Sales. The International segment is made up of all operations outside the U.S. and its territories, including Canada, Europe, China, Mexico, and Turkey. It also markets its products under the brand names: Best Buy, bestbuy.com, Best Buy Direct, Best Buy Express, Best Buy Mobile, Geek Squad, GreatCall, Magnolia and Pacific Kitchen and Home. The company was founded by Richard M. Schulze in 1966 and is headquartered in Richfield, MN.

Related stocks

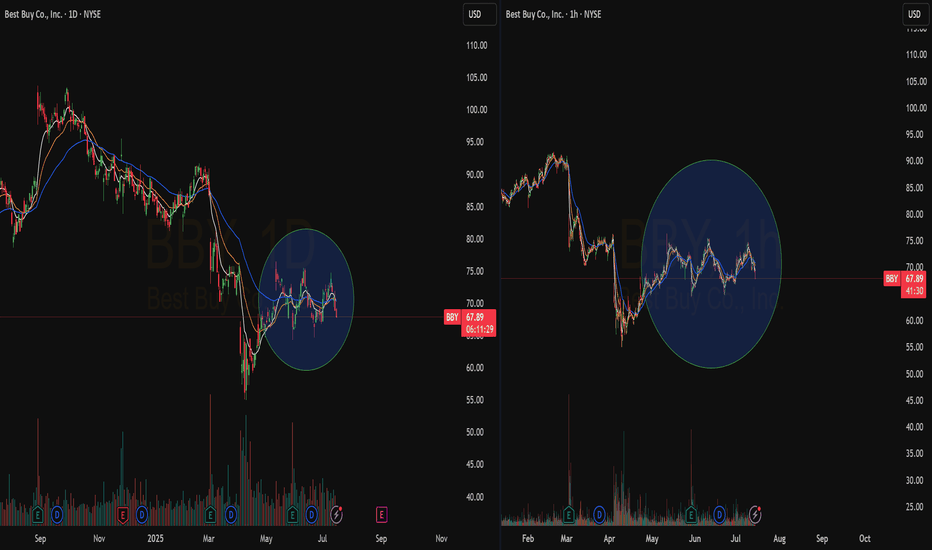

Quantum's BBY Outlook 7/20/25🚀 G.O.D. Flow (Gamma, Orderflow, Dealer Positioning)

1. 🧩 Summary Overview

Ticker: BBY

Current Price: $67.50

Flow Setup Date: Current Session

Trade Type: Intraday / 0–2 Day Swing

2. 🔬 Flow Breakdown

🔵 GEX (Gamma Exposure):

Highest -GEX at 70 → potential volatility pocket and resistance zone.

Despit

Best Buy Bounces Toward GapBest Buy has rebounded from last month’s sharp drop, but some traders may expect another push to the downside.

The first pattern on today’s chart is the price zone between $67.16 and $73.28. That matches the bearish price gap on April 3, one day after hefty tariffs were announced.

The electronics

BBY Possible Play's Again my cus trades stocks so I figured I would post what I charted up for him. When looking at possible play's you will need to go down to a 2min time frame to get your entries. With the gaps in these stocks it can be difficult to find entries with so much missing data. maybe I don't pay enough to

When to buy BBYBest Buy (BBY) has just broken out of the base it established back in November 2022. The reaction to the most recent earnings is strong and yesterday June 4th 2024, BBY hit the same high from February 2023.

Idea 1: It can blow through this line top line and continue its climb. If this is the case,

best buy potential longyou know ive been seeing chatter about this ticker more than usual. I know best buy is a consolidation nightmare but i see a trade. Break and entry would be 101. The anchored vwap shows a switch of trend and it can be used to ensure momentum is ensuing and the trade is going well. Also eventually th

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

BBY5055320

Best Buy Co., Inc. 1.95% 01-OCT-2030Yield to maturity

4.91%

Maturity date

Oct 1, 2030

BBY4720674

Best Buy Co., Inc. 4.45% 01-OCT-2028Yield to maturity

4.44%

Maturity date

Oct 1, 2028

See all 4BBY bonds

Curated watchlists where 4BBY is featured.

Frequently Asked Questions

The current price of 4BBY is 56.99 EUR — it has decreased by −1.83% in the past 24 hours. Watch BEST BUY CO stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on EUROTLX exchange BEST BUY CO stocks are traded under the ticker 4BBY.

4BBY stock has fallen by −0.63% compared to the previous week, the month change is a −2.33% fall, over the last year BEST BUY CO has showed a −29.61% decrease.

We've gathered analysts' opinions on BEST BUY CO future price: according to them, 4BBY price has a max estimate of 80.73 EUR and a min estimate of 53.54 EUR. Watch 4BBY chart and read a more detailed BEST BUY CO stock forecast: see what analysts think of BEST BUY CO and suggest that you do with its stocks.

4BBY reached its all-time high on Nov 26, 2024 with the price of 97.60 EUR, and its all-time low was 50.78 EUR and was reached on Apr 11, 2025. View more price dynamics on 4BBY chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

4BBY stock is 1.86% volatile and has beta coefficient of 1.08. Track BEST BUY CO stock price on the chart and check out the list of the most volatile stocks — is BEST BUY CO there?

Today BEST BUY CO has the market capitalization of 12.13 B, it has decreased by −8.79% over the last week.

Yes, you can track BEST BUY CO financials in yearly and quarterly reports right on TradingView.

BEST BUY CO is going to release the next earnings report on Sep 2, 2025. Keep track of upcoming events with our Earnings Calendar.

4BBY earnings for the last quarter are 1.02 EUR per share, whereas the estimation was 0.97 EUR resulting in a 4.80% surprise. The estimated earnings for the next quarter are 1.02 EUR per share. See more details about BEST BUY CO earnings.

BEST BUY CO revenue for the last quarter amounts to 7.74 B EUR, despite the estimated figure of 7.78 B EUR. In the next quarter, revenue is expected to reach 7.85 B EUR.

4BBY net income for the last quarter is 178.36 M EUR, while the quarter before that showed 112.96 M EUR of net income which accounts for 57.90% change. Track more BEST BUY CO financial stats to get the full picture.

Yes, 4BBY dividends are paid quarterly. The last dividend per share was 0.83 EUR. As of today, Dividend Yield (TTM)% is 5.60%. Tracking BEST BUY CO dividends might help you take more informed decisions.

BEST BUY CO dividend yield was 4.49% in 2024, and payout ratio reached 87.85%. The year before the numbers were 4.86% and 64.79% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 27, 2025, the company has 85 K employees. See our rating of the largest employees — is BEST BUY CO on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. BEST BUY CO EBITDA is 2.29 B EUR, and current EBITDA margin is 6.23%. See more stats in BEST BUY CO financial statements.

Like other stocks, 4BBY shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BEST BUY CO stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So BEST BUY CO technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating BEST BUY CO stock shows the sell signal. See more of BEST BUY CO technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.