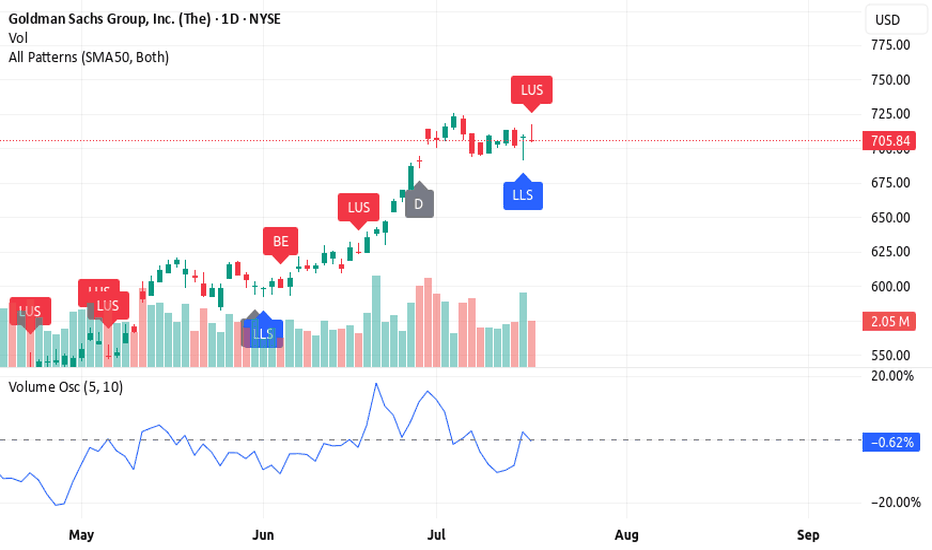

3 Reasons Why Goldman Sachs (GS) Still Looks Bullish🚀 3 Reasons Why Goldman Sachs (GS) Still Looks Bullish (Despite a Bearish Candle)

Goldman Sachs is in a bullish trend, but the latest candlestick is flashing a warning. Here's why GS still looks strong — and what to watch for next 📈

1️⃣ Candlestick pattern – long upper shadow

The long upper shado

Key facts today

Goldman Sachs saw a 71% rise in M&A fees year-over-year, reaching $1.2 billion, driven by increased activity in mid-to-small cap firms amid high financing costs.

Goldman Sachs reported robust earnings, contributing to positive investor sentiment and supporting overall gains in the stock market this week.

HSBC has revised its price target for Goldman Sachs Group to $652 from $627, while keeping a 'Reduce' rating on the stock.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

39.1 EUR

13.79 B EUR

122.51 B EUR

305.06 M

About Goldman Sachs Group, Inc. (The)

Sector

Industry

CEO

David Michael Solomon

Website

Headquarters

New York

Founded

1869

FIGI

BBG000QY2067

The Goldman Sachs Group, Inc. engages in the provision of financial services. It operates through the following business segments: Global Banking and Markets, Asset and Wealth Management, and Platform Solutions. The Global Banking and Markets segment includes investment banking, global investments, and equity and debt investments. The Asset and Wealth Management segment relates to the direct-to-consumer banking business which includes lending, deposit-taking, and investing. The Platform Solutions segment includes consumer platforms such as partnerships offering credit cards and point-of-sale financing, and transaction banking. The company was founded by Marcus Goldman in 1869 and is headquartered in New York, NY.

Related stocks

The Return Of The 3 Step Rocket Booster StrategyOne thing you can know about me is i desire to learn how to

drive a car.I still dont know how to drive car.

Sometimes i feel safe being driven

on public roads.

But the freedom that comes from owning your own car,

i still dont know how that feels like.

Whats better to do it yourself, or have other

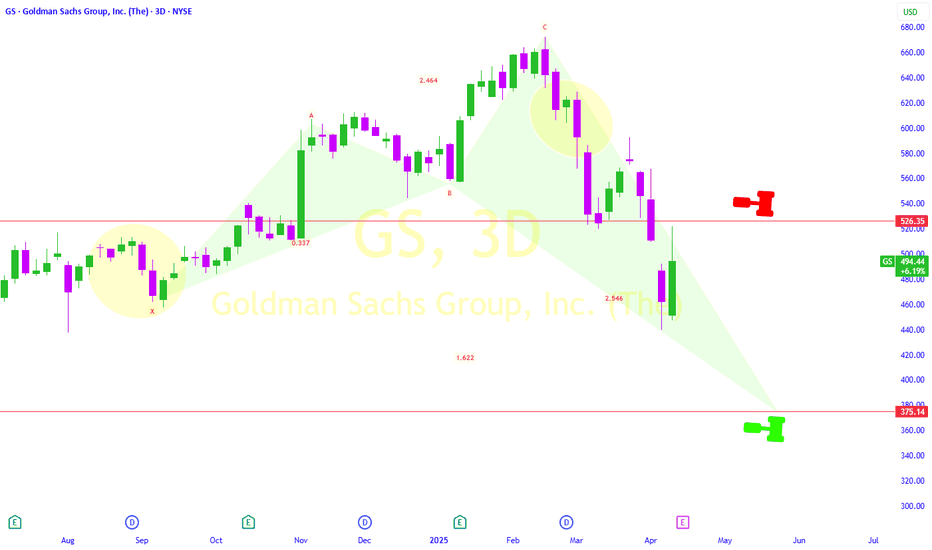

Goldman Sachs (GS): Long Position Opportunity Amid Stabilizing V

-Key Insights: Goldman Sachs (GS) stands to benefit from stabilizing market

volatility, as reflected by the declining VIX. While macroeconomic uncertainties

and earnings season pressures persist, GS has room for recovery with strong

potential upside driven by resilience in financial services and li

4/14/25 - $gs - A buy4/14/25 :: VROCKSTAR :: NYSE:GS

A buy

- 1.5x book w/ mid teens ROEs.

- 11x PE

- great result

- financials will do well in this environment

- not a tariff punching bag

- all the financial services should supplement IPO/ IB issues in the ST

- trying to keep cash high

- but you could get 3% yield on

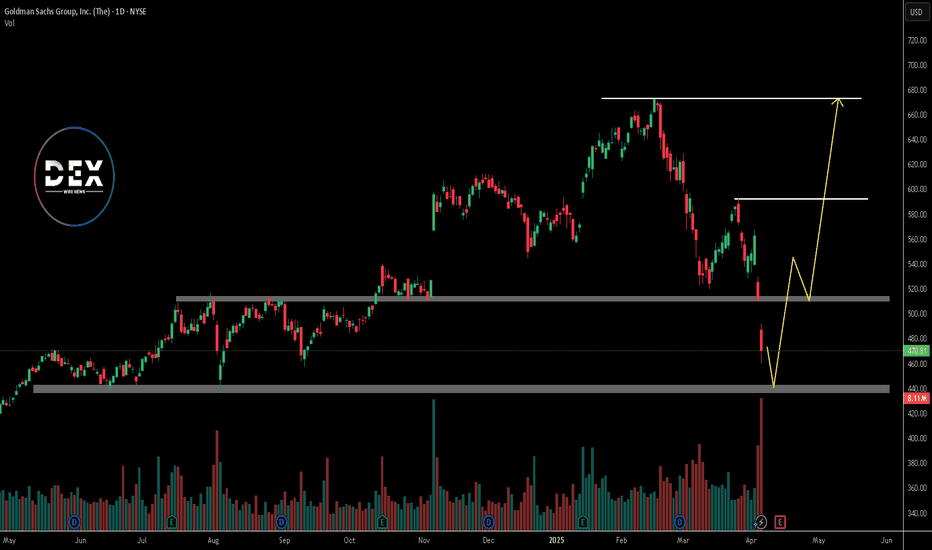

Just In: The Goldman Sachs Group, Inc. (GS) Set for Breakout The Goldman Sachs Group, Inc. (GS) shares is set for a breakout today as the firm smashes Q1 Estimates leading to a 2.45% surge in Monday's premarket trading.

Reports Overview

Goldman Sachs delivered a strong first-quarter performance, beating Wall Street expectations on both earnings and revenue,

"Trip of Sache Sellers Crab" is still ongoing.Alright folks, let's talk Goldman Sachs.

They're dropping their earnings report tomorrow, which means Wall Street's gonna be buzzing like a caffeinated hive. Are we ready for a bullish breakout? A bearish beatdown? Honestly, your guess is as good as mine.I’m about as fundamentally clueless as a go

Goldman Sachs Raises Recession Odds to 35% Amid Tariff Fears Goldman Sachs (NYSE: GS) has lowered its S&P 500 year-end target again. The firm now sees the index ending at 5,700 points, down from its earlier forecast of 6,200. This revision comes just days before President Trump’s new round of tariffs is set to begin. The updated target implies only a 2% gain

Goldman Sachs Earnings Tomorrow – Ready for a Bullish Breakout?Goldman Sachs (NYSE: GS) is shaping up for a potential bullish move ahead of its earnings report tomorrow (January 15) before the market opens. With the stock bouncing off key support levels and positive momentum indicators, a strong earnings surprise could trigger further upside toward my targets.

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where 4GS is featured.

Frequently Asked Questions

The current price of 4GS is 606.9 EUR — it has decreased by −0.82% in the past 24 hours. Watch GOLDMAN SACHS GROUP stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on EUROTLX exchange GOLDMAN SACHS GROUP stocks are traded under the ticker 4GS.

4GS stock has risen by 0.85% compared to the previous week, the month change is a 10.19% rise, over the last year GOLDMAN SACHS GROUP has showed a 33.91% increase.

We've gathered analysts' opinions on GOLDMAN SACHS GROUP future price: according to them, 4GS price has a max estimate of 715.75 EUR and a min estimate of 431.17 EUR. Watch 4GS chart and read a more detailed GOLDMAN SACHS GROUP stock forecast: see what analysts think of GOLDMAN SACHS GROUP and suggest that you do with its stocks.

4GS stock is 0.82% volatile and has beta coefficient of 1.47. Track GOLDMAN SACHS GROUP stock price on the chart and check out the list of the most volatile stocks — is GOLDMAN SACHS GROUP there?

Today GOLDMAN SACHS GROUP has the market capitalization of 186.77 B, it has increased by 0.91% over the last week.

Yes, you can track GOLDMAN SACHS GROUP financials in yearly and quarterly reports right on TradingView.

GOLDMAN SACHS GROUP is going to release the next earnings report on Oct 14, 2025. Keep track of upcoming events with our Earnings Calendar.

4GS earnings for the last quarter are 9.26 EUR per share, whereas the estimation was 8.19 EUR resulting in a 13.02% surprise. The estimated earnings for the next quarter are 8.97 EUR per share. See more details about GOLDMAN SACHS GROUP earnings.

GOLDMAN SACHS GROUP revenue for the last quarter amounts to 12.38 B EUR, despite the estimated figure of 11.46 B EUR. In the next quarter, revenue is expected to reach 11.68 B EUR.

4GS net income for the last quarter is 3.16 B EUR, while the quarter before that showed 4.38 B EUR of net income which accounts for −27.84% change. Track more GOLDMAN SACHS GROUP financial stats to get the full picture.

Yes, 4GS dividends are paid quarterly. The last dividend per share was 2.64 EUR. As of today, Dividend Yield (TTM)% is 1.70%. Tracking GOLDMAN SACHS GROUP dividends might help you take more informed decisions.

GOLDMAN SACHS GROUP dividend yield was 2.01% in 2024, and payout ratio reached 28.37%. The year before the numbers were 2.72% and 45.92% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 19, 2025, the company has 46.5 K employees. See our rating of the largest employees — is GOLDMAN SACHS GROUP on this list?

Like other stocks, 4GS shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade GOLDMAN SACHS GROUP stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So GOLDMAN SACHS GROUP technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating GOLDMAN SACHS GROUP stock shows the strong buy signal. See more of GOLDMAN SACHS GROUP technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.