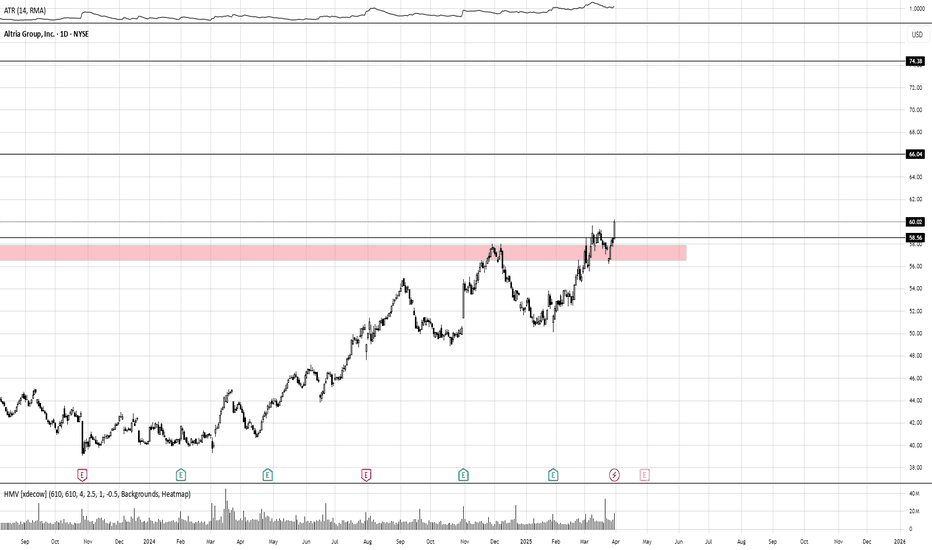

Altria Group (MO) – Rising Inside Ending Diagonal, Possible BaseAltria (MO) is advancing within a rising ending diagonal structure. After completing wave 5 of wave C, price is currently moving upward within the wedge.

Although there is no contact yet with the lower diagonal boundary, a third test remains structurally possible. Such formations often invite a fin

Key facts today

Altria Group, Inc. will hold a live audio webcast on July 30, 2025, at 9:00 a.m. ET to discuss its Q2 and first-half results, with a press release at 7:00 a.m.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

5.53 EUR

10.85 B EUR

19.75 B EUR

1.68 B

About Altria Group, Inc.

Sector

Industry

CEO

William F. Gifford

Website

Headquarters

Richmond

Founded

1919

FIGI

BBG000QFT3N4

Altria Group, Inc. is a holding company, which engages in the manufacture and sale of cigarettes in the United States. It operates through the following segments: Smokeable Products, Oral Tobacco Products, and All Other. The Smokeable Products segment consists of cigarettes manufactured and sold by PM USA, and machine-made large cigars and pipe tobacco manufactured and sold by Middleton. The Oral Tobacco Products segment includes MST and snus products manufactured and sold by USSTC, and oral nicotine pouches manufactured and sold by Helix. The All Other segment refers to the financial results of NJOY, Helix ROW, and the IQOS System heated tobacco business. The company was founded in 1919 and is headquartered in Richmond, VA.

Related stocks

OptionsMastery: A break and retest on MO!🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

OptionsMastery: Immediate buy on MO!?🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Everyone’s scared of booze stocks… Why I’m still buyingThis analysis is provided by Eden Bradfeld at BlackBull Research.

One of the things I find interesting is that a lot of people say “why do you like booze stocks so much Eden” and yet many of these same people are at the pub, or buying En primeur from Glengarry Wines. The short answer is — I like

$MO Rally - Base - Rally Breakout say no to this stuff ( word substitute)

About Altria Group, Inc.

Altria Group, Inc. is a leading US-based holding company in the tobacco industry. Here's a brief overview:

* Founded in 1919

* Headquartered in Richmond, VA

* Operates through three main segments:

+ Smokeable Products: cigarettes,

Altria $MO to $57+ if They Beat Earnings on ThursdayAltria NYSE:MO is trading at a P/E ratio of 9 right now, which is pretty crazy. Tech sectors overall are also showing signs of extreme uncertainty, which furthers the fundamental argument for value stocks like NYSE:MO and NYSE:PM as they approach earnings. 🔥🛡💎

If Altria provides a solid repo

$MO Double D Bottom BreakoutHere on NYSE:MO we can see a very clearly defined double bottom on the Quarterly chart with the current quarter candle pushing into and above the breakout zone.

Quarterly CCI is also firmly broken out into positive momentum sure to keep those milky double d bottoms producing sweet sweet buttermi

Buying MO should be your only M.OTop 3 Technical Reasons MO Will Rise

Breakout from Support: MO recently bounced off its $41 support level, a floor it has respected for months. Buyers are clearly showing up to the party, and the stock looks ready to grind higher.

Strong Relative Strength: The stock’s RSI has climbed out of overs

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US2209SBN2

ALTRIA GRP 21/51Yield to maturity

7.40%

Maturity date

Feb 4, 2051

US2209SAV5

ALTRIA GROUP 16/46Yield to maturity

7.18%

Maturity date

Sep 16, 2046

US2209SBP7

ALTRIA GRP 21/61Yield to maturity

7.18%

Maturity date

Feb 4, 2061

US2209SBM4

ALTRIA GRP 21/41Yield to maturity

7.12%

Maturity date

Feb 4, 2041

MO4984042

Altria Group, Inc. 4.45% 06-MAY-2050Yield to maturity

7.01%

Maturity date

May 6, 2050

0ATD

ALTRIA GROUP 12/42Yield to maturity

6.88%

Maturity date

Aug 9, 2042

MO4001429

Altria Group, Inc. 4.5% 02-MAY-2043Yield to maturity

6.79%

Maturity date

May 2, 2043

US2209SBG7

ALTRIA GRP 19/59Yield to maturity

6.39%

Maturity date

Feb 14, 2059

0ATF

ALTRIA GROUP 13/44Yield to maturity

6.26%

Maturity date

Jan 31, 2044

US2209SBF9

ALTRIA GRP 19/49Yield to maturity

6.24%

Maturity date

Feb 14, 2049

US2209SBE2

ALTRIA GRP 19/39Yield to maturity

5.82%

Maturity date

Feb 14, 2039

See all 4MO bonds

Curated watchlists where 4MO is featured.

Frequently Asked Questions

The current price of 4MO is 50.30 EUR — it has increased by 0.56% in the past 24 hours. Watch ALTRIA GROUP stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on EUROTLX exchange ALTRIA GROUP stocks are traded under the ticker 4MO.

4MO stock has risen by 2.59% compared to the previous week, the month change is a −0.04% fall, over the last year ALTRIA GROUP has showed a 12.36% increase.

We've gathered analysts' opinions on ALTRIA GROUP future price: according to them, 4MO price has a max estimate of 62.59 EUR and a min estimate of 42.01 EUR. Watch 4MO chart and read a more detailed ALTRIA GROUP stock forecast: see what analysts think of ALTRIA GROUP and suggest that you do with its stocks.

4MO stock is 0.56% volatile and has beta coefficient of −0.02. Track ALTRIA GROUP stock price on the chart and check out the list of the most volatile stocks — is ALTRIA GROUP there?

Today ALTRIA GROUP has the market capitalization of 85.22 B, it has increased by 2.30% over the last week.

Yes, you can track ALTRIA GROUP financials in yearly and quarterly reports right on TradingView.

ALTRIA GROUP is going to release the next earnings report on Jul 30, 2025. Keep track of upcoming events with our Earnings Calendar.

4MO earnings for the last quarter are 1.14 EUR per share, whereas the estimation was 1.10 EUR resulting in a 3.63% surprise. The estimated earnings for the next quarter are 1.18 EUR per share. See more details about ALTRIA GROUP earnings.

ALTRIA GROUP revenue for the last quarter amounts to 4.18 B EUR, despite the estimated figure of 4.27 B EUR. In the next quarter, revenue is expected to reach 4.41 B EUR.

4MO net income for the last quarter is 990.90 M EUR, while the quarter before that showed 2.93 B EUR of net income which accounts for −66.16% change. Track more ALTRIA GROUP financial stats to get the full picture.

Yes, 4MO dividends are paid quarterly. The last dividend per share was 0.88 EUR. As of today, Dividend Yield (TTM)% is 6.93%. Tracking ALTRIA GROUP dividends might help you take more informed decisions.

ALTRIA GROUP dividend yield was 7.65% in 2024, and payout ratio reached 61.16%. The year before the numbers were 9.52% and 84.11% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 17, 2025, the company has 6.2 K employees. See our rating of the largest employees — is ALTRIA GROUP on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ALTRIA GROUP EBITDA is 11.12 B EUR, and current EBITDA margin is 58.78%. See more stats in ALTRIA GROUP financial statements.

Like other stocks, 4MO shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ALTRIA GROUP stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ALTRIA GROUP technincal analysis shows the neutral today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ALTRIA GROUP stock shows the buy signal. See more of ALTRIA GROUP technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.