NIKE Confirms A Bullish Reversal With An Impulsive RecoveryWe talked about Nike on July 10 with our members, where we mentioned and highlighted a completed higher degree ABC correction in wave IV on the monthly and weekly charts.

Today we want to represent a closer view, as we see a five-wave impulsive recovery away from the lows on a daily chart. It actua

Key facts today

RBC Capital Markets noted that Nike's product range is improving in the U.S., especially in running, which is balancing weaker demand for its classic basketball styles.

NIKE, Inc. declared a quarterly cash dividend of $0.40 per share on its Class A and Class B Common Stock, scheduled for payment on October 1, 2025, to shareholders on record as of September 2, 2025.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.91 EUR

2.84 B EUR

40.90 B EUR

1.17 B

About Nike

Sector

Industry

CEO

Elliott J. Hill

Website

Headquarters

Beaverton

Founded

1964

FIGI

BBG00HLHDRZ9

NIKE, Inc. engages in the design, development, marketing, and sale of athletic footwear, apparel, accessories, equipment, and services. It operates through the following segments: North America, Europe, Middle East, and Africa (EMEA), Greater China, Asia Pacific and Latin America (APLA), Global Brand Divisions, Converse, and Corporate. The North America, EMEA, Greater China, and APLA segments refer to the design, development, marketing, and selling of athletic footwear, apparel, and equipment. The Global Brand Divisions segment represents its NIKE Brand licensing businesses. The Converse segment designs, markets, licenses, and sells casual sneakers, apparel, and accessories. The Corporate segment is composed of unallocated general and administrative expenses. The company was founded by William Jay Bowerman and Philip Hampson Knight on January 25, 1964 and is headquartered in Beaverton, OR.

Related stocks

Bearish Setup on Nike ($NKE): Divergence + Supply Rejection📉 I'm watching a high-probability bearish setup on NYSE:NKE , with price rejecting a key 1D supply zone ($77–80) on bearish RSI divergence and fading momentum. A downside gap below adds further confluence.

📊 Technical Context:

Clear 1D supply rejection with divergence

Lower RSI highs vs higher pri

Nike - This is the bottom!💉Nike ( NYSE:NKE ) creates the bottom now:

🔎Analysis summary:

More than four years ago, Nike created its previous all time high. We have been witnessing a downtrend ever since and a correction of about -70%. But with the recent retest of an important horizontal structure and bullish confirmat

Possible Scenarios for Nike🔺 Pattern:

An ascending triangle is forming, which is a bullish technical pattern if it breaks out with volume above the resistance level.

The TP1 (Take Profit 1) marked in the $64.72–$66.38 USD zone is logical and aligns with previous resistance levels.

🟢 Bullish Signals:

Imminent triangle break

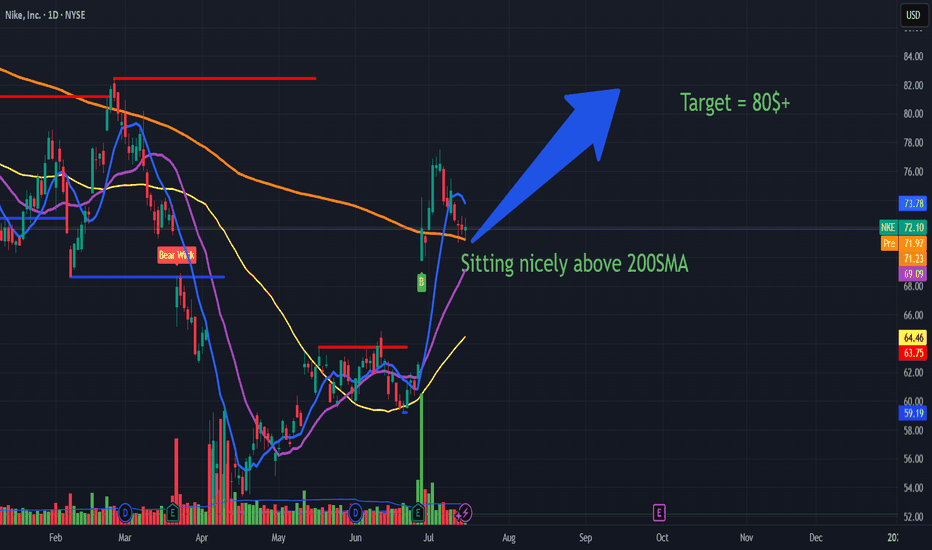

Nike is a screaming BUY with target above 80$ in the short termSummary: In short NKE is on reversal mode to the upside and 80$ is on the horizon and 100$+ by next quarter Earnings call which is an upside over 40% NYSE:NKE

Nike (NKE): Technical Strength Above the 200 SMA 🟢

Nike (NKE): Recent Earnings Overview 🏅

Above the 200-Day Simple Moving Average (S

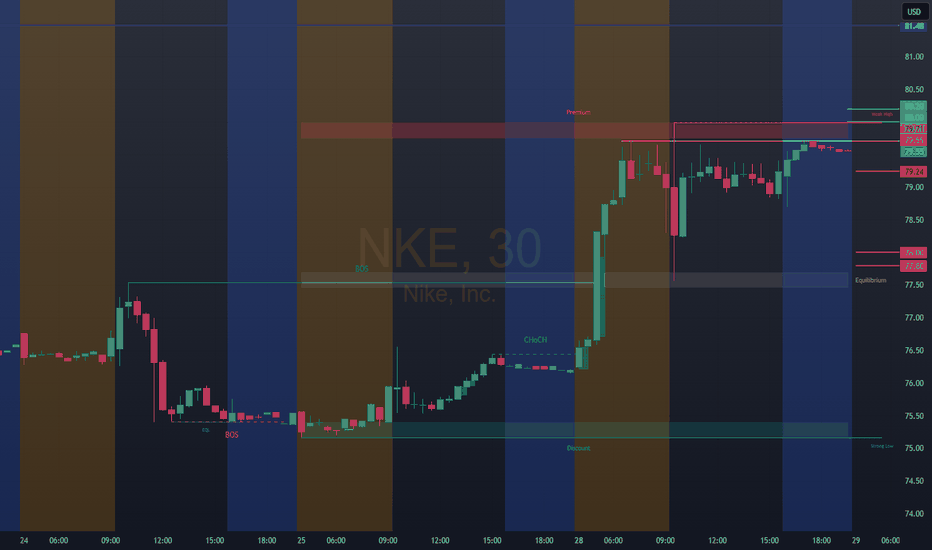

Break of downward sloping channel LongNike has swept liquidity and is now showing a strong bounce to the upside.

Although I didn’t manage to enter the initial long, I am monitoring for a break above the current downward-sloping channel. A clean breakout followed by a retest would provide a more reliable entry point. I’m not aiming to c

NKE Pullback-I'm Buying the DipNike (NKE) is under pressure — post-earnings volatility, macro noise, and sentiment all weighing in. But for swing traders, this looks like a textbook accumulation setup.

📌 Entry Zones I’m Targeting:

🔹 $70.00

🔹 $65.00

🔹 $60.00

Profit Targets (Taking wins before 88):

✅ $78.80

✅ $82.50

Let the m

Long NKE on pull back after break?Nke just woke investors back up with their recent forecast after earnings. This push has temporarily broken the down trend on the daily time frame and it is holding the break on the weekly. We now have a healthy-looking retest with the rsi on the daily time frame above 50 signaling a bounce is comin

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US654106AG8

NIKE 16/46Yield to maturity

6.39%

Maturity date

Nov 1, 2046

NKE4971170

NIKE, Inc. 3.375% 27-MAR-2050Yield to maturity

6.29%

Maturity date

Mar 27, 2050

NKEB

NIKE 15/45Yield to maturity

6.13%

Maturity date

Nov 1, 2045

NKEA

NIKE 13/43Yield to maturity

6.07%

Maturity date

May 1, 2043

NKE4971169

NIKE, Inc. 3.25% 27-MAR-2040Yield to maturity

5.75%

Maturity date

Mar 27, 2040

NKE4971168

NIKE, Inc. 2.85% 27-MAR-2030Yield to maturity

4.23%

Maturity date

Mar 27, 2030

US654106AF0

NIKE 16/26Yield to maturity

4.20%

Maturity date

Nov 1, 2026

NKE4971167

NIKE, Inc. 2.75% 27-MAR-2027Yield to maturity

4.08%

Maturity date

Mar 27, 2027

See all 4NKE bonds

Curated watchlists where 4NKE is featured.

Frequently Asked Questions

The current price of 4NKE is 64.13 EUR — it has increased by 0.82% in the past 24 hours. Watch NIKE stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on EUROTLX exchange NIKE stocks are traded under the ticker 4NKE.

4NKE stock has fallen by −2.16% compared to the previous week, the month change is a 0.59% rise, over the last year NIKE has showed a −3.59% decrease.

We've gathered analysts' opinions on NIKE future price: according to them, 4NKE price has a max estimate of 99.28 EUR and a min estimate of 32.81 EUR. Watch 4NKE chart and read a more detailed NIKE stock forecast: see what analysts think of NIKE and suggest that you do with its stocks.

4NKE reached its all-time high on Nov 22, 2021 with the price of 156.44 EUR, and its all-time low was 42.74 EUR and was reached on Oct 12, 2017. View more price dynamics on 4NKE chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

4NKE stock is 1.50% volatile and has beta coefficient of 0.99. Track NIKE stock price on the chart and check out the list of the most volatile stocks — is NIKE there?

Today NIKE has the market capitalization of 95.57 B, it has decreased by −2.94% over the last week.

Yes, you can track NIKE financials in yearly and quarterly reports right on TradingView.

NIKE is going to release the next earnings report on Sep 30, 2025. Keep track of upcoming events with our Earnings Calendar.

4NKE earnings for the last quarter are 0.12 EUR per share, whereas the estimation was 0.11 EUR resulting in a 7.45% surprise. The estimated earnings for the next quarter are 0.23 EUR per share. See more details about NIKE earnings.

NIKE revenue for the last quarter amounts to 9.78 B EUR, despite the estimated figure of 9.46 B EUR. In the next quarter, revenue is expected to reach 9.40 B EUR.

4NKE net income for the last quarter is 185.99 M EUR, while the quarter before that showed 765.41 M EUR of net income which accounts for −75.70% change. Track more NIKE financial stats to get the full picture.

Yes, 4NKE dividends are paid quarterly. The last dividend per share was 0.35 EUR. As of today, Dividend Yield (TTM)% is 2.08%. Tracking NIKE dividends might help you take more informed decisions.

NIKE dividend yield was 2.59% in 2024, and payout ratio reached 72.55%. The year before the numbers were 1.53% and 38.91% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 8, 2025, the company has 77.8 K employees. See our rating of the largest employees — is NIKE on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. NIKE EBITDA is 3.77 B EUR, and current EBITDA margin is 9.21%. See more stats in NIKE financial statements.

Like other stocks, 4NKE shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade NIKE stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So NIKE technincal analysis shows the neutral today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating NIKE stock shows the sell signal. See more of NIKE technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.