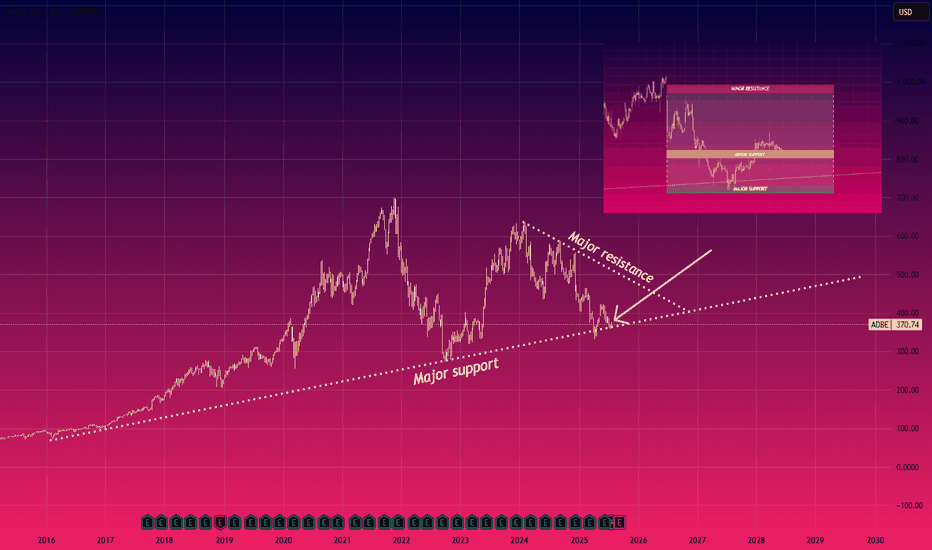

Bottom Feeding - Opportunity?Adobe is sitting on two areas of support - an 11 year old trendline and the 0.786 Fibonacci. It looks like it's coiling up in a giant triangle. This is a steadily growing business with a very sticky product suite. Whilst everyone is falling over themselves to buy Figma at $110, I think it's time to

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

13.85 EUR

5.26 B EUR

20.35 B EUR

422.72 M

About Adobe Inc.

Sector

Industry

CEO

Shantanu Narayen

Website

Headquarters

San Jose

Founded

1982

FIGI

BBG000C2WLP2

Adobe, Inc. is a global technology company, which engages in the provision of digital marketing and media solutions. It operates through the following segments: Digital Media, Digital Experience, and Publishing and Advertising. The Digital Media segment offers products and services that enable individuals, teams, businesses, and enterprises to create, publish, and promote content anywhere and accelerate productivity by transforming view, share, engage with and collaborate on documents and creative content. The Digital Experience segment focuses on integrated platform and set of products, services, and solutions that enable businesses to create, manage, execute, measure, monetize, and optimize customer experiences that span from analytics to commerce. The Publishing and Advertising segment includes legacy products and services that address diverse market opportunities, including eLearning solutions, technical document publishing, web conferencing, document and forms platform, web app development, high-end printing, and Adobe Advertising offerings. The company was founded by Charles M. Geschke and John E. Warnock in December 1982 and is headquartered in San Jose, CA.

Related stocks

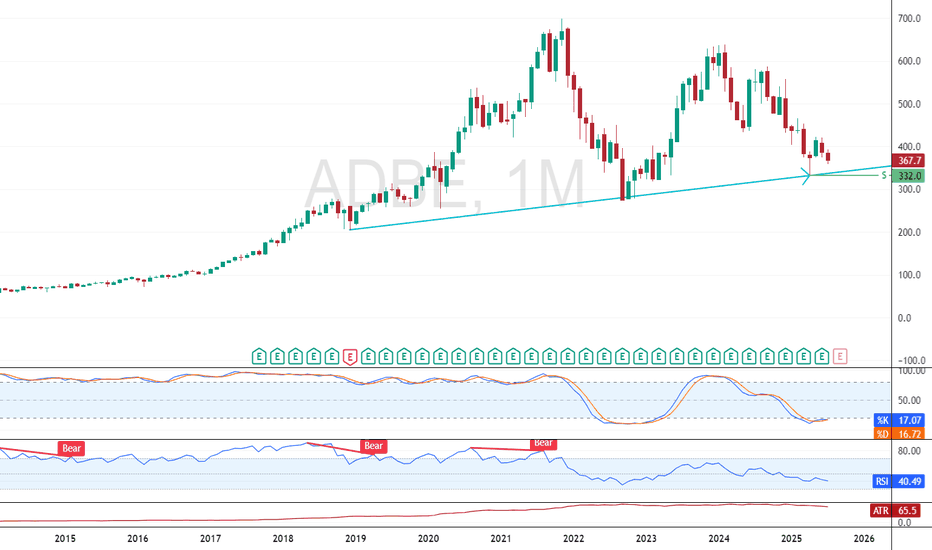

Adobe Wave Analysis – 1 August 2025- Adobe broke the key support level 360.00

- Likely to fall to support level 335.00

Adobe recently broke below the key support level 360.00 (which stopped the previous minor impulse wave i at the start of July).

The breakout of the support level 360.00 accelerated the active impulse wave C of the

L: Quick Analysis on $NASDAQ:ADBE Support and ResistanceQuick Analysis on NASDAQ:ADBE Support and Resistance

The chart shows NASDAQ:ADBE nearing a major support level around $370, Which has held since 2016, the downward resistance line suggests continued pressure, but a breakout above $400 levels could signal a bullish reversal

Please note this

Adobe - A gigantic triangle breakout! 🔋Adobe ( NASDAQ:ADBE ) will break the triangle:

🔎Analysis summary:

Yes, for the past five years Adobe has been overall consolidating. But this consolidation was governed by a strong symmetrical triangle pattern. Thus following the underlying uptrend, there is already a higher chance that we w

ADOBE MONEY SNATCH! High-Reward Long Setup (Police Trap Alert!)🚨 ADOBE HEIST ALERT: Bullish Bank Robbery Plan! (High-Risk, High-Reward Loot) 🚨

🌟 ATTENTION, MARKET PIRATES & MONEY SNATCHERS! 🌟

(Hola! Bonjour! Marhaba! Hallo!)

🔥 THIEF TRADING STRATEGY 🔥 – ADOBE INC. (ADBE) is primed for a bullish heist! Time to steal profits like a pro!

🔓 ENTRY POINT: "BREAK TH

The only way is down (Otis Clay, inverted)!NASDAQ:ADBE has been in a steady decline since Sept 24. It jumped prior to earnings in Dec 24, only to get hammered back down immediately after release. Since, it has been a sad show. The trend is down. Price has declined over time, MACD is negative, RSI has crossed negative, price is below 100 and

Adobe Wave Analysis – 18 June 2025- Adobe broke support zone

- Likely to fall to support level 364.90

Adobe recently broke through the support zone located between the support level 392.85 (which stopped wave A at the end of May) and the 61.8% Fibonacci correction of the upward impulse (1) from April.

The breakout of this support

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ADBE5784629

Adobe Inc. 4.95% 04-APR-2034Yield to maturity

4.54%

Maturity date

Apr 4, 2034

ADBE5981558

Adobe Inc. 5.3% 17-JAN-2035Yield to maturity

4.53%

Maturity date

Jan 17, 2035

US724PAD1

ADOBE 20/30Yield to maturity

4.28%

Maturity date

Feb 1, 2030

ADBE5981252

Adobe Inc. 4.95% 17-JAN-2030Yield to maturity

4.01%

Maturity date

Jan 17, 2030

US724PAC3

ADOBE 20/27Yield to maturity

4.00%

Maturity date

Feb 1, 2027

ADBE5784440

Adobe Inc. 4.8% 04-APR-2029Yield to maturity

3.94%

Maturity date

Apr 4, 2029

ADBE5784439

Adobe Inc. 4.85% 04-APR-2027Yield to maturity

3.89%

Maturity date

Apr 4, 2027

ADBE5981557

Adobe Inc. 4.75% 17-JAN-2028Yield to maturity

3.88%

Maturity date

Jan 17, 2028

See all ADB bonds

Curated watchlists where ADB is featured.

Frequently Asked Questions

The current price of ADB is 294.00 EUR — it has increased by 0.02% in the past 24 hours. Watch ADOBE INC. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange ADOBE INC. stocks are traded under the ticker ADB.

ADB stock has fallen by −7.47% compared to the previous week, the month change is a −8.24% fall, over the last year ADOBE INC. has showed a −35.24% decrease.

We've gathered analysts' opinions on ADOBE INC. future price: according to them, ADB price has a max estimate of 529.95 EUR and a min estimate of 245.27 EUR. Watch ADB chart and read a more detailed ADOBE INC. stock forecast: see what analysts think of ADOBE INC. and suggest that you do with its stocks.

ADB stock is 1.33% volatile and has beta coefficient of 0.96. Track ADOBE INC. stock price on the chart and check out the list of the most volatile stocks — is ADOBE INC. there?

Today ADOBE INC. has the market capitalization of 124.26 B, it has decreased by −2.03% over the last week.

Yes, you can track ADOBE INC. financials in yearly and quarterly reports right on TradingView.

ADOBE INC. is going to release the next earnings report on Sep 10, 2025. Keep track of upcoming events with our Earnings Calendar.

ADB earnings for the last quarter are 4.46 EUR per share, whereas the estimation was 4.38 EUR resulting in a 1.75% surprise. The estimated earnings for the next quarter are 4.48 EUR per share. See more details about ADOBE INC. earnings.

ADOBE INC. revenue for the last quarter amounts to 5.18 B EUR, despite the estimated figure of 5.11 B EUR. In the next quarter, revenue is expected to reach 5.11 B EUR.

ADB net income for the last quarter is 1.49 B EUR, while the quarter before that showed 1.75 B EUR of net income which accounts for −14.62% change. Track more ADOBE INC. financial stats to get the full picture.

No, ADB doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 5, 2025, the company has 30.71 K employees. See our rating of the largest employees — is ADOBE INC. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ADOBE INC. EBITDA is 8.11 B EUR, and current EBITDA margin is 40.74%. See more stats in ADOBE INC. financial statements.

Like other stocks, ADB shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ADOBE INC. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ADOBE INC. technincal analysis shows the strong sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ADOBE INC. stock shows the sell signal. See more of ADOBE INC. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.