Key facts today

Morgan Stanley may benefit from a proposed cut in the enhanced supplementary leverage ratio by the Federal Reserve, aimed at reducing capital requirements and boosting Treasury market activity.

Morgan Stanley is in talks with officials in Republican states over claims of political bias in its practices, especially concerning gun and fossil fuel companies, amid state blacklists.

On June 25, 2025, Morgan Stanley was named Coordinating Stabilisation Manager for Aktiebolaget Svensk Exportkredit's securities offer, overseeing market price support during the stabilisation period.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

7.98 EUR

12.93 B EUR

103.74 B EUR

1.23 B

About Morgan Stanley

Sector

Industry

CEO

Edward N. Pick

Website

Headquarters

New York

Founded

1924

FIGI

BBG000BLX7W3

Morgan Stanley operates as a global financial services company. The firm provides investment banking products and services to its clients and customers including corporations, governments, financial institutions, and individuals. It operates through the following segments: Institutional Securities, Wealth Management, and Investment Management. The Institutional Services segment provides financial advisory, capital-raising services, and related financing services on behalf of institutional investors. The Wealth Management segment offers brokerage and investment advisory services covering various types of investments, including equities, options, futures, foreign currencies, precious metals, fixed-income securities, mutual funds, structured products, alternative investments, unit investment trusts, managed futures, separately managed accounts, and mutual fund asset allocation programs. The Investment Management segment provides equity, fixed income, alternative investments, real estate, and merchant banking strategies. The company was founded by Harold Stanley and Henry S. Morgan in 1924 and is headquartered in New York, NY.

Related stocks

Morgan Stanley (NYSE: MS) Reports Strong Q125 ResultsMorgan Stanley (NYSE: NYSE:MS ) Beats Q1 estimates with record Equity Trading Revenue. The bank posted earnings per share (EPS) of $2.60, beating analyst expectations of $2.18. Revenue reached a record $17.74 billion, topping forecasts of $16.44 billion.

The bank's equity trading revenue soared 45

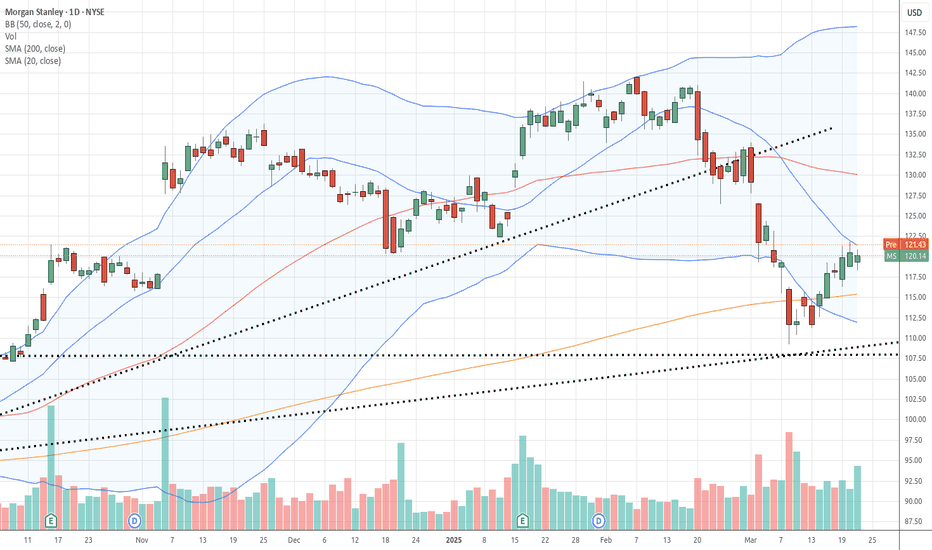

Playing off the potential false breakout?Morgan Stanley's chart is at a critical juncture. After a slide in a descending channel, it briefly poked its head above, but that breakout looks shaky! Now it's dancing around the $115 support zone. A solid hold here, and we might see a bounce. But if that support caves? Watch out for further downs

Morgan Stanley Correction. MSOur last take on MS was dead on and quite profitable. The idea will be linked to this one. ABC zigzag, now impulsing down in C wave. Indicator below are bearish but quite choppy, making meaningful interpretation difficult. Price action, MIDAS cross and behavior of vWAP/US duo are key factors in this

The Last Step Of The 3 Step System ExplainedLook at this chart what do you see?

Yesterday I felt happy because for the first

time even if am broke I get to see the

light of a negative situation

to be esteemed is more important

than gold and silver.

Sometimes all you need is to be

Motivated so that no matter what you

are going through in

Morgan Stanley, can we follow up on great earnings call?Hi guys, we are next looking into Morgan Stanley. Currently they had a fantastic 2024 , with great growth and great beat over their earnings calls.

Fundamental overview :

Morgan Stanley has adopted a bullish stance on U.S. equities, forecasting the S&P 500 to potentially reach 7,400 by 2025. This

Morgan Stanley Wave Analysis – 30 January 2025

- Morgan Stanley is rising inside impulse wave iv

- Likely to rise to the resistance level of 145.00

Morgan Stanley continues to rise inside the minor impulse wave iv, which started earlier from the key support level of 135.00 (the former monthly high from November), acting as support after it was

Morgan Stanley Breaks Free A Bullish Wedge Reversal in ActionMorgan Stanley (MS) on the 4-hour chart has confirmed a breakout from a descending wedge pattern, signaling a strong bullish reversal. The breakout is accompanied by increased momentum, as indicated by the clean surge above the wedge’s upper boundary. This setup is a classic reversal signal, with bu

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

M

MS5169549

Morgan Stanley Finance LLC 0.0% 30-APR-2031Yield to maturity

102.10%

Maturity date

Apr 30, 2031

M

MS4685759

Morgan Stanley Finance LLC 0.0% 29-SEP-2028Yield to maturity

92.20%

Maturity date

Sep 29, 2028

M

MS4855431

Morgan Stanley Finance LLC 0.0% 31-JUL-2029Yield to maturity

71.51%

Maturity date

Jul 31, 2029

M

MS5276420

Morgan Stanley Finance LLC 0.0% 03-NOV-2025Yield to maturity

36.88%

Maturity date

Nov 3, 2025

M

FR0013328002

MorganStanleyCo 11/06/2026 Bkt of SharesYield to maturity

22.81%

Maturity date

Jun 11, 2026

See all DWD bonds

Curated watchlists where DWD is featured.

Frequently Asked Questions

The current price of DWD is 116.62 EUR — it has increased by 0.96% in the past 24 hours. Watch MORGAN STANLEY DL-,01 stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange MORGAN STANLEY DL-,01 stocks are traded under the ticker DWD.

DWD stock has risen by 3.21% compared to the previous week, the month change is a 3.52% rise, over the last year MORGAN STANLEY DL-,01 has showed a 28.93% increase.

We've gathered analysts' opinions on MORGAN STANLEY DL-,01 future price: according to them, DWD price has a max estimate of 134.40 EUR and a min estimate of 88.74 EUR. Watch DWD chart and read a more detailed MORGAN STANLEY DL-,01 stock forecast: see what analysts think of MORGAN STANLEY DL-,01 and suggest that you do with its stocks.

DWD stock is 0.70% volatile and has beta coefficient of 0.09. Track MORGAN STANLEY DL-,01 stock price on the chart and check out the list of the most volatile stocks — is MORGAN STANLEY DL-,01 there?

Today MORGAN STANLEY DL-,01 has the market capitalization of 185.21 B, it has increased by 2.79% over the last week.

Yes, you can track MORGAN STANLEY DL-,01 financials in yearly and quarterly reports right on TradingView.

MORGAN STANLEY DL-,01 is going to release the next earnings report on Jul 16, 2025. Keep track of upcoming events with our Earnings Calendar.

DWD earnings for the last quarter are 2.40 EUR per share, whereas the estimation was 2.04 EUR resulting in a 17.84% surprise. The estimated earnings for the next quarter are 1.77 EUR per share. See more details about MORGAN STANLEY DL-,01 earnings.

MORGAN STANLEY DL-,01 revenue for the last quarter amounts to 16.40 B EUR, despite the estimated figure of 15.29 B EUR. In the next quarter, revenue is expected to reach 13.89 B EUR.

DWD net income for the last quarter is 3.99 B EUR, while the quarter before that showed 3.59 B EUR of net income which accounts for 11.17% change. Track more MORGAN STANLEY DL-,01 financial stats to get the full picture.

Yes, DWD dividends are paid quarterly. The last dividend per share was 0.82 EUR. As of today, Dividend Yield (TTM)% is 2.76%. Tracking MORGAN STANLEY DL-,01 dividends might help you take more informed decisions.

MORGAN STANLEY DL-,01 dividend yield was 2.82% in 2024, and payout ratio reached 44.68%. The year before the numbers were 3.49% and 62.71% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jun 25, 2025, the company has 80 K employees. See our rating of the largest employees — is MORGAN STANLEY DL-,01 on this list?

Like other stocks, DWD shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MORGAN STANLEY DL-,01 stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So MORGAN STANLEY DL-,01 technincal analysis shows the strong buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating MORGAN STANLEY DL-,01 stock shows the strong buy signal. See more of MORGAN STANLEY DL-,01 technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.