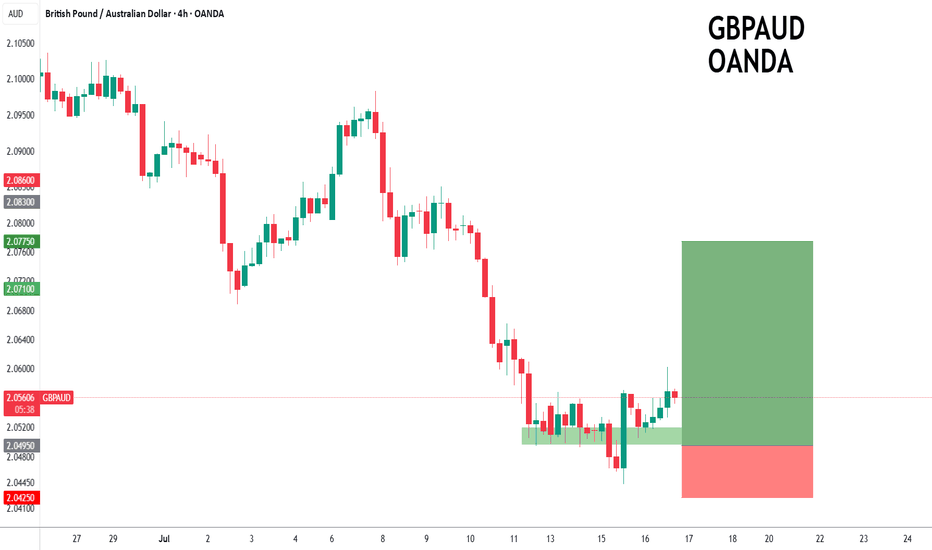

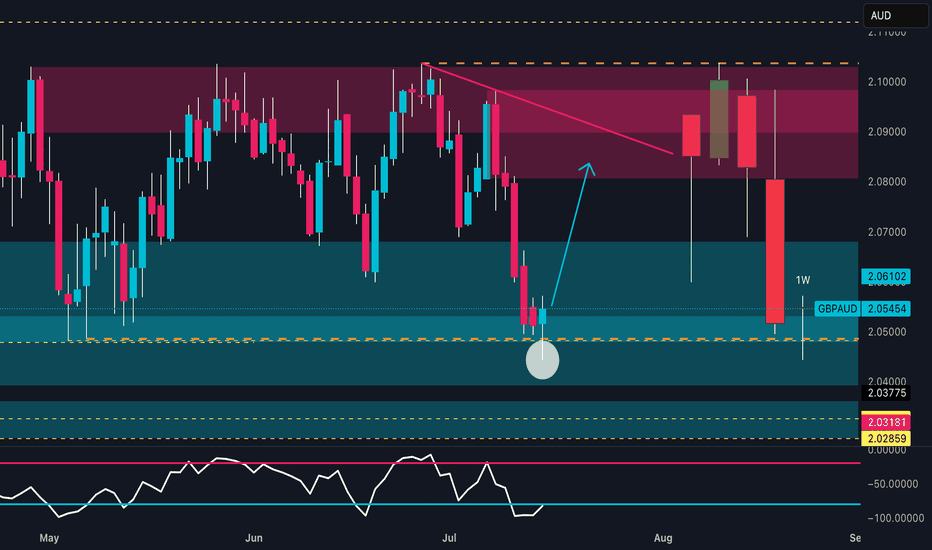

GBPAUD to turnaround?GBPAUD - 24h expiry

The primary trend remains bullish.

Price action looks to be forming a bottom.

We look for a temporary move lower.

Preferred trade is to buy on dips.

Bespoke support is located at 2.0495.

We look to Buy at 2.0495 (stop at 2.0425)

Our profit targets will be 2.0775 and 2.082

About British Pound / Australian Dollar

The British Pound vs. the Australian Dollar. Due to its relatively higher interest rates and its correlation to global equity markets, the Australian Dollar is often referred to as a risk currency. Mining, which is Australia’s largest economy sector, has been negatively affected by a slowdown in the global commodity super cycle and a decline in China’s growth.

Related currencies

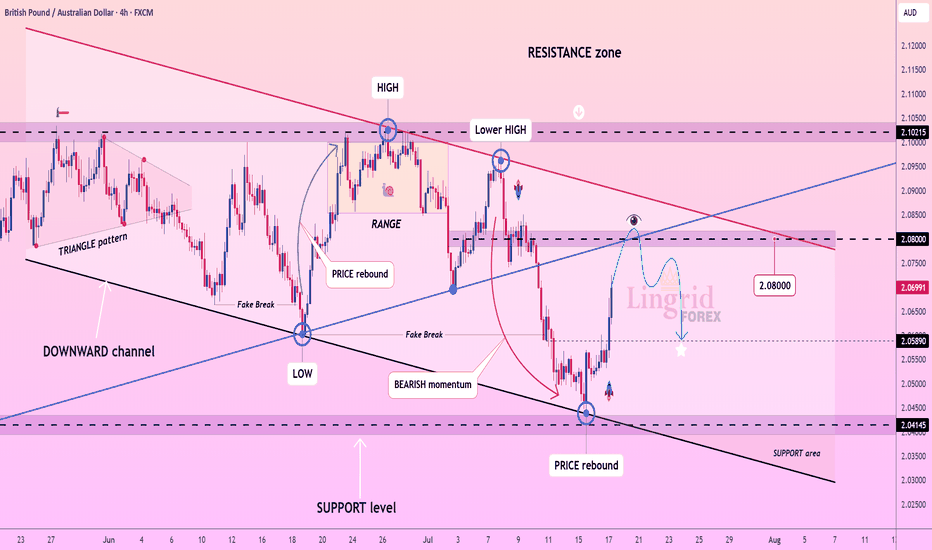

Lingrid | GBPAUD Selling Opportunity From the Key LevelFX:GBPAUD rebounded sharply from the key support zone near 2.0415, forming a corrective leg toward the mid-range resistance at 2.0800. However, the overall structure remains within a downward channel, and the recent lower high under the red resistance trendline suggests continuation of bearish pres

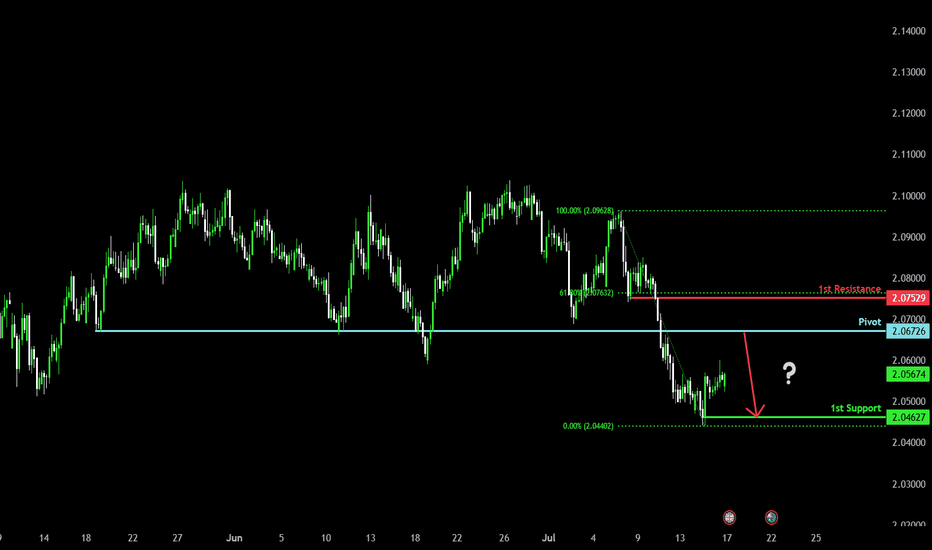

Heading into major resistance?GBP/AUD is rising towards the pivot which is a pullback resistance and could reverse to the 1st support which is a pullback support.

Pivot: 2.0672

1st Support: 2.0462

1st Resistance: 2.0752

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trad

GBPAUD - Trading The Range - AGAIN!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GBPAUD has been hovering within a big range.

Last week, as per our previous analysis, GBPAUD rejected the upper bound of the range and traded lower.

This week, GA is retesting the lower bound of the range a

MarketBreakdown | GBPAUD, WTI CRUDE OIL, US30, US100

Here are the updates & outlook for multiple instruments in my watch list.

1️⃣ #GBPAUD daily time frame 🇬🇧🇦🇺

The market is trading within a wide horizontal parallel channel.

The price is stuck on its support.

Probabilities will be high that the market will start growing from that.

Alternative

GBPAUD: Weekly Reversal | COT & Seasonality Support Bullish📊 Technical Outlook

Price strongly reacted from a key weekly demand zone between 2.0400 and 2.0500, showing clear absorption of bearish pressure. The RSI is rebounding from the 30 area, signaling early reversal potential.

The next technical target lies between 2.08900 and 2.10000, within a well-defi

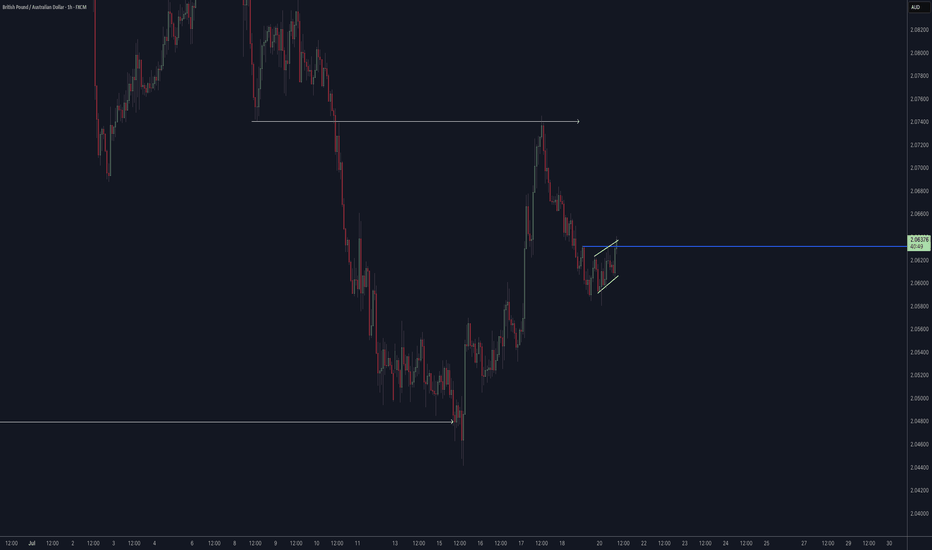

GBPAUD Long Trade OANDA:GBPAUD Long Trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

Note: Manage your risk yourself, its risky trade, see how much your can risk yourself on this trade.

Use proper risk management

Looks like good trade.

Lets mo

GBP/AUD Ready To Go Up After Melted , 2 Entries Valid !Here is my GBP/AUD 1H Chart and this is my opinion , the price moved very hard to downside without any correction and the price at strong support now 2.05000 which is forced the price many times to go up , so it`s my best place to enter a buy trade , and if you checked the chart you will see the pri

GBPAUD's wide trading range remains intact✏️GBPAUD is trading in a wide range. After the increase on Friday, the pair is retesting the support zone breaking past resistance. And the current reaction point also coincides with the 20 SMA. There is not much momentum for the pair to break out of the wide trading range, so buying the pair to the

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of GBPAUD is 2.06654 AUD — it has increased by 0.01% in the past 24 hours. See more of GBPAUD rate dynamics on the detailed chart.

The value of the GBPAUD pair is quoted as 1 GBP per x AUD. For example, if the pair is trading at 1.50, it means it takes 1.5 AUD to buy 1 GBP.

The term volatility describes the risk related to the changes in an asset's value. GBPAUD has the volatility rating of 0.48%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The GBPAUD showed a 0.31% rise over the past week, the month change is a −0.86% fall, and over the last year it has increased by 6.91%. Track live rate changes on the GBPAUD chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

GBPAUD is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade GBPAUD right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with GBPAUD technical analysis. The technical rating for the pair is sell today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the GBPAUD shows the buy signal, and 1 month rating is buy. See more of GBPAUD technicals for a more comprehensive analysis.