Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

5.3 PLN

6.79 B PLN

106.70 B PLN

1.61 B

About Advanced Micro Devices Inc

Sector

Industry

CEO

Lisa T. Su

Website

Headquarters

Santa Clara

Founded

1969

FIGI

BBG01R39RCR1

Advanced Micro Devices, Inc. engages in the provision of semiconductor businesses. It operates through the following segments: Data Center, Client, Gaming, and Embedded. The Data Center segment includes server-class CPUs, GPUs, AI accelerators, DPUs, FPGAs, SmartNICs, and Adaptive SoC products. The Client segment refers to the computing platforms, which are a collection of technologies that are designed to work together to provide a more complete computing solution. The Gaming segment is a fundamental component across many products and can be found in APU, GPU, SoC or a combination of a discrete GPU with another product working in tandem. The Embedded segment focuses on the embedded CPUs, GPUs, APUs, FPGAs, and Adaptive SoC products. The company was founded by W. J. Sanders III on May 1, 1969 and is headquartered in Santa Clara, CA.

Related stocks

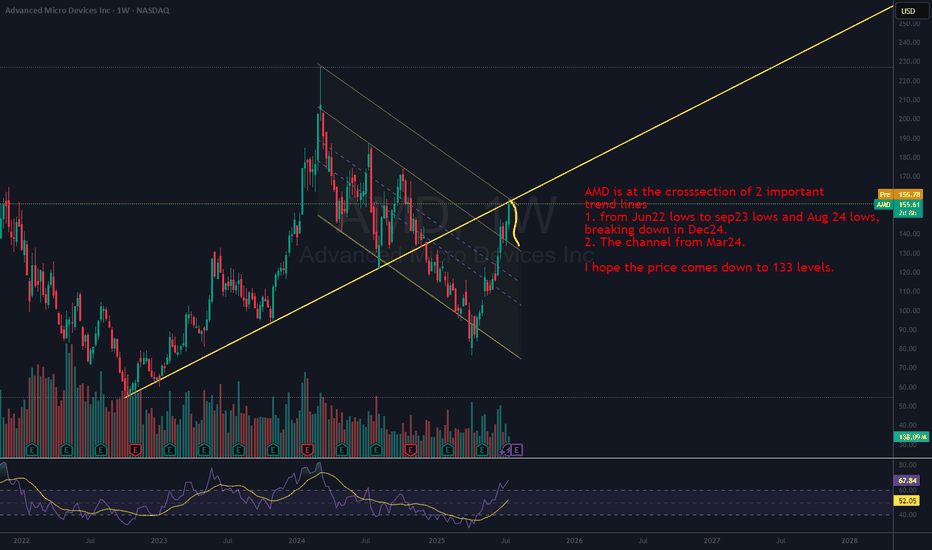

Trading Thesis: Silicon Whiplash – AMD Coiling for a Re-Launch🧠 Trading Thesis: “Silicon Whiplash – AMD Coiling for a Re-Launch to $164+?”

📉 Ticker: NASDAQ:AMD

🗓️ Timeframe: Daily (1D)

📍 Current Price: $144.42

📈 Fibonacci Expansion Target: $164.54 (1.236 extension), $174.98 (1.382 extension)

📉 Support Zone: $120.78

🔭 Play Duration: 2–4 weeks (event-based str

Advanced Micro Devices | AMD | Long at $126.00Advanced Micro Devices NASDAQ:AMD may be the sleeping giant in the semiconductor / AI space. While all eyes on NVidia NASDAQ:NVDA , earnings for NASDAQ:AMD grew by 800% over the past year... and are now forecast to grow 40% per year. Any other company would be soaring right now (like NVidia),

7/15 AMD short AMD just reached a major resistance level and is expected to pull back toward the $135 area. While it may not signal a full trend reversal, a retracement from today’s high is likely.

If the 7/15 candle forms a red shooting star, it would provide further confirmation.

May the trend be with you.

Must go down to go upI think AMD needs to cool off before it continues further, possibly tapping $160 first before a serious correction. Targets are listed at the strong support ending at $120. RSI printing bearish divergence on multiple time frames

Look at the red line, look at the direction of price. It's still a dow

AMD new range higherAMD essentially hit my buy zone that I called months ago almost to the T. Now with renewed strength and the market realizing there is share for both NVDA and AMD, the stock rips. I believe it will push up into this zone over the next week weeks and consolidate here. I am not currently in this trade

Safe Entry Zone AMDPrice Rejected From Resistance.

Safe Entry Green Zone.

Target after that 162$ price level.

Note: 1- Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Z

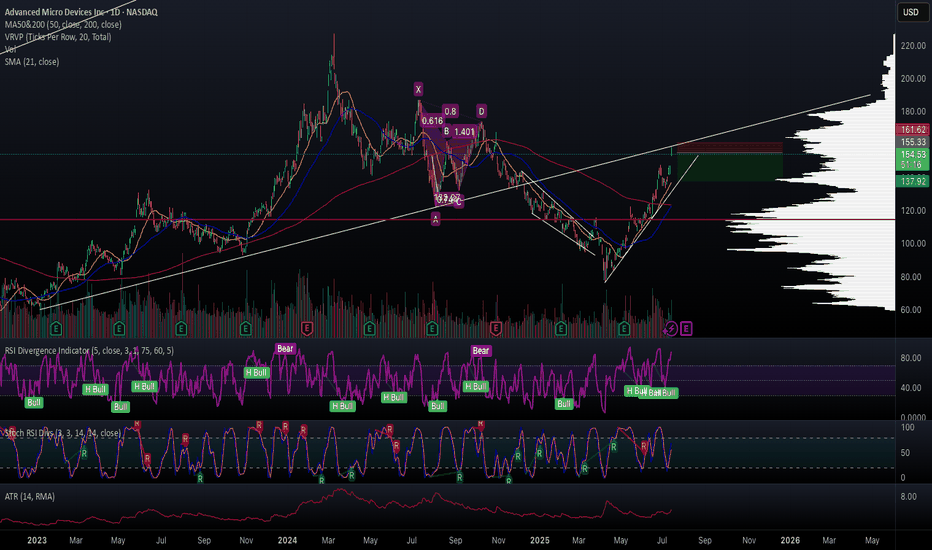

How 3 Bullish Timeframe Signals Suggest a Buy Opportunity on AMDHow 3 Bullish Timeframe Signals Suggest a Buy Opportunity on AMD Stock

AMD stock has flashed a compelling multi-timeframe buy signal based on a weekly breakout, daily reversal, and 4H stochastic

momentum shift—all aligned with the 50 and 200 EMA and Stochastic RSI indicators.

---

Advanced Mic

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

AMD5426832

Advanced Micro Devices, Inc. 4.393% 01-JUN-2052Yield to maturity

6.18%

Maturity date

Jun 1, 2052

AMD5426831

Advanced Micro Devices, Inc. 3.924% 01-JUN-2032Yield to maturity

4.78%

Maturity date

Jun 1, 2032

AMD6026360

Advanced Micro Devices, Inc. 4.319% 24-MAR-2028Yield to maturity

4.22%

Maturity date

Mar 24, 2028

AMD6026359

Advanced Micro Devices, Inc. 4.212% 24-SEP-2026Yield to maturity

4.14%

Maturity date

Sep 24, 2026

See all AMD bonds

Curated watchlists where AMD is featured.

Frequently Asked Questions

The current price of AMD is 595.6 PLN — it has decreased by −1.67% in the past 24 hours. Watch ADVANCED stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on GPW exchange ADVANCED stocks are traded under the ticker AMD.

AMD stock has risen by 12.05% compared to the previous week, the month change is a 31.30% rise, over the last year ADVANCED has showed a 3.22% increase.

We've gathered analysts' opinions on ADVANCED future price: according to them, AMD price has a max estimate of 732.49 PLN and a min estimate of 347.93 PLN. Watch AMD chart and read a more detailed ADVANCED stock forecast: see what analysts think of ADVANCED and suggest that you do with its stocks.

AMD stock is 5.51% volatile and has beta coefficient of 2.12. Track ADVANCED stock price on the chart and check out the list of the most volatile stocks — is ADVANCED there?

Today ADVANCED has the market capitalization of 950.61 B, it has increased by 11.80% over the last week.

Yes, you can track ADVANCED financials in yearly and quarterly reports right on TradingView.

ADVANCED is going to release the next earnings report on Aug 5, 2025. Keep track of upcoming events with our Earnings Calendar.

AMD earnings for the last quarter are 3.72 PLN per share, whereas the estimation was 3.66 PLN resulting in a 1.64% surprise. The estimated earnings for the next quarter are 1.72 PLN per share. See more details about ADVANCED earnings.

ADVANCED revenue for the last quarter amounts to 28.82 B PLN, despite the estimated figure of 27.61 B PLN. In the next quarter, revenue is expected to reach 26.76 B PLN.

AMD net income for the last quarter is 2.75 B PLN, while the quarter before that showed 1.99 B PLN of net income which accounts for 37.74% change. Track more ADVANCED financial stats to get the full picture.

No, AMD doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 17, 2025, the company has 28 K employees. See our rating of the largest employees — is ADVANCED on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ADVANCED EBITDA is 23.16 B PLN, and current EBITDA margin is 20.11%. See more stats in ADVANCED financial statements.

Like other stocks, AMD shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ADVANCED stock right from TradingView charts — choose your broker and connect to your account.