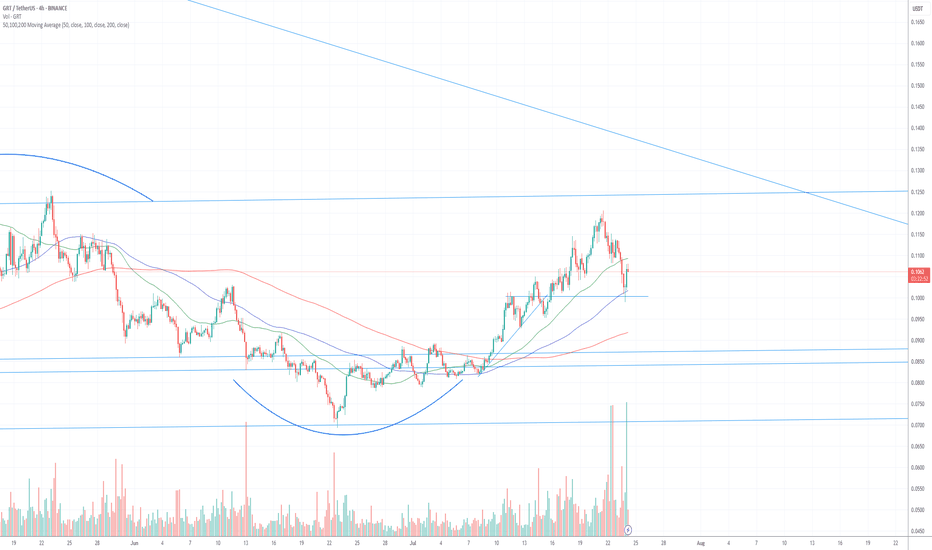

GRT Short Term BullishOverall this crypto is very weak. Most alts are weak, with few exceptions. The Graph has actually been non-stop building even though the coin has bled out for 4+ years. I doubt the long-term trend is bullish, but on the short term, it looks like a standard head and shoulders pattern on the 1-hour. On the 4-hour we have a golden cross - although every other time frame is so bearish.

I started buying some on the left shoulder while it fell in the target zone; I loaded the trade fully on 40x leverage after the right shoulder completed and broker through the zone of resistance.

Looking to see a break of $0.13, which is the top of the head pattern. If we see blow off top in crypto, it should break through decisively over the next 30 days and we could see low .20s

Anything is possible but I may be out of this trade by the time you read this. Not Financial Advice. Probably completely random nonsense.

GRTUSDT.P trade ideas

GRT. USDTThe Graph(GRT) is a Web 3 project that is used to search data from other platforms, such as Ethereum.

Similarly, AI (Artificial intelligence) developers can use it to promote their services.

And it has been in a neutral trend for a long time after a sharp correction.

Therefore, the probability of price growth of this project is very high.

The first target is $0.2.

The next targets are $0.5 and $1.

Nice Bounce for GRT - What's next? *4 Hour Charting*I re-entered a trade at the 50ma (on the 4-hour) for a significantly smaller position than my previous trade where I went 40x long. There is no leverage here - not because I lack confidence in the trade, but because risk management is the single most important think you can do to protect yourself... and the best way to risk manage is to POSITION SIZE CORRECTLY.

I bought a traunch (about 1/6 the size of my 40x trade), using all of the profits from from my prior trade. I entered at .102 and feel pretty confident we won't go lower. Thus far we have seen a 7% bounce off the 100ma retest.

If we go lower, the 200ma will act as major support around 0.092 ... If that happened, I would probably re-enter on leverage knowing that this is going to re-test the .12-.13 level again.

Something to note... other coins got crushed much harderr and have yet to rebound...

GRT's rebound shows relative strength - and the higher than normal volume supports his thesis.

Short-Term capitulation likely occurred today with people taking profits and avoiding additional risk.

I will exit this trade on a retest of .12, but as you all know, the more we re-test, the higher the probability we break through it, so I might not actually exit the trade depending on the price action. The longer it takes to hit .12, the less likely I am to close the trade. If we see a re-test to the upside in the next 72-hours, I would likely exit this particular trade.

I have a large core position here that I've been holding since 2021 that I don't intend to sell until we see alt-season in full bloom

GRT/USDT Short Setup – Fib Reversal Play + Divergence Signals Targeting a short entry on GRT/USDT after key signs of exhaustion and overextension.

🔹 Fib Tool anchored from local bottom at ~$0.08185 to top ~$0.10015

🔹 Currently testing 0.236 retracement at ~$0.09650 after rejection near top of BB

🔹 Bearish divergence forming on RSI (Lower High) vs. price (Higher High)

🔹 MACD histogram flipping red, signal line curling

🔹 Volume declining, suggesting weakness in bullish momentum

🔹 Entry just under $0.097 with tight SL at ~$0.101 (above previous wick)

TP Zones:

• 25% at 0.382 ($0.0910 / ~$0.0888)

• Optional deep catch at 0.786 if market momentum collapses

This idea is designed around structure breaks, mean reversion, and a weakening bullish impulse.

Always DYOR – sharing this for community refinement and feedback.

Is a Breakout Imminent for #GRT or Another Bull Trap is Ahead?Yello, Paradisers! Are we looking at a clean breakout setup that could send #GRT flying or is this the perfect trap to wipe out early bulls? Let's see the latest #GRTUSDT moves:

💎The daily chart on #GRTUSD is showing a perfectly formed descending channel, with price now hovering just above the lower boundary—a zone that has consistently held as strong descending support. After multiple rejections from the upper boundary and rebounds off the lower trendline, the price has now shown its first serious signs of momentum since bottoming in the strong demand zone

💎This structure has been in play since early May for #TheGraph, with each bounce from the support line giving temporary relief, only for the price to get slapped down at the descending resistance. But this most recent bounce looks different—it’s happening directly above a well-defined demand zone between $0.0668–$0.0700, a level that has historically attracted strong buyer interest.

💎A breakout above the descending resistance trendline, ideally with a strong daily close above $0.085–$0.090, would invalidate the bearish pressure and likely trigger a sharp leg up. The mid-term resistance sits around $0.1032, and clearing that would open the door to a retest of $0.1318, a level that previously acted as a strong rejection zone.

💎If the price fails to reclaim the descending channel and rolls over again, especially losing $0.0668 on a daily close, the bullish structure would be invalidated. That would shift focus toward the support zone at $0.053, and if that breaks, the next target becomes $0.0300—a brutal drop that would liquidate most late longs and signal deeper downside.

Stay disciplined. The next big opportunity will come to those who wait, not those who chase.

MyCryptoParadise

iFeel the success🌴

GRT/USDT at a Critical Point! Reversal Structure or Breakdown?📊 Full Technical Analysis – GRT/USDT (1W Timeframe)

🔎 Overview:

GRT is currently positioned at one of the most critical technical levels in its long-term structure. After a prolonged downtrend from the $2.88 all-time high, price is once again testing the historical demand zone between $0.07 – $0.09, which has repeatedly acted as a strong support level since mid-2022. This area represents a major accumulation zone, where smart money may be silently positioning.

🧠 Structure & Pattern Formation:

✅ Historical Demand Zone (Major Support Area):

The $0.07 – $0.09 range has been tested over 5 times in the last 2 years, showing strong demand.

This zone also acts as the potential base of a double bottom pattern, indicating a possible macro reversal.

🟡 Double Bottom Potential (Reversal Pattern):

Two nearly equal lows forming around this demand area hint at a classic double bottom formation.

Confirmation comes if price breaks and holds above $0.1281 resistance.

🔻 Declining Selling Pressure:

Sellers appear to be losing momentum, as seen in the declining weekly volume.

This could signal distribution is ending and accumulation is underway.

📈 Bullish Scenario:

If GRT holds this critical support and breaks above key resistance, a strong mid-term rally may follow:

1. Breakout Confirmation:

Valid if the weekly candle closes above $0.1281.

2. Upside Targets (Fibonacci + Historical Resistance):

🎯 $0.1868 → minor resistance / past consolidation zone.

🎯 $0.2402 → previous rejection area.

🎯 $0.3233 → key Fibonacci retracement level.

🎯 $0.4352 → strong horizontal resistance.

🎯 $0.5285 → mid-term bullish target.

3. Ideal Bullish Conditions:

Bullish divergence on the weekly RSI.

Increasing volume on breakout confirmation.

📉 Bearish Scenario:

If the support fails to hold, GRT could face further downside:

1. Breakdown Below $0.07 – $0.09 Zone:

⚠️ $0.0550 → minor support.

⚠️ $0.0300 → All-Time Low and psychological support.

2. Deeper Risk:

If panic selling occurs or broader market sentiment worsens, GRT may print new lows, continuing its long-term bearish trend.

🧭 Conclusion & Strategy:

> GRT is in a highly interesting accumulation phase from a technical perspective.

The risk-to-reward from this support zone is attractive, with signs of a potential reversal building. However, traders should wait for confirmation and always use proper risk management.

Entry Strategy:

Speculative entry: inside the $0.08–$0.09 zone (tight stop-loss below $0.07).

Confirmed entry: after breakout and weekly close above $0.1281 (targeting levels mentioned above).

#GRT #TheGraph #GRTUSDT #CryptoReversal #DoubleBottom #SupportZone #AltcoinSetup #BullishCrypto #BearishRisk #TechnicalAnalysis

GRT/USDT: The Graph's Phoenix Rising - A Technical Deep Dive🎯 The Trading Strategy : ⚠️ The Reality Check

Let's be honest - this trade isn't without risks...

Entry Strategy:

The Golden Support Zone : 0.05-0.055 (ALL TIME LOW levels)

⚡Target 1: $0.11

⚡Target 2: $0.13

⚡Target 3: midlle of 1W FVG

🔥 Risk/Reward: 4:1 🔥

_________________

Risk Management:

Stop Loss: 0.048 (Below major support)

Trade smart, trade safe, and may the charts be ever in your favor! 🚀

🚨 RISK WARNING 🛡️ DYOR 🚨 DISCLAIMER - JUST FOR EDUCATION PROPOSAL ⚠️

GRTUSDTCryptocurrency Futures Market Disclaimer 🚨🚨🚨

Trading cryptocurrency futures involves high risks and is not suitable for all investors.

Cryptocurrency prices are highly volatile, which can lead to significant gains or losses in a short period.

Before engaging in crypto futures trading, consider your risk tolerance, experience, and financial situation.

Risk of Loss: You may lose more than your initial capital due to the leveraged nature of futures. You are fully responsible for any losses incurred.

Market Volatility: Crypto prices can fluctuate significantly due to factors such as market sentiment, regulations, or unforeseen events.

Leverage Risk: The use of leverage can amplify profits but also increases the risk of total loss.

Regulatory Uncertainty: Regulations related to cryptocurrencies vary by jurisdiction and may change, affecting the value or legality of trading.

Technical Risks: Platform disruptions, hacking, or technical issues may result in losses.

This information is not financial, investment, or trading advice. Consult a professional financial advisor before making decisions. We are not liable for any losses or damages arising from cryptocurrency futures trading.

Note: Ensure compliance with local regulations regarding cryptocurrency trading in your region.

thanks for like and follow @ydnldn

The altcoin cycle is loading… don’t get caught chasing!Why It Might Be a Good Time to Start Building Your Nest Now 🥚🐣💸

If history’s taught us anything, it’s this: the best opportunities usually show up before everyone’s talking about them. 📈 Every cycle, whether it’s stocks, crypto, or real estate, rewards the people who start stacking early, not the ones waiting for a perfect moment (spoiler: it rarely comes).

A lot of people sit on the sidelines thinking they’ll “jump in later” … but by the time it feels safe, the big moves have usually already happened. 👀💨

Of course, this isn’t financial advice, just something to think about. 🤝 The ones who build their nest patiently, stay consistent, and prepare ahead of time tend to be the ones who win when the cycle really kicks off. 🛠️

Moral of the story: Start now, stay ready. Your future self will thank you. 🚀🫡

Maintaining support is necessary, not essential, for the climb.Hello friends🙌

🔊Given the price drop, you can see that the support we identified has worked well for you so far and buyers have supported the price.

Now, given the heavy price drop and disappointment in the market, we can expect a rise until the targets are set.

Don't forget capital and risk management, friends.🙏

🔥Join us for more signals🔥

*Trade safely with us*

GRT | Altcoins | MASSIVE UPSIDE Potential on The GraphAnother altcoin that has great upside potential is the Graph BINANCE:GRTUSDT

The Graph from a weekly perspective may seem like there's not much action, but if you zoon in to the daily timeframe we see a different picture.

WEEKLY:

VS DAILY:

We can see anything from a +40% increase to a -30% dip in just a few days; a picture that is lost when we look at the weekly. This is IDEAL for swing trading.

Once you've established the general direction from the MACRO, swing trades become very viable (spot). If your patient enough to wait for a few days, a +30% could easily be achieved within a two week timespan.

______________________

BINANCE:GRTUSDT

GRTUSDT: Trend in daily time frameThe color levels are very accurate levels of support and resistance in different time frames, and we have to wait for their reaction in these areas.

So, Please pay special attention to the very accurate trend, colored levels, and you must know that SETUP is very sensitive.

Be careful

BEST

MT

GRTUSDT 1D#GRT is moving inside a Descending Broadening Wedge on the daily chart and is now on the verge of breaking out above both the EMA100 and the wedge resistance. 📈

In case of a successful breakout, the targets are:

🎯 $0.1330

🎯 $0.1742

🎯 $0.2076

🎯 $0.2409

🎯 $0.2883

⚠️ Don’t forget to use a tight stop-loss to manage risk effectively.

GRT Analysis (12H)From the point where we placed the red arrow on the chart, it seems that a large-degree triangle on the GRT chart has completed, and we are now in a new wave sequence.

In these new downward waves, wave A/W has completed, and it now appears we are in the middle of wave B/X.

We are looking for a rebuy opportunity around the green zone.

It is expected that during the middle of wave B/X, there will be a correction down toward the green zone, followed by an upward move to continue wave B/X.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

$GRT Head & Shoulders breakoutJSE:GRT Classic inverse

Head & Shoulders breakout on BINANCE:GRTUSDT

A strong 6h formation just confirmed with price breaking through neckline resistance around 0.111.

Targeting a potential 60% move towards 0.18 based on measured move projection! 🚀

The chart says it all

DYRO, NFA