KE Holdings (BEKE) – Transforming China’s Real Estate MarketCompany Overview:

KE Holdings NYSE:BEKE is revolutionizing real estate with its hybrid digital-physical platform, leveraging strategic backing from Tencent (8% voting power).

Key Catalysts:

Strong Financial & Earnings Growth 💰

Analysts project 20.9% annual earnings growth and 26.7% EPS increase

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.40 HKD

4.41 B HKD

101.33 B HKD

2.09 B

About KE HOLDINGS INC

Sector

Industry

CEO

Yongdong Peng

Website

Headquarters

Beijing

Founded

2018

FIGI

BBG0178BHH86

KE Holdings, Inc. engages in the provision of an integrated online and offline platform for housing transactions and services through its subsidiaries. It operates under the following segments: Existing Home Transaction Services, New Home Transaction Services, Home Renovation and Furnishing, and Emerging and Other Services. The Existing Home Transaction Services segment provides services in existing home market. The New Home Transaction Services segment consists of new home transaction services in new home market. The Home Renovation and Furnishing segment provides a one-stop solution to give housing customers access to a comprehensive range of home renovation and furnishing, ranging from interior design, renovation, re-modeling, furnishing, supplies, to after-sales maintenance and repair. The Emerging and Other Services segment includes rental property management service business, financial service business, and other newly developed businesses. The company was founded by Hui Zou, Yongdong Peng, and Shan Yi Gang on July 6, 2018 and is headquartered in Beijing, China.

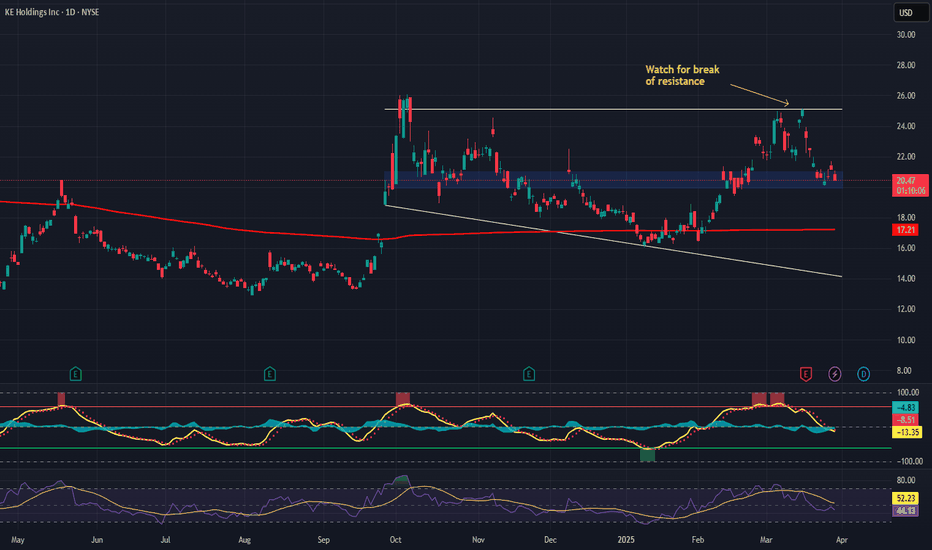

$BEKE Inverse head and shouldersKE Holdings Inc. is a publicly traded Chinese real estate holding firm that offers a comprehensive online and offline platform for housing transactions and related services through its subsidiaries. It stands as the largest online real estate transaction platform in China.

Investors commonly refer

My Watchlist: BEKEBEKE: I have a green setup signal (dot Indictor). It has an excellent risk-to-reward ratio(RR:). I'm looking to enter long near the close of the day if the stock can manage to CLOSE above the last candle highs(white line). If triggered, I will then place a stop-loss below(red line) and a price targe

Chinese Real Estate looks healthyIn recent years we saw stresses in the Chinese real estate market related to their debt. The Chinese government has been handling it early for years by slowly deflating its real estate bubble. Despite the media narrative, on a financial and technical aspect, the Chinese real estate market is looking

Bullish BEKEI have a bullish outlook on NYSE:BEKE as it recently crossed both the 20 and 50 Moving Averages. Last Friday, it successfully defended these levels and closed near a crucial support level. With the current price around $17, I anticipate that the stock has the potential to reach approximately $18-1

BEKE KE Holdings Options Ahead of EarningsIf you haven`t sold BEKE here:

And bought it back here:

Now Analyzing the options chain of BEKE KE Holdings prior to the earnings report this week,

I would consider purchasing the 17.50usd strike price Calls with

an expiration date of 2024-1-19,

for a premium of approximately $3.20

If these optio

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Related stocks

Frequently Asked Questions

The current price of 2423 is 49.55 HKD — it has increased by 2.15% in the past 24 hours. Watch KE HOLDINGS INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on HKEX exchange KE HOLDINGS INC stocks are traded under the ticker 2423.

2423 stock has risen by 2.46% compared to the previous week, the month change is a −6.46% fall, over the last year KE HOLDINGS INC has showed a 16.45% increase.

We've gathered analysts' opinions on KE HOLDINGS INC future price: according to them, 2423 price has a max estimate of 85.87 HKD and a min estimate of 57.25 HKD. Watch 2423 chart and read a more detailed KE HOLDINGS INC stock forecast: see what analysts think of KE HOLDINGS INC and suggest that you do with its stocks.

2423 reached its all-time high on Oct 7, 2024 with the price of 73.50 HKD, and its all-time low was 24.75 HKD and was reached on Oct 31, 2022. View more price dynamics on 2423 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

2423 stock is 2.25% volatile and has beta coefficient of 1.99. Track KE HOLDINGS INC stock price on the chart and check out the list of the most volatile stocks — is KE HOLDINGS INC there?

Today KE HOLDINGS INC has the market capitalization of 178.92 B, it has increased by 3.03% over the last week.

Yes, you can track KE HOLDINGS INC financials in yearly and quarterly reports right on TradingView.

KE HOLDINGS INC is going to release the next earnings report on Aug 6, 2025. Keep track of upcoming events with our Earnings Calendar.

2423 earnings for the last quarter are 0.43 HKD per share, whereas the estimation was 0.35 HKD resulting in a 21.97% surprise. The estimated earnings for the next quarter are 0.61 HKD per share. See more details about KE HOLDINGS INC earnings.

KE HOLDINGS INC revenue for the last quarter amounts to 25.25 B HKD, despite the estimated figure of 24.30 B HKD. In the next quarter, revenue is expected to reach 30.75 B HKD.

2423 net income for the last quarter is 914.97 M HKD, while the quarter before that showed 616.41 M HKD of net income which accounts for 48.43% change. Track more KE HOLDINGS INC financial stats to get the full picture.

Yes, 2423 dividends are paid annually. The last dividend per share was 0.93 HKD. As of today, Dividend Yield (TTM)% is 1.87%. Tracking KE HOLDINGS INC dividends might help you take more informed decisions.

KE HOLDINGS INC dividend yield was 1.97% in 2024, and payout ratio reached 74.84%. The year before the numbers were 2.12% and 50.89% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jun 6, 2025, the company has 135.07 K employees. See our rating of the largest employees — is KE HOLDINGS INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. KE HOLDINGS INC EBITDA is 5.83 B HKD, and current EBITDA margin is 5.27%. See more stats in KE HOLDINGS INC financial statements.

Like other stocks, 2423 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade KE HOLDINGS INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So KE HOLDINGS INC technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating KE HOLDINGS INC stock shows the buy signal. See more of KE HOLDINGS INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.