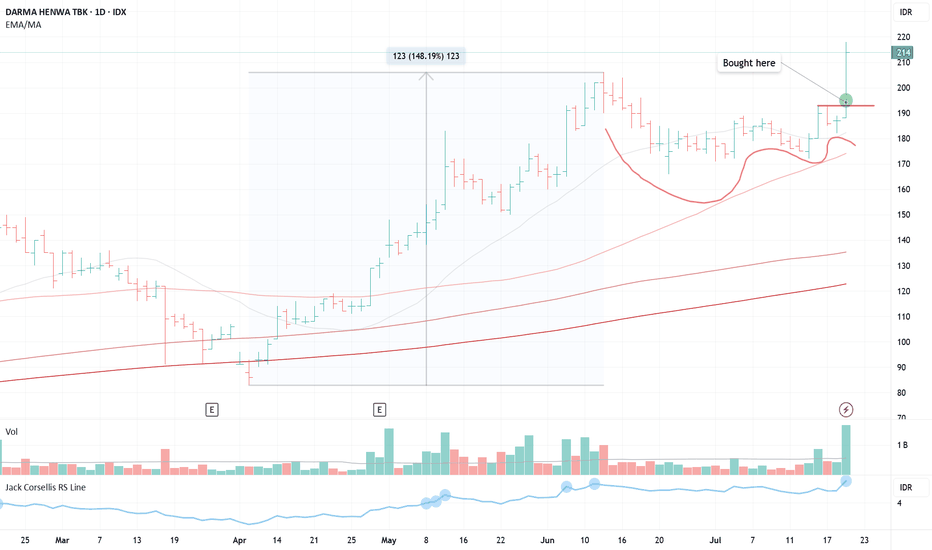

$DEWA (VCP - 6W 19/6 3T)Position update: July 21, 2025.

Key factors:

1. Confirmed stage 2 uptrend.

2. A textbook Volatility Contraction Pattern (VCP) with a clearly defined, low-risk entry point.

3.Currently forming a VCP following a prior price surge of nearly 150%, demonstrating strong momentum.

4. The stock moves on

4 IDR

16.34 B IDR

6.03 T IDR

15.53 B

About DARMA HENWA TBK

Sector

Industry

CEO

Teguh Boentoro

Website

Headquarters

Jakarta

Founded

1991

ISIN

ID1000107303

FIGI

BBG000QXYY33

PT Darma Henwa Tbk engages in the provision of general mining contractor services. It operates through the Mining and Other Services segments. The Mining segment includes mining contract activity, civil engineering, and rent equipment. The Other Services segment includes employment service and management. The company was founded on October 8, 1991 and is headquartered in Jakarta, Indonesia.

Related stocks

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of DEWA is 218 IDR — it has increased by 0.93% in the past 24 hours. Watch DARMA HENWA TBK stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on IDX exchange DARMA HENWA TBK stocks are traded under the ticker DEWA.

DEWA stock has risen by 16.58% compared to the previous week, the month change is a 20.44% rise, over the last year DARMA HENWA TBK has showed a 240.63% increase.

We've gathered analysts' opinions on DARMA HENWA TBK future price: according to them, DEWA price has a max estimate of 450.00 IDR and a min estimate of 300.00 IDR. Watch DEWA chart and read a more detailed DARMA HENWA TBK stock forecast: see what analysts think of DARMA HENWA TBK and suggest that you do with its stocks.

DEWA reached its all-time high on Oct 18, 2007 with the price of 742 IDR, and its all-time low was 46 IDR and was reached on Oct 24, 2008. View more price dynamics on DEWA chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

DEWA stock is 6.60% volatile and has beta coefficient of 1.60. Track DARMA HENWA TBK stock price on the chart and check out the list of the most volatile stocks — is DARMA HENWA TBK there?

Today DARMA HENWA TBK has the market capitalization of 4.76 T, it has increased by 6.74% over the last week.

Yes, you can track DARMA HENWA TBK financials in yearly and quarterly reports right on TradingView.

DEWA net income for the last quarter is 68.89 B IDR, while the quarter before that showed 6.89 B IDR of net income which accounts for 900.59% change. Track more DARMA HENWA TBK financial stats to get the full picture.

No, DEWA doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 26, 2025, the company has 2.76 K employees. See our rating of the largest employees — is DARMA HENWA TBK on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. DARMA HENWA TBK EBITDA is 1.02 T IDR, and current EBITDA margin is 14.50%. See more stats in DARMA HENWA TBK financial statements.

Like other stocks, DEWA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade DARMA HENWA TBK stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So DARMA HENWA TBK technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating DARMA HENWA TBK stock shows the strong buy signal. See more of DARMA HENWA TBK technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.